概述

该策略名称为“双重过滤量化”,它采用多时间框架技术,实现了基于双重过滤思想的高频量化交易策略。策略利用不同时间框架上的指标进行判断,实现更严谨的交易信号过滤,能过滤掉大量的假信号,从而获取更高的胜率。

策略原理

该策略的核心原理是:

利用周线、日线判断市场趋势方向,作为策略方向过滤条件,只有符合趋势条件才能交易。

4小时级别构建通道,判断卖点和买点,发出交易信号。

周线、日线与4小时判断的方向一致性,能过滤掉大量假信号,提高交易信号的可靠性。

利用Fibonacci回撤点确定止盈止损位置,实现迅速止盈止损。

具体来说,策略首先在周线和日线上判断趋势优先方向,判断优先方向的原理是:当前K线收盘价在周期线上滞后角度较大的一侧,就判断为该周期线方向;然后在4小时级别构建A B C D通道,通过通道方向和折返点判断买卖点,发出交易信号;最后一定要当前周期线判断的优先方向与4小时的交易信号方向一致,这样能过滤掉很多假信号,从而提高交易信号的可靠性。

策略优势

该策略主要具有以下优势:

基于多时间框架的双重信号过滤机制,能过滤掉大量噪音,获取高可靠性的交易机会。

利用通道构建买卖点判定,交易信号清晰。

Fibonacci回撤点设置止盈止损位置,能快速止盈止损。

策略参数较少,容易理解掌握。

可扩展性良好,容易进行优化改进。

策略风险

该策略主要存在以下风险:

监控时间框架过多,增加了复杂度,容易出错。

未考虑特殊行情的突发事件,如重大新闻事件造成的行情剧烈波动。

回撤点设置止盈止损存在盈利不足的可能。

参数设置不当可能导致过度交易或漏单。

对策:

加强异常情况和重大新闻事件的监控。

优化止盈止损逻辑,确保盈利达到一定水平。

详细测试与优化参数,减少过度交易和漏单概率。

策略优化方向

该策略的主要优化方向有:

增加机器学习模型判断趋势优先方向的可能性,利用更多的数据提高判断准确性。

测试其他指标构建通道,判断买卖点。

尝试更先进的止盈止损方式,如移动止盈、跳跃止盈等。

利用回测结果推导最优参数,使参数设置更加符合量化投资原则。

增加对重大突发事件的监控和响应机制。

总结

该策略整体来说,核心思想是基于双重过滤减少噪音的高频量化交易策略。它利用多时间框架判断和通道判定买卖点的方法,实现了交易信号的双重可靠性过滤。同时,策略参数较少,容易掌握;可扩展性良好,容易进行优化改进。下一步将从判断准确性、止盈止损方式、参数优化等方面进行优化,使策略效果更好。

