概述

双均线金叉死叉策略是一种比较常见的趋势追踪策略。该策略使用两条不同周期的均线,根据它们的交叉情况来判断行情趋势并进行交易。具体来说,当短周期均线上穿长周期均线时,产生金叉信号,认为行情进入上涨趋势,可以买入;当短周期均线下穿长周期均线时,产生死叉信号,认为行情进入下跌趋势,可以卖出。

策略原理

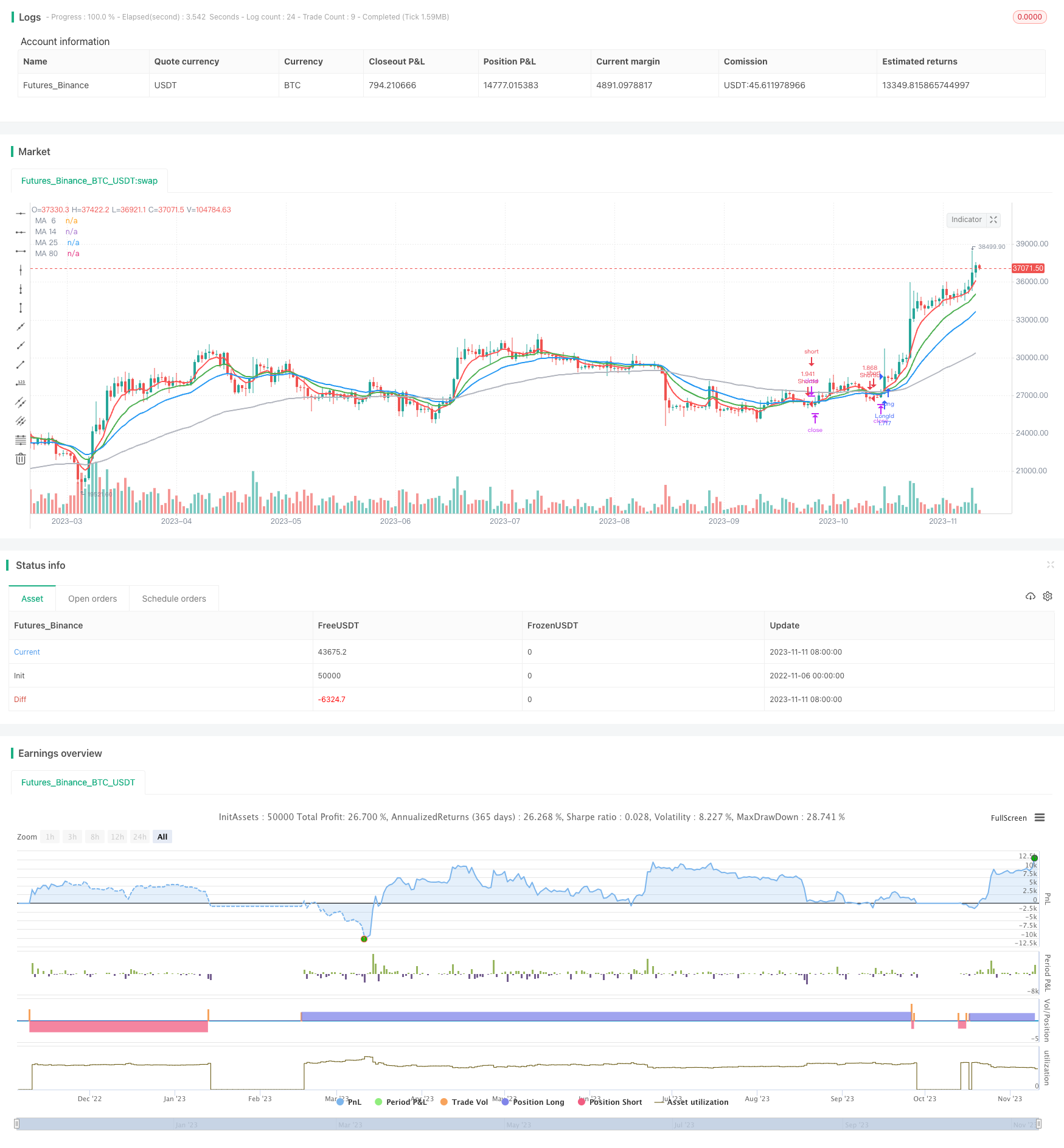

该策略主要使用6周期、14周期、25周期以及80周期的EMA均线。策略首先计算这4条均线的值,然后根据6周期EMA与其他三条均线的交叉情况来判断行情走势。

当6周期EMA上穿14周期或25周期EMA,并且6周期EMA高于80周期EMA时,产生买入信号。这表示短期均线正在突破中长期均线,行情可能进入上涨趋势,因此可以考虑买入。

