multiple auxiliary RSI indicator strategy

Author: ChaoZhang, Date: 2023-12-06 11:57:29Tags:

Overview

This strategy uses the RSI indicator to identify overbought and oversold conditions, and enters trades combining multiple auxiliary factors such as MACD, Stochastic indicators, etc. The goal of this strategy is to capture short-term reversal opportunities. It belongs to mean reversion strategies.

How it Works

The core logic of this strategy relies mainly on the RSI indicator to determine whether the market is in an overbought or oversold state. When the RSI indicator exceeds the set overbought threshold, it is a sign that the market may be overbought. The strategy will choose to short at this time. When the RSI falls below the oversold threshold, it indicates the market may be oversold. The strategy will go long in such cases. By capturing the short-term trading opportunities during the transition from one extreme condition to another, the strategy hopes to profit.

In addition, the strategy also incorporates multiple auxiliary factors such as MACD, Stochastic indicators. The role of these auxiliary factors is to filter out some potentially false positive trading signals. Only when the RSI indicator triggers a signal, and the auxiliary factors also endorse that signal, will the strategy take actual trading actions. Such collaborations between multiple factors can improve the reliability of the trading signals generated by the strategy, thus enhancing its stability.

Advantage Analysis

The biggest advantage of this strategy is its high capturing efficiency realized through a multi-factor confirmation mechanism to improve signal quality. Specifically, it is reflected in the following aspects:

- The RSI indicator itself has strong capabilities of identifying market regimes and overextended conditions.

- With the help of multiple auxiliary tools for multi-factor confirmation, the signal quality is improved and large amounts of false positives are filtered out.

- The strategy is not sensitive to parameters and is easy to optimize.

Risks and Solutions

There are still some risks associated with this strategy, which are mainly concentrated in two aspects:

- Failed reversal risk. Reversal signals themselves rely on statistical arbitrage opportunities, and there is still probability for individual failed reversals. We can control risks by reducing position sizes or setting stop losses.

- Loss risk in uptrends. The strategy is still mainly contrarian, inevitably leading to certain losses in upward trending markets. This requires us to accurately judge the major trend. If necessary, manual intervention can be introduced to skip unfavorable market environments.

Optimization Directions

The following aspects need to be optimized for this strategy going forward:

- Test on different products to find the optimal parameter combinations. Although not very sensitive, it is still advisable to search for the best parameters for different products.

- Introduce adaptive exit mechanisms. Approaches like dynamic stops, timed exits etc. can be tested to make the strategy more adaptive to evolving markets.

- Incorporate machine learning models. Models can be trained to estimate reversal success probabilities in order to improve the strategy’s winning rate.

Conclusion

In conclusion, this is a short-term mean reversion strategy. By leveraging RSI’s capabilities of gauging overbought/oversold conditions, and combining multiple auxiliary tools for multi-factor confirmation, the signal quality is improved. The strategy has high capturing efficiency and good stability. It deserves further testing and optimization for eventual profitability.

