概述

本策略运用动量指标ADX、RSI以及布林带,通过判断市场趋势和超买超卖情况,实现低买高卖,获利退出的自动交易策略。

策略原理

- ADX指标判断趋势。当ADX大于32时,认为行情处于趋势状态。

- RSI指标判断超买超卖。当RSI指标上穿30级时,认为行情超卖;当RSI指标下穿70级时,认为行情超买。

- 布林带判断盘整与突破。当收盘价突破布林带上轨时,认为行情结束盘整上涨;当收盘价跌破布林带下轨时,认为行情结束盘整下跌。

根据以上指标判断市场状态,制定交易策略如下:

买入条件: 1. ADX>32,趋势状况 2. RSI上穿30级,超卖状况 3. 收盘价低于布林带下轨,结束下跌盘整

卖出条件:

1. ADX>32,趋势状况

2. RSI下穿70级,超买状况

3. 收盘价高于布林带上轨,结束上涨盘整

优势分析

本策略综合运用多种指标判断市场状态,避免单一指标判断失误的概率。同时,通过趋势、超买超卖状态的判断,可以有效锁定市场转折点,实现低买高卖。

相比单一使用趋势指标,本策略可以更及时地捕捉短期机会。相比单一使用震荡指标,本策略则可以更好地把握趋势方向。所以,本策略既保留了趋势跟踪的优点,又具有逆势操作的灵活性,是一种潜在效率较高的量化策略。

风险分析

本策略主要存在以下风险:

- 指标发出错误信号的风险。当市场突发重大事件时,指标判断可能会失效。

- 止损位置设置过于激进的风险。如果止损距离过小,可能会被短期市场波动止损出场。

- 参数数据拟合风险。如果指标参数仅基于历史数据拟合得到,则参数稳定性会较差,可能无法适应市场变化。

对应风险管理措施: 1. 人工干预异常市场,手动暂停策略,避免错误信号带来损失。 2. 设置合理的止损距离,同时结合均线等指标判断止损价位,避免被套。 3. 增加 Parameter Tuning 模块,使用 Walk Forward Analysis 方法动态优化参数,保证参数的稳健性。

优化方向

本策略的优化空间主要在以下几个方面:

优化指标参数。可以引入智能优化算法,针对不同品种参数进行独立优化。

增加特征工程。引入更多价格技术指标,建立支持向量机等模型进行训练,提升信号准确率。

结合突破策略。根据不同品种行情特点,运用基于通道、支撑阻力等判断规则,把握突破点位,增强策略稳定性。

优化止盈止损机制。引入跟踪止盈、移动止损等方式,实现止盈止损动态调整,最大限度锁定利润,有效控制风险。

总结

本策略作为一种中短期量化交易策略,运用 ADX、RSI、布林带等多种技术指标判断市场状态,在判断市场结构发生重大变化时进行买入卖出操作。策略逻辑清晰可解释,可大幅度减少单一技术指标判断失误的概率。与此同时,策略也需要警惕指标发出错误信号、设置过于激进止损和参数偏差等风险,需要从风险管理和模型优化方面入手,提高策略的稳定性和效率。

