AO Indicator Based Trend Following Strategy

Author: ChaoZhang, Date: 2023-12-20 11:59:48Tags:

Overview

This strategy uses the Awesome Oscillator (AO) indicator to determine the trend direction and moving averages to confirm the trend. It belongs to the trend following strategy. It goes long when the AO indicator crosses above the 0 level and the fast MA crosses above the slow MA, and goes short when the AO crosses below the 0 level and the fast MA crosses below the slow MA, taking advantage of the directionality of trends to profit.

Strategy Logic

This strategy mainly relies on the AO indicator to determine the short-term trend direction. The AO indicator is calculated based on the difference between the 5-period and 34-period simple moving averages of the mid-price. It belongs to the Momentum category of indicators. When the AO is positive, it means the short-term MA is above the long-term MA, which should be interpreted as a bullish sign. When the AO is negative, it means the short-term MA is below the long-term MA, which should be interpreted as a bearish sign.

Therefore, the AO indicator can effectively determine the direction of the trend. When the AO crosses above the 0 level, it signals that the market trend has turned bullish and we should go long. When the AO crosses below the 0 level, it signals that the market trend has turned bearish and we should go short.

In addition, this strategy also incorporates the 20-period and 200-period moving averages. The slope of these two MAs represents the direction of the medium to long-term trend. Judging only by the AO indicator for the short-term trend direction is not enough, confirmation from the mid-long term trend is also needed, hence the addition of the MA crossover rules.

When the fast MA crosses above the slow MA, the mid-long term trend turns bullish, we go long when the AO crosses above 0 to ride the uptrend. When the fast MA crosses below the slow MA, the mid-long term trend turns bearish, we go short when the AO crosses below 0 to ride the downtrend.

Advantages

- Accurately determining short-term trend direction using the AO indicator

- Adding MA filters to confirm mid-long term trend, effectively avoiding false breakouts

- Fast profits, suitable for short-term trading

Risk Analysis

- Risk of failed entry when going short. Price may continue going up for some time after AO crosses below 0 and MA signals sell before turning down.

- Risk of failed entry when going long. Price may continue going down for some time after AO crosses above 0 and MA signals buy before turning up.

- Risk of distorted AO signals at major technical levels.

Improvement Directions

- Test different MA combinations to find better settings, e.g. 10- and 50-period MAs

- Add other indicators like RSI for signal confirmation

- Optimize stop loss percentage for better risk/reward ratio

Conclusion

This is a simple trend following strategy. Using the AO to determine short-term trend direction confirmed by mid-long term MAs is logically sound. The combination of AO and MAs sees widespread usage and is relatively mature. This strategy is also very reliable. Further optimization of parameters and other indicators can improve strategy performance.

