概述

该策略通过集成移动平均线、相对强弱指标(RSI)和移动平均聚散指标(MACD)三种主要技术指标,实现多空仓位的自动开平。策略名称中含有“多重指标”,主要是为了突出该策略所采用的多种指标。

策略原理

该策略主要通过比较两条移动平均线的大小关系来判断趋势方向,并结合RSI指标避免错过反转机会。具体来说,策略使用EMA或SMA计算快线和慢线,快线上穿慢线为买入信号,快线下穿慢线为卖出信号。为过滤假突破,策略还设置RSI指标的多空逻辑,只有当RSI指标也满足条件时,才会发出交易信号。

除此之外,策略还集成了MACD指标来进行交易决策。当MACD指标的差离值上穿0轴时为买入信号,差离值下穿0轴时为卖出信号。这样可以利用MACD指标判断趋势是否发生转折,避免在趋势转折点产生错误的信号。

优势分析

该策略最大的优势在于集成多种指标过滤信号,可以有效降低假信号的产生,提高信号质量。具体来说,优势有以下几点:

快慢线结合RSI指标,可以避免单一使用移动平均线产生的假突破。

MACD指标的集成,可以提早判断趋势是否反转,避免在转折点产生错误信号。

允许选择EMA或SMA指标,可以根据不同市场特点选择更合适的指标参数。

允许选择资金管理方案,可以控制单笔订单规模,有效控制风险。

支持止损止盈,可以锁定盈利,避免亏损扩大。

风险分析

该策略主要面临以下风险:

参数优化不当可能导致策略效果不佳。需要花时间测试不同的参数组合。

指标发出错误信号的概率仍然存在。当三种指标同时发出错误信号时,将导致较大亏损。

单一品种效果并不稳定,需要扩展到其他品种。

Datenicht zureichen, Strategie effekt wird in der Zukunft abnehmen。

优化方向

该策略主要可以从以下几个方面进行优化:

测试不同的指标参数组合,寻找最优参数。

增加止损机制中的移动止损。当价格运行一定距离后,可以 trail stop 来锁定利润。

增加对大级别趋势的判断指标,避免逆势交易。例如集成 ADX 指标。

Fügen Sie Moneymanagement Module hinzu für besseres Risikomanagement.

Fügen Sie Filter für fundamentale Faktoren wie Nachrichten hinzu.

总结

该策略通过集成多种技术指标如移动平均线、RSI 和 MACD,实现多空头寻找和过滤。其优势在于可以有效过滤假信号,提高信号质量。主要缺陷是参数选择和指标发出错误信号的概率仍然存在。未来的优化方向包括参数优化、止损优化、趋势过滤等。总体来说,该策略作为多重指标策略框架是行之有效的,后续需要继续优化和验证。