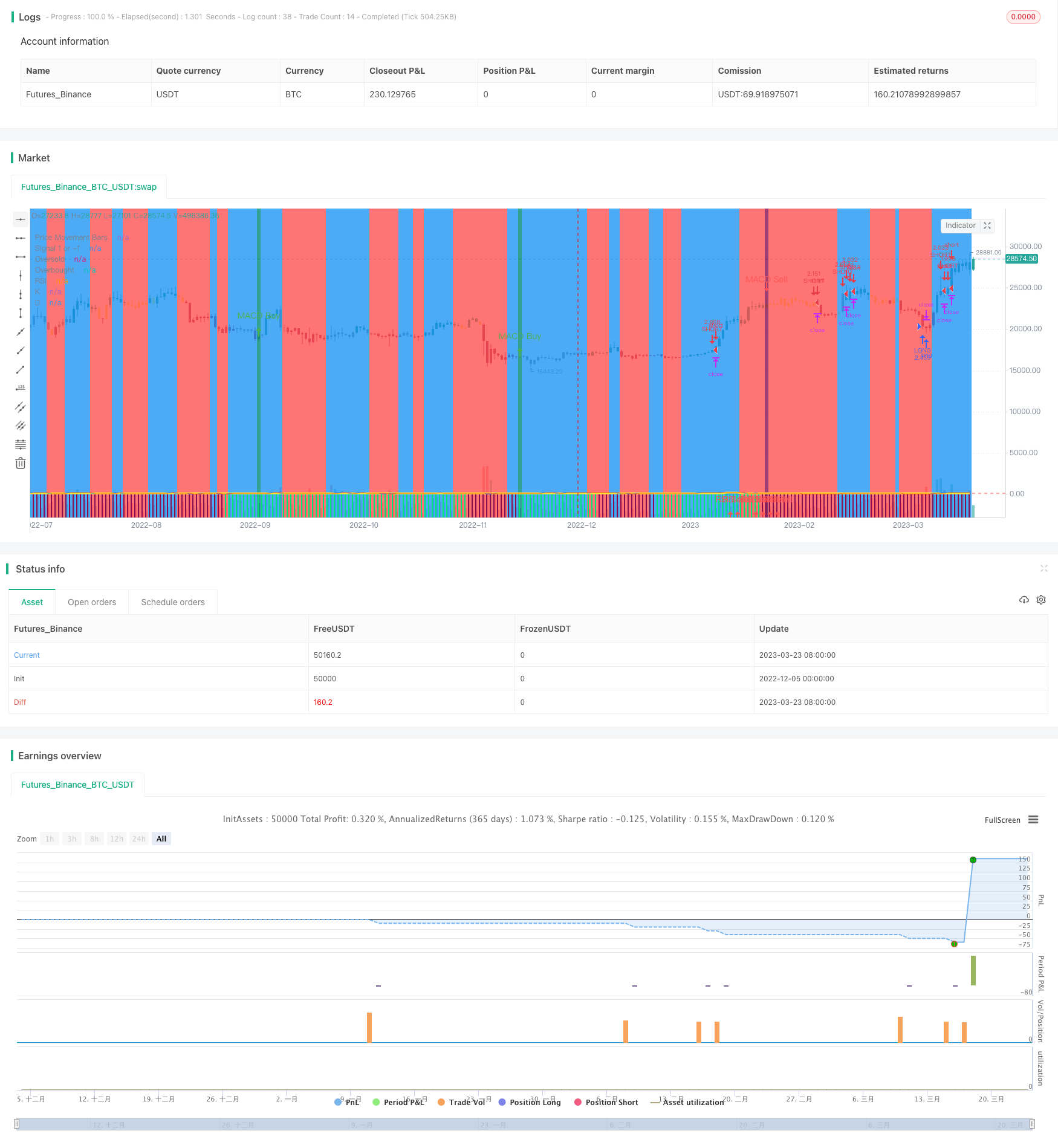

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(shorttitle='Ain1',title='All in One Strategy', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.18, calc_on_every_tick=true)

kcolor = #0094FF

dcolor = #FF6A00

// ----------------- Strategy Inputs -------------------------------------------------------------

//Backtest dates with auto finish date of today

start = input(defval = timestamp("01 April 2021 00:00 -0500"), title = "Start Time", type = input.time)

finish = input(defval = timestamp("31 December 2021 00:00 -0600"), title = "Start Time", type = input.time)

window() => true

// Strategy Selection - Long, Short, or Both

strat = input(title="Strategy", defval="Long/Short", options=["Long Only", "Long/Short", "Short Only"])

strat_val = strat == "Long Only" ? 1 : strat == "Long/Short" ? 0 : -1

// Risk Management Inputs

sl= input(10.0, "Stop Loss %", minval = 0, maxval = 100, step = 0.01)

stoploss = sl/100

tp = input(20.0, "Target Profit %", minval = 0, maxval = 100, step = 0.01)

TargetProfit = tp/100

// RSI and Stochastic Inputs

length = input(14, "RSI Length", minval=1)

ob_min = input(52, "Overbought Lookback Minimum Value", minval=0, maxval=200)

ob_lb = input(25, "Overbought Lookback Bars", minval=0, maxval=100)

os_min = input(50, "Oversold Lookback Minimum Value", minval=0, maxval=200)

os_lb = input(35, "Oversold Lookback Bars", minval=0, maxval=100)

source = input(title="Source", type=input.source, defval=close)

RSI = rsi(source, length)

// Define f_print function to show key recommendations for RSI

// f_print(_text) =>

// // Create label on the first bar.

// var _label = label(na),

// label.delete(_label),

// _label := label.new(

// time + (time-time[1]),

// ohlc4,

// _text,

// xloc.bar_time,

// yloc.price,

// color(na),

// label.style_none,

// color.gray,

// size.large,

// text.align_left

// )

// Display highest and lowest RSI values

AvgHigh(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] > val

count := count + 1

total := total + src[i]

round(total / count)

RSI_high = AvgHigh(RSI, ob_lb, ob_min)

AvgLow(src,cnt,val) =>

total = 0.0

count = 0

for i = 5 to cnt by 5

if src[i] < val

count := count + 1

total := total + src[i]

round(total / count)

RSI_low = AvgLow(RSI, os_lb, os_min)

// f_print("Recommended RSI Settings:" + "\nOverbought = " + tostring(RSI_high) + "\nOversold = " + tostring(RSI_low))

overbought= input(62, "Overbought")

oversold= input(35, "Oversold")

