Adaptive Price Channel Strategy

Author: ChaoZhang, Date: 2023-12-04 16:33:45Tags:

Overview

This strategy is an adaptive price channel strategy based on the Average True Range (ATR) indicator and Average Directional Index (ADX). It aims to identify sideways markets and trends in price movements and make trades accordingly.

Strategy Logic

-

Calculate the highest high (HH) and lowest low (LL) over a given length. Also calculate ATR over the same length.

-

Calculate +DI and -DI based on upward and downward price moves. Then calculate ADX.

-

If ADX < 25, the market is considered sideways. If close > upper channel (HH - ATR multiplier * ATR), go long. If close < lower channel (LL + ATR multiplier * ATR), go short.

-

If ADX >= 25 and +DI > -DI, market is bullish. If close > upper channel, go long.

-

If ADX >= 25 and +DI < -DI, market is bearish. If close < lower channel, go short.

-

Exit position after exit_length bars since entry.

Advantage Analysis

-

The strategy adapts automatically based on market conditions, using channel strategy in sideways market and trend following in trending market.

-

Using ATR and ADX ensures adaptiveness. ATR adjusts channel width, ADX determines trend.

-

Forced exit adds stability.

Risk Analysis

-

ADX can generate false signals frequently.

-

Poor ATR and ADX parameters lead to bad performance.

-

Unable to effectively guard against black swan events.

Optimization Directions

-

Optimize parameters for ATR and ADX to improve adaptability.

-

Add stop loss to limit losses.

-

Add filters to avoid false signals.

Conclusion

The strategy combines indicators and mechanisms to adapt across market conditions. But misjudgements can happen due to indicator limitations. Future optimizations on parameters and risk control.