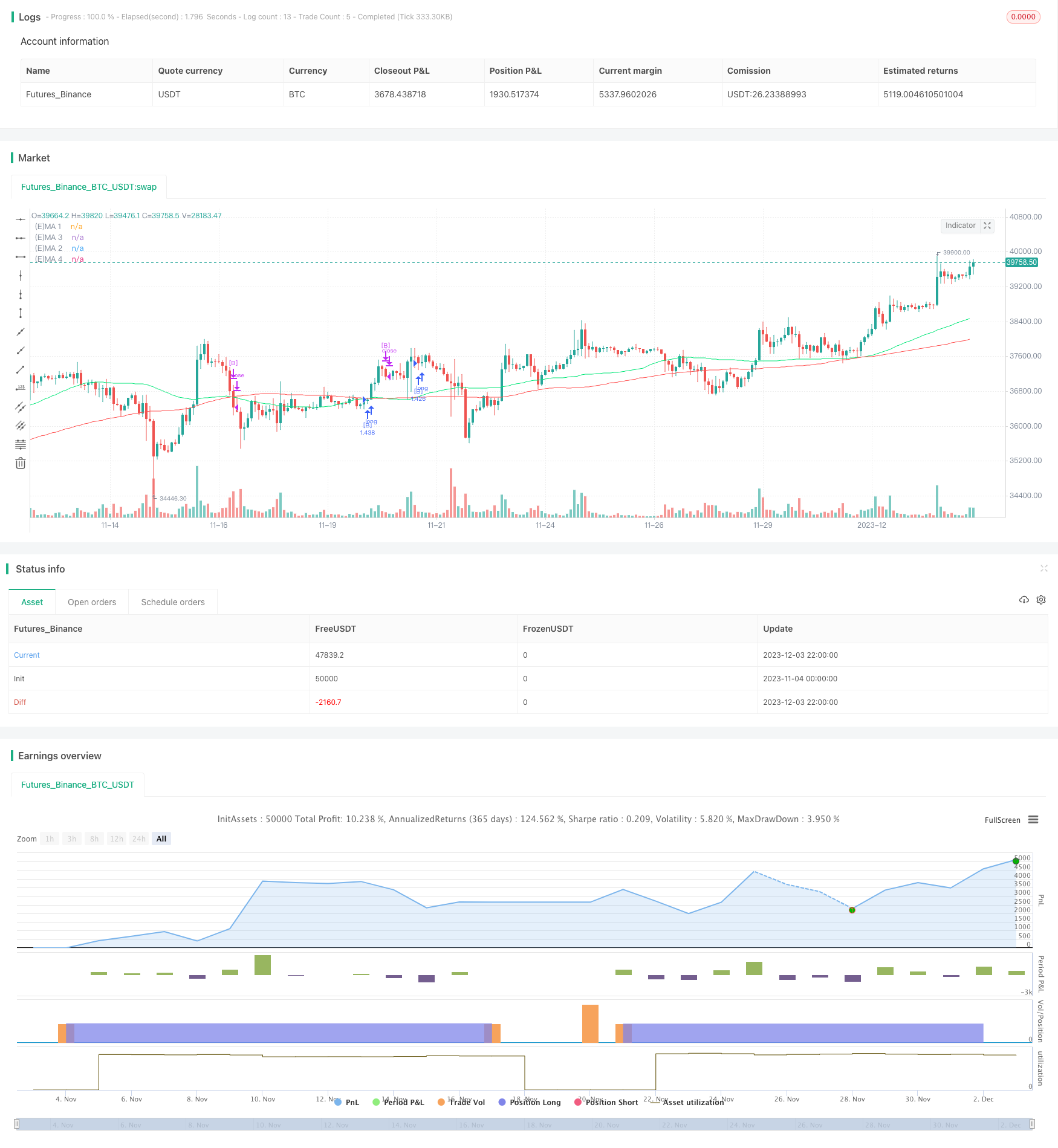

/*backtest

start: 2023-11-04 00:00:00

end: 2023-12-04 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fikira

//@version=4

strategy("Strategy Tester EMA-SMA-RSI-MACD", shorttitle="Strat-test", overlay=true, max_bars_back=5000,

default_qty_type= strategy.percent_of_equity, calc_on_order_fills=false, calc_on_every_tick=false,

pyramiding=0, default_qty_value=100, initial_capital=100)

Tiny = "Tiny"

Small = "Small"

Normal = "Normal"

Large = "Large"

cl = "close" , op = "open" , hi = "high" , lo = "low"

c4 = "ohlc4" , c3 = "hlc3" , hl = "hl2"

co = "(E)MA 1 > (E)MA 2"

cu = "(E)MA 3 < (E)MA 4"

co_HTF = "(E)MA 1 (HTF) > (E)MA 2 (HTF)"

cu_HTF = "(E)MA 3 (HTF) < (E)MA 4 (HTF)"

