Candlestick Body Based Dual Thrust Strategy

Author: ChaoZhang, Date: 2023-11-16 17:14:48Tags:

Overview

This strategy uses the length of the candlestick body to determine the long and short direction. It calculates the average body length of the recent 30 candlesticks. When the bullish candle body length is greater than average, it goes long. When the bearish candle body length is greater than average, it goes short.

Strategy Logic

This strategy first calculates the candlestick body length body and the average body length of recent 30 candlesticks sbody.

When today’s candlestick is bearish (bar==-1) and the body length is greater than average body length, it opens long position (up1).

When today’s candlestick is bullish (bar==1) and the body length is greater than average body length, it opens short position (dn1).

After opening long, if today’s candlestick is bullish (bar==1) and the current position is profitable, it closes long position.

After opening short, if today’s candlestick is bearish (bar==-1) and the current position is profitable, it closes short position.

The strategy simply and effectively uses the candlestick body length to determine the market trend. The longer the body, the stronger the trend. So it uses body length as the criterion for long and short.

Advantage Analysis

The advantages of this strategy:

-

The logic is simple and clear, easy to understand and implement.

-

Using candlestick body length to determine trend, avoid noise interference.

-

Adopt dynamic average calculation, can adapt to market changes.

-

Set profitable exit condition to improve profitability.

-

Configurable parameters, adaptable to different market environments.

Risk Analysis

The risks of this strategy:

-

Long body does not necessarily represent strong trend, could be normal fluctuation.

-

Improper average body length time window may miss trading opportunities.

-

Black swan events may cause losses.

-

Holding positions for too long may amplify losses.

Solutions:

-

Combine with other indicators to determine trend, avoid wrong trades.

-

Test different parameter values, optimize average body length calculation.

-

Set stop loss to control single loss.

-

Optimize entry and exit logic to avoid holding too long.

Optimization Directions

The strategy can be optimized in the following aspects:

-

Combine MACD, RSI to determine trend, avoid wrong signals from normal fluctuations.

-

Test different average body length time window parameters to find optimal parameter set.

-

Add position sizing control logic, gradually reduce position size when incurring losses.

-

Set trailing stop loss or profit target to control single loss percentage.

-

Optimize entry and exit conditions to avoid ineffective trades. For example, wait for 3 consecutive long candlesticks before entering.

-

Avoid trading at certain periods or around important data release to control loss from volatility.

Conclusion

The strategy has clear and easy-to-understand logic of comparing candlestick body to its average length for entry timing. Large room for optimization from multiple dimensions to tailor it better for different market environments. Overall a simple and reliable introductory quant trading strategy suitable for novice traders to use and learn. Further combine more indicators and optimize to improve profitability and robustness.

