Dual Rate of Change Momentum Indicator Trading Strategy

Author: ChaoZhang, Date: 2023-11-23 10:37:00Tags:

Overview

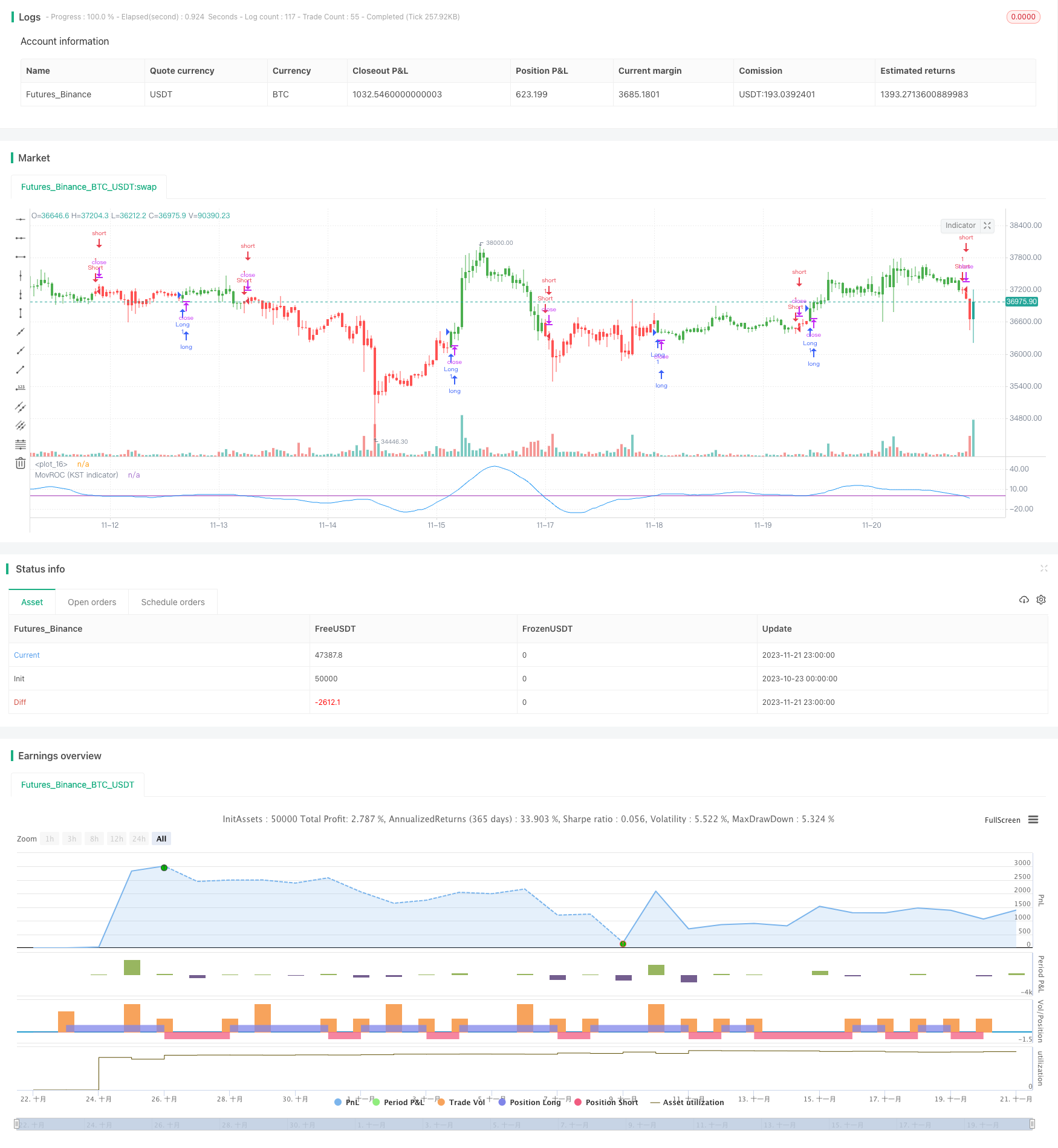

This is a trading strategy based on the Dual Rate of Change Momentum Indicator (DRCMI). It generates trading signals by gauging market momentum across multiple timeframes.