L_S = "Long & Short" , _L_ = "Long Only" , _S_ = "Short Only"

cla = "Close above (E)MA 1"

clu = "Close under (E)MA 3"

cla_HTF = "Close above (E)MA 1 (HTF)"

clu_HTF = "Close under (E)MA 3 (HTF)"

rsi = "RSI strategy"

none = "NONE"

mch = "macd > signal" , mcl = "macd < signal"

mch0 = "macd > 0" , mcl0 = "macd < 0"

sgh0 = "signal > 0" , sgl0 = "signal < 0"

mch_HTF = "macd (HTF) > signal (HTF)" , mcl_HTF = "macd (HTF) < signal (HTF)"

mch0HTF = "macd (HTF) > 0" , mcl0HTF = "macd (HTF) < 0"

sgh0HTF = "signal (HTF) > 0" , sgl0HTF = "signal (HTF) < 0"

EMA = "EMA" , SMA = "SMA"

s = input(cl, "Source" , options=[cl, op, hi, lo, c4, c3, hl])

src =

s == cl ? close :

s == op ? open :

s == hi ? high :

s == lo ? low :

s == c4 ? ohlc4 :

s == c3 ? hlc3 :

s == hl ? hl2 :

close

__1_ = input(false, ">=< >=< [STRATEGIES] >=< >=<")

Type = input(_L_, "Type Strategy", options=[L_S, _L_, _S_])

_1a_ = input(false, ">=< >=< [BUY/LONG] >=< >=<")

ENT = input(co, "Pick your poison:", options=[co, cla, rsi, mch, mch0, sgh0])

EH = input(0, " if RSI >")

EL = input(100, " if RSI <")

EH_HTF = input(0, " if RSI (HTF) >")

EL_HTF = input(100, " if RSI (HTF) <")

EX = input(none, " Extra argument", options=[none, mch, mch0, sgh0])

EX2 = input(none, " Second argument", options=[none, mch_HTF, mch0HTF, sgh0HTF, co_HTF, cla_HTF])

_1b_ = input(false, ">=< [(E)MA settings (Buy/Long)] >=<")

ma1 = input(SMA, " (E)MA 1", options=[EMA, SMA])

len1 = input(50, " Length" )

ma2 = input(SMA, " (E)MA 2", options=[EMA, SMA])

len2 = input(100, " Length" )

ma1HTF = input(SMA, " (E)MA 1 - HTF", options=[EMA, SMA])

len1HTF = input(50, " Length" )

ma2HTF = input(SMA, " (E)MA 2 - HTF", options=[EMA, SMA])

len2HTF = input(100, " Length" )

_2a_ = input(false, ">=< >=< [SELL/SHORT] >=< >=<")

CLO = input(cu, "Pick your poison:", options=[cu, clu, rsi, mcl, mcl0, sgl0])

CH = input(0, " if RSI >")

CL = input(100, " if RSI <")

CH_HTF = input(0, " if RSI (HTF) >")

CL_HTF = input(100, " if RSI (HTF) <")

CX = input(none, " Extra argument", options=[none, mcl, mcl0, sgl0])

CX2 = input(none, " Second argument", options=[none, mcl_HTF, mcl0HTF, sgl0HTF, cu_HTF, clu_HTF])

_2b_ = input(false, ">=< [(E)MA settings (Sell/Short)] >=<")

ma3 = input(SMA, " (E)MA 3", options=[EMA, SMA])

len3 = input(50, " Length" )

ma4 = input(SMA, " (E)MA 4", options=[EMA, SMA])

len4 = input(100, " Length" )

ma3HTF = input(SMA, " (E)MA 3 - HTF", options=[EMA, SMA])

len3HTF = input(50, " Length" )

ma4HTF = input(SMA, " (E)MA 4 - HTF", options=[EMA, SMA])

len4HTF = input(100, " Length" )

__3_ = input(false, ">=< >=< [RSI] >=< >=< >=<")

ler = input(20 , " RSI Length")

