Overview

This strategy identifies the price bands of Bitcoin by combining quantitative indicators across different timeframes, and conducts trend tracking trades. It adopts the 5-minute timeframe and aims for long-term holding of bands for profit.

Strategy Logic

- The RSI indicator calculated based on the daily timeframe weighs based on trading volume to filter false breakouts.

- The daily RSI indicator is smoothed by an EMA to build a quantitative band indicator.

- The 5-minute timeframe uses a combination of Linear Regression and HMA indicators to generate trading signals.

- By combining the quantitative band indicator and trading signals across timeframes, the strategy identifies mid-to-long-term price bands.

Advantage Analysis

- The volume-weighted RSI indicator can effectively identify true bands and filter false breakouts.

- The HMA indicator is more sensitive to price changes and can capture turns timely.

- Combining multiple timeframes leads to more accurate identification of mid-to-long-term bands.

- Trading on the 5-minute timeframe allows higher operation frequency.

- As a band tracking strategy, it does not require accurate picking of points and can hold for longer periods.

Risk Analysis

- Quantitative indicators may generate false signals, fundamental analysis is recommended.

- Bands may see midway reversals, stop-loss mechanisms should be in place.

- Signal delays may lead to missing best entry points.

- Profitable bands need longer holding periods, requiring capital pressure tolerance.

Optimization Directions

- Test effectiveness of RSI indicators with different parameters.

- Try introducing other auxiliary band indicators.

- Optimize HMA indicator length parameters.

- Add stop loss and take profit strategies.

- Adjust holding cycle for band trades.

