Overview

This strategy first combines the reversal strategy proposed by Ulf Jensen on page 183 of his book “How I Tripled My Money in the Futures Market” with the comparative relative strength indicator to obtain stronger signals. The combined strategy is called “Quantitative Strategy Based on Reversal and Comparative Relative Strength”.

The main idea of this strategy is to judge by multiple factors at the same time. By combining the reversal factor and the comparative relative strength signal, it will only place buy or sell orders when both give the same signal, in order to improve the stability of the strategy.

Strategy Principle

The first part is a reversal strategy. The strategy goes long when: the closing price has risen continuously for the last two days, and the 9-day Stochastic slow line is below 50. The closing condition is: the closing price has fallen continuously for the last two days, and the 9-day Stochastic fast line is above 50.

The second part is the comparative relative strength indicator. This indicator calculates the moving average of the N-day closing price change rate between the target stock and the benchmark index, and compares it with the preset buy zone, sell zone and close zone. It goes long when the indicator crosses above the buy zone, goes short when it falls below the sell zone, and closes positions when long and the indicator falls below the close zone, and when short and the indicator rises above the close zone.

This combined strategy judges the signals of both parts at the same time. It will only place buy or sell orders when both give the same signal (both buy or both sell).

Advantage Analysis

This strategy combines the advantages of reversal factors and relative strength factors. The reversal strategy can capture extremes in the short term; the relative strength strategy can grasp the main trend of the broader market. Signals from both strategies can improve reliability and filter out some false signals caused by noise.

In addition, the Stochastic indicator, as an indicator for distinguishing overbought and oversold zones, can better determine reversal points. Using it in combination with trend indicators like moving averages can form a more mature combined strategy.

Risk Analysis

The biggest risk of reversal strategies is that they cannot determine the timing of market reversals, which may lead to continued losses after the market reversal. In this case, the relative strength indicator can come into play to judge whether the major trend has changed.

The risk of the relative strength strategy lies in inappropriate parameter settings, which may generate too many false signals. In this case, the reversal strategy can play a role in filtering to reduce unnecessary trades.

Optimization Directions

This strategy can be optimized in the following aspects:

Test more reversal factors to find better reversal strategies. The current one uses just a simple N-day new high/low statistics strategy.

Test and optimize parameters for the relative strength indicator to find the optimal parameter combination, since current settings are subjective and likely not optimized.

Add stop loss strategies. Currently there is no stop loss, adding reasonable stop loss can control downside risk.

Test different benchmark indices to calculate relative strength to the target stock and find the best matching index.

Conclusion

This strategy combines reversal factors and relative strength factors for trading. It utilizes the advantages of both to improve signal quality and is a relatively mature combined strategy. There is still much room for optimization by parameters tuning, adding stop loss strategies, and adjusting the strategy combination methods to achieve even better results.

