概述

这个策略利用多种指标组合判断趋势方向和交易时机,采用压力平衡的方法提高交易胜率。主要使用MACD,PSAR和EMA三个指标进行判断,结合止损止盈实现高效盈利。

策略原理

使用EMA计算均线,判断整体趋势方向。EMA值较大代表目前处于上升趋势,EMA值较小代表目前处于下降趋势。

使用MACD计算快线和慢线的差值,当差值大于0代表目前处于上升趋势,当差值小于0代表目前处于下降趋势。

使用PSAR计算连续变动点,当PSAR值较大代表目前处于下降趋势,当PSAR值较小代表目前处于上升趋势。

结合上述三个指标,判断趋势一致性。当三个指标判断结果一致时,代表趋势较为明确,可以进行买入或卖出操作。

根据买入和卖出条件开仓,并设置止损止盈点,在达到止损或止盈条件时平仓,实现盈利。

具体操作规则如下:

- 买入条件:非上升趋势,MACD差值小于0,收盘价高于EMA均线

- 卖出条件:上升趋势,MACD差值大于0,收盘价低于EMA均线

- 止损条件:价格触及下一个PSAR值

- 止盈条件:达到设定的止盈比例

策略优势

使用多种指标判断趋势,提高判断准确性。

采用压力平衡方式,在趋势明确时开仓,增加获利概率。

设定止损止盈点,可以限制亏损,锁定盈利。

交易规则清晰系统,适合程序化交易。

可以通过参数优化,调整适应不同品种和交易周期。

策略风险

趋势判断存在错误的可能,导致开仓方向错误。

市场出现剧烈变动,指标发出虚假信号的可能。

止损点设置过大,无法及时止损。

参数设置不当,导致过于频繁交易或无法及时开仓。

交易品种流动性不足,无法按计划止损止盈。

可以通过优化参数,调整止损止盈点,选择流动性好的交易品种来降低风险。

策略优化方向

调整EMA周期参数,优化判断趋势的准确性。

调整MACD快线慢线周期参数,优化MACD指标的敏感性。

调整止损止盈比例参数,取得止损止盈的最佳平衡。

添加其他辅助指标,提高开仓时机选择的准确性。

优化交易品种选择,选择流动性好、波动较大的品种。

调整交易时间周期,适应不同品种的行情特点。

总结

这个策略综合运用多种指标判断趋势,在趋势明确时开仓,并设置止损止盈,可以有效把握市场走势,在保证一定盈利的前提下获取比较理想的回报。通过参数优化和加入其他辅助指标,可以进一步提高策略的稳定性和盈利水平。该策略交易规则清晰易懂,非常适合程序化交易。

