Overview

The core idea of this strategy is to generate trading signals based on the crossover of multiple exponential moving averages (EMA). It goes long when shorter term EMA crosses over longer term EMA from below, and closes positions when shorter term EMA crosses under longer term EMA. This strategy allows configuring multiple EMA periods, and each EMA can be enabled independently. The strategy will trade crossovers on all the enabled EMAs.

Strategy Name

Multi Timeframe Dynamic EMA Trading Strategy

Strategy Principle

The strategy sets up 8 EMA periods - 8 days, 13 days, 21 days, 34 days, 55 days, 89 days, 144 days and 233 days. These EMAs can be enabled or disabled independently.

It generates long signals when the shorter term EMA crosses over the longer term EMA from below. It generates exit signals when the shorter term EMA crosses under the longer term EMA from above. So if two EMAs are enabled, shorterEMA > longerEMA is long signal, shorterEMA < longerEMA is exit signal.

For example, if 55 days EMA and 89 days EMA are enabled, the strategy goes long when 55 days EMA crosses over 89 days EMA, and exits when 55 days EMA crosses under 89 days EMA. This allows the strategy to dynamically adjust the EMA combinations used, switching from longer timeframes to shorter or vice versa.

The position sizing is set to account equity divided by close divided by number of enabled EMAs. This makes sure the position sizes on each EMA crossover is equal.

Advantage Analysis

- Flexibility to adjust timeframe by configuring different EMAs

- Each EMA can be enabled/disabled independently, highly customizable

- Positions evenly distributed across EMAs, good for risk management

- Utilizes multiple EMAs, can switch to more suitable EMAs for different market stages

- Simple and clear logic, easy to understand and debug

Risk Analysis

- EMA alone cannot determine market structure, prone to false signals

- Whipsaw markets lead to excessive EMA crossovers, increasing trade frequency and slippage cost

- Needs optimization of EMA parameters for different markets

- May need other indicators to confirm signals

Consider combining EMA with other indicators e.g. channels or oscillators to filter signals, or incorporate trend and reversal indicators. Also optimizing EMA parameters is very important, needs tuning for different markets.

Optimization Directions

The strategy can be optimized in several aspects:

Optimize EMA parameters via parameter scanning and walk forward analysis to find best EMA combinations.

Add filter conditions on EMA crossovers to avoid false signals e.g. volume filter, volatility filter etc.

Combine with other indicators like MACD, KDJ, Bollinger Bands to take advantage of complementarity.

Dynamically adjust position sizing on each EMA based on market volatility or trend strength.

Optimize stop loss and take profit levels to achieve best risk-reward ratio.

Conclusion

Overall this is a very simple and straightforward strategy generating signals from EMA crossovers to catch short term and medium term trends. Its main advantage lies in the high configurability and flexibility to allow traders to select the EMAs suitable for them. However EMA alone can give false signals easily which is the biggest risk. Combining with other indicators and parameter optimization can lead to better trading performance.