__4_ = input(false, ">=< >=< [MACD] >=< >=< >=<")

fst = input(12, " Fast Length")

slw = input(26, " Slow Length")

sgn = input(9 , " Signal Smoothing")

sma_source = input(false, "Simple MA(Oscillator)")

sma_signal = input(false, "Simple MA(Signal Line)")

__5_ = input(false, ">=< >=< [HTF settings] >=< >=<")

MA_HTF = input("D", " (E)MA HTF", type = input.resolution)

RSI_HTF = input("D", " RSI HTF" , type = input.resolution)

MACD_HTF= input("D", " MACD HTF" , type = input.resolution)

__6_ = input(false, ">=< >=< [SL/TP] >=< >=< >=<")

sl = input(false, "Stop Loss?")

SL = input(10.0, title=" Stop Loss %" ) / 100

tp = input(false, "Take Profit?")

TP = input(20.0, title=" Take Profit %") / 100

SL_ = strategy.position_avg_price * (1 - SL)

TP_ = strategy.position_avg_price * (1 + TP)

// Limitation in time

// (= inspired from a script of "Che_Trader")

xox = input(false, ">=< >=< [TIME] >=< >=< >=<")

ystr1 = input(2010, " Since Year" )

ystp1 = input(2099, " Till Year" )

mstr1 = input(1 , " Since Month")

mstp1 = input(12 , " Till Month" )

dstr1 = input(1 , " Since Day" )

dstp1 = input(31 , " Till Day" )

_Str1 = timestamp(ystr1, mstr1, dstr1, 1, 1)

Stp1_ = timestamp(ystp1, mstp1, dstp1, 23, 59)

TIME = time >= _Str1 and time <= Stp1_ ? true : false

////////////////////////////////////////////////////////////////////////////////////////////

_1 =

ma1 == SMA ? sma(src, len1) :

ma1 == EMA ? ema(src, len1) :

na

_2 =

ma2 == SMA ? sma(src, len2) :

ma2 == EMA ? ema(src, len2) :

na

_3 =

ma3 == SMA ? sma(src, len3) :

ma3 == EMA ? ema(src, len3) :

na

_4 =

ma4 == SMA ? sma(src, len4) :

ma4 == EMA ? ema(src, len4) :

na

_1b =

ma1HTF == SMA ? sma(src, len1HTF) :

ma1HTF == EMA ? ema(src, len1HTF) :

na

_2b =

ma2HTF == SMA ? sma(src, len2HTF) :

ma2HTF == EMA ? ema(src, len2HTF) :

na

_3b =

ma3HTF == SMA ? sma(src, len3HTF) :

ma3HTF == EMA ? ema(src, len3HTF) :

na

_4b =

ma4HTF == SMA ? sma(src, len4HTF) :

ma4HTF == EMA ? ema(src, len4HTF) :

na

_1_HTF = security(syminfo.tickerid, MA_HTF, _1b)

_2_HTF = security(syminfo.tickerid, MA_HTF, _2b)

_3_HTF = security(syminfo.tickerid, MA_HTF, _3b)

_4_HTF = security(syminfo.tickerid, MA_HTF, _4b)

cl_HTF = security(syminfo.tickerid, MA_HTF, close)

////////////////////////////////////////////////////////////////////////////////////////////

plot(ENT == co or ENT == cla ? _1 : na , title="(E)MA 1", color=color.lime )

plot(ENT == co ? _2 : na , title="(E)MA 2", color=color.red )

plot(CLO == cu or CLO == clu ? _3 : na , title="(E)MA 3", color= _3 == _1 ? color.lime : color.yellow)

plot(CLO == cu ? _4 : na , title="(E)MA 4", color= _4 == _2 ? color.red : color.blue )

plot(EX2 == co_HTF or EX2 == cla_HTF ? _1_HTF : na, title="(E)MA 1 HTF", color=color.lime, linewidth=2, transp=50)

plot(EX2 == co_HTF ? _2_HTF : na, title="(E)MA 2 HTF", color=color.red , linewidth=2, transp=50)

plot(CX2 == cu_HTF or CX2 == clu_HTF ? _3_HTF : na, title="(E)MA 3 HTF", color= _3_HTF == _1_HTF ? color.lime : color.yellow, linewidth=2, transp=50)

plot(CX2 == cu_HTF ? _4_HTF : na, title="(E)MA 4 HTF", color= _4_HTF == _2_HTF ? color.red : color.blue , linewidth=2, transp=50)