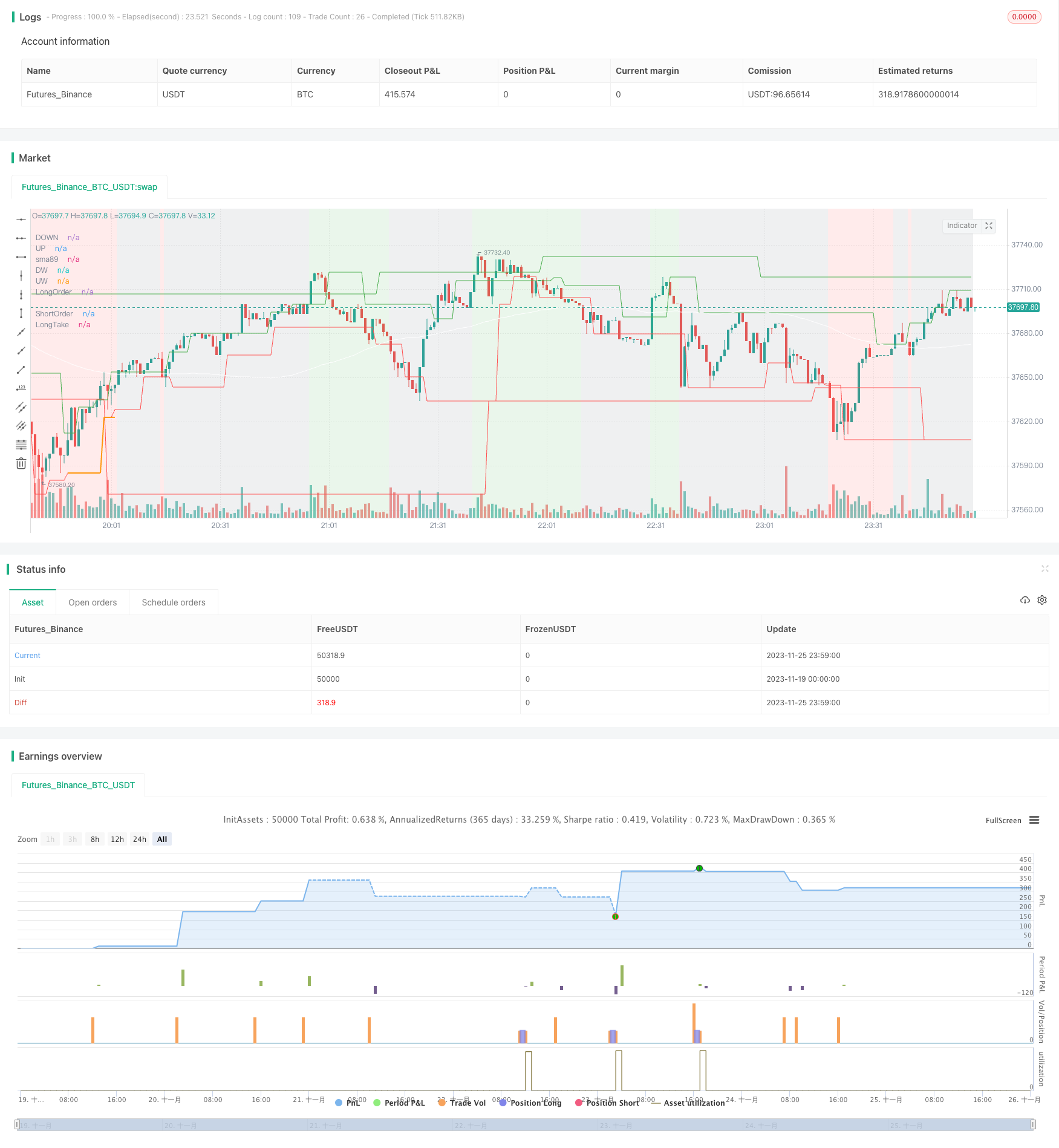

/*backtest

start: 2023-11-19 00:00:00

end: 2023-11-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='AG328', shorttitle='AG328', overlay=true )

// Настройки для включения/выключения торговли в Лонг и Шорт

longEnabled = input(true, title="Торговля в Лонг")

shortEnabled = input(true, title="Торговля в Шорт")

smaEnabled = input(true, title="Включить SMA89")

tradeInGrey = input(false, title = "Сигнал в серой зоне")

pipsBuyStop = input.int(0, title="Пунктов добавить для Buy ордера", minval=-50, step=1, maxval=50)

pipsSellStop = input.int(0, title="Пунктов добавить для Sell ордера", minval=-50, step=1, maxval=50)

