A quantitative trading strategy that uses an EMA system to determine trend direction, ADX indicator to determine trend strength, and incorporates trading volume filtering for entry

Principle

The strategy first uses 5 EMAs of different periods to judge the price trend direction. When all 5 EMAs rise, it is judged as a bullish trend formation. When all 5 EMAs fall, it is judged as a bearish trend formation.

It then uses the ADX indicator to judge the strength of the trend. When the DI+ line is higher than the DI- line and the ADX value exceeds the set threshold, it is judged as a strong bullish trend. When the DI- line is higher than the DI+ line and the ADX value exceeds the set threshold, it is judged as a bearish trend.

At the same time, breakthroughs in trading volume are used for additional confirmation, requiring the trading volume of the current K-line to be greater than a certain multiple of the mean volume over a period, thereby avoiding wrong entries in low volume positions.

Combined with the comprehensive judgment of trend direction, trend strength and trading volume, the long and short opening logic of this strategy is formed.

Advantages

Using an EMA system to judge trend direction is more reliable than a single EMA.

Using the ADX indicator to judge the strength of the trend avoids wrong entries when there is no clear trend.

The trading volume filter mechanism ensures sufficient trading volume support and enhances the reliability of the strategy.

Multiple condition comprehensive judgment makes opening signals more precise and reliable.

The relatively large number of strategy parameters allows performance improvements through ongoing parameter optimization.

Risks and Solutions

In range-bound markets, EMA, ADX and other judgments may give wrong signals, resulting in unnecessary losses. Parameters can be adjusted appropriately or other indicators can be added for auxiliary judgment.

The trading volume filter conditions may be too strict, missing market opportunities. The parameters can be appropriately reduced.

The trading frequency generated by the strategy may be relatively high. Attention should be paid to money management and the size of single positions should be appropriately controlled.

Optimization Directions

Test different parameter combinations to find optimal parameters to improve strategy performance.

Add other indicators such as MACD, KDJ to combine with EMA and ADX to form a more powerful comprehensive open position judgment.

Add stop loss strategies to further control risks.

Optimize position management strategies to achieve more scientific capital management.

Summary

By comprehensively considering price trend direction, trend strength and trading volume information, this strategy forms opening rules to avoid some common traps to some extent and has relatively strong reliability. But it still needs further improvement of the strategy system through parameter optimization, indicator selection and risk control to further improve performance. In general, this strategy framework has great potential for expansion and optimization space.