相反,当6周期EMA下穿14周期或25周期EMA,并且低于80周期EMA时,产生卖出信号。这表示短期均线被中长期均线突破,行情可能进入下跌趋势,因此可以考虑卖出。

交易信号产生后,策略会开仓买入或卖出。此外,策略还设置了止损逻辑,当亏损超过设置的止损比例时,策略会退出仓位,以控制风险。

优势分析

该策略具有以下优势:

使用均线交叉判断趋势,是一种较为成熟和可靠的技术指标。

同时结合多周期均线,可以减少误判概率。6周期均线负责产生交易信号,14周期、25周期均线作为确认,80周期均线判断整体趋势。

设置止损来控制亏损风险,可以有效保护资金。

策略逻辑简单清晰,易于理解和验证。

可根据市场情况调整均线周期,优化策略参数。

风险分析

该策略也存在一些风险:

在震荡行情中,均线可能产生多次无效交叉,带来过多无效交易。可以适当调整均线周期优化。

固定的止损方式可能过于机械,可改为追踪止损或动态止损。

大幅度跳空导致止损被突破的风险。可结合附加条件判断跳过止损。

无法响应短期价格波动。可结合其他指标过滤交易信号。

参数优化空间有限。可尝试改进为自适应均线。

优化方向

该策略可以从以下几个方面进行优化:

测试不同的均线周期组合,找到对市场更敏感的周期参数。

改进止损机制,使用追踪止损或动态止损,减小止损被突破的概率。

增加其他指标进行滤波,如KDJ、MACD等,避免在震荡中产生过多无效交易。

优化入场条件,待均线完全交叉后再入场,减少假信号。

使用自适应均线,根据市场波动自动调整均线周期参数。

新增仓位管理机制,根据市场情况调整仓位。

添加止盈退出机制。

总结

综上所述,该双均线金叉死叉策略通过简单的均线交叉原理判断行情趋势,易于实现,风险可控,适用于追踪中长期趋势。但该策略可优化空间较大,可从入场条件、止损方式、指标过滤等方面进行改进,使策略更适应市场环境。整体来说,该策略作为基础趋势跟随策略,优势和风险都在可控范围内,值得学习和实践。

/*backtest

start: 2022-11-06 00:00:00

end: 2023-11-12 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = " bhramaji EMA Cross Strategy", shorttitle = "EMA Cross",calc_on_order_fills=true,calc_on_every_tick =true, initial_capital=21000,commission_value=.25,overlay = true,default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

StartYear = input(2018, "Backtest Start Year")

StartMonth = input(1, "Backtest Start Month")

StartDay = input(1, "Backtest Start Day")

UseStopLoss = input(true,"UseStopLoss")

stopLoss = input(20, title = "Stop loss percentage(0.1%)")

maSource = input(defval = close, title = "MA Source")

maLength6 = input(defval = 6, title = "MA Period 6", minval = 1)

maLength14 = input(defval = 14, title = "MA Period 14", minval = 1)

maLength25 = input(defval = 25, title = "MA Period 25", minval = 1)

maLength80 = input(defval = 80, title = "MA Period 80", minval = 1)

ma6 = ema(maSource, maLength6)

ma14 = ema(maSource, maLength14)

ma25 = ema(maSource, maLength25)

ma80 = ema(maSource, maLength80)

ma_6_plot = plot(ma6 , title = "MA 6", color = red, linewidth = 2, style = line, transp = 50)

ma14_plot = plot(ma14, title = "MA 14", color = green, linewidth = 2, style = line, transp = 50)

ma25_plot = plot(ma25, title = "MA 25", color = blue, linewidth = 2, style = line, transp = 50)

ma80_plot = plot(ma80, title = "MA 80", color = silver, linewidth = 2, style = line, transp = 50)

longEMA = (crossover(ma6, ma14) or crossover(ma6, ma25)) and (ma6>ma80)

exitLong = (crossunder(ma6, ma14) or crossunder(ma6, ma25))

shortEMA = (crossunder(ma6, ma14) or crossunder(ma6, ma25)) and (ma6< ma80)

exitShort =(crossover(ma6, ma14) or crossover(ma6, ma25))

if (longEMA)

strategy.entry("LongId", strategy.long)

if (shortEMA)

strategy.entry("ShortId", strategy.short)

if (UseStopLoss)

strategy.exit("StopLoss", "LongId", loss = close * stopLoss / 1000 / syminfo.mintick)

strategy.exit("StopLoss", "ShortId", loss = close * stopLoss / 1000 / syminfo.mintick)