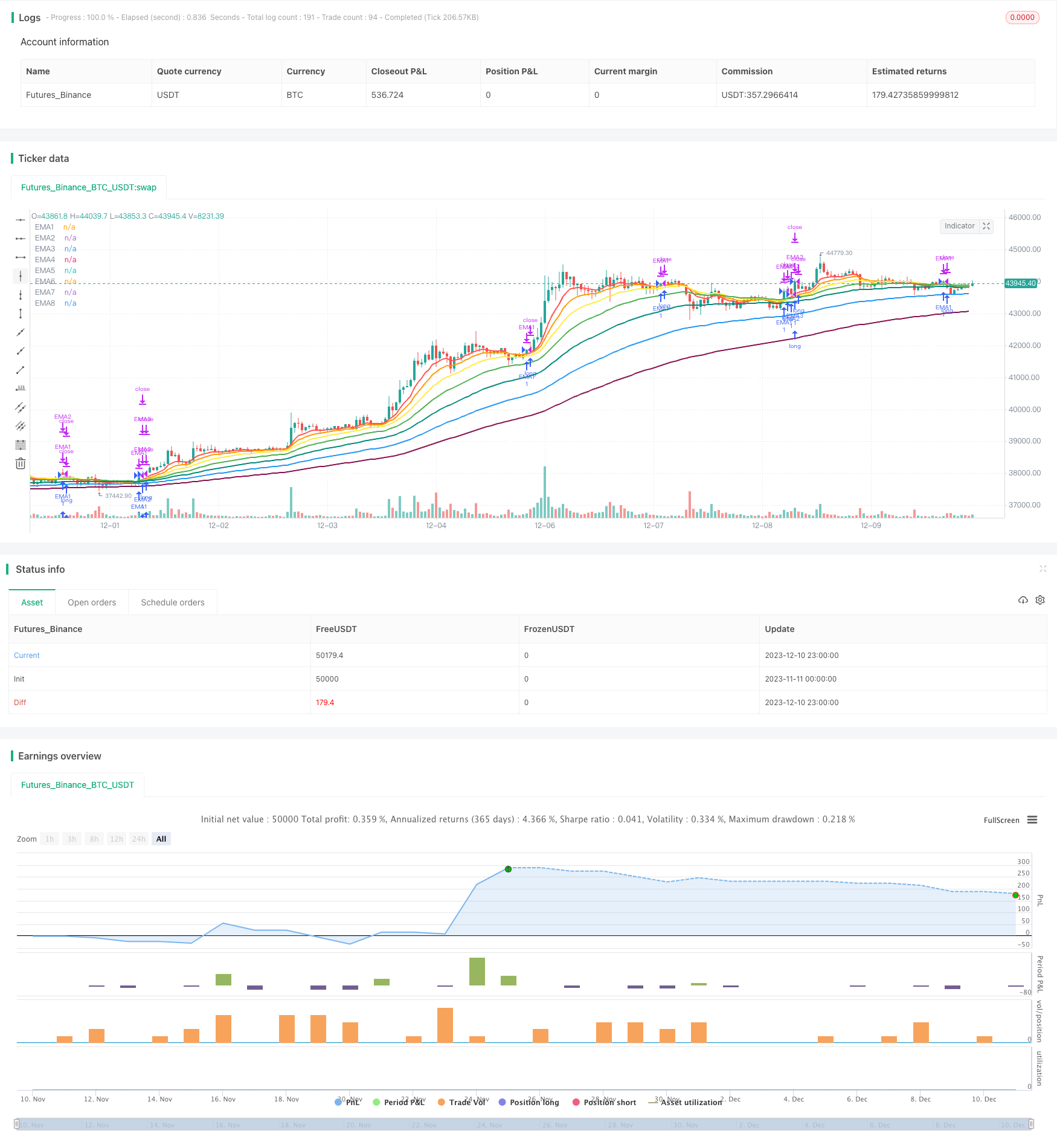

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("EMA Fan", shorttitle = "EMA Fan", overlay=true)

// Revision: 1

// Author: @ToS_MavericK

buyprice = 0.0

buyprice := buyprice[1]

// === INPUT SMA ===

EMA1 = input(8)

EMA2 = input(13)

EMA3 = input(21)

EMA4 = input(34)

EMA5 = input(55)

EMA6 = input(89)

EMA7 = input(144)

EMA8 = input(233)

EnableEMA1 = input(true)

EnableEMA2 = input(true)

EnableEMA3 = input(true)

EnableEMA4 = input(true)

EnableEMA5 = input(true)

EnableEMA6 = input(true)

EnableEMA7 = input(true)

EnableEMA8 = input(true)

//Profit = input(defval = 5, type = integer, title = "Profit", minval = 1, step = 1)

//StopLoss = input(defval = 15, type = integer, title = "StopLoss", minval = 1, step = 1)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2012)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2020, title = "To Year", minval = 2012)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

// === SERIES SETUP ===

vEMA1 = ema(close, EMA1)

vEMA2 = ema(close, EMA2)

vEMA3 = ema(close, EMA3)

vEMA4 = ema(close, EMA4)

vEMA5 = ema(close, EMA5)

vEMA6 = ema(close, EMA6)

vEMA7 = ema(close, EMA7)

vEMA8 = ema(close, EMA8)

count = -1

if (EnableEMA1 == true)

count := count + 1

if (EnableEMA2 == true)

count := count + 1

if (EnableEMA3 == true)

count := count + 1

if (EnableEMA4 == true)

count := count + 1

if (EnableEMA5 == true)

count := count + 1

if (EnableEMA6 == true)

count := count + 1

if (EnableEMA7 == true)

count := count + 1

if (EnableEMA8 == true)

count := count + 1

// set position size

Amount = 1 / (close * count)

// === EXECUTION ===

strategy.entry("EMA1", strategy.long, qty = Amount, when = window() and crossover(vEMA1,vEMA2) and EnableEMA1 and EnableEMA2)

strategy.close("EMA1", time > finish or crossunder(vEMA1,vEMA2))

strategy.entry("EMA2", strategy.long, qty = Amount, when = window() and crossover(vEMA2,vEMA3) and EnableEMA2 and EnableEMA3)

strategy.close("EMA2", time > finish or crossunder(vEMA2,vEMA3))

strategy.entry("EMA3", strategy.long, qty = Amount, when = window() and crossover(vEMA3,vEMA4) and EnableEMA3 and EnableEMA4)

strategy.close("EMA3", time > finish or crossunder(vEMA3,vEMA4))

strategy.entry("EMA4", strategy.long, qty = Amount, when = window() and crossover(vEMA4,vEMA5) and EnableEMA4 and EnableEMA5)

strategy.close("EMA4", time > finish or crossunder(vEMA4,vEMA5))

strategy.entry("EMA5", strategy.long, qty = Amount, when = window() and crossover(vEMA5,vEMA6) and EnableEMA5 and EnableEMA6)

strategy.close("EMA5", time > finish or crossunder(vEMA5,vEMA6))

strategy.entry("EMA6", strategy.long, qty = Amount, when = window() and crossover(vEMA6,vEMA7) and EnableEMA6 and EnableEMA7)

strategy.close("EMA6", time > finish or crossunder(vEMA6,vEMA7))

strategy.entry("EMA7", strategy.long, qty = Amount, when = window() and crossover(vEMA7,vEMA8) and EnableEMA7 and EnableEMA8)

strategy.close("EMA7", time > finish or crossunder(vEMA7,vEMA8))

plot(vEMA1, title = 'EMA1', color = red, linewidth = 2, style = line) // plot FastMA

plot(vEMA2, title = 'EMA2', color = orange, linewidth = 2, style = line) // plot SlowMA

plot(vEMA3, title = 'EMA3', color = yellow, linewidth = 2, style = line) // plot SlowMA

plot(vEMA4, title = 'EMA4', color = green, linewidth = 2, style = line) // plot SlowMA

plot(vEMA5, title = 'EMA5', color = teal, linewidth = 2, style = line) // plot SlowMA

plot(vEMA6, title = 'EMA6', color = blue, linewidth = 2, style = line) // plot SlowMA

plot(vEMA7, title = 'EMA7', color = maroon, linewidth = 2, style = line) // plot SlowMA

plot(vEMA8, title = 'EMA8', color = white, linewidth = 2, style = line) // plot SlowMA

//plot(long_stop, title = 'High-ATR', color = red, linewidth = 2, style = line) // plot SlowMA

//plot(short_stop, title = 'Low+ATR', color = green, linewidth = 2, style = line) // plot SlowMA