Reverse Mean Breakthrough Strategy

Author: ChaoZhang, Date: 2023-12-20 14:48:57Tags:

Overview

The Reverse Mean Breakthrough Strategy is a multi-factor trend reversal strategy. It combines moving average, Bollinger Bands, CCI, RSI and other technical indicators to capture price reversal opportunities from overbought and oversold areas. The strategy also incorporates regular divergence analysis to detect inconsistencies between current and previous trends, thus avoiding false breakouts.

Strategy Principle

The core logic of this strategy is to take appropriate short or long positions when prices reverse from overbought or oversold zones. Specifically, the strategy judges reversal opportunities from four aspects:

-

CCI indicator or momentum indicator issues golden cross dead cross signals to determine overbought or oversold status.

-

RSI indicator judges whether it is in overbought or oversold zone. Overbought above 65 and oversold below 35.

-

Use Bollinger Bands upper and lower rail to determine if price deviates from normal range. Prices may reverse when return to normal range.

-

Detect regular divergence of RSI indicator to avoid chasing false breakouts.

When the above conditions are met, the strategy will take reverse direction entry. And set stop loss to control risk.

Advantage Analysis

The biggest advantage of this strategy is that it combines multiple indicators to determine reversal opportunities with relatively high winning rate. Specifically:

-

Reliability is higher by using multiple factors. Avoid relying solely on single indicator thus reduce misjudgment.

-

Trend reversal has larger winning probability. It’s a relatively reliable trading method.

-

Detecting divergence avoids chasing false breakout and reduces systemic risk.

-

Stop loss mechanism controls risk. Can minimize single ticket loss as much as possible.

Risk Analysis

There are also some risks with this strategy:

-

Judgment inaccuracies on reversal timing point. Stop loss can be triggered. Expand stop loss range appropriately.

-

Bollinger Bands parameters set inappropriately, takes normal price action as abnormal. Parameters should cater to market volatility.

-

Number of trades could be relatively high. Expand CCI etc. judgment range properly to reduce trading frequency.

-

Long short imbalance. Judge if parameters suit historical data.

Optimization

The strategy can be optimized in the following aspects:

-

Use machine learning algorithms to automatically optimize parameters. Avoid artificial empirical errors.

-

Increase shale index, amplitude index etc. to determine overbought & oversold strength.

-

Add trading volume indicators to determine reversal reliability, e.g. volume, open interest etc.

-

Incorporate blockchain data to gauge market sentiment. Improve strategy adaptivity.

-

Introduce adaptive stop loss mechanism based on market volatility.

Summary

The reverse mean breakthrough strategy integrates multiple indicators to determine reversal trades. With proper risk control, it has relatively large winning rate. The strategy is practical with room for further optimization. With proper parameter tuning, it should yield fairly ideal results.