// Price Movement Inputs

look_back = input(9,"Look Back Bars")

high_source = input(high,"High Source")

low_source= input(low,"Low Source")

HTF = input("","Curernt or Higher time frame only", type=input.resolution)

// EMA and SMA Background Inputs

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

k_mode = input("SMA", "K Mode", options=["SMA", "EMA", "WMA"])

// MACD Inputs

fastLength = input(5, minval=1, title="EMA Fast Length")

slowLength = input(10, minval=1, title="EMA Slow Length")

// Selections to show or hide the overlays

showZones = input(true, title="Show Bullish/Bearish Zones")

showStoch = input(true, title="Show Stochastic Overlays")

showRSIBS = input(true, title="Show RSI Buy Sell Zones")

showMACD = input(true, title="Show MACD")

color_bars=input(true, "Color Bars")

useXRSI = input(false, "Use RSI crossing back, select only one")

useMACD = input(false, "Use MACD Only, select only one")

useCRSI = input(false, "Use Tweaked Connors RSI, select only one")

// ------------------ Background Colors based on EMA Indicators -----------------------------------

// Uses standard lengths of 9 and 21, if you want control delete the constant definition and uncomment the inputs

haClose(gap) => (open[gap] + high[gap] + low[gap] + close[gap]) / 4

rsi_ema = rsi(haClose(0), length)

v2 = ema(rsi_ema, length)

v3 = 2 * v2 - ema(v2, length)

emaA = ema(rsi_ema, fastLength)

emaFast = 2 * emaA - ema(emaA, fastLength)

emaB = ema(rsi_ema, slowLength)

emaSlow = 2 * emaB - ema(emaB, slowLength)

// bullish signal rule:

bullishRule =emaFast > emaSlow

// bearish signal rule:

bearishRule =emaFast < emaSlow

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

bgcolor(showZones ? ( ruleState==1 ? color.blue : ruleState==-1 ? color.red : color.gray ) : na , title=" Bullish/Bearish Zones", transp=95)

// ------------------ Stochastic Indicator Overlay -----------------------------------------------

// Calculation

// Use highest highs and lowest lows

h_high = highest(high_source ,look_back)

l_low = lowest(low_source ,look_back)

stoch = stoch(RSI, RSI, RSI, length)

k =

k_mode=="EMA" ? ema(stoch, smoothK) :

k_mode=="WMA" ? wma(stoch, smoothK) :

sma(stoch, smoothK)

d = sma(k, smoothD)

k_c = change(k)

d_c = change(d)

kd = k - d

// Plot

signalColor = k>oversold and d<overbought and k>d and k_c>0 and d_c>0 ? kcolor :

k<overbought and d>oversold and k<d and k_c<0 and d_c<0 ? dcolor : na

kp = plot(showStoch ? k : na, "K", transp=80, color=kcolor)

dp = plot(showStoch ? d : na, "D", transp=80, color=dcolor)

fill(kp, dp, color = signalColor, title="K-D", transp=88)

signalUp = showStoch ? not na(signalColor) and kd>0 : na

signalDown = showStoch ? not na(signalColor) and kd<0 : na

plot(signalUp ? kd : na, "Signal Up", color=kcolor, transp=90, style=plot.style_columns)

plot(signalDown ? (kd+100) : na , "Signal Down", color=dcolor, transp=90, style=plot.style_columns, histbase=100)

// -------------- Add Price Movement to Strategy for better visualization -------------------------

// Calculations

h1 = vwma(high, length)

l1 = vwma(low, length)

hp = h_high[1]

lp = l_low[1]

// Plot

var plot_color=#353535

var sig = 0

if (h1 >hp)

sig:=1

plot_color:=color.lime

else if (l1 <lp)

sig:=-1

plot_color:=color.maroon

plot(1,title = "Price Movement Bars", style=plot.style_columns,color=plot_color)

plot(sig,title="Signal 1 or -1",display=display.none)

// --------------------------------------- RSI Plot ----------------------------------------------

// Plot Oversold and Overbought Lines

over = hline(oversold, title="Oversold", color=color.green)

under = hline(overbought, title="Overbought", color=color.red)

fill(over, under, color=#9915FF, transp=90, title="Band Background")

// Show RSI and EMA crosses with arrows and RSI Color (tweaked Connors RSI)

// Improves strategy setting ease by showing where EMA 5 crosses EMA 10 from above to confirm overbought conditions or trend reversals

// This shows where you should enter shorts or exit longs

// Tweaked Connors RSI Calculation

connor_ob = 80

connor_os = 20

ma3 = sma(close,3)

ma20 = sma(close, 20)

ma50 = sma(close, 50)

erection = ((((close[1]-close[2])/close[2]) + ((close[0]-close[1])/close[1]))/2)*100

