概述

黄金交叉均线交易策略是一个非常简单的移动平均线交易策略。它的交易信号来自两条不同周期的简单移动平均线(SMA)的黄金交叉。具体来说,当较快周期的SMA线从下方突破较慢周期的SMA线时生成买入信号;当较快周期的SMA线从上方跌破较慢周期的SMA线时生成卖出信号。

策略原理

该策略使用两条移动平均线:一条是50周期的SMA快线,另一条是200周期的SMA慢线。

当SMA快线从下方向上突破SMA慢线时,产生买入信号,代表牛市来临。这种突破被称为“黄金交叉”。当SMA快线从上方向下突破SMA慢线时,产生卖出信号,代表熊市来临。这种突破被称为“死亡交叉”。

该策略只做多,不做空。也就是说,它只在黄金交叉时买入,在死亡交叉时卖出平仓。除此之外,策略中没有设置止损或止盈逻辑。

策略优势分析

该策略最大的优势在于非常简单和直观。移动平均线被广泛认为是显示市场趋势变化的有效技术指标。该策略正是利用了移动平均线的这一关键性质来判断市场的长线趋势。

另一个优势是参数设置比较固定。50周期和200周期的选取有一定的道理,不需要频繁调整,适合长期持有。

从历史数据来看,这种简单的移动平均线策略实现了不错的效果。

风险分析

该策略最大的风险也来自于其过于简单。由于没有设定止损逻辑,可能面临较大的单笔损失。这对于风险管理不利。

另外,移动平均线本身也存在一定滞后性。信号的产生需要一定的确认,可能错过短线操作机会。

优化方向

可以考虑在策略中加入其他技术指标,构建更加复杂的交易系统,以提高盈利率和胜率。例如可以加入相对强弱指标(RSI)等震荡指标来捕捉短线信号。

另一方面,也可以优化资金管理策略。设定合理的止损和止盈可以有效控制风险,这是移动这类趋势跟踪策略的常见做法。

总结

黄金交叉均线交易策略是一个高度简化的趋势跟踪策略。它利用移动平均线的黄金交叉和死亡交叉来判断市场长线趋势的变化,以此产生交易信号。该策略的优势在于非常简单直观,容易理解和跟踪,历史表现也不错。但同时也面临一定的风险,特别是在止损和止盈控制上比较缺失。未来可以通过加入其他指标或者优化资金管理来使策略更加稳健可靠。

