概述

本策略是一个基于简单移动平均线的趋势跟踪和反转交易策略。它使用1日线和4日线的均线交叉来判断趋势方向,进而产生买入和卖出信号。

策略原理

当1日线从上方向下交叉4日线时,产生卖出信号;当1日线从下方向上交叉4日线时,产生买入信号。这样通过快速移动平均线和慢速移动平均线的交叉来判断市场趋势的转折点,进而获利。

入市后设置止损点和止盈点。止损点设置为入市价格之下10个点,止盈点设置为入市价格之上100个点。这样可以限制损失和锁定利润。

优势分析

- 使用双均线判断趋势反转点,简单实用

- 设置止损止盈点,可以限制风险

- 参数可调,可以适应不同市场情况

- 容易理解实现,适合初学者

风险分析

- 均线参数不当可能导致交易频繁或漏掉良好机会

- 止损止盈点设置不当,可能过早止损或止盈不充分

- 双均线判断趋势转折的滞后性可能导致亏损

- 参数不随市场环境变化而调整的话,效果会变差

可以通过调整均线参数,设置动态止损止盈机制,或加入其它指标判断来降低这些风险。

优化方向

- 可以考虑加入MACD,KD等其它指标来验证交易信号,过滤假信号

- 可以研究不同周期均线的效果

- 可以加入趋势判断指标,避免逆势交易

- 可以使止损止盈按比例移动,而不是固定值

- 可以结合波动率指标动态调整参数

总结

本策略整体来说是一个典型的双均线交易策略。它使用快慢均线交叉判断趋势转折点,设置止损止盈控制风险,简单实用,容易理解,适合初学者。通过参数调整和优化,可以适应不同市场环境,也可以加入其他指标过滤来提高效果。总的来说,本策略作为一个入门学习策略是非常不错的。

策略源码

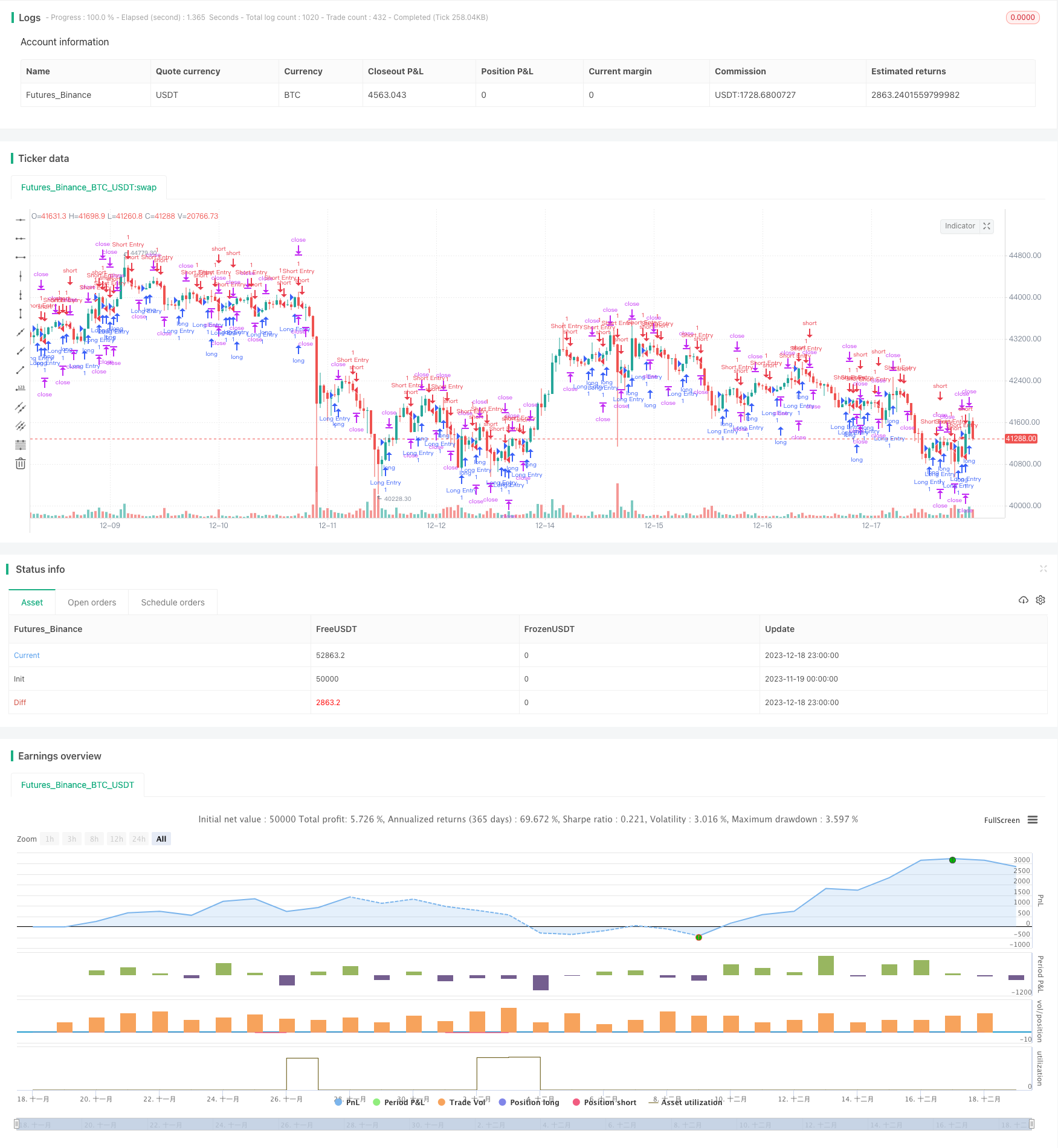

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © cesarpieres72

//@version=5

strategy("300% STRATEGY", overlay=true, margin_long=10, margin_short=10)

var float lastLongOrderPrice = na

var float lastShortOrderPrice = na

longCondition = ta.crossover(ta.sma(close, 1), ta.sma(close, 4))

if (longCondition)

strategy.entry("Long Entry", strategy.long) // Enter long

shortCondition = ta.crossunder(ta.sma(close, 1), ta.sma(close, 4))

if (shortCondition)

strategy.entry("Short Entry", strategy.short) // Enter short

if (longCondition)

lastLongOrderPrice := close

if (shortCondition)

lastShortOrderPrice := close

// Calculate stop loss and take profit based on the last executed order's price

stopLossLong = lastLongOrderPrice - 170 // 10 USDT lower than the last long order price

takeProfitLong = lastLongOrderPrice + 150 // 100 USDT higher than the last long order price

stopLossShort = lastShortOrderPrice + 170 // 10 USDT higher than the last short order price

takeProfitShort = lastShortOrderPrice - 150 // 100 USDT lower than the last short order price

// Apply stop loss and take profit to long positions

strategy.exit("Long Exit", from_entry="Long Entry", stop=stopLossLong, limit=takeProfitLong)

// Apply stop loss and take profit to short positions

strategy.exit("Short Exit", from_entry="Short Entry", stop=stopLossShort, limit=takeProfitShort)