Momentum Index ETF Trend Following Strategy

Author: ChaoZhang, Date: 2023-12-05 15:13:25Tags:

Overview

This is a momentum index ETF trend following strategy based on moving averages. It uses the crossover and slope of fast and slow moving averages to determine the trend direction for low-risk momentum trend following of index ETF assets.

Strategy Logic

The strategy uses 50-period and 150-period moving averages. When the fast moving average crosses over the slow moving average, and the slope of the fast moving average is greater than the threshold, it signals an upside trend reversal for long entry. When the fast moving average crosses below the slow moving average, or the slope of the fast moving average is less than the threshold, it signals a downside trend reversal for exiting positions.

The strategy simply utilizes the direction and slope of moving averages to determine market trend, avoiding overfitting and effectively controlling risks. Meanwhile, moving averages inherently have the ability to filter out market noise for robust signals.

Advantage Analysis

This is a low-risk momentum index ETF trend following strategy with the following advantages:

- Strong risk control ability. Moving averages filter market noise for effective risk control.

- Low implementation cost. Only simple moving averages are used, resulting in low cost and easy implementation.

- Stable profits. Index ETFs themselves have low volatility, combined with trend following, stable excess returns can be achieved.

- High adaptability. Many adjustable parameters allow optimizations for different index ETFs.

Risk Analysis

There are also some risks:

- Potentially missing quick reversals. Using moving averages to determine trends may miss out quick reversals.

- Parameter sensitive. Improper parameter settings may result in overtrading or missing opportunities.

- Performance dependence on market conditions. May underperform in choppy/sideway markets.

Solutions:

- Incorporate other indicators to determine quick reversals.

- Test and optimize parameters.

- Dynamically adjust parameters based on changing market conditions.

Optimization Directions

There are a few areas this strategy can be further optimized:

- Utilize other indicators like MACD, KD to complement the strategy.

- Incorporate stop loss logic to further control risks.

- Optimize moving average periods to adapt more index ETFs.

- Dynamically adjust parameters to suit different market environments.

Conclusion

In conclusion, this is a low-risk, easy-to-implement momentum index ETF trend following strategy. It determines trend directions using moving average crossovers and has advantages like strong risk control, low implementation cost and stable profits. Although some flaws exist, the strategy can be further improved in many aspects to become an effective tool for index ETF asset allocation.

