Moving Average Trend Following Trading Strategy

Author: ChaoZhang, Date: 2023-12-11 15:05:31Tags:

Overview

This strategy calculates the moving average and price change rate to determine whether the current state is in an uptrend or a downtrend combined with K-lines over a certain period, and accordingly goes long or short.

Strategy Principle

This strategy first calculates the simple moving average a of length l and the price change rate r of length l. Then it calculates the difference k between the current K-line price and the moving average. Finally, it calculates the sum sum of k over the past s K-lines.

When sum>0, it indicates a current uptrend and the strategy will go long. When sum<0, it indicates a current downtrend and the strategy will go short.

After going long or short, the position will be held until the trend reverses (sum changes from positive to negative or vice versa), then the position will be closed.

Advantage Analysis

The biggest advantage of this strategy is that it can catch the trend and is suitable for trend trading. Specifically, it has the following advantages:

-

Using the moving average to determine the overall trend direction can effectively filter market noise and lock in the major trend.

-

Applying the price change rate indicator to measure momentum strength avoids missing strong momentum.

-

Taking into account multiple K-lines over a period can more accurately determine the trend and avoid being misled by einzelne Ausreißer.

-

As long as the trend remains unchanged, continue holding the position to maximize profits from the trending market.

Risk Analysis

The main risks of this strategy are:

-

Unable to accurately determine the end time of the trend, may stop loss prematurely or miss some profits.

-

Unable to effectively control the size of single loss, losses may be large in extreme market conditions.

-

Improper strategy parameters may lead to over-frequent trading or missing some trading opportunities.

-

Long-term holdings may face overnight interest and margin risks.

To control risks, we can set stop loss points, trade only highly liquid products, optimize parameters and reasonably use leverage.

Optimization Directions

The main aspects to optimize this strategy include:

-

Test moving averages and price change rates of different lengths to find the best parameter combination.

-

Try other indicators such as MACD to better determine the trend and further improve accuracy.

-

Add position management mechanisms, such as taking profit after making some profits, to control single loss.

-

Incorporate volatility indicators to set dynamic stops to reduce risks in extreme market conditions.

-

Optimize entry and exit logic to filter false breakouts and improve trading efficiency.

Conclusion

The overall logic of this strategy is clear and easy to implement. By tracking trends for long-term holding trading, drawdown control is relatively reasonable. It is suitable for investors seeking stable returns. Further optimizing the stop loss and position management can expect good long-term steady returns.