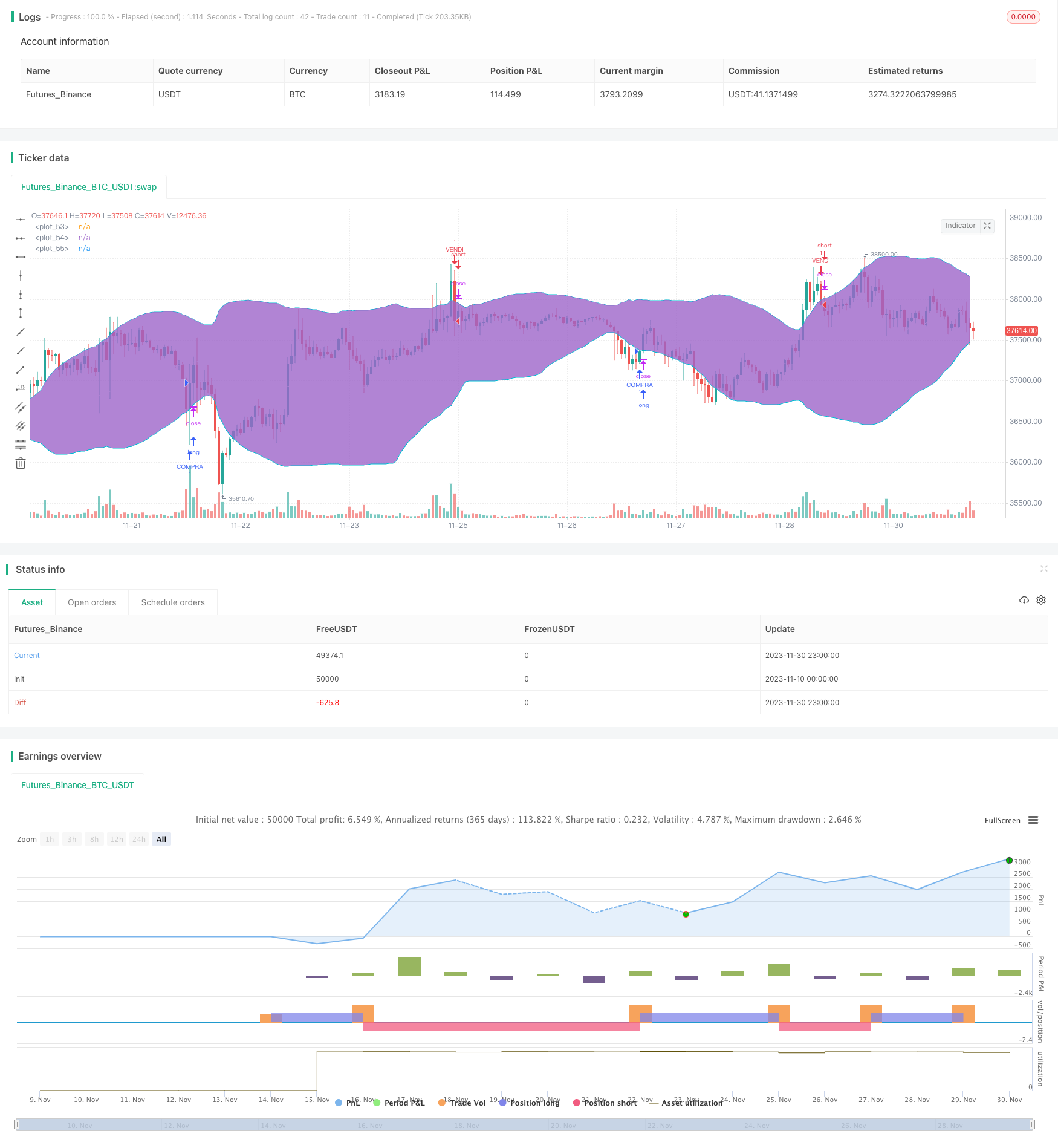

/*backtest

start: 2023-11-10 00:00:00

end: 2023-12-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("DAX Shooter 5M Strategy", overlay=true)

//Creo ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

th = input(title="threshold", type=input.integer, defval=20)

dirmov(len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : up > down and up > 0 ? up : 0

minusDM = na(down) ? na : down > up and down > 0 ? down : 0

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

adx

[plus, minus] = dirmov(dilen)

sig = adx(dilen, adxlen)

//Creo RSI

src = close

len = input(7, minval=1, title="Periodo RSI")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

bandainf = input(30, title="Livello Ipervenduto")

bandasup = input(70, title="Livello Ipercomprato")

//Creo Bande di Bollinger

source = close

length = input(50, minval=1, title="Periodo BB")

mult = input(2.0, minval=0.001, maxval=50, title="Dev BB")

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

plot(basis, color=color.white)

p1 = plot(upper, color=color.aqua)

p2 = plot(lower, color=color.aqua)

fill(p1, p2)

//Stabilisco regole di ingresso

if crossover(rsi, bandainf) and adx(dilen, adxlen) > 32 and low < lower

strategy.entry("COMPRA", strategy.long, limit=upper, oca_name="DaxShooter", comment="COMPRA")

else

//strategy.exit("exit", "COMPRA", loss = 90)

strategy.cancel(id="COMPRA")

if crossunder(rsi, bandasup) and adx(dilen, adxlen) > 32 and high > upper

strategy.entry("VENDI", strategy.short, limit=lower, oca_name="DaxShooter",comment="VENDI")

else

//strategy.exit("exit", "VENDI", loss = 90)

strategy.cancel(id="VENDI")

//Imposto gli alert

buy= crossover(rsi, bandainf) and adx(dilen, adxlen) > 32 and low < lower

sell= crossunder(rsi, bandasup) and adx(dilen, adxlen) > 32 and high > upper

alertcondition(buy, title='Segnale Acquisto', message='Compra DAX')

alertcondition(sell, title='Segnale Vendita', message='Vendi DAX')

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)