// Const

LicenseID = 6889430941909

contracts = input.float(0.01, title="Контрактов на сделку:", minval=0, step=0.01, maxval=10)

var float sma = na

var float UW = na

var float DW = na

var bool weeklyLongPriority = na

var bool weeklyShortPriority = na

var float UD = na

var float DD = na

var bool dailyLongPriority = na

var bool dailyShortPriority = na

var float UP = na

var float DOWN = na

var bool h4LongPriority = na

var bool h4ShortPriority = na

var bool LongCondition = na

var bool ShortCondition = na

var bool GreenZone = na

var bool GreyZone = na

var bool RedZone = na

var float LongOrder = 0

var float ShortOrder = 0

var float LongTP = 0

var float ShortTP = 0

var float LongTake = 0

var float ShortTake = 0

var float AA = 0

var float BB = 0

var float CC = 0

var float D = 0

var float AAA = 0

var float BBB = 0

var float CCC = 0

var float DDD = 0

var float stopLong = 0

var float stopShort = 0

var string olderTF = ""

var string oldestTF = ""

var string pivotTF = ""

// Создаем входную настройку для ТФ Пивота

maxValuePivotTF = input.int(2, title="ТФ Пивота старше на:", minval=1, step=1, maxval=3)

// Шаг цены инструмента

stepSize = syminfo.mintick

currentTF = timeframe.period // Получаем текущий ТФ

if currentTF == "1" // Определяем 2 более старших ТФ

olderTF := "5"

oldestTF := "15"

pivotTF := (maxValuePivotTF == 1 ? "5" : (maxValuePivotTF == 2 ? "15" : "60"))

if currentTF == "5"

olderTF := "15"

oldestTF := "60"

pivotTF := (maxValuePivotTF == 1 ? "15" : (maxValuePivotTF == 2 ? "60" : "240"))

if currentTF == "15"

olderTF := "60"

oldestTF := "240"

pivotTF := (maxValuePivotTF == 1 ? "60" : (maxValuePivotTF == 2 ? "240" : "D"))

if currentTF == "60"

olderTF := "240"

oldestTF := "D"

pivotTF := (maxValuePivotTF == 1 ? "240" : (maxValuePivotTF == 2 ? "D" : "W"))

if currentTF == "240"

olderTF := "D"

oldestTF := "W"

pivotTF := (maxValuePivotTF == 1 ? "D" : (maxValuePivotTF == 2 ? "W" : "M"))

if currentTF == "D"

olderTF := "W"

oldestTF := "M"

pivotTF := (maxValuePivotTF == 1 ? "W" : (maxValuePivotTF == 2 ? "M" : "3M"))

if currentTF == "W"

olderTF := "M"

oldestTF := "3M"

pivotTF := (maxValuePivotTF == 1 ? "M" : (maxValuePivotTF == 2 ? "3M" : "3M"))

// Рассчитываем бары ТФ+2

weekHigh0 = request.security(syminfo.tickerid, oldestTF, high)

weekHigh1 = request.security(syminfo.tickerid, oldestTF, high[1])

weekHigh2 = request.security(syminfo.tickerid, oldestTF, high[2])

weekHigh3 = request.security(syminfo.tickerid, oldestTF, high[3])

weekHigh4 = request.security(syminfo.tickerid, oldestTF, high[4])

weekLow0 = request.security(syminfo.tickerid, oldestTF, low)

weekLow1 = request.security(syminfo.tickerid, oldestTF, low[1])

weekLow2 = request.security(syminfo.tickerid, oldestTF, low[2])

weekLow3 = request.security(syminfo.tickerid, oldestTF, low[3])

weekLow4 = request.security(syminfo.tickerid, oldestTF, low[4])

// ТФ+2 Фракталы

weekFractal_UP = weekHigh2 > weekHigh1 and weekHigh2 > weekHigh0 and weekHigh2 > weekHigh3 and weekHigh2 > weekHigh4

weekFractal_DOWN = weekLow2 < weekLow1 and weekLow2 < weekLow0 and weekLow2 < weekLow3 and weekLow2 < weekLow4

if weekFractal_UP

UW := weekHigh2

UW

if weekFractal_DOWN

DW := weekLow2

DW

// Рисуем UW, DW

plot(UW, title = "UW", color=color.green)

plot(DW, title = "DW", color=color.red)

