RSI-EMA Trend Breakout Strategy

Author: ChaoZhang, Date: 2023-12-20 13:47:28Tags:

Overview

This is a trend following and trend breakout trading strategy based on RSI and EMA indicators. The strategy name is “RSI-EMA Trend Breakout Strategy”. It incorporates trend tracking and oscillating indicators to capture the medium-to-long term trend direction and enter at trend breakout points.

Strategy Logic

The strategy uses 5-day EMA, 20-day EMA and 50-day EMA to construct the long and short trend framework. When 5-day EMA crosses over 20-day EMA, and both EMAs are above 50-day EMA, it determines a recent bullish trend breakout for long entry. When 5-day EMA crosses below 20-day EMA, and both EMAs are below 50-day EMA, it determines a recent bearish trend breakout for short entry.

Meanwhile, the strategy also incorporates the RSI indicator to judge if it reaches overbought or oversold zones. RSI can effectively identify overbought and oversold conditions to avoid wrong signals when trend topping or consolidating. When RSI indicator moves from overbought to neutral zone, long position exits. When RSI indicator moves from oversold to neutral zone, short position exits.

Advantage Analysis

This strategy combines EMA and RSI indicators, which can capture medium-to-long term trends and avoid risks at trend ending, with very good risk-reward ratio characteristics. The main advantages are:

- EMA judges trend direction smoothly based on prices

- RSI avoids buying overbought zones and selling oversold zones to mitigate risks

- The strategy has relatively low trading frequency, suitable for medium-to-long term holding, reducing trading and slippage costs

Risk Analysis

There are also some risks in this strategy:

- In ranging markets, EMA and RSI will produce more wrong signals, leading to excessive invalid trades

- Breakout failures happen a lot, so stop loss should be set to control losses

- In some trending markets, RSI does not enter overbought or oversold zones. Using RSI for entry and take profit will miss some opportunities

To reduce these risks, we can set stop loss, adjust RSI parameters, or incorporate other indicators for confirmation.

Optimization Directions

There is room for further optimization of this strategy:

- Test different parameter combinations like EMA periods, RSI parameters to find the optimal

- Incorporate other indicators like MACD, Bollinger Bands to confirm trading signals and reduce errors

- Use machine learning etc. methods to dynamically optimize parameter settings

- Build trend judging system to dynamically adjust strategy parameters in different market environments

Conclusion

This RSI-EMA trend breakout strategy comprehensively considers trend tracking and entry timing judgment to capture trend profits on the basis of risk control. It is a very practical medium-to-long term strategy. We can further improve the stability and profitability through parameter optimization, adding other indicators etc.