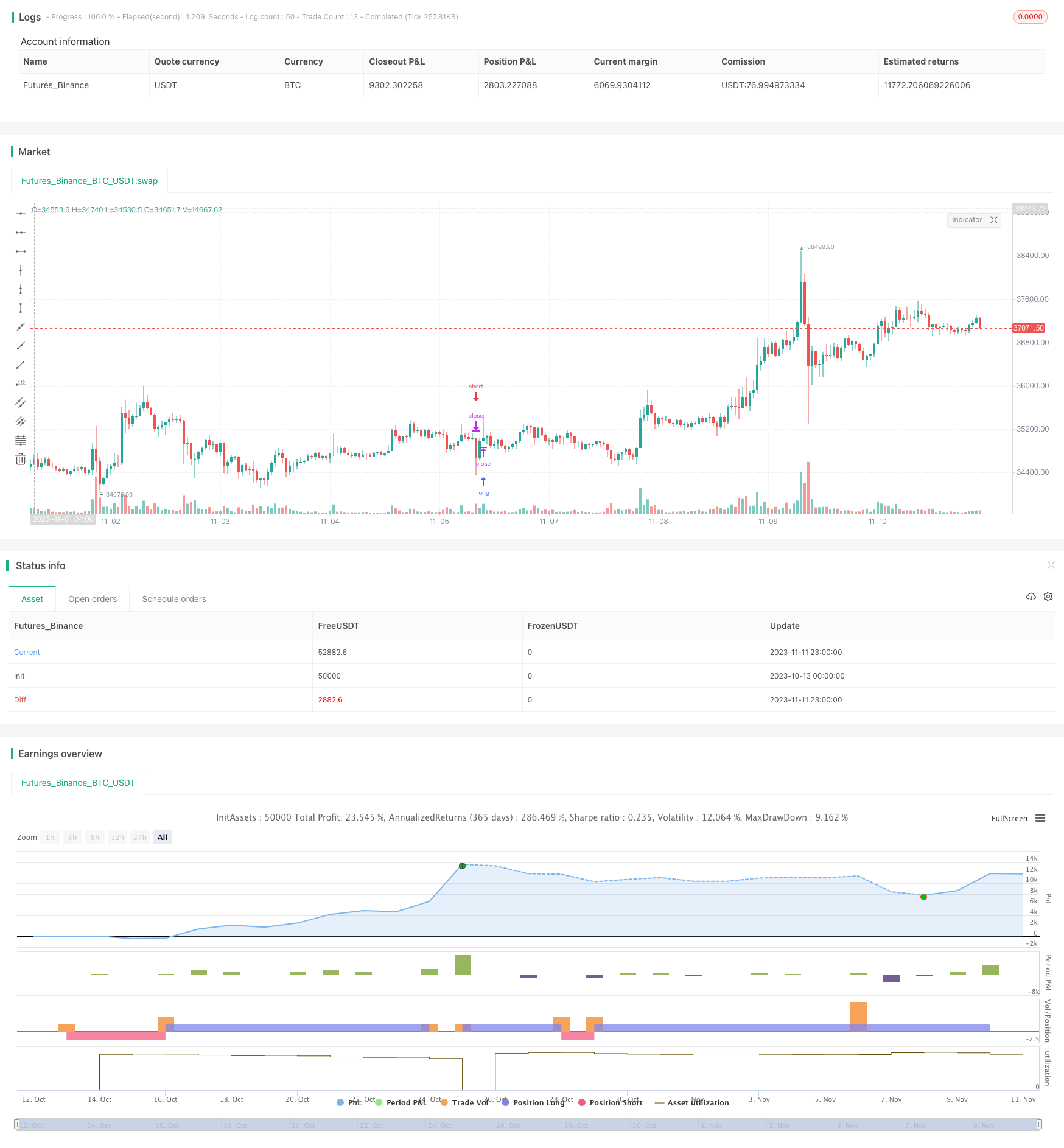

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy(title = "Crypto Scalper", overlay = true, pyramiding=1,initial_capital = 100, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

len = input(60, minval=1, title="Length EMA")

src = input(close, title="Source")

out = ema(src, len)

//

fast_length = input(title="Fast Length MACD", type=input.integer, defval=12)

slow_length = input(title="Slow Length MACD", type=input.integer, defval=26)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Oscillator MA Type MACD", type=input.string, defval="EMA", options=["SMA", "EMA"])

sma_signal = input(title="Signal Line MA Type MACD", type=input.string, defval="EMA", options=["SMA", "EMA"])

// Calculating

fast_ma = sma_source == "SMA" ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source == "SMA" ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

tplong=input(0.245, step=0.005)

sllong=input(1.0, step=0.005)

tpshort=input(0.055, step=0.005)

slshort=input(0.03, step=0.005)

if (uptrend and hist >0 and close < out)

strategy.entry("short", strategy.short, stop=nextBarSAR, comment="short")

strategy.exit("short_tp/sl", "short", profit=close * tpshort / syminfo.mintick, loss=close * slshort / syminfo.mintick, comment='SHORT EXIT', alert_message = 'closeshort')

if (not uptrend and hist <0 and close > out)

strategy.entry("long", strategy.long, stop=nextBarSAR, comment="long")

strategy.exit("short_tp/sl", "long", profit=close * tplong / syminfo.mintick, loss=close * sllong / syminfo.mintick, comment='LONG EXIT', alert_message = 'closelong')