/*backtest

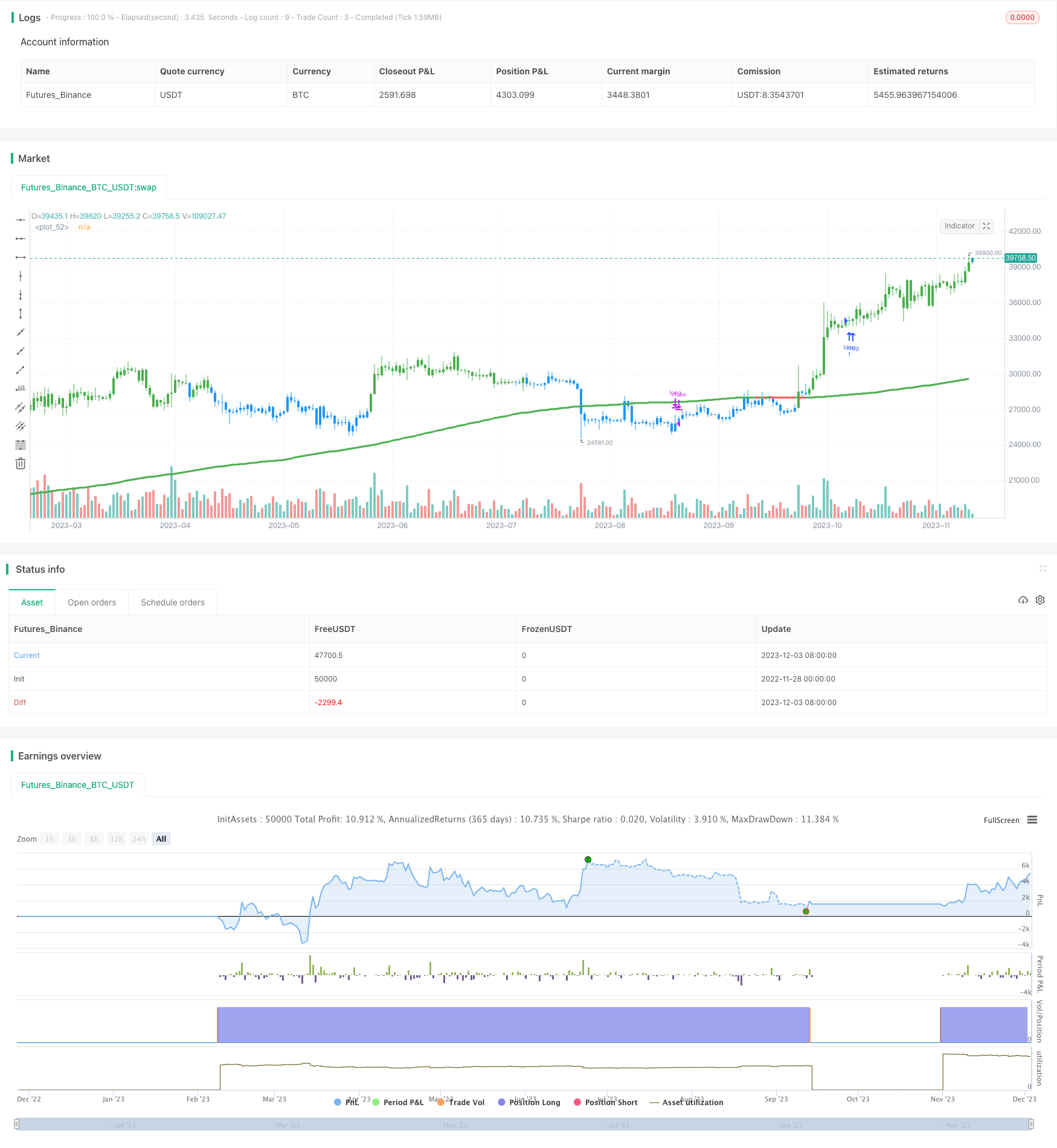

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Golden Cross, SMA 200 Long Only, Moving Average Strategy (by ChartArt)", shorttitle="CA_-_Golden_Cross_Strat", overlay=true)

// ChartArt's Golden Cross Strategy

//

// Version 1.0

// Idea by ChartArt on June 19, 2016.

//

// This moving average strategy is very easy to follow:

//

// The strategy goes long when the faster SMA 50 (the

// simple moving average of the last 50 bars) crosses

// above the SMA 200. Orders are closed when the SMA 50

// crosses below SMA 200. The strategy does not short.

//

// This simple strategy does not have any other

// stop loss or take profit money management logic.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

// Input

switch1=input(true, title="Enable Bar Color?")

switch2=input(false, title="Show Fast Moving Average")

switch3=input(true, title="Show Slow Moving Average")

movingaverage_fast = sma(close, input(50))

movingaverage_slow = sma(close, input(200))

// Calculation

bullish_cross = crossover(movingaverage_fast, movingaverage_slow)

bearish_cross = crossunder(movingaverage_fast, movingaverage_slow)

// Strategy

if bullish_cross

strategy.entry("long", strategy.long)

strategy.close("long", when = bearish_cross )

// Colors

bartrendcolor = close > movingaverage_fast and close > movingaverage_slow and change(movingaverage_slow) > 0 ? green : close < movingaverage_fast and close < movingaverage_slow and change(movingaverage_slow) < 0 ? red : blue

barcolor(switch1?bartrendcolor:na)

// Output

plot(switch2?movingaverage_fast:na,color = change(movingaverage_fast) > 0 ? green : red,linewidth=3)

plot(switch3?movingaverage_slow:na,color = change(movingaverage_slow) > 0 ? green : red,linewidth=3)

//

alertcondition(bullish_cross, title='Golden Cross (bullish)', message='Bullish')

alertcondition(bearish_cross, title='Death Cross (bearish)', message='Bearish')