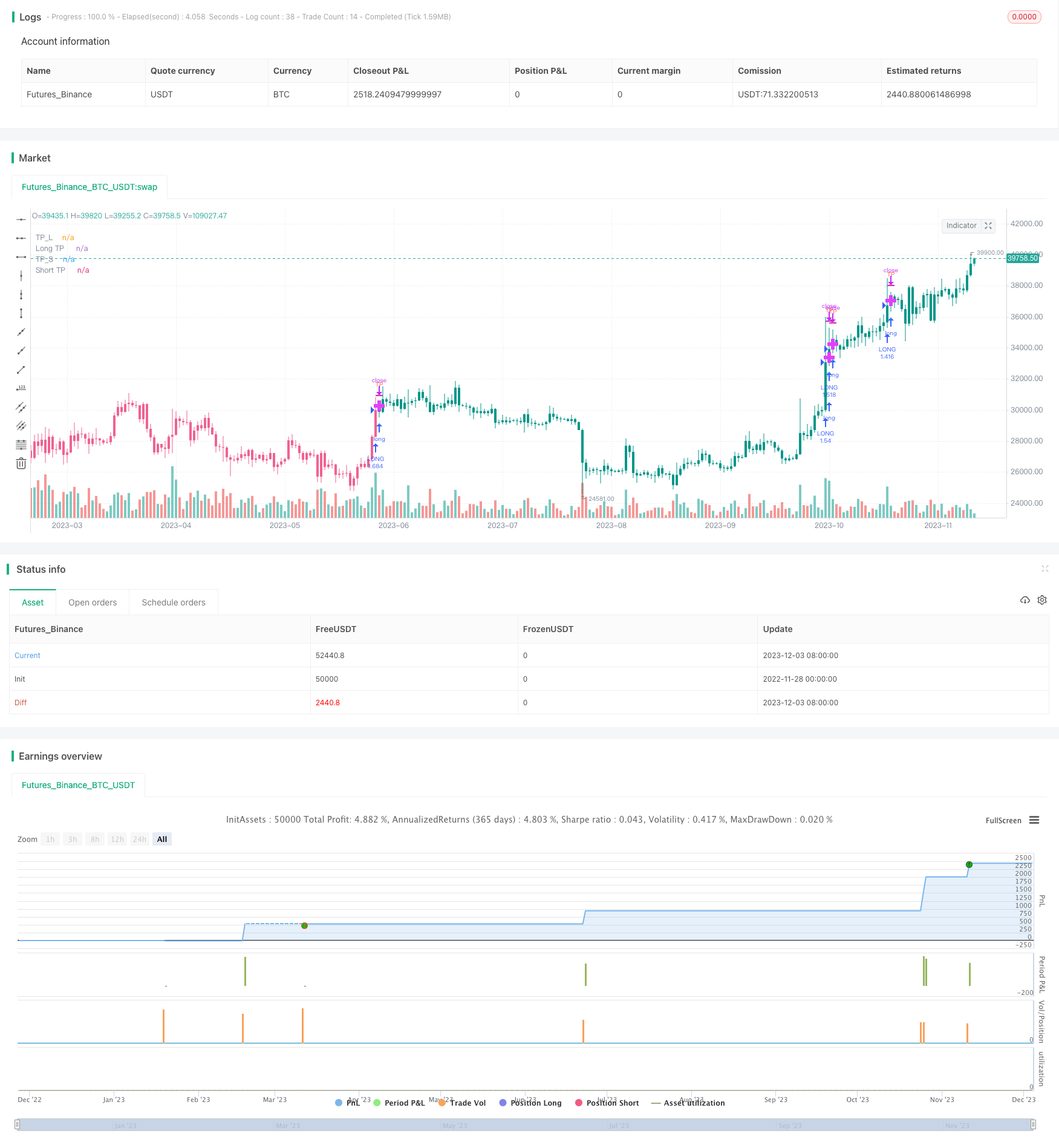

/*backtest

start: 2022-11-28 00:00:00

end: 2023-12-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BabehDyo

//@version=4

strategy("EMA/ADX/VOL-CRYPTO KILLER [15M]", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

//SOURCE =============================================================================================================================================================================================================================================================================================================

src = input(open, title=" Source")

// Inputs ========================================================================================================================================================================================================================================================================================================

//ADX --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ADX_options = input("MASANAKAMURA", title=" Adx Type", options = ["CLASSIC", "MASANAKAMURA"], group="ADX")

ADX_len = input(21, title=" Adx Length", type=input.integer, minval = 1, group="ADX")

th = input(20, title=" Adx Treshold", type=input.float, minval = 0, step = 0.5, group="ADX")

//EMA--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Length_ema1 = input(8, title=" 1-EMA Length", minval=1)

Length_ema2 = input(13, title=" 2-EMA Length", minval=1)

Length_ema3 = input(21, title=" 3-EMA Length", minval=1)

Length_ema4 = input(34, title=" 4-EMA Length", minval=1)

Length_ema5 = input(55, title=" 5-EMA Length", minval=1)

// Range Filter ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

per_ = input(15, title=" Period", minval=1, group = "Range Filter")

mult = input(2.6, title=" mult.", minval=0.1, step = 0.1, group = "Range Filter")

// Volume ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

volume_f = input(3.2, title=" Volume mult.", minval = 0, step = 0.1, group="Volume")

sma_length = input(20, title=" Volume lenght", minval = 1, group="Volume")

volume_f1 = input(1.9, title=" Volume mult. 1", minval = 0, step = 0.1, group="Volume")

sma_length1 = input(22, title=" Volume lenght 1", minval = 1, group="Volume")

//TP PLOTSHAPE -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tp_long0 = input(0.9, title=" % TP Long", type = input.float, minval = 0, step = 0.1, group="Target Point")

tp_short0 = input(0.9, title=" % TP Short", type = input.float, minval = 0, step = 0.1, group="Target Point")

// SL PLOTSHAPE ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

sl0 = input(4.2, title=" % Stop loss", type = input.float, minval = 0, step = 0.1, group="Stop Loss")

//INDICATORS =======================================================================================================================================================================================================================================================================================================

//ADX-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

L_adx = DIPlus > DIMinus and ADX > th

S_adx = DIPlus < DIMinus and ADX > th

//EMA-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

xPrice = close

EMA1 = ema(xPrice, Length_ema1)

EMA2 = ema(xPrice, Length_ema2)

EMA3 = ema(xPrice, Length_ema3)

EMA4 = ema(xPrice, Length_ema4)

EMA5 = ema(xPrice, Length_ema5)

L_ema = EMA1 < close and EMA2 < close and EMA3 < close and EMA4 < close and EMA5 < close

S_ema = EMA1 > close and EMA2 > close and EMA3 > close and EMA4 > close and EMA5 > close

// Range Filter ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool L_RF = na, var bool S_RF = na

Range_filter(_src, _per_, _mult)=>

var float _upward = 0.0

var float _downward = 0.0

wper = (_per_*2) - 1

avrng = ema(abs(_src - _src[1]), _per_)

_smoothrng = ema(avrng, wper)*_mult

_filt = _src

_filt := _src > nz(_filt[1]) ? ((_src-_smoothrng) < nz(_filt[1]) ? nz(_filt[1]) : (_src-_smoothrng)) : ((_src+_smoothrng) > nz(_filt[1]) ? nz(_filt[1]) : (_src+_smoothrng))

_upward := _filt > _filt[1] ? nz(_upward[1]) + 1 : _filt < _filt[1] ? 0 : nz(_upward[1])

_downward := _filt < _filt[1] ? nz(_downward[1]) + 1 : _filt > _filt[1] ? 0 : nz(_downward[1])

[_smoothrng,_filt,_upward,_downward]

[smoothrng, filt, upward, downward] = Range_filter(src, per_, mult)

hband = filt + smoothrng

lband = filt - smoothrng

L_RF := high > hband and upward > 0

S_RF := low < lband and downward > 0

// Volume -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Volume_condt = volume > sma(volume,sma_length)*volume_f

Volume_condt1 = volume > sma(volume,sma_length1)*volume_f1

//STRATEGY ==========================================================================================================================================================================================================================================================================================================

var bool longCond = na, var bool shortCond = na

var int CondIni_long = 0, var int CondIni_short = 0

var bool _Final_longCondition = na, var bool _Final_shortCondition = na

var float last_open_longCondition = na, var float last_open_shortCondition = na

var int last_longCondition = na, var int last_shortCondition = na

var int last_Final_longCondition = na, var int last_Final_shortCondition = na

var int nLongs = na, var int nShorts = na

L_1 = L_adx and Volume_condt and L_RF and L_ema

S_1 = S_adx and Volume_condt and S_RF and S_ema

L_2 = L_adx and L_RF and L_ema and Volume_condt1

S_2 = S_adx and S_RF and S_ema and Volume_condt1

L_basic_condt = L_1 or L_2

S_basic_condt = S_1 or S_2

longCond := L_basic_condt

shortCond := S_basic_condt

CondIni_long := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_long[1] )

CondIni_short := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_short[1] )

longCondition = (longCond[1] and nz(CondIni_long[1]) == -1 )

shortCondition = (shortCond[1] and nz(CondIni_short[1]) == 1 )

//POSITION PRICE-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var float sum_long = 0.0, var float sum_short = 0.0

var float Position_Price = 0.0

last_open_longCondition := longCondition ? close[1] : nz(last_open_longCondition[1] )

last_open_shortCondition := shortCondition ? close[1] : nz(last_open_shortCondition[1] )

last_longCondition := longCondition ? time : nz(last_longCondition[1] )

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1] )

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

last_Final_longCondition := longCondition ? time : nz(last_Final_longCondition[1] )

last_Final_shortCondition := shortCondition ? time : nz(last_Final_shortCondition[1] )

nLongs := nz(nLongs[1] )

nShorts := nz(nShorts[1] )

if longCondition

nLongs := nLongs + 1

nShorts := 0

sum_long := nz(last_open_longCondition) + nz(sum_long[1])

sum_short := 0.0

if shortCondition

nLongs := 0

nShorts := nShorts + 1

sum_short := nz(last_open_shortCondition)+ nz(sum_short[1])

sum_long := 0.0

Position_Price := nz(Position_Price[1])

Position_Price := longCondition ? sum_long/nLongs : shortCondition ? sum_short/nShorts : na

//TP---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool long_tp = na, var bool short_tp = na

var int last_long_tp = na, var int last_short_tp = na

var bool Final_Long_tp = na, var bool Final_Short_tp = na

var bool Final_Long_sl0 = na, var bool Final_Short_sl0 = na

var bool Final_Long_sl = na, var bool Final_Short_sl = na

var int last_long_sl = na, var int last_short_sl = na

tp_long = ((nLongs > 1) ? tp_long0 / nLongs : tp_long0) / 100

tp_short = ((nShorts > 1) ? tp_short0 / nShorts : tp_short0) / 100

long_tp := high > (fixnan(Position_Price) * (1 + tp_long)) and in_longCondition

short_tp := low < (fixnan(Position_Price) * (1 - tp_short)) and in_shortCondition

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

Final_Long_tp := (long_tp and last_longCondition > nz(last_long_tp[1]) and last_longCondition > nz(last_long_sl[1]))

Final_Short_tp := (short_tp and last_shortCondition > nz(last_short_tp[1]) and last_shortCondition > nz(last_short_sl[1]))

L_tp = iff(Final_Long_tp, fixnan(Position_Price) * (1 + tp_long) , na)

S_tp = iff(Final_Short_tp, fixnan(Position_Price) * (1 - tp_short) , na)

//TP SIGNALS--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tplLevel = (in_longCondition and

(last_longCondition > nz(last_long_tp[1])) and

(last_longCondition > nz(last_long_sl[1])) and not Final_Long_sl[1]) ?

(nLongs > 1) ?

(fixnan(Position_Price) * (1 + tp_long)) : (last_open_longCondition * (1 + tp_long)) : na

tpsLevel = (in_shortCondition and

(last_shortCondition > nz(last_short_tp[1])) and

(last_shortCondition > nz(last_short_sl[1])) and not Final_Short_sl[1]) ?

(nShorts > 1) ?

(fixnan(Position_Price) * (1 - tp_short)) : (last_open_shortCondition * (1 - tp_short)) : na

//SL ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Risk = sl0

Percent_Capital = 99

sl = in_longCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nLongs)))) :

in_shortCondition ? min(sl0,(((Risk) * 100) / (Percent_Capital * max(1, nShorts)))) : sl0

Normal_long_sl = ((in_longCondition and low <= ((1 - (sl / 100)) * (fixnan(Position_Price)))))

Normal_short_sl = ((in_shortCondition and high >= ((1 + (sl / 100)) * (fixnan(Position_Price)))))

last_long_sl := Normal_long_sl ? time : nz(last_long_sl[1])

last_short_sl := Normal_short_sl ? time : nz(last_short_sl[1])

Final_Long_sl := Normal_long_sl and last_longCondition > nz(last_long_sl[1]) and last_longCondition > nz(last_long_tp[1]) and not Final_Long_tp

Final_Short_sl := Normal_short_sl and last_shortCondition > nz(last_short_sl[1]) and last_shortCondition > nz(last_short_tp[1]) and not Final_Short_tp

//RE-ENTRY ON TP-HIT-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if Final_Long_tp or Final_Long_sl

CondIni_long := -1

sum_long := 0.0

nLongs := na

if Final_Short_tp or Final_Short_sl

CondIni_short := 1

sum_short := 0.0

nShorts := na

// Colors ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bar_color = in_longCondition ? #009688 : in_shortCondition ? #f06292 : color.orange

barcolor (color = Bar_color)

//PLOTS==============================================================================================================================================================================================================================================================================================================

plot(L_tp, title = "TP_L", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

plot(S_tp, title = "TP_S", style = plot.style_cross, color = color.fuchsia, linewidth = 7 )

//Price plots ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plot((nLongs > 1) or (nShorts > 1) ? Position_Price : na, title = "Price", color = in_longCondition ? color.aqua : color.orange, linewidth = 2, style = plot.style_cross)

plot(tplLevel, title="Long TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

plot(tpsLevel, title="Short TP ", style = plot.style_cross, color=color.fuchsia, linewidth = 1 )

//PLOTSHAPES----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(Final_Long_tp, title="TP Long Signal", style = shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , text="TP", textcolor=color.red, transp = 0 )

plotshape(Final_Short_tp, title="TP Short Signal", style = shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny , text="TP", textcolor=color.green, transp = 0 )

plotshape(longCondition, title="Long", style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.tiny , transp = 0 )

plotshape(shortCondition, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny , transp = 0 )

// Backtest ==================================================================================================================================================================================================================================================================================================================================

if L_basic_condt

strategy.entry ("LONG", strategy.long )

if S_basic_condt

strategy.entry ("SHORT", strategy.short )

strategy.exit("TP_L", "LONG", profit = (abs((last_open_longCondition * (1 + tp_long)) - last_open_longCondition) / syminfo.mintick), limit = nLongs >= 1 ? strategy.position_avg_price * (1 + tp_long) : na, loss = (abs((last_open_longCondition*(1-(sl/100)))-last_open_longCondition)/syminfo.mintick))

strategy.exit("TP_S", "SHORT", profit = (abs((last_open_shortCondition * (1 - tp_short)) - last_open_shortCondition) / syminfo.mintick), limit = nShorts >= 1 ? strategy.position_avg_price*(1-(tp_short)) : na, loss = (abs((last_open_shortCondition*(1+(sl/100)))-last_open_shortCondition)/syminfo.mintick))

//By BabehDyo