// ТФ+2 priority

if close > UW

weeklyLongPriority := true

weeklyLongPriority

else if close < DW

weeklyLongPriority := false

weeklyLongPriority

//weeklyColor = weeklyLongPriority ? color.new(color.green, transp=70) : color.new(color.red, transp=70)

//bgcolor(weeklyColor, title = "WeeklyPriority")

//-----------------------------------------------

// Рассчитываем дневные бары

dayHigh0 = request.security(syminfo.tickerid, olderTF, high)

dayHigh1 = request.security(syminfo.tickerid, olderTF, high[1])

dayHigh2 = request.security(syminfo.tickerid, olderTF, high[2])

dayHigh3 = request.security(syminfo.tickerid, olderTF, high[3])

dayHigh4 = request.security(syminfo.tickerid, olderTF, high[4])

dayLow0 = request.security(syminfo.tickerid, olderTF, low)

dayLow1 = request.security(syminfo.tickerid, olderTF, low[1])

dayLow2 = request.security(syminfo.tickerid, olderTF, low[2])

dayLow3 = request.security(syminfo.tickerid, olderTF, low[3])

dayLow4 = request.security(syminfo.tickerid, olderTF, low[4])

// Дневные Фракталы

dayFractal_UP = dayHigh2 > dayHigh1 and dayHigh2 > dayHigh0 and dayHigh2 > dayHigh3 and dayHigh2 > dayHigh4

dayFractal_DOWN = dayLow2 < dayLow1 and dayLow2 < dayLow0 and dayLow2 < dayLow3 and dayLow2 < dayLow4

if dayFractal_UP

UD := dayHigh2

UD

if dayFractal_DOWN

DD := dayLow2

DD

// Рисуем UD, DD

//plot(UD, title = "UD", color=color.green)

//plot(DD, title = "DD", color=color.red)

// Daily priority

if close > UD

dailyLongPriority := true

dailyLongPriority

else if close < DD

dailyLongPriority := false

dailyLongPriority

//dailyColor = dailyLongPriority ? color.new(color.green, transp=70) : color.new(color.red, transp=70)

//bgcolor(dailyColor, title = "DailyPriority")

//-----------------------------------------------

// Рассчитываем 4-часовые бары

h4High0 = request.security(syminfo.tickerid, currentTF, high)

h4High1 = request.security(syminfo.tickerid, currentTF, high[1])

h4High2 = request.security(syminfo.tickerid, currentTF, high[2])

h4High3 = request.security(syminfo.tickerid, currentTF, high[3])

h4High4 = request.security(syminfo.tickerid, currentTF, high[4])

h4Low0 = request.security(syminfo.tickerid, currentTF, low)

h4Low1 = request.security(syminfo.tickerid, currentTF, low[1])

h4Low2 = request.security(syminfo.tickerid, currentTF, low[2])

h4Low3 = request.security(syminfo.tickerid, currentTF, low[3])

h4Low4 = request.security(syminfo.tickerid, currentTF, low[4])

// H4 Фракталы

h4Fractal_UP = h4High2 > h4High1 and h4High2 > h4High0 and h4High2 > h4High3 and h4High2 > h4High4

h4Fractal_DOWN = h4Low2 < h4Low1 and h4Low2 < h4Low0 and h4Low2 < h4Low3 and h4Low2 < h4Low4

if h4Fractal_UP

UP := h4High2

UP

if h4Fractal_DOWN

DOWN := h4Low2

DOWN

// Рисуем UP, DOWN

plot(UP, title='UP', color=color.new(color.green, 0))

plot(DOWN, title='DOWN', color=color.new(color.red, 0))

// SMA89

sma89 = ta.sma(close, 89)

plot(smaEnabled ? sma89 : na, title='sma89', color=color.new(color.white, transp=10))

//smaColor = close > sma89 ? color.new(color.green, transp=70) : color.new(color.red, transp=70)

//bgcolor(smaColor, title = "smaPriority")