Strategy Logic

The core of this strategy is the DRCMI, which is a weighted average of multiple Rate of Change (ROC) indicators across different periods. Specifically, it incorporates 6-period, 10-period, 15-period, and 20-period ROC. The 6-period and 10-period ROC have a weight of 1, while the 15-period ROC has a weight of 2, and the 20-period ROC has a weight of 3. Thus, longer-term ROC is given greater emphasis.

By combining ROC across timeframes, the DRCMI reflects both short-term and longer-term momentum. When it is positive, it indicates an uptrend in both the short and long run. When negative, it signals a downtrend. The intensity of the momentum is also captured in the amplitude of DRCMI fluctuations.

Trading signals are generated based on the cyclicality of DRCMI. A long position is initiated when DRCMI crosses above 0, while a short position is initiated when it crosses below 0.

Advantage Analysis

The main advantages of this strategy are:

- Integrates momentum across periods for more accurate trend identification.

- Better captures cyclicality compared to single timeframe ROC.

- Reasonable weighting methodology focuses on longer-term to filter noise.

- Simple to implement with just a single indicator for signals.

- Customizable lookback periods suit different products.

Risk Analysis

There are also some risks to consider:

- Sensitivity to parameters with multiple integrated timeframes.

- May overlook other factors by only considering momentum.

- Potential lag requires optimized entry and exit.

- Stop loss still necessary during high volatility.

To mitigate risks, stop losses should be utilized along with optimization of the DRCMI parameters and incorporation of additional technical indicators.

Optimization Directions

Some ways to improve the strategy:

- Optimize DRCMI parameters like periods and weights.

- Incorporate trend indicators to dynamically adjust parameters based on market regime.

- Implement dynamic stops to lock in profits.

- Consider intermarket relationships with correlation analysis to construct spreads.

Conclusion

This strategy generates trading signals by condensing momentum from multiple timeframes into the DRCMI indicator. It is simple yet effective in profiting from momentum swings. However, parameter tuning and stop loss implementation requires further optimization, and combining DRCMI with additional technical indicators can improve performance.

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 20/09/2017

// This indicator really is the KST indicator presented by Martin Pring.

// the KST indicator is a weighted summed rate of change oscillator that

// is designed to identify meaningful turns. Various smoothed rate of change

// indicators can be combined to form different measurements of cycles.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="MovROC (KST indicator)", shorttitle="MovROC (KST indicator)")

reverse = input(false, title="Trade reverse")

hline(0, color=purple, linestyle=line)

xROC6 = sma(roc(close, 6), 10)

xROC10 = sma(roc(close, 10), 10)

xROC15 = sma(roc(close, 15), 9)

xROC20 = sma(roc(close, 20), 15)

nRes = xROC6 + (2 * xROC10) + (3 * xROC15) + (4 * xROC20)

pos = iff(nRes > 0, 1,

iff(nRes < 0, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nRes, color=blue, title="MovROC (KST indicator)")

- Moving Average Crossover Strategy

- Momentum Turtle Trend Tracking Strategy

- Bearish Harami Reversal Backtest Strategy

- Dynamic Moving Average Strategy

- Momentum Alpha Strategy

- Double VWAP Oscillation Breakthrough Strategy

- Low-High-Trend Strategy

- Cloud Soaring High Yield Daily Trading Strategy

- Bollinger Trend Shock Trading Strategy

- Dynamic Price Swing Oscillator Strategy

- The Dynamic Box Percentage Tracking Strategy

- SSL Channel Backtester Strategy With ATR and Money Management

- Bollinger Band Reversal Based Quantitative Strategy

- Dual Reversal Tracking Strategy

- Modern Laguerre Transform Relative Strength Index Optimization Strategy

- Dual Moving Average Crossover Trend Strategy

- Bollinger Band Trend Chaser

- Moving Average Crossover Strategy

- Kairou Strategy

- Trend Following Strategy Based on Stochastic and CCI