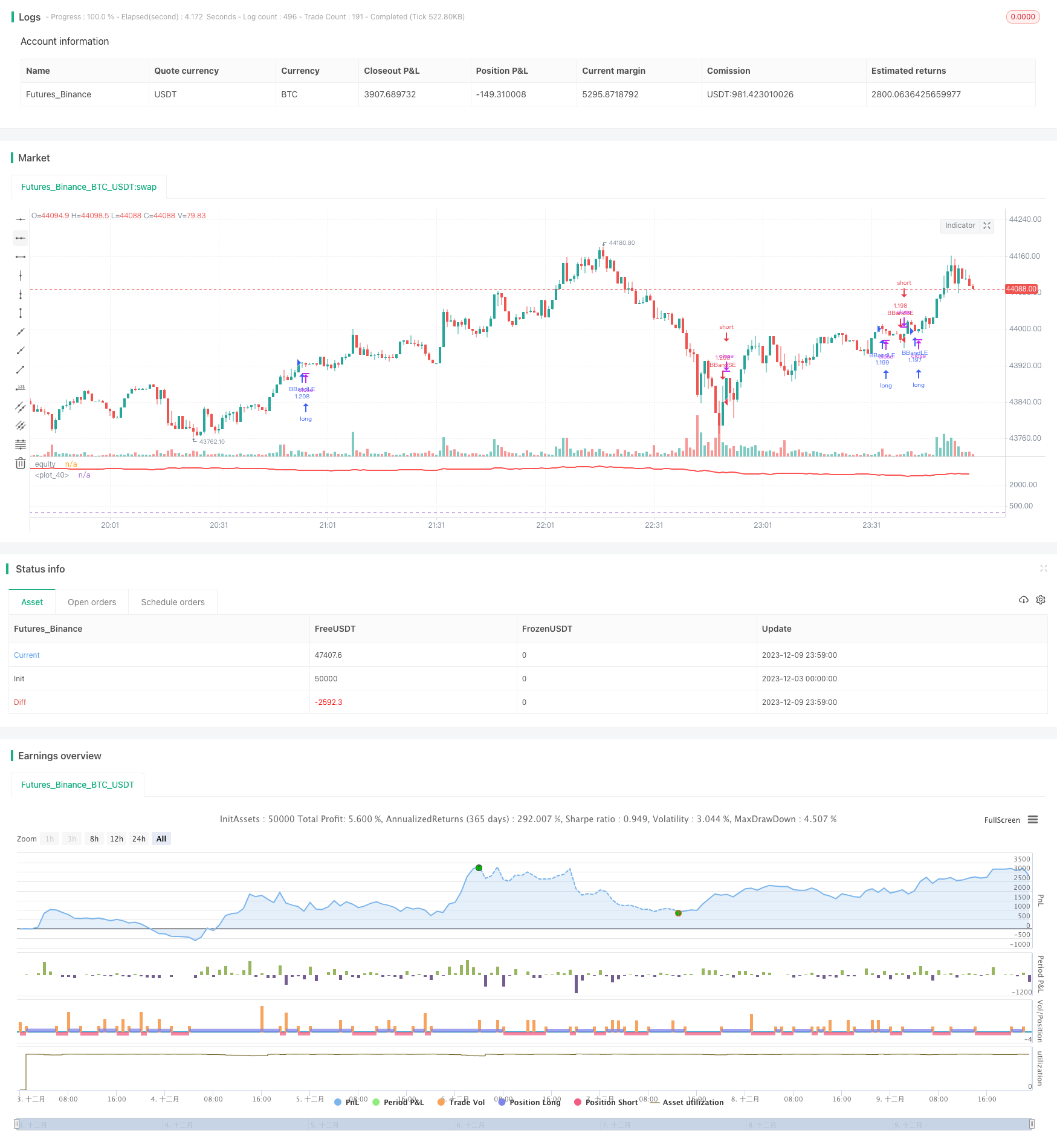

/*backtest

start: 2023-12-03 00:00:00

end: 2023-12-10 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Indicator Integrator Strat",default_qty_type = strategy.percent_of_equity, default_qty_value = 100,currency="USD",initial_capital=662, overlay=false)

l = input(defval=170,title="Length for indicator")

s = input(title="Length of summation",defval=18)

a= sma(close,l)

r=roc(close,l)

k=close-a

sum = 0

for i = 0 to s

sum := sum + k[i]

//plot(a,color=yellow,linewidth=2,transp=0)

//bc = iff( sum > 0, white, teal)

//plot(sum,color=bc, transp=20, linewidth=3,style=columns)

//plot(sma(sum,3),color=white)

//hline(0)

inpTakeProfit = input(defval = 0, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

////buyEntry = crossover(source, lower)

////sellEntry = crossunder(source, upper)

if sum>0

strategy.entry("BBandLE", strategy.long, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if sum<0

strategy.entry("BBandSE", strategy.short, oca_name="BollingerBands", comment="BBandSE")

else

strategy.cancel(id="BBandSE")

strategy.initial_capital = 50000

plot(strategy.equity-strategy.initial_capital-strategy.closedtrades*.25/2, title="equity", color=red, linewidth=2)

hline(0)

//longCondition = sum>0

//exitlong = sum<0

//shortCondition = sum<0

//exitshort = sum>0

//strategy.entry(id = "Long", long=true, when = longCondition)

//strategy.close(id = "Long", when = exitlong)

//strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=exitlong)

//strategy.entry(id = "Short", long=false, when = shortCondition)

//strategy.close(id = "Short", when = exitshort)

//strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=exitshort)

- RSI-MA Trend Following Strategy

- ADX、RSI Momentum Indicators Strategy

- EMA Strategy with ATR Stop Loss

- Look-Up and Look-Down Strategy Based on Internal Price Channels

- EMA and SuperTrend Combined Trend Following Strategy

- Dynamic Trend Following Strategy

- ATR Channel Mean Reversion Quantitative Trading Strategy

- Double Moving Average Crossover Strategy

- Inside Bar Range Breakout Strategy

- Dual Moving Average Bollinger Band Trend Tracking Strategy

- Ichimoku Trend Following Strategy

- MACD Trend Following Strategy

- Octa-EMA and Ichimoku Cloud Quantitative Trading Strategy

- The Smooth Moving Average Ribbon Strategy

- 52 Week High Low Box Trading Strategy

- Oscillation Trading Strategy Between Moving Averages

- RSI Breakout Strategy

- Dynamic ATR Trailing Stop Loss Strategy

- Volatility Breakout Trading Strategy

- Momentum Reversal Trend Tracking Strategy