// Condition

LongCondition := weeklyLongPriority and dailyLongPriority and (smaEnabled ? close > sma89 : true)

ShortCondition := weeklyLongPriority == false and dailyLongPriority == false and (smaEnabled ? close < sma89 : true)

ConditionColor = LongCondition ? color.new(color.green, transp=85) : ShortCondition ? color.new(color.red, transp=85) : color.new(color.gray, transp=85)

bgcolor(ConditionColor, title='Condition')

// LOGIC LONG

if AA == 0 and h4Fractal_UP

AA := UP

if (AA[1] != 0 and BB == 0 and h4Fractal_DOWN) or (AA[1] != 0 and BB != 0 and D == 2 and h4Fractal_DOWN)

BB := DOWN

D := 1

if BB != 0 and D == 1 and ta.crossunder(low, BB)

D := 2

if AA != 0 and BB != 0

if D == 2 and (D[1] == 1 or D[2] == 1 or D[3] == 1) and h4Fractal_UP

CC := UP

else if D == 1 and h4Fractal_UP

CC := UP

if (AA != 0 and high > AA) or (LongOrder != 0 and high > LongOrder + pipsBuyStop * stepSize) or (tradeInGrey ? ShortCondition : not LongCondition)

AA := 0

BB := 0

CC := 0

D := 0

//

//plot(AA != 0 ? AA : na, title='A', color=color.new(color.white, transp=10), linewidth=2, style=plot.style_linebr)

//plot(BB != 0 ? BB : na, title='B', color=color.new(color.gray, transp=10), linewidth=2, style=plot.style_linebr)

//plot(CC != 0 ? CC : na, title='C', color=color.new(color.blue, transp=10), linewidth=2, style=plot.style_linebr)

//plot(D != 0 ? D : na, title='D', color=color.new(color.green, transp=80), linewidth=2, style=plot.style_linebr)

// LOGIC SHORT

if AAA == 0 and h4Fractal_DOWN

AAA := DOWN

if (AAA[1] != 0 and BBB == 0 and h4Fractal_UP) or (AAA[1] != 0 and BBB[1] != 0 and DDD == 2 and h4Fractal_UP)

BBB := UP

DDD := 1

if BBB != 0 and DDD == 1 and ta.crossover(high, BBB)

DDD := 2

if AAA != 0 and BBB != 0

if DDD == 2 and (DDD[1] == 1 or DDD[2] == 1 or DDD[3] == 1) and h4Fractal_DOWN

CCC := DOWN

else if DDD == 1 and h4Fractal_DOWN

CCC := DOWN

if (AAA != 0 and low < AAA) or (ShortOrder != 0 and low < ShortOrder - pipsSellStop * stepSize) or (tradeInGrey ? LongCondition : not ShortCondition)

AAA := 0

BBB := 0

CCC := 0

DDD := 0

//

//plot(AAA != 0 ? AAA : na, title='ShortA', color=color.new(color.white, transp=10), linewidth=2, style=plot.style_linebr)

//plot(BBB != 0 ? BBB : na, title='ShortB', color=color.new(color.gray, transp=10), linewidth=2, style=plot.style_linebr)

//plot(CCC != 0 ? CCC : na, title='ShortC', color=color.new(color.blue, transp=10), linewidth=2, style=plot.style_linebr)

//plot(DDD != 0 ? DDD : na, title='ShortD', color=color.new(color.green, transp=80), linewidth=2, style=plot.style_linebr)

// LongOrder

if (tradeInGrey ? not ShortCondition : LongCondition) and CC != 0 and D == 2 and strategy.position_size[1] == 0 and longEnabled

LongOrder := CC

LongOrder

else if (tradeInGrey ? ShortCondition : not LongCondition) or strategy.position_size[1] > 0 or (LongOrder != 0 and high > LongOrder + pipsBuyStop * stepSize)

LongOrder := 0

LongOrder

plot(LongOrder != 0 ? LongOrder : na, title='LongOrder', color=color.new(color.yellow, transp=10), linewidth=2, style=plot.style_linebr)

// ShortOrder

if (tradeInGrey ? not LongCondition : ShortCondition) and CCC != 0 and DDD == 2 and strategy.position_size[1] == 0 and shortEnabled

ShortOrder := CCC

ShortOrder

else if (tradeInGrey ? LongCondition : not ShortCondition) or strategy.position_size[1] < 0 or (ShortOrder != 0 and low < ShortOrder - pipsSellStop * stepSize)

ShortOrder := 0

ShortOrder

plot(ShortOrder != 0 ? ShortOrder : na, title='ShortOrder', color=color.new(color.orange, transp=10), linewidth=2, style=plot.style_linebr)

// Fibo Pivots

H = request.security(syminfo.tickerid, pivotTF, high[1])

L = request.security(syminfo.tickerid, pivotTF, low[1])

C = request.security(syminfo.tickerid, pivotTF, close[1])

PP = (H + L + C) / 3

R3 = PP + 1.000 * (H - L)

R2 = PP + 0.618 * (H - L)

R1 = PP + 0.382 * (H - L)

S1 = PP - 0.382 * (H - L)

S2 = PP - 0.618 * (H - L)

S3 = PP - 1.000 * (H - L)

//plot(PP)

//plot(R3)

//plot(R2)

//plot(R1)

//plot(S1)

//plot(S2)

//plot(S3)

// Расчет цены Лонг Тейка

if S3 - LongOrder > LongOrder - DOWN

LongTP := S3

LongTP

else if S2 - LongOrder > LongOrder - DOWN

LongTP := S2

LongTP

else if S1 - LongOrder > LongOrder - DOWN

LongTP := S1

LongTP

else if PP - LongOrder > LongOrder - DOWN

LongTP := PP

LongTP

else if R1 - LongOrder > LongOrder - DOWN

LongTP := R1

LongTP

else if R2 - LongOrder > LongOrder - DOWN

LongTP := R2

LongTP

else if R3 - LongOrder > LongOrder - DOWN

LongTP := R3

LongTP

else

LongTP := 0

LongTP

//

//plot(LongTake)

if strategy.position_size == 0

if LongTP == 0 and LongOrder != 0

LongTake := LongOrder + LongOrder - DOWN

LongTake

else

LongTake := LongTP

LongTake

plot(series=strategy.position_size > 0 ? LongTake : na, title='LongTake', color=color.new(color.rgb(99, 253, 104), transp=0), linewidth=1, style=plot.style_linebr)

// Расчет цены Шорт Тейка

if ShortOrder - R3 > UP - ShortOrder

ShortTP := R3

ShortTP

else if ShortOrder - R2 > UP - ShortOrder

ShortTP := R2

ShortTP

else if ShortOrder - R1 > UP - ShortOrder

ShortTP := R1

ShortTP

else if ShortOrder - PP > UP - ShortOrder

ShortTP := PP

ShortTP

else if ShortOrder - S1 > UP - ShortOrder

ShortTP := S1

ShortTP

else if ShortOrder - S2 > UP - ShortOrder

ShortTP := S2

ShortTP

else if ShortOrder - S3 > UP - ShortOrder

ShortTP := S3

ShortTP

else

ShortTP := 0

ShortTP

//

//plot(ShortTP)

if strategy.position_size == 0

if ShortTP == 0 and ShortOrder != 0

ShortTake := ShortOrder - (UP - ShortOrder)

ShortTake

else

ShortTake := ShortTP

ShortTake

plot(series=strategy.position_size < 0 ? ShortTake : na, title='ShortTake', color=color.new(color.rgb(99, 253, 104), transp=0), linewidth=1, style=plot.style_linebr)

// StopForLONG and SHORT

stopLong := math.min(DOWN,ta.lowest(low,3)) - pipsSellStop*stepSize

//plot(stopLong)

stopShort := math.max(UP,ta.highest(high,3)) + pipsBuyStop*stepSize

//plot(stopShort)

// TRADES LONG

if LongOrder > 0 and close < LongOrder and longEnabled and LongCondition

strategy.entry('Long', strategy.long, stop=LongOrder + pipsBuyStop*stepSize)

if LongOrder == 0 or not LongCondition or not longEnabled

strategy.cancel('Long')

strategy.exit('CloseLong', from_entry='Long', stop=stopLong, limit=LongTake - pipsSellStop*stepSize)

// // LONG ALERT !!!