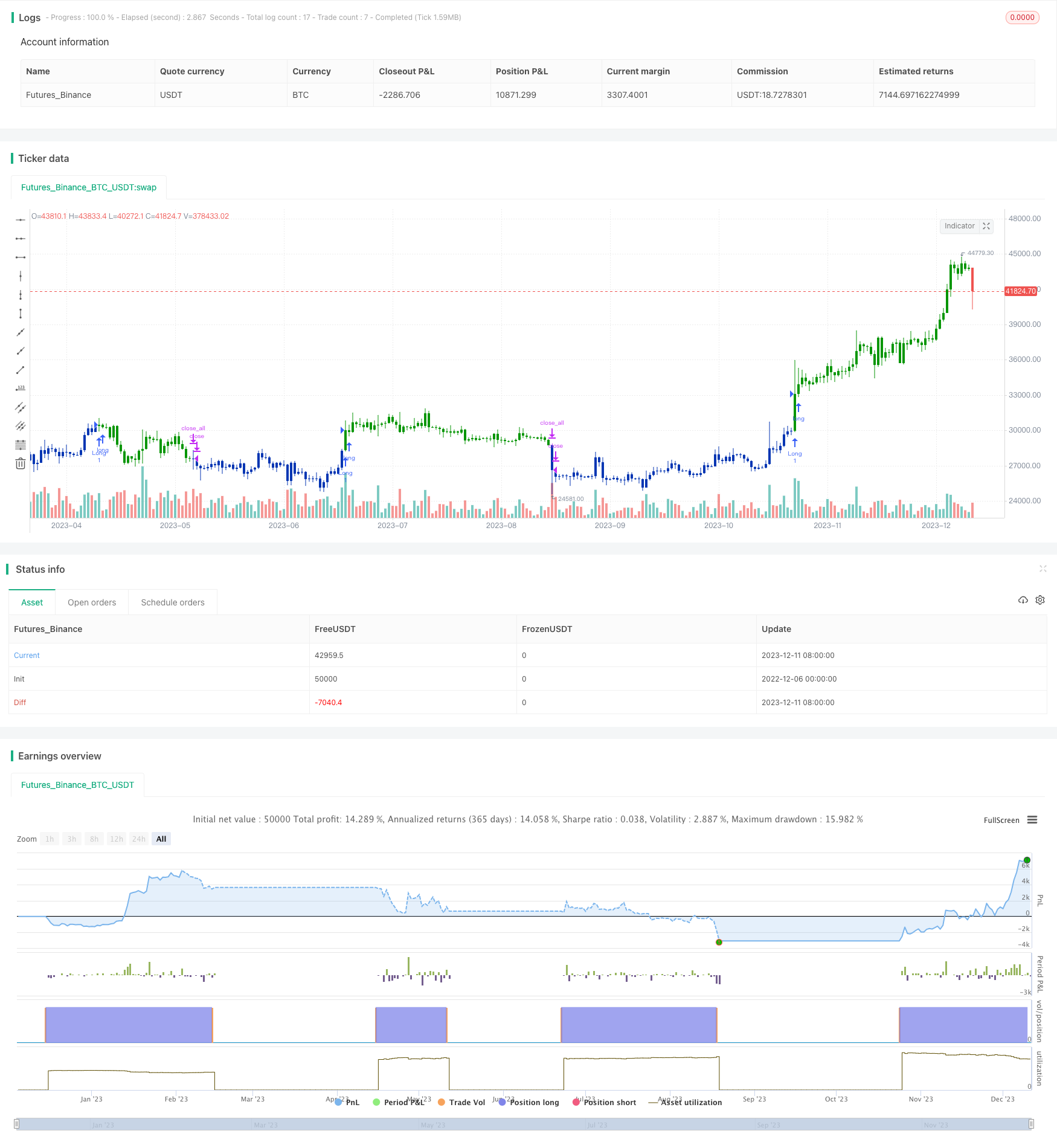

/*backtest

start: 2022-12-06 00:00:00

end: 2023-12-12 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 30/10/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Comparative Relative Strength Strategy for ES

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

CRS(a, b, len, BuyBand, SellBand, CloseBand) =>

pos = 0.0

as = security(a, timeframe.period, close)

bs = security(b, timeframe.period, close)

nRes = sma(as/bs, len)

pos := iff(nRes > BuyBand, 1,

iff(nRes < SellBand, -1,

iff(pos[1] == 1 and nRes < CloseBand, 0,

iff(pos[1] == -1 and nRes > CloseBand, 0, nz(pos[1], 0)))))

pos

strategy(title="Combo Backtest 123 Reversal & Comparative Relative Strength", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

a = syminfo.tickerid

b = input("BTC_USDT:swap", type=input.symbol)

LengthCRS = input(10)

BuyBand = input(0.9988, step = 0.0001)

SellBand = input(0.9960, step = 0.0001)

CloseBand = input(0.9975, step = 0.0001)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posCRS = CRS(a, b, LengthCRS, BuyBand, SellBand, CloseBand)

pos = iff(posReversal123 == 1 and posCRS == 1 , 1,

iff(posReversal123 == -1 and posCRS == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )