Moving Average Crossover and Upper Rail Breakthrough Impulse Strategy

Author: ChaoZhang, Date: 2023-11-13 11:52:22Tags:

Overview

This strategy utilizes the crossover signals of the MACD fast line and slow line, combined with judgments based on multiple other indicators, to capture the breakthrough signals of the moving average index line in a timely manner and make buy or sell decisions. It belongs to a short-term trading strategy.

Strategy Logic

-

Use the crossover of the MACD fast line and slow line as the primary trading signal. When the fast line crosses above the slow line, take a long position. When the fast line crosses below the slow line, take a short position.

-

Incorporate the RSI indicator to determine overbought and oversold conditions. Below the centerline suggests long, while above suggests short.

-

Compare the current closing price to the SMA line of a certain period. Closing price below SMA suggests long, while above suggests short.

-

Calculate the 0.5 Fibonacci level of the Highest value of a certain period as the resistance for long. Calculate the 0.5 Fibonacci level of the Lowest value of a certain period as the support for short.

-

Take long when the fast line crosses above and the price is below support. Take short when the fast line crosses below and the price is above resistance.

-

Adopt a trailing stop loss mechanism. The stop loss is fixed at a certain percentage of the entry price initially. When the loss reaches a certain level, switch to a gradual trailing stop loss.

Advantages

-

The strategy makes full use of the MACD crossover signals, which is a classic and effective technical indicator trading signal.

-

Incorporating confirmations from multiple indicators like RSI and SMA can filter false signals and improve reliability.

-

Calculating dynamic support and resistance levels for breakout trading can capture larger trends.

-

The trailing stop loss can lock in most profits while controlling risk.

-

The strategy logic is clear and simple, easy to understand and master for beginners.

Risks

-

The MACD indicator has lagging issues and may miss the optimal entry and exit points.

-

Combining multiple indicators increases complexity and risks of conflicting signals.

-

There are risks of incorrect breakouts when dynamically calculating support and resistance.

-

Trailing stop loss may exit prematurely in strong trends, failing to ride trends.

-

Parameters require repetitive testing and optimization, improper parameters negatively impact performance.

Optimization Directions

-

Test different parameter combinations to optimize MACD periods.

-

Introduce more indicators like Bollinger Bands, KDJ for multidimensional analysis.

-

Incorporate more factors to judge the reasonableness of support and resistance.

-

Research more advanced stop loss mechanisms like time-based or volatility-based stops.

-

Add an auto-optimization module for automatic parameter optimization.

Summary

This strategy combines MACD, RSI, SMA and other indicators to capture moving average breakthrough signals opportunistically. It belongs to typical short-term breakout trading strategies. There is some lag in its signal generation, but accuracy can be improved through parameter optimization. Overall, this is a strategy with simple and clear logic, easy to grasp for most, and worth further testing and optimization.

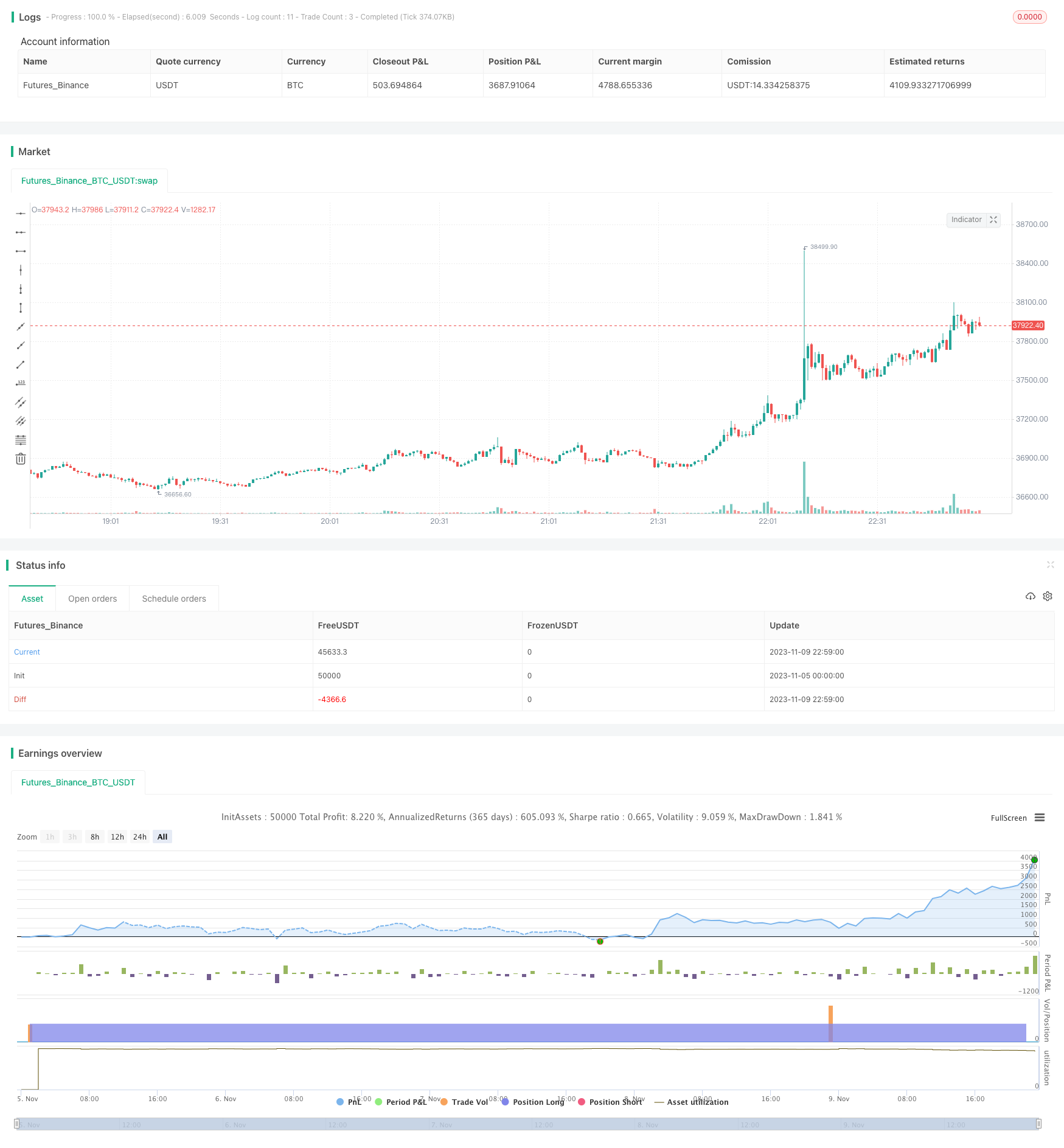

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-09 23:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © onurenginogutcu

//@version=4

strategy("R19 STRATEGY", overlay=true, calc_on_every_tick=true , margin_long=100, margin_short=100 , process_orders_on_close=true )

sym = input(title="Symbol", type=input.symbol, defval="BINANCE:BTCUSDT" , group = "SYMBOL")

timeFrame = input(title="Strategy Decision Time Frame", type = input.resolution , defval="60")

adxlen = input(14, title="ADX Smoothing" , group = "ADX")

dilen = input(14, title="ADX DI Length", group = "ADX")

adxemalenght = input(30, title="ADX EMA", group = "ADX")

adxconstant = input(19, title="ADX CONSTANT", group = "ADX")

fibvar = input (title = "Fibo Look Back Canles" , defval = 50 , minval = 0 , group = "FIBO MACD SMA")

smaLookback = input (title = "SMA Look Back Candles" , defval = 30 , minval = 0 , group = "FIBO MACD SMA")

MACDFast = input (title = "MACD Fast Lenght" , defval = 15 , minval = 0 , group = "FIBO MACD SMA")

MACDSlow = input (title = "MACD Slow Lenght" , defval = 30 , minval = 0 , group = "FIBO MACD SMA")

MACDSmooth = input (title = "MACD Signal Smoothing" , defval = 9 , minval = 0 , group = "FIBO MACD SMA")

MACDLookback = input (title = "MACD Look Back Candles" , defval = 100 , minval = 0 , group = "FIBO MACD SMA")

trailingStopLong = input (title = "Trailing Long Stop %" , defval = 2.0 , step = 0.1, group = "TP & SL") * 0.01

trailingStopShort = input (title = "Trailing Short Stop %" , defval = 2.0 , step = 0.1 , group = "TP & SL") * 0.01

LongTrailingProfitStart = input (title = "Long Profit Start %" , defval = 2.0 , step = 0.1 , group = "TP & SL") * 0.01

ShortTrailingProfitStart = input (title = "Short Profit Start %" , defval = 2.0 , step = 0.1, group = "TP & SL") * 0.01

lsl = input(title="Max Long Stop Loss (%)",

minval=0.0, step=0.1, defval=3.0, group = "TP & SL") * 0.01

ssl = input(title="Max Short Stop Loss (%)",

minval=0.0, step=0.1, defval=2.5, group = "TP & SL") * 0.01

longtp = input(title="Long Take Profit (%)",

minval=0.0, step=0.1, defval=100, group = "TP & SL") * 0.01

shorttp = input(title="Short Take Profit (%)",

minval=0.0, step=0.1, defval=100, group = "TP & SL") * 0.01

capperc = input(title="Capital Percentage to Invest (%)",

minval=0.0, maxval=100, step=0.1, defval=95, group = "CAPITAL TO INVEST") * 0.01

symClose = security(sym, timeFrame, close)

symHigh = security(sym, timeFrame, high)

symLow = security(sym, timeFrame, low)

atr = atr (14)

/////////adx code

dirmov(len) =>

up = change(symHigh)

down = -change(symLow)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

emasig = ema (sig , adxemalenght )

////////adx code over

i = ema (symClose , MACDFast) - ema (symClose , MACDSlow)

r = ema (i , MACDSmooth)

sapust = highest (i , MACDLookback) * 0.729

sapalt = lowest (i , MACDLookback) * 0.729

simRSI = rsi (symClose , 50 )

fibtop = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

fibbottom = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

cond1 = 0

cond2 = 0

cond3 = 0

cond4 = 0

longCondition = crossover(i, r) and i < sapalt and sig > adxconstant and symClose < sma (symClose , smaLookback) and simRSI < sma (simRSI , 50) and symClose < fibbottom

shortCondition = crossunder(i, r) and i > sapust and sig > adxconstant and symClose > sma (symClose , smaLookback) and simRSI > sma (simRSI , 50) and symClose > fibtop

//////////////////////probability long/short

if (crossover(i, r) and i < sapalt)

cond1 := 35

else if (crossunder(i, r) and i > sapust)

cond1 := -35

else

cond1 := 0

if (symClose < sma (symClose , smaLookback))

cond2 := 30

else if (symClose > sma (symClose , smaLookback))

cond2 := -30

else

cond2 := 0

if (simRSI < sma (simRSI , 50))

cond3 := 25

else if (simRSI > sma (simRSI , 50))

cond3 := -25

else

cond3 := 0

if (symClose < fibbottom)

cond4 := 10

else if (symClose > fibbottom)

cond4 := -10

else

cond4 := 0

probab = cond1 + cond2 + cond3 + cond4

////////////////////////////////////////////////////////////////

///////////////////////////////////////////STRATEGY ENTRIES AND STOP LOSSES /////

var startTrail = 0

var trailingLongPrice = 0.0

var trailingShortPrice = 0.0

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long , qty = capperc * strategy.equity / close )

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short" , strategy.short , qty = capperc * strategy.equity / close )

if (strategy.position_size == 0)

trailingShortPrice := 0.0

trailingLongPrice := 0.0

startTrail := 0

/////////////////////////////////strategy exit

if (strategy.position_size > 0 and close >= strategy.position_avg_price * (1 + LongTrailingProfitStart))

startTrail := 1

if (strategy.position_size < 0 and close <= strategy.position_avg_price * (1 - ShortTrailingProfitStart))

startTrail := -1

trailingLongPrice := if strategy.position_size > 0 and startTrail == 1

stopMeasure = close * (1 - trailingStopLong)

max (stopMeasure , trailingLongPrice [1])

else if strategy.position_size > 0 and startTrail == 0

strategy.position_avg_price * (1 - lsl)

trailingShortPrice := if strategy.position_size < 0 and startTrail == -1

stopMeasure = close * (1 + trailingStopShort)

min (stopMeasure , trailingShortPrice [1])

else if strategy.position_size < 0 and startTrail == 0

strategy.position_avg_price * (1 + ssl)

if (strategy.position_size > 0)

strategy.exit("Exit Long", "Long", stop = trailingLongPrice , limit=strategy.position_avg_price*(1 + longtp))

if (strategy.position_size < 0)

strategy.exit("Exit Short", "Short", stop = trailingShortPrice , limit=strategy.position_avg_price*(1 - shorttp))

////////////////////////vertical colouring signals

bgcolor(color=longCondition ? color.new (color.green , 70) : na)

bgcolor(color=shortCondition ? color.new (color.red , 70) : na)

plot (trailingLongPrice , color = color.green) ///long price trailing stop

plot (trailingShortPrice , color = color.red) /// short price trailing stop

plot (startTrail , color = color.yellow)

plot (probab , color = color.white) ////probability

- Inverse MACD Momentum Entangled with DMI Breakout Short-Term Scalping Strategy

- EMA Percentage Channel with Bollinger Band Range Trading Strategy

- Dual EMA Crossover Strategy

- Gradual Stop Loss Movement Strategy

- Momentum Breakout Strategy with Volatility Stop

- Extreme Distribution Swing Strategy

- Multi-indicator Crossover Strong Trend Tracking Strategy

- Momentum Breakout Trading Strategy Based on Price Breakout and Mean Reversion

- Momentum Price Trend Tracking Strategy

- FX Strategy Based on Fractal Waves and SMMA

- Coppock Curve Based Quantitative Trading Strategy

- High Probability Breakthrough Trading Strategy Based on Pressure Balance

- Fast RSI Risk Control Compound Futures Trading Strategy

- Dual DI Crossover Daily Trading Strategy

- Bollinger Band Breakout Strategy

- Moving Average Trading Strategy

- Williams' Alligator Strategy

- Dual Moving Average Crossover Strategy

- Long-Term Trend Reversal Strategy

- Dual Moving Average Crossover Persistent Uptrend Strategy