// if longEnabled and LongCondition and LongOrder[1] == 0 and LongOrder != 0

// alert(str.tostring(LicenseID)+',buystop,GBPUSDb,price=' +str.tostring(LongOrder + pipsBuyStop*stepSize)+',risk='+str.tostring(contracts), alert.freq_once_per_bar_close)

// if longEnabled and LongCondition and LongOrder[1] != 0 and LongOrder != 0 and LongOrder != LongOrder[1]

// alert(str.tostring(LicenseID)+',cancellongbuystop,GBPUSDb,price='+str.tostring(LongOrder + pipsBuyStop*stepSize)+',risk='+str.tostring(contracts), alert.freq_once_per_bar_close)

// if (strategy.position_size > 0 and (LongTake != LongTake[1] or stopLong != stopLong[1])) or (strategy.position_size > 0 and strategy.position_size[1] == 0 )

// alert(str.tostring(LicenseID)+',newsltplong,GBPUSDb,sl='+str.tostring(stopLong)+',tp='+str.tostring(LongTake - pipsSellStop*stepSize), alert.freq_once_per_bar_close)

// if strategy.position_size == 0 and ((LongCondition[1] and not LongCondition) or not longEnabled) and (LongOrder[1] != 0 and LongOrder == 0)

// alert(str.tostring(LicenseID)+',cancellong,GBPUSDb', alert.freq_once_per_bar_close)

// // TRADES SHORT

// if ShortOrder > 0 and close > ShortOrder and shortEnabled and ShortCondition

// strategy.entry('Short', strategy.short, stop=ShortOrder - pipsSellStop*stepSize)

// if ShortOrder == 0 or not ShortCondition or not shortEnabled

// strategy.cancel('Short')

// strategy.exit('CloseShort', from_entry='Short', stop=stopShort, limit=ShortTake + pipsBuyStop*stepSize)

// // SHORT ALERT !!!

// if shortEnabled and ShortCondition and ShortOrder[1] == 0 and ShortOrder != 0

// alert(str.tostring(LicenseID)+',sellstop,GBPUSDb,price=' +str.tostring(ShortOrder - pipsSellStop*stepSize)+',risk='+str.tostring(contracts), alert.freq_once_per_bar_close)

// if shortEnabled and ShortCondition and ShortOrder[1] != 0 and ShortOrder != 0 and ShortOrder != ShortOrder[1]

// alert(str.tostring(LicenseID)+',cancelshortsellstop,GBPUSDb,price='+str.tostring(ShortOrder - pipsSellStop*stepSize)+',risk='+str.tostring(contracts), alert.freq_once_per_bar_close)

// if (strategy.position_size < 0 and (ShortTake != ShortTake[1] or stopShort != stopShort[1])) or (strategy.position_size < 0 and strategy.position_size[1] == 0)

// alert(str.tostring(LicenseID)+',newsltpshort,GBPUSDb,sl='+str.tostring(stopShort)+',tp='+str.tostring(ShortTake + pipsBuyStop*stepSize), alert.freq_once_per_bar_close)

// if strategy.position_size == 0 and ((ShortCondition[1] and not ShortCondition) or not shortEnabled) and (ShortOrder[1] != 0 and ShortOrder == 0)

// alert(str.tostring(LicenseID)+',cancelshort,GBPUSDb', alert.freq_once_per_bar_close)