Conclusion

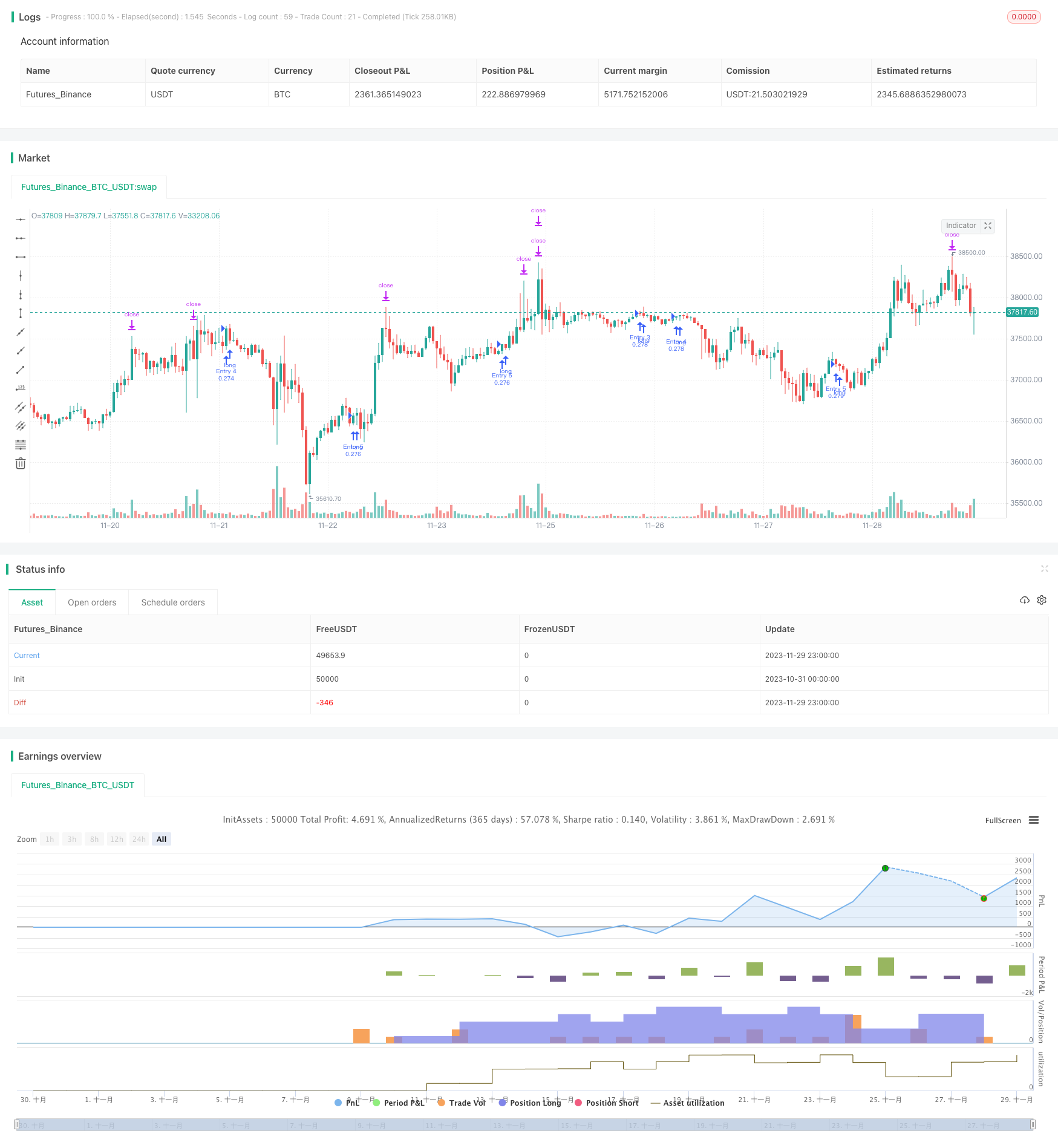

This strategy effectively captures Bitcoin’s mid-to-long-term trends by coupling timeframes and band tracking. Compared to short-term trading, mid-to-long-term band trading sees smaller drawdowns and greater profit potential. Next steps involve further enhancing profitability and stability through parameter tuning and risk management additions.

Strategy source code

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title='Pyramiding BTC 5 min', overlay=true, pyramiding=5, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=20, commission_type=strategy.commission.percent, commission_value=0.075)

//the pyramide based on this script https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

//

fastLength = input(250, title="Fast filter length ", minval=1)

slowLength = input(500,title="Slow filter length", minval=1)

source=close

v1=ema(source,fastLength)

v2=ema(source,slowLength)

//

//Backtest dates

fromMonth = input(defval=1, title="From Month")

fromDay = input(defval=10, title="From Day")

fromYear = input(defval=2020, title="From Year")

thruMonth = input(defval=1, title="Thru Month")

thruDay = input(defval=1, title="Thru Day")

thruYear = input(defval=2112, title="Thru Year")

showDate = input(defval=true, title="Show Date Range")

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

leng=1

p1=close[1]

len55 = 10

//taken from https://www.tradingview.com/script/Ql1FjjfX-security-free-MTF-example-JD/

HTF = input("1D", type=input.resolution)

ti = change( time(HTF) ) != 0

T_c = fixnan( ti ? close : na )

vrsi = rsi(cum(change(T_c) * volume), leng)

pp=wma(vrsi,len55)

d=(vrsi[1]-pp[1])

len100 = 10

x=ema(d,len100)

//

zx=x/-1

col=zx > 0? color.lime : color.orange

//

tf10 = input("1", title = "Timeframe", type = input.resolution, options = ["1", "5", "15", "30", "60","120", "240","360","720", "D", "W"])

length = input(50, title = "Period", type = input.integer)

shift = input(1, title = "Shift", type = input.integer)

hma(_src, _length)=>

wma((2 * wma(_src, _length / 2)) - wma(_src, _length), round(sqrt(_length)))

hma3(_src, _length)=>

p = length/2

wma(wma(close,p/3)*3 - wma(close,p/2) - wma(close,p),p)

b =security(syminfo.tickerid, tf10, hma3(close[1], length)[shift])

//plot(a,color=color.gray)

//plot(b,color=color.yellow)

close_price = close[0]

len = input(25)

linear_reg = linreg(close_price, len, 0)

filter=input(true)

buy=crossover(linear_reg, b)

longsignal = (v1 > v2 or filter == false ) and buy and window()

//set take profit

ProfitTarget_Percent = input(3)

Profit_Ticks = close * (ProfitTarget_Percent / 100) / syminfo.mintick

//set take profit

LossTarget_Percent = input(10)

Loss_Ticks = close * (LossTarget_Percent / 100) / syminfo.mintick

//Order Placing

strategy.entry("Entry 1", strategy.long, when=strategy.opentrades == 0 and longsignal)

strategy.entry("Entry 2", strategy.long, when=strategy.opentrades == 1 and longsignal)

strategy.entry("Entry 3", strategy.long, when=strategy.opentrades == 2 and longsignal)

strategy.entry("Entry 4", strategy.long, when=strategy.opentrades == 3 and longsignal)

strategy.entry("Entry 5", strategy.long, when=strategy.opentrades == 4 and longsignal)

if strategy.position_size > 0

strategy.exit(id="Exit 1", from_entry="Entry 1", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 2", from_entry="Entry 2", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 3", from_entry="Entry 3", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 4", from_entry="Entry 4", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 5", from_entry="Entry 5", profit=Profit_Ticks, loss=Loss_Ticks)