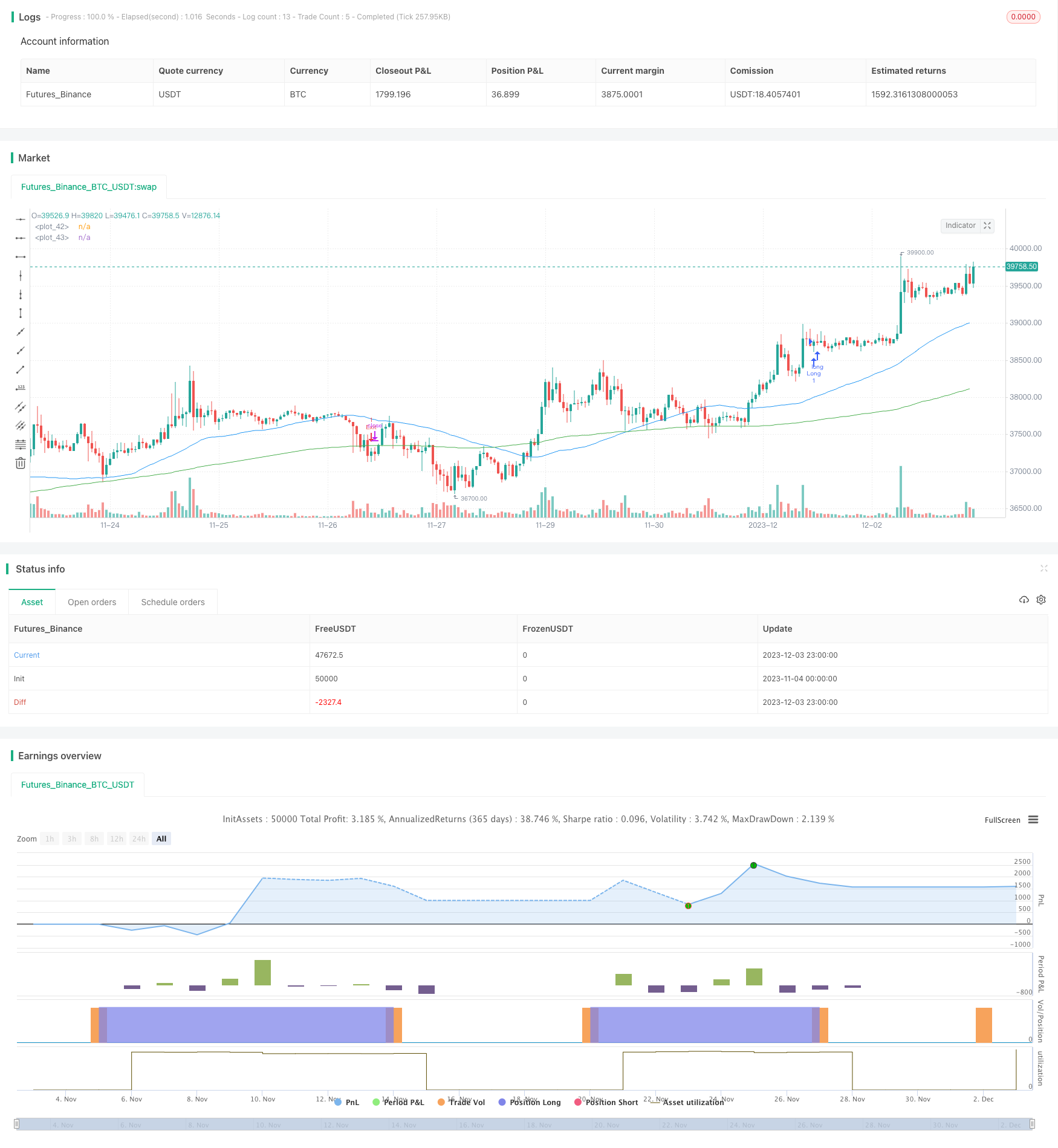

/*backtest

start: 2023-11-04 00:00:00

end: 2023-12-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//please use on daily SPY, or other indexes only

strategy("50-150 INDEX TREND FOLLOWING", overlay=true)

//user input

fastSMA = input(title="Fast Moving Average (Int)",type=input.integer,minval=1,maxval=1000,step=1,defval=50,confirm=false)

slowSMA = input(title="Slow Moving Average (Int)",type=input.integer,minval=1,maxval=1000,step=1,defval=150,confirm=false)

longSlopeThreshold = input(title="Bullish Slope Angle (Deg)",type=input.integer,minval=-90,maxval=90,step=1,defval=5,confirm=false)

shortSlopeThreshold = input(title="Bearish Slope Angle (Deg)",type=input.integer,minval=-90,maxval=90,step=1,defval=-5,confirm=false)

atrValue = input(title="Average True Range (Int)",type=input.integer,minval=1,maxval=100,step=1,defval=14,confirm=false)

risk = input(title="Risk (%)",type=input.integer,minval=1,maxval=100,step=1,defval=100,confirm=false)

//create indicator

shortSMA = sma(close, fastSMA)

longSMA = sma(close, slowSMA)

//calculate ma slope

angle(_source) =>

rad2degree=180/3.14159265359

ang=rad2degree*atan((_source[0] - _source[1])/atr(atrValue))

shortSlope=angle(shortSMA)

longSlope=angle(longSMA)

//specify crossover conditions

longCondition = (crossover(shortSMA, longSMA) and (shortSlope > longSlopeThreshold)) or ((close > shortSMA) and (shortSMA > longSMA) and (shortSlope > longSlopeThreshold))

exitCondition = crossunder(shortSMA, longSMA) or (shortSlope < shortSlopeThreshold)

strategy.initial_capital = 50000

//units to buy

amount = (risk / 100) * (strategy.initial_capital + strategy.netprofit)

units = floor(amount / close)

//long trade

if (longCondition and strategy.position_size == 0)

strategy.order("Long", strategy.long, units)

//close long trade

if (exitCondition and strategy.position_size > 0)

strategy.order("Exit", strategy.short, strategy.position_size)

// Plot Moving Average's to chart

plot(shortSMA, color=color.blue)

plot(longSMA, color=color.green)

- Triple SuperTrend and Stoch RSI Strategy

- 1% Profit Moving Average Cross Strategy

- Weighted Quantitative Moving Average Crossover Trading Strategy

- multiple auxiliary RSI indicator strategy

- Dual Moving Average Crossover Trend Strategy

- Reversal Bollinger Bands Strategy

- An Adaptive ATR-ADX Trend Strategy V2

- Dual-factor Cycle Trading Strategy

- Average Highest High and Lowest Low Swinger Strategy

- Oscillation Breakthrough - Market Structure Shift Strategy

- TTM Falcon Oscillator Reversal Strategy Based on Price Reversion

- Hybrid Moving Average Breakout Turtle Trading Strategy

- Low Frequency Fourier Transform Trend Following Moving Average Strategy

- STARC Channel Backtest Strategy

- PercentR Reversa Channe Strategy

- Moving Average Crossover Strategy

- Volume-driven Oscillation Quant Strategy

- Cross Moving Average Golden Cross Death Cross Strategy

- EMA/ADX/VOL-CRYPTO KILLER

- SuperTrend Multi Timeframe Backtest Strategy