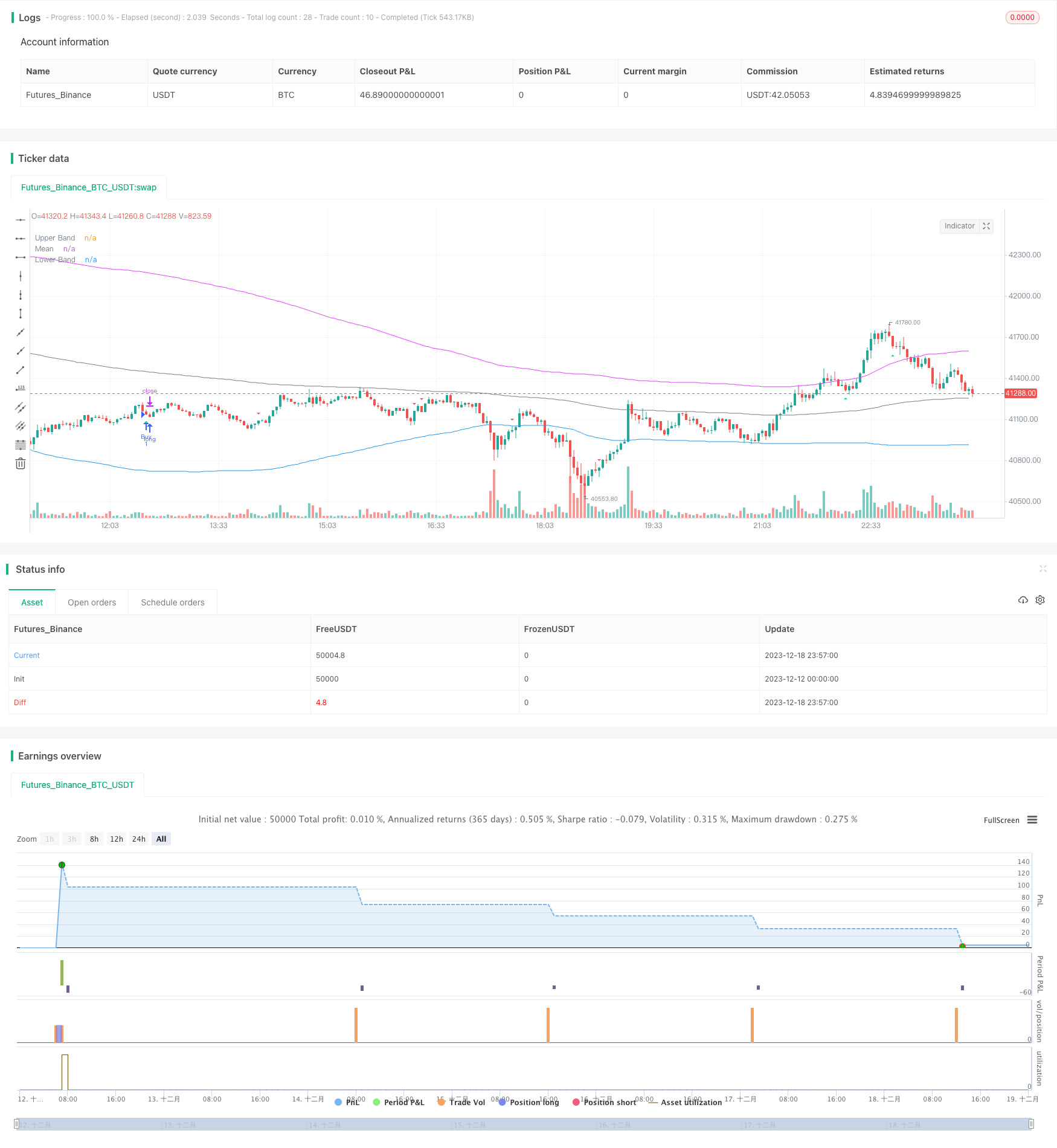

/*backtest

start: 2023-12-12 00:00:00

end: 2023-12-19 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='BroTheJo Strategy', shorttitle='BTJ INV', overlay=true)

// Input settings

stopLossInPips = input.int(10, minval=0, title='Stop Loss (in Pips)')

ccimomCross = input.string('CCI', 'Entry Signal Source', options=['CCI', 'Momentum'])

ccimomLength = input.int(10, minval=1, title='CCI/Momentum Length')

useDivergence = input.bool(false, title='Find Regular Bullish/Bearish Divergence')

rsiOverbought = input.int(65, minval=1, title='RSI Overbought Level')

rsiOversold = input.int(35, minval=1, title='RSI Oversold Level')

rsiLength = input.int(14, minval=1, title='RSI Length')

plotMeanReversion = input.bool(true, 'Plot Mean Reversion Bands on the chart')

emaPeriod = input(200, title='Lookback Period (EMA)')

bandMultiplier = input.float(1.6, title='Outer Bands Multiplier')

// CCI and Momentum calculation

momLength = ccimomCross == 'Momentum' ? ccimomLength : 10

mom = close - close[momLength]

cci = ta.cci(close, ccimomLength)

ccimomCrossUp = ccimomCross == 'Momentum' ? ta.cross(mom, 0) : ta.cross(cci, 0)

ccimomCrossDown = ccimomCross == 'Momentum' ? ta.cross(0, mom) : ta.cross(0, cci)