////////////////////////////////////////////////////////////////////////////////////////////

// RSI

rsi_ = rsi(src, ler)

rsi_HTF = security(syminfo.tickerid, RSI_HTF, rsi_)

////////////////////////////////////////////////////////////////////////////////////////////

// MACD

fast_ma = sma_source ? sma(src, fst) : ema(src, fst)

slow_ma = sma_source ? sma(src, slw) : ema(src, slw)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, sgn) : ema(macd, sgn)

hist = macd - signal

macd_HTF = security(syminfo.tickerid, MACD_HTF, macd )

signal_HTF = security(syminfo.tickerid, MACD_HTF, signal)

////////////////////////////////////////////////////////////////////////////////////////////

extra =

EX == none ? true :

EX == mch ? macd > signal :

EX == mch0 ? macd > 0 :

EX == sgh0 ? signal > 0 :

false

cxtra =

CX == none ? true :

CX == mcl ? macd <= signal :

CX == mcl0 ? macd <= 0 :

CX == sgl0 ? signal <= 0 :

false

EXTRA =

EX2 == none ? true :

EX2 == mch_HTF ? macd_HTF > signal_HTF :

EX2 == mch0HTF ? macd_HTF > 0 :

EX2 == sgh0HTF ? signal_HTF > 0 :

EX2 == co_HTF ? _1_HTF > _2_HTF :

EX2 == cla_HTF ? cl_HTF > _1_HTF :

false

CXTRA =

CX2 == none ? true :

CX2 == mcl_HTF ? macd_HTF <= signal_HTF :

CX2 == mcl0HTF ? macd_HTF <= 0 :

CX2 == sgl0HTF ? signal_HTF <= 0 :

CX2 == cu_HTF ? _3_HTF <= _4_HTF :

CX2 == clu_HTF ? cl_HTF <= _3_HTF :

false

RSI = rsi_ > EH and rsi_ <= EL and rsi_HTF > EH_HTF and rsi_HTF <= EL_HTF

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

BUY =

ENT == co and TIME and extra and EXTRA and RSI ? _1 > _2 :

ENT == cla and TIME and extra and EXTRA and RSI ? src > _1 :

ENT == rsi and TIME and extra and EXTRA ? RSI :

ENT == mch and TIME and extra and EXTRA and RSI ? macd > signal :

ENT == mch0 and TIME and extra and EXTRA and RSI ? macd > 0 :

ENT == sgh0 and TIME and extra and EXTRA and RSI ? signal > 0 :

na

SELL =

CLO == cu and TIME and cxtra and CXTRA and RSI ? _3 <= _4 :

CLO == clu and TIME and cxtra and CXTRA and RSI ? src <= _3 :

CLO == rsi and TIME and cxtra and CXTRA ? RSI :

CLO == mcl and TIME and cxtra and CXTRA and RSI ? macd <= signal :

CLO == mcl0 and TIME and cxtra and CXTRA and RSI ? macd <= 0 :

CLO == sgl0 and TIME and cxtra and CXTRA and RSI ? signal <= 0 :

na

if BUY

if (Type == _S_)

strategy.close("[S]")

else

strategy.entry("[B]", strategy.long)

if SELL

if (Type == _L_)

strategy.close("[B]")

else

strategy.entry("[S]", strategy.short)

strategy.exit("[SL/TP]", "[B]", stop= sl ? SL_ : na, limit= tp ? TP_ : na)