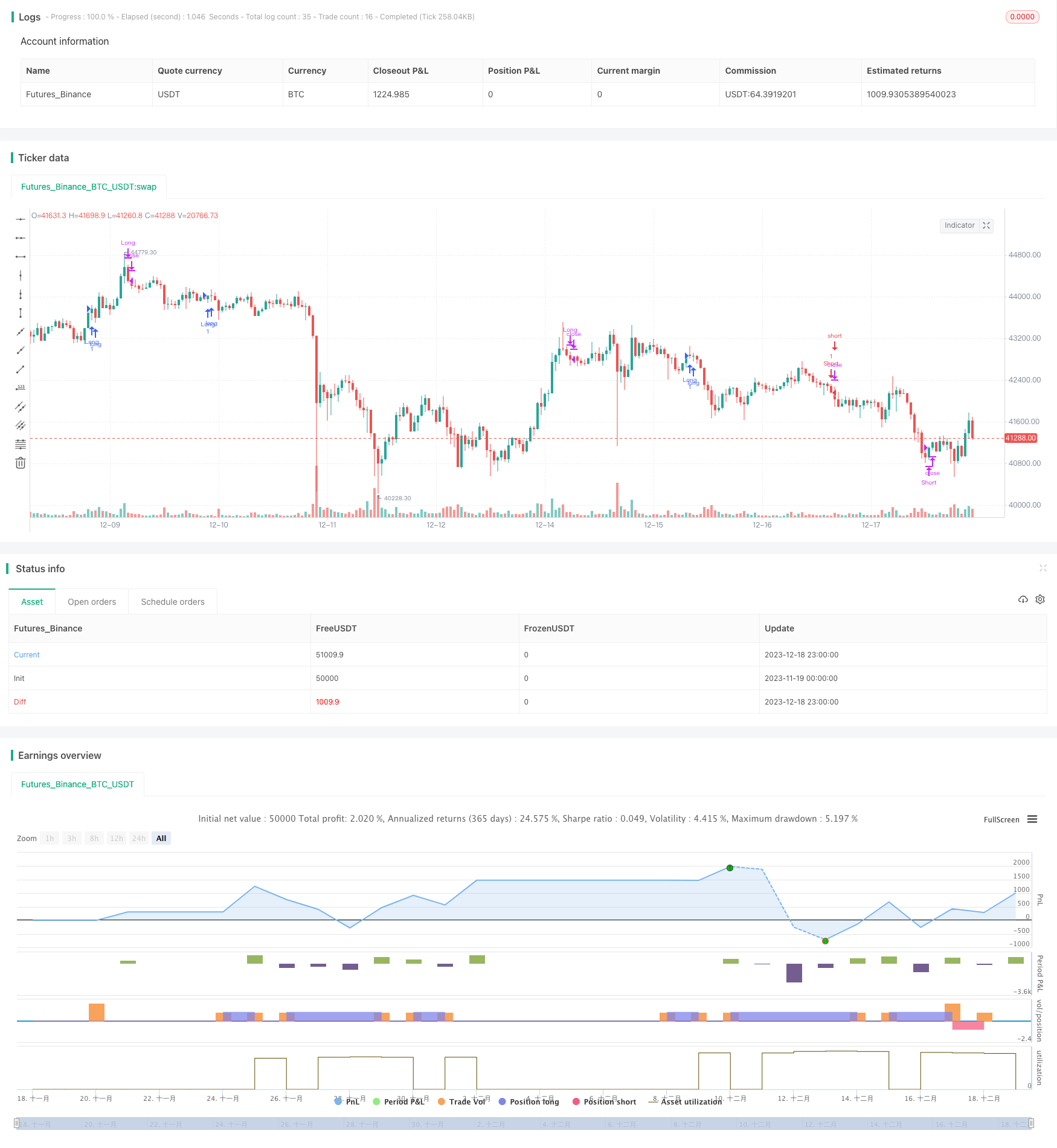

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BrendanW98

//@version=4

strategy("My Strategy", overlay=true)

ema5 = ema(close, 9)

ema20 = ema(close, 21)

ema50 = ema(close, 55)

//RSI Signals

// Get user input

rsiSource = close

rsiLength = 14

rsiOverbought = 70

rsiOversold = 30

rsiMid = 50

// Get RSI value

rsiValue = rsi(rsiSource, rsiLength)

//See if RSI crosses 50

doBuy = crossover(rsiValue, rsiOversold) and rsiValue < 50

doSell = crossunder(rsiValue, rsiOverbought) and rsiValue > 50

emacrossover = crossover(ema5, ema20) and ema5 > ema50 and ema20 > ema50 and close > ema50

emacrossunder = crossunder(ema5, ema20) and ema5 < ema50 and ema20 < ema50 and close < ema50

//Entry and Exit

longCondition = emacrossover

closelongCondition = doSell

strategy.entry("Long", strategy.long, 1, when=longCondition)

strategy.close("Long", when=closelongCondition)

shortCondition = emacrossunder

closeshortCondition = doBuy

strategy.entry("Short", strategy.short, 1, when=shortCondition)

strategy.close("Short", when=closeshortCondition)

- Meticulous EMA Crossover Strategy

- Trend Following Strategy Based on Moving Average

- RSI Trading Strategy

- Turtle Trend Trading System

- Multiple Moving Averages Crossover Trading Strategy

- Flexible MA/VWAP Crossover Strategy with Stop Loss/Take Profit

- Bollinger Band-based Price Action Strategy

- Dual Moving Average Range Breakout Strategy

- Grid Strategy with Moving Average Lines

- Dual Moving Average Intelligent Tracking Strategy

- Pivot Point Forecast Oscillator Backtesting Strategy

- Integrated Ichimoku Keltner Trading System Based on Moving Average Strategy

- Dual-Tracking Turtle Trading Strategy

- Ichimoku Kinko Hyo Based BTC Trading Strategy

- AO Indicator Based Trend Following Strategy

- Universal Sniper Strategy

- Dual Indicator Hybrid Quantitative Trading Strategy

- Bollinger Bands Momentum Breakout Strategy

- Bollinger Band Short-term Reversion Quantitative Strategy Based on Moving Average

- Gradient MACD Quant Strategy