Overview

This strategy is a high-performance algorithmic trading strategy based on quantitative models. It uses the Modelius Volume model as the basic model and further extends and optimizes it. This strategy can capture quantitative trading opportunities in the market and achieve steady profits.

Strategy Principle

The core of this strategy is the Modelius Volume model. This model identifies quantitative trading opportunities in the market by detecting price and volume changes. Specifically, the strategy combines close price, open price, highest price, lowest price to calculate the direction of the current K-line based on certain rules. When the K-line direction changes, the quality of the quantitative trading opportunity is judged based on the trading volume. In addition, the strategy also combines the SAR indicator and moving average indicator to assist in determining entry and exit timing.

The basic trading logic is to go long when the indicator breaks through from negative to positive and go short when the indicator breaks through from positive to negative. In addition, stop loss, take profit, trailing stop loss are set up to control risks.

Advantage Analysis

The biggest advantage of this strategy is that the Modelius Volume model can effectively identify quantitative trading opportunities. Compared with traditional technical indicators, this model pays more attention to volume changes, which is very practical in today’s high-frequency quantitative trading. In addition, the entry rules of the strategy are relatively strict, which can effectively avoid missing quantitative trading opportunities while reducing the probability of disorder as much as possible.

Risk Analysis

The main risk of this strategy is that the Modelius Volume model itself cannot completely avoid noise. When there is abnormal market fluctuation, it will lead to wrong trading signals. In addition, the parameter settings in the strategy will also affect the final results.

To control risks, parameters can be adjusted accordingly and combined with other indicators for auxiliary judgment. In addition, stop loss and take profit should be set reasonably.

Optimization Directions

There is still room for optimizing this strategy. For example, machine learning algorithms can be considered to dynamically optimize parameter settings. Or combine sentiment analysis and other indicators to improve decision accuracy. In addition, the correlation between different varieties can be studied to establish a multi-variety arbitrage model.

Summary

In summary, this strategy utilizes the advantages of the Modelius Volume quantitative model and designs a set of algorithmic trading strategies with high operability. It can be further optimized and enhanced through parameter tuning, model expansion, machine learning, etc. to obtain relatively good and steady returns in actual trading.