// RSI calculation

src = close

up = ta.rma(math.max(ta.change(src), 0), rsiLength)

down = ta.rma(-math.min(ta.change(src), 0), rsiLength)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

oversoldAgo = rsi[0] <= rsiOversold or rsi[1] <= rsiOversold or rsi[2] <= rsiOversold or rsi[3] <= rsiOversold

overboughtAgo = rsi[0] >= rsiOverbought or rsi[1] >= rsiOverbought or rsi[2] >= rsiOverbought or rsi[3] >= rsiOverbought

// Regular Divergence Conditions

bullishDivergenceCondition = rsi[0] > rsi[1] and rsi[1] < rsi[2]

bearishDivergenceCondition = rsi[0] < rsi[1] and rsi[1] > rsi[2]

// Mean Reversion Indicator

meanReversion = plotMeanReversion ? ta.ema(close, emaPeriod) : na

stdDev = plotMeanReversion ? ta.stdev(close, emaPeriod) : na

upperBand = plotMeanReversion ? meanReversion + stdDev * bandMultiplier : na

lowerBand = plotMeanReversion ? meanReversion - stdDev * bandMultiplier : na

// Entry Conditions

prevHigh = ta.highest(high, 1)

prevLow = ta.lowest(low, 1)

shortEntryCondition = ccimomCrossUp and oversoldAgo and (not useDivergence or bullishDivergenceCondition) and (prevHigh >= meanReversion) and (prevLow >= meanReversion)

longEntryCondition = ccimomCrossDown and overboughtAgo and (not useDivergence or bearishDivergenceCondition) and (prevHigh <= meanReversion) and (prevLow <= meanReversion)

// Plotting

oldShortEntryCondition = ccimomCrossUp and oversoldAgo and (not useDivergence or bullishDivergenceCondition)

oldLongEntryCondition = ccimomCrossDown and overboughtAgo and (not useDivergence or bearishDivergenceCondition)

plotshape(oldLongEntryCondition, title='BUY', style=shape.triangleup, text='B', location=location.belowbar, color=color.new(color.lime, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(oldShortEntryCondition, title='SELL', style=shape.triangledown, text='S', location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// Strategy logic

if (longEntryCondition)

stopLoss = close - stopLossInPips

strategy.entry("Buy", strategy.long)

strategy.exit("exit", "Buy", stop=stopLoss)

if (shortEntryCondition)

stopLoss = close + stopLossInPips

strategy.entry("Sell", strategy.short)

strategy.exit("exit", "Sell", stop=stopLoss)

// Close all open positions when outside of bands

closeAll = (high >= upperBand) or (low <= lowerBand)

if (closeAll)

strategy.close_all("Take Profit/Cut Loss")

// Plotting

plot(upperBand, title='Upper Band', color=color.fuchsia, linewidth=1)

plot(meanReversion, title='Mean', color=color.gray, linewidth=1)

plot(lowerBand, title='Lower Band', color=color.blue, linewidth=1)

- Trading Strategy Based on Bollinger Bands and MACD

- Macd Blue Red Leverage Strategy

- Momentum Capture Channel Strategy

- Hedging Oscillation Reversal Strategy

- Quantitative Trading Strategy Based on Bollinger Bands and RSI

- The Relative Volume Indicator Strategy

- The Octagon Cloud Tracing Strategy

- Probability-Enhanced RSI Strategy

- Triple EMA Trend Following Strategy

- Stan The Man - An Advanced Stock Trading Strategy Based on Dual Moving Average and Volatility

- Double Moving Average Reversal Strategy

- Logarithmic Price Forecasting Strategy

- Simple Moving Average Crossover Strategy

- Bollinger Bands and RSI Trend Following Strategy

- Meticulous EMA Crossover Strategy

- Trend Following Strategy Based on Moving Average

- RSI Trading Strategy

- Turtle Trend Trading System

- Multiple Moving Averages Crossover Trading Strategy

- Flexible MA/VWAP Crossover Strategy with Stop Loss/Take Profit