// Buy Sell Zones using tweaked Connors RSI (RSI values of 80 and 20 for Crypto as well as ma3, ma20, and ma50 are the tweaks)

RSI_SELL = ma20 > ma50 and open > ma3 and RSI >= connor_ob and erection <=4 and window()

RSI_BUY = ma20 < ma50 and ma3 > close and RSI <= connor_os and window()

// Color Definition

col = useCRSI ? (close > ma20 and close < ma3 and RSI <= connor_os ? color.lime : close < ma20 and close > ma3 and RSI <= connor_ob ? color.red : color.yellow ) : color.yellow

// Plot colored RSI Line

plot(RSI, title="RSI", linewidth=3, color=col)

// Shape Plots

plotshape(showRSIBS ? RSI_BUY: na, title = "RSI Buy", style = shape.arrowup, text = "RSI Buy", location = location.bottom, color=color.green, textcolor=color.green, size=size.small)

plotshape(showRSIBS ? RSI_SELL: na, title = "RSI Sell", style = shape.arrowup, text = "RSI Sell", location = location.bottom, color=color.red, textcolor=color.red, size=size.small)

// MACD as another complement to RSI strategy

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, length)

bartrendcolor = macdLine > signalLine and k > 50 and RSI > 50 ? color.teal : macdLine < signalLine and k < 50 and RSI < 50 ? color.maroon : macdLine < signalLine ? color.yellow : color.gray

barcolor(color = color_bars ? bartrendcolor : na)

MACDBuy = crossover(macdLine, signalLine) and macdLine<0 and RSI<RSI_low and window()

MACDSell = crossunder(macdLine, signalLine) and macdLine>0 and RSI>RSI_high and window()

plotshape(showMACD ? MACDBuy: na, title = "MACD Buy", style = shape.arrowup, text = "MACD Buy", color=color.green, textcolor=color.green, size=size.small)

plotshape(showMACD ? MACDSell: na, title = "MACD Sell", style = shape.arrowdown, text = "MACD Sell", color=color.red, textcolor=color.red, size=size.small)

bgcolor(showMACD ? (MACDBuy ? color.teal : MACDSell ? color.maroon : na) : na, title ="MACD Signals", transp=50)

// -------------------------------- Entry and Exit Logic ------------------------------------

// Entry Logic

XRSI_OB = crossunder(RSI, overbought) and window()

RSI_OB = crossover(RSI, overbought) and window()

XRSI_OS = crossover(RSI, oversold) and window()

RSI_OS = crossunder(RSI, oversold) and window()

// Strategy Entry and Exit with built in Risk Management

GoLong = strat_val > -1 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

GoShort = strat_val < 1 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

convert_percent_to_points(percent) =>

strategy.position_size != 0 ? round(percent * strategy.position_avg_price / syminfo.mintick) : float(na)

setup_percent(percent) =>

convert_percent_to_points(percent)

if (GoLong)

strategy.entry("LONG", strategy.long)

strategy.exit(id="Exit Long", from_entry = "LONG", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseLong = strategy.position_size > 0 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

if(CloseLong)

strategy.close("LONG")

if (GoShort)

strategy.entry("SHORT", strategy.short)

strategy.exit(id="Exit Short", from_entry = "SHORT", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseShort = strat_val < 1 and strategy.position_size < 0 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

if(CloseShort)

strategy.close("SHORT")

- Momentum Price Channel Opening and Closing Strategy

- Improved Moving Average Crossover Strategy with Market Trend Guidance

- Dynamic Candlestick Big Yang Line Trading Strategy

- SSL Hybrid Exit Arrow Quant Strategy

- Dual Moving Average ADX Timing Strategy

- BB Percentage Index Trend Fading Strategy

- MACD Bollinger Turtle Trading Strategy

- Triple SuperTrend and Stoch RSI Strategy

- 1% Profit Moving Average Cross Strategy

- Weighted Quantitative Moving Average Crossover Trading Strategy

- Dual Moving Average Crossover Trend Strategy

- Reversal Bollinger Bands Strategy

- An Adaptive ATR-ADX Trend Strategy V2

- Dual-factor Cycle Trading Strategy

- Average Highest High and Lowest Low Swinger Strategy

- Oscillation Breakthrough - Market Structure Shift Strategy

- Momentum Index ETF Trend Following Strategy

- TTM Falcon Oscillator Reversal Strategy Based on Price Reversion

- Hybrid Moving Average Breakout Turtle Trading Strategy

- Low Frequency Fourier Transform Trend Following Moving Average Strategy