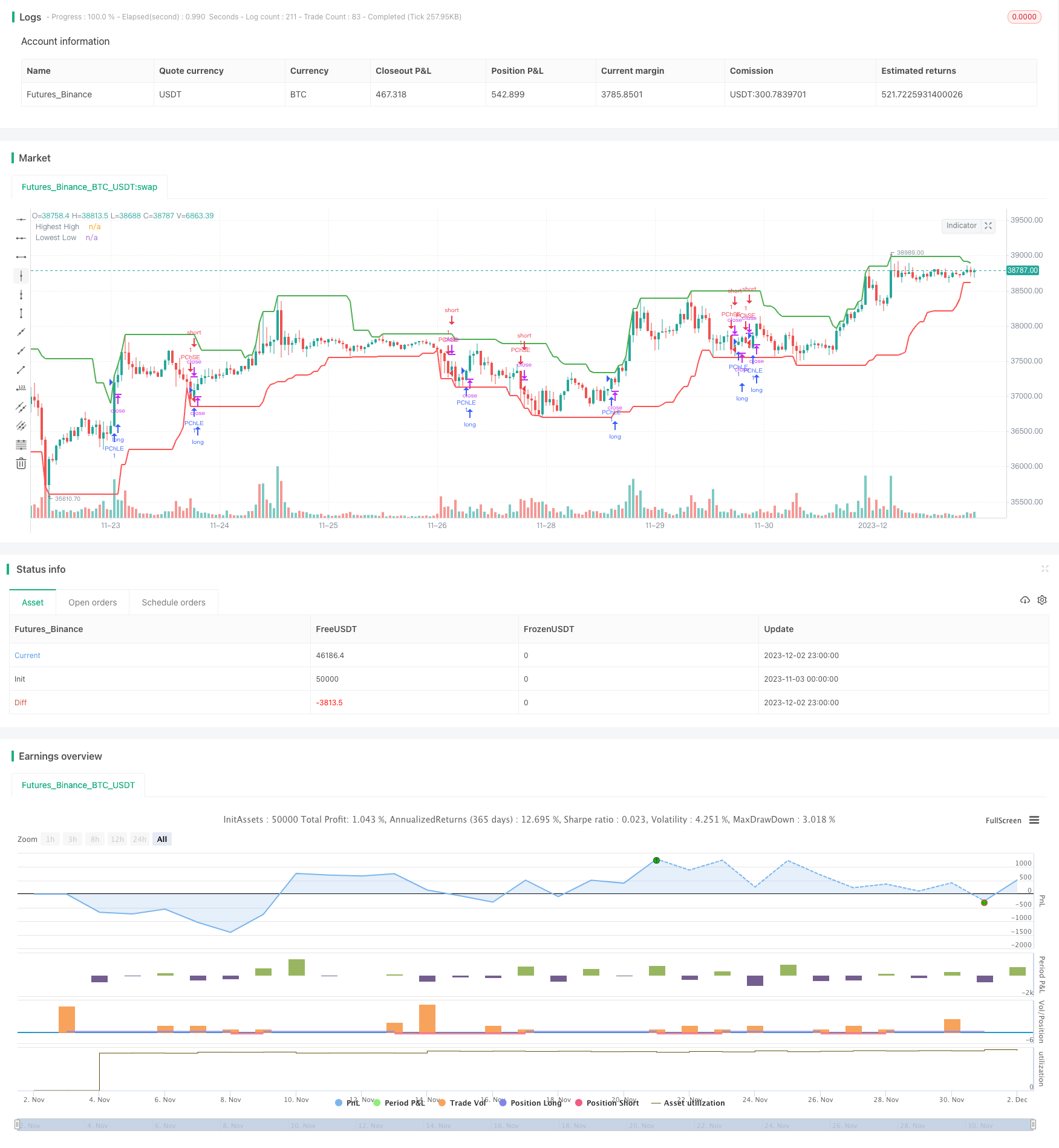

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Adaptive Price Channel Strategy", overlay=true)

length = input(20, title="Length")

exit_length = input(10, title="Exit After X Periods")

atr_multiplier = input(3.2, title="ATR Multiplier")

startDate = input(defval = timestamp("2019-01-15T08:15:15+00:00"), title = "Start Date")

endDate = input(defval = timestamp("2033-04-01T08:15:00+00:00"), title = "End Date")

hh = ta.highest(high, length)

ll = ta.lowest(low, length)

atr = ta.atr(length)

// calculate +DI and -DI

upMove = high - high[1]

downMove = low[1] - low

plusDM = na(upMove[1]) ? na : (upMove > downMove and upMove > 0 ? upMove : 0)

minusDM = na(downMove[1]) ? na : (downMove > upMove and downMove > 0 ? downMove : 0)

plusDI = ta.rma(plusDM, length) / atr * 100

minusDI = ta.rma(minusDM, length) / atr * 100

// calculate ADX

dx = math.abs(plusDI - minusDI) / (plusDI + minusDI) * 100

adx = ta.rma(dx, length)

var int barSinceEntry = na

if (not na(close[length]) )

if (adx < 25) // Sideways market

if (close > hh - atr_multiplier * atr)

strategy.entry("PChLE", strategy.long, comment="PChLE")

barSinceEntry := 0

else if (close < ll + atr_multiplier * atr)

strategy.entry("PChSE", strategy.short, comment="PChSE")

barSinceEntry := 0

else if (adx >= 25 and plusDI > minusDI) // Bullish market

if (close > hh - atr_multiplier * atr)

strategy.entry("PChLE", strategy.long, comment="PChLE")

barSinceEntry := 0

else if (adx >= 25 and plusDI < minusDI) // Bearish market

if (close < ll + atr_multiplier * atr)

strategy.entry("PChSE", strategy.short, comment="PChSE")

barSinceEntry := 0

if (na(barSinceEntry))

barSinceEntry := barSinceEntry[1] + 1

else if (barSinceEntry >= exit_length)

strategy.close("PChLE")

strategy.close("PChSE")

barSinceEntry := na

plot(hh, title="Highest High", color=color.green, linewidth=2)

plot(ll, title="Lowest Low", color=color.red, linewidth=2)

- Volume-driven Oscillation Quant Strategy

- Cross Moving Average Golden Cross Death Cross Strategy

- EMA/ADX/VOL-CRYPTO KILLER

- SuperTrend Multi Timeframe Backtest Strategy

- Eight Days Reversal Momentum Strategy

- Dual Moving Average Breakthrough Strategy

- Golden Cross Moving Average Trading Strategy

- Multi Indicator Quantitative Trading Strategy

- Full Crypto Swing ALMA Cross MACD Quantitative Strategy

- Dual Moving Average Reversal Trading Strategy

- Turtle Breakout Strategy

- Mean Reversion Envelope Moving Average Strategy

- Momentum Breakout Moving Average Trading Strategy

- Dynamic Grid Trading Management Strategy

- Dynamic Moving Average Tracking Strategy

- Double Moving Average Oscillation Trading Strategy

- EMA bands + Leledc + Bollinger bands trend following strategy

- Fast RSI Strategy Analysis

- Adaptive Volatility Breakout Trading Strategy

- High Minus Exponential Moving Average Stock Strategy