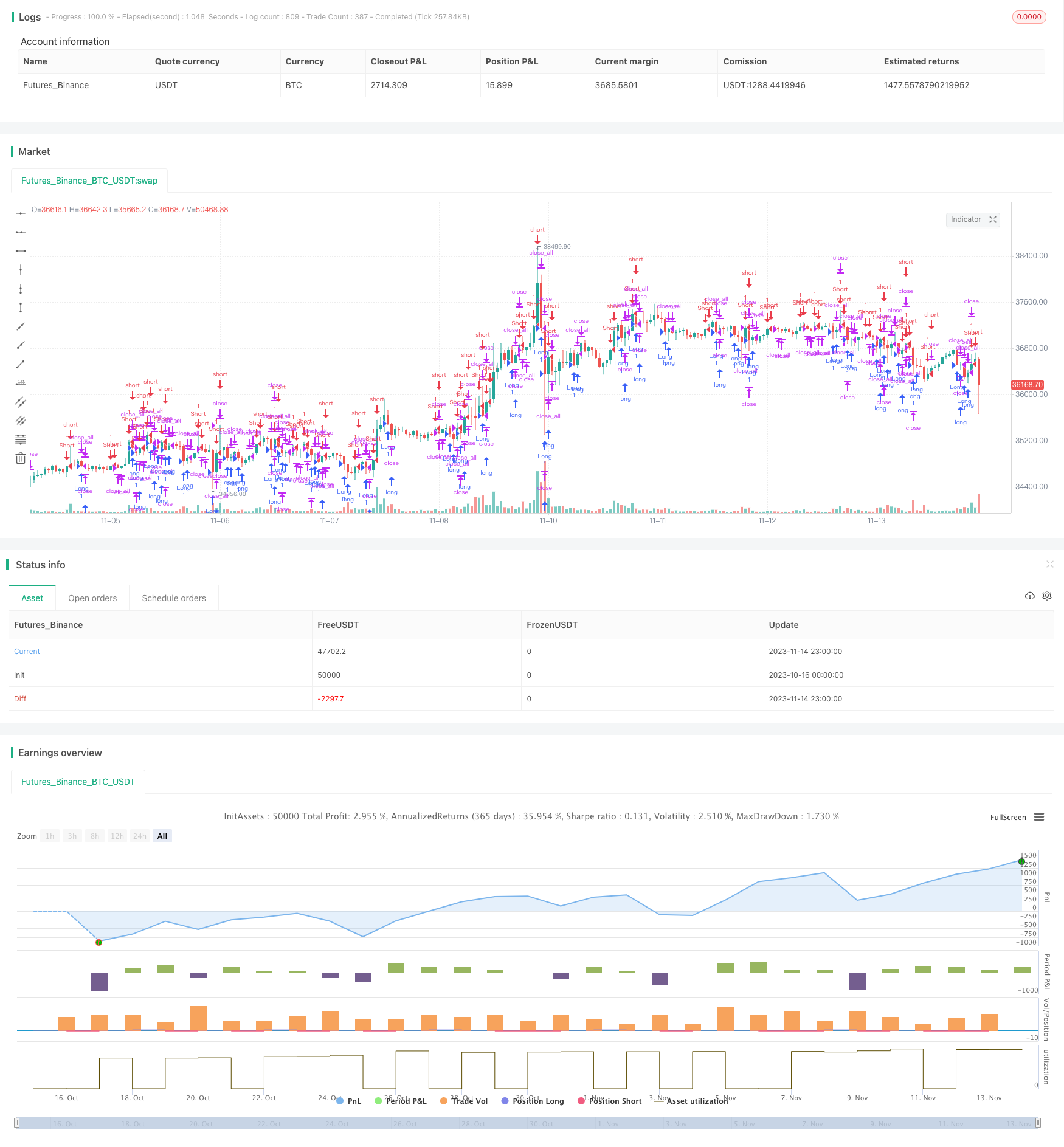

/*backtest

start: 2023-10-16 00:00:00

end: 2023-11-15 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=3

strategy(title = "Noro's ColorBar Strategy v1.0", shorttitle = "ColorBar str v1.0", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100.0, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usebody = input(true, defval = true, title = "Use body")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Signals

bar = close > open ? 1 : close < open ? - 1 : 0

body = abs(close - open)

sbody = ema(body, 30)

up1 = bar == -1 and (body > sbody or usebody == false)

dn1 = bar == 1 and (body > sbody or usebody == false)

plus = (close > strategy.position_avg_price and strategy.position_size > 0) or (close < strategy.position_avg_price and strategy.position_size < 0)

exit = ((strategy.position_size > 0 and bar == 1) or (strategy.position_size < 0 and bar == -1)) and plus

if up1

strategy.entry("Long", strategy.long, needlong == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, 01, 00, 00) and time < timestamp(toyear, tomonth, 31, 00, 00)))

if dn1

strategy.entry("Short", strategy.short, needshort == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, 01, 00, 00) and time < timestamp(toyear, tomonth, 31, 00, 00)))

if time > timestamp(toyear, tomonth, 31, 00, 00) or exit

strategy.close_all()

- Bidirectional Breakout Reversal Strategy

- Momentum Exhaustion Strategy

- Dual Moving Average Crossover Strategy

- Multi-Timeframe Trend Tracking Intraday Scalping Strategy

- MACD Trend Following Strategy

- Dual-track Bollinger Band Momentum Trading Strategy

- Ichimoku Kinko Hyo Trading Strategy

- MZ MA Cross Multiple TimeFrame Strategy

- Dual Moving Average Crossover Momentum Strategy

- Dual Moving Average Tracking Stop Loss Strategy

- Fixed Grid Trading Strategy

- Relative Strength Index Long/Short Strategy

- Dual Momentum Breakout Strategy

- Mean Reversion Trading Strategy Based on Bollinger Bands and Golden Ratio

- Momentum Trend Following Oscillation Strategy

- WaveTrend and CMF Based Trend Following Strategy

- Adaptive Bollinger Trend Tracking Strategy

- Multi-Timeframe RSI Moving Average Crossover Strategy

- Trend Breakout Strategy Based on Bollinger Bands

- Adaptive Regularized Moving Average Cross-Market Arbitrage Strategy