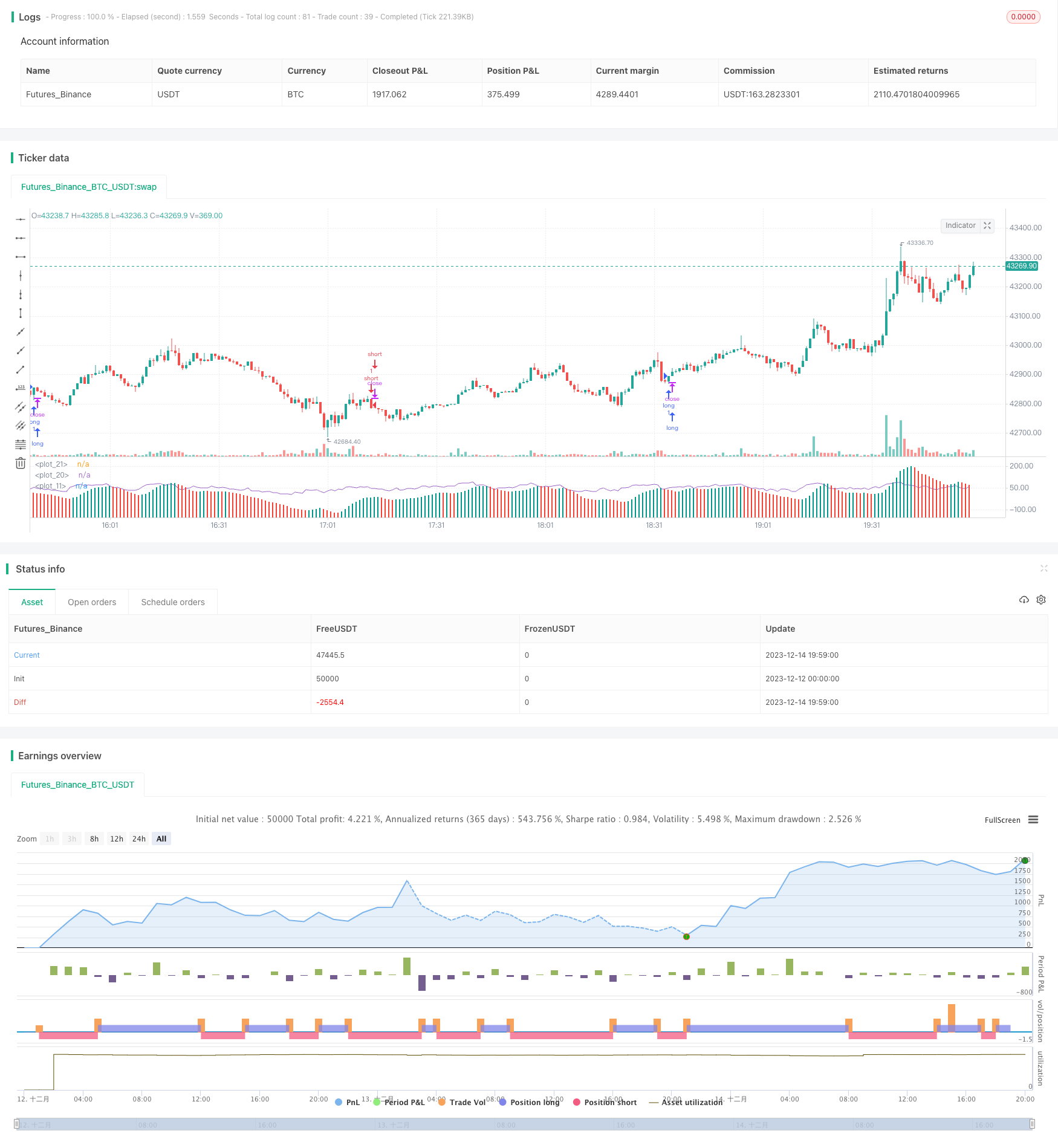

/*backtest

start: 2023-12-12 00:00:00

end: 2023-12-14 20:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// https://www.youtube.com/watch?v=zr3AVwjCtDA

//@version=5

strategy(title="Bingx ESTRATEGIA de Trading en 1 minuto ", shorttitle="AO")

long = input.bool(true, "long")

short = input.bool(true, "short")

profit = (input.float(10, "profit") / 100) + 1

stop = (input.float(5, "stop") / 100) + 1

ao = ta.sma(hl2,5) - ta.sma(hl2,34)

diff = ao - ao[1]

plot(ao, color = diff <= 0 ? #F44336 : #009688, style=plot.style_columns)

changeToGreen = ta.crossover(diff, 0)

changeToRed = ta.crossunder(diff, 0)

alertcondition(changeToGreen, title = "AO color changed to green", message = "Awesome Oscillator's color has changed to green")

alertcondition(changeToRed, title = "AO color changed to red", message = "Awesome Oscillator's color has changed to red")

ema20 = ta.ema(close, 20)

ema200 = ta.ema(close, 200)

rsi = ta.rsi(close, 7)

plot(rsi)

plot(0, color=color.white)

var float pentry = 0.0

var float lentry = 0.0

var bool oab = false

// oab := ta.crossover(ao, 0) ? true : ta.crossover(0, ao) ? false : oab[1]

if long and close > open and ta.crossover(close, ema20) and ema20 > ema200 and ao > 0 and rsi > 50

strategy.entry("long", strategy.long)

pentry := close

strategy.exit("exit long", "long", limit=pentry * profit, stop=pentry / stop)

if short and close < open and ta.crossunder(close, ema20) and ema20 < ema200 and ao < 0 and rsi < 50

strategy.entry("short", strategy.short)

lentry := close

strategy.exit("exit short", "short", limit=lentry / profit, stop=lentry * stop)

- Flexible MA/VWAP Crossover Strategy with Stop Loss/Take Profit

- Bollinger Band-based Price Action Strategy

- Dual Moving Average Range Breakout Strategy

- Grid Strategy with Moving Average Lines

- Dual Moving Average Intelligent Tracking Strategy

- RSI-EMA Trend Breakout Strategy

- Pivot Point Forecast Oscillator Backtesting Strategy

- Integrated Ichimoku Keltner Trading System Based on Moving Average Strategy

- Dual-Tracking Turtle Trading Strategy

- Ichimoku Kinko Hyo Based BTC Trading Strategy

- Universal Sniper Strategy

- Dual Indicator Hybrid Quantitative Trading Strategy

- Bollinger Bands Momentum Breakout Strategy

- Bollinger Band Short-term Reversion Quantitative Strategy Based on Moving Average

- Gradient MACD Quant Strategy

- Dual-Track Fast Quantitative Reversal Trading Strategy

- Heikin Ashi and Kaufman Adaptive Moving Average Trading Strategy

- Momentum Breakout Trading Strategy

- Ichimoku Moving Average Crossover Strategy

- Momentum and Volume Trading Strategy