Range Breakthrough Dual Moving Average Filtering Strategy

Author: ChaoZhang, Date: 2023-11-27 17:03:08Tags:

Overview

This is a strategy that utilizes moving averages and Bollinger Bands for trend judgment, combined with breakout filtering and stop loss principles. It can capture signals in a timely manner when trend changes, reduce false signals through dual moving average filtering, and control risks by setting stop loss.

Strategy Principle

The strategy consists of the following main parts:

-

Trend judgment: Use MACD to judge the price trend and distinguish bullish and bearish trends.

-

Range filtering: Use Bollinger Bands to judge the price fluctuation range and filter out signals that do not break through the range.

-

Dual moving average confirmation: The fast EMA and slow EMA form the dual moving average to confirm trend signals. Buy signals are generated only when fast EMA > slow EMA.

-

Stop loss mechanism: Set stop loss points. Close positions when prices break through stop loss points in unfavorable directions.

The logic for entry signals is:

- MACD judges an upward trend

- Price breaks through the upper rail of Bollinger Bands

- Fast EMA is higher than slow EMA

When all three conditions are met at the same time, a buy signal is generated.

There are two types of closing positions, take profit and stop loss. The take profit point is the entry price multiplied by a certain percentage, and the stop loss point is the entry price multiplied by a certain percentage. When the price breaks through either point, close positions.

Advantage Analysis

The advantages of this strategy are:

- Can capture trend changes in a timely manner with fewer tracebacks.

- Reduce false signals by filtering with dual moving averages, improving signal quality.

- The stop loss mechanism effectively controls single loss.

- Large parameter optimization space that can be adjusted to the optimal state.

Risk Analysis

There are also some risks in this strategy:

- False signals generated in sideways markets may lead to losses.

- Improper settings of stop losses may lead to unnecessary losses.

- Inappropriate parameters may result in poor strategy performance.

To address these risks, the strategy can be optimized by adjusting parameters, setting stop loss positions, etc.

Optimization Directions

The strategy can be optimized in the following aspects:

- Adjust the dual moving average length to find the optimal parameter combination.

- Test different stop loss methods, such as trailing stop loss, oscillating stop loss, etc.

- Test MACD parameters to find the optimal settings.

- Use machine learning for automated parameter optimization.

- Add additional conditions to filter signals.

By testing different parameter settings and evaluating returns and Sharpe ratios, the optimal state of the strategy can be found.

Conclusion

This is a quantitative strategy that utilizes trend judgment, range filtering, dual moving average confirmation and stop loss ideas. It can effectively determine the trend direction and strike a balance between profit maximization and risk control. Through parameter optimization, machine learning and other means, the strategy has great room for improvement to achieve better results.

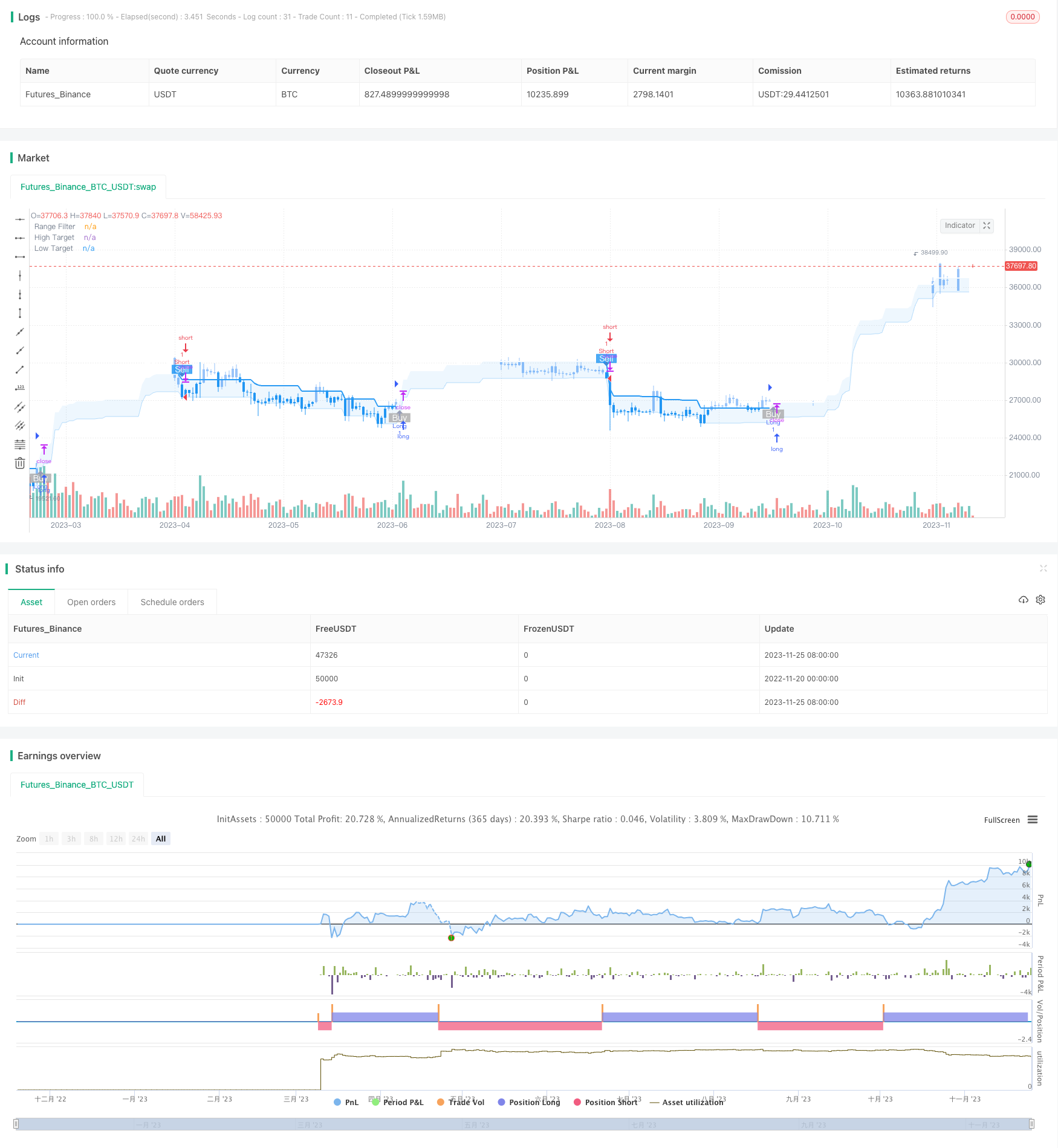

/*backtest

start: 2022-11-20 00:00:00

end: 2023-11-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Range Filter Buy and Sell Strategies", shorttitle="Range Filter Strategies", overlay=true,pyramiding = 5)

// Original Script > @DonovanWall

// Adapted Version > @guikroth

//

// Updated PineScript to version 5

// Republished by > @tvenn

// Strategizing by > @RonLeigh

//////////////////////////////////////////////////////////////////////////

// Settings for 5min chart, BTCUSDC. For Other coin, change the parameters

//////////////////////////////////////////////////////////////////////////

SS = input.bool(false,"Percentage Take Profit Stop Loss")

longProfitPerc = input.float(title='LongProfit(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

shortProfitPerc = input.float(title='ShortProfit(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

longLossPerc = input.float(title='LongStop(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

shortLossPerc = input.float(title='ShortStop(%)', minval=0.0, step=0.1, defval=1.5) * 0.01

// Color variables

upColor = color.white

midColor = #90bff9

downColor = color.blue

// Source

src = input(defval=close, title="Source")

// Sampling Period

// Settings for 5min chart, BTCUSDC. For Other coin, change the paremeters

per = input.int(defval=100, minval=1, title="Sampling Period")

// Range Multiplier

mult = input.float(defval=3.0, minval=0.1, title="Range Multiplier")

// Smooth Average Range

smoothrng(x, t, m) =>

wper = t * 2 - 1

avrng = ta.ema(math.abs(x - x[1]), t)

smoothrng = ta.ema(avrng, wper) * m

smoothrng

smrng = smoothrng(src, per, mult)

// Range Filter

rngfilt(x, r) =>

rngfilt = x

rngfilt := x > nz(rngfilt[1]) ? x - r < nz(rngfilt[1]) ? nz(rngfilt[1]) : x - r :

x + r > nz(rngfilt[1]) ? nz(rngfilt[1]) : x + r

rngfilt

filt = rngfilt(src, smrng)

// Filter Direction

upward = 0.0

upward := filt > filt[1] ? nz(upward[1]) + 1 : filt < filt[1] ? 0 : nz(upward[1])

downward = 0.0

downward := filt < filt[1] ? nz(downward[1]) + 1 : filt > filt[1] ? 0 : nz(downward[1])

// Target Bands

hband = filt + smrng

lband = filt - smrng

// Colors

filtcolor = upward > 0 ? upColor : downward > 0 ? downColor : midColor

barcolor = src > filt and src > src[1] and upward > 0 ? upColor :

src > filt and src < src[1] and upward > 0 ? upColor :

src < filt and src < src[1] and downward > 0 ? downColor :

src < filt and src > src[1] and downward > 0 ? downColor : midColor

filtplot = plot(filt, color=filtcolor, linewidth=2, title="Range Filter")

// Target

hbandplot = plot(hband, color=color.new(upColor, 70), title="High Target")

lbandplot = plot(lband, color=color.new(downColor, 70), title="Low Target")

// Fills

fill(hbandplot, filtplot, color=color.new(upColor, 90), title="High Target Range")

fill(lbandplot, filtplot, color=color.new(downColor, 90), title="Low Target Range")

// Bar Color

barcolor(barcolor)

// Break Outs

longCond = bool(na)

shortCond = bool(na)

longCond := src > filt and src > src[1] and upward > 0 or

src > filt and src < src[1] and upward > 0

shortCond := src < filt and src < src[1] and downward > 0 or

src < filt and src > src[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

// alertcondition(longCondition, title="Buy alert on Range Filter", message="Buy alert on Range Filter")

// alertcondition(shortCondition, title="Sell alert on Range Filter", message="Sell alert on Range Filter")

// alertcondition(longCondition or shortCondition, title="Buy and Sell alert on Range Filter", message="Buy and Sell alert on Range Filter")

////////////// 副

sensitivity = input(150, title='Sensitivity')

fastLength = input(20, title='FastEMA Length')

slowLength = input(40, title='SlowEMA Length')

channelLength = input(20, title='BB Channel Length')

multt = input(2.0, title='BB Stdev Multiplier')

DEAD_ZONE = nz(ta.rma(ta.tr(true), 100)) * 3.7

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, multt) =>

basis = ta.sma(source, length)

dev = multt * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, multt) =>

basis = ta.sma(source, length)

dev = multt * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength)) * sensitivity

e1 = calc_BBUpper(close, channelLength, multt) - calc_BBLower(close, channelLength, multt)

trendUp = t1 >= 0 ? t1 : 0

trendDown = t1 < 0 ? -1 * t1 : 0

duoad = trendUp > 0 and trendUp > e1

kongad = trendDown > 0 and trendDown > e1

duo = longCondition and duoad

kong = shortCondition and kongad

//Alerts

plotshape(longCondition and trendUp > e1 and trendUp > 0 , title="Buy Signal", text="Buy", textcolor=color.white, style=shape.labelup, size=size.small, location=location.belowbar, color=color.new(#aaaaaa, 20))

plotshape(shortCondition and trendDown > e1 and trendDown > 0 , title="Sell Signal", text="Sell", textcolor=color.white, style=shape.labeldown, size=size.small, location=location.abovebar, color=color.new(downColor, 20))

if longCondition and trendUp > e1 and trendUp > 0

strategy.entry('Long',strategy.long, comment = "buy" )

if shortCondition and trendDown > e1 and trendDown > 0

strategy.entry('Short',strategy.short, comment = "sell" )

longlimtPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortlimtPrice = strategy.position_avg_price * (1 - shortProfitPerc)

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

if (strategy.position_size > 0) and SS == true

strategy.exit(id="Long",comment_profit = "Profit",comment_loss = "StopLoss", stop=longStopPrice,limit = longlimtPrice)

if (strategy.position_size < 0) and SS == true

strategy.exit(id="Short",comment_profit = "Profit",comment_loss = "StopLoss", stop=shortStopPrice,limit = shortlimtPrice)

- A Trend Following Strategy Based on Keltner Channels

- RSI Moving Average Crossover Strategy

- momentum breakout trading strategy

- Dynamic RSI and CCI Combined Multi-factor Quantitative Trading Strategy

- Super Z Quantitative Trend Strategy

- Candlestick Pattern Strategy

- CK Momentum Reversal Stop Loss Strategy

- Dual Moving Average Oscillation Breakthrough Strategy

- Momentum Smooth Moving Average Line and Moving Average Line Crossover Strategy

- Moving Average Crossover Trading Strategy

- Cross Moving Average Price Strategy

- No Nonsense SSL Channel Trading Strategy

- Momentum Breakout Moving Average Strategy

- Dual Moving Average Crossover Breakout Strategy

- Double Filtering High Frequency Quantitative Trading Strategy

- Quantitative Trading Strategy Based on RSI Indicator

- Trend Following Strategy Based on Moving Averages

- Four Indicator Momentum Reversal Strategy

- London MACD RSI Bitcoin Trading Strategy

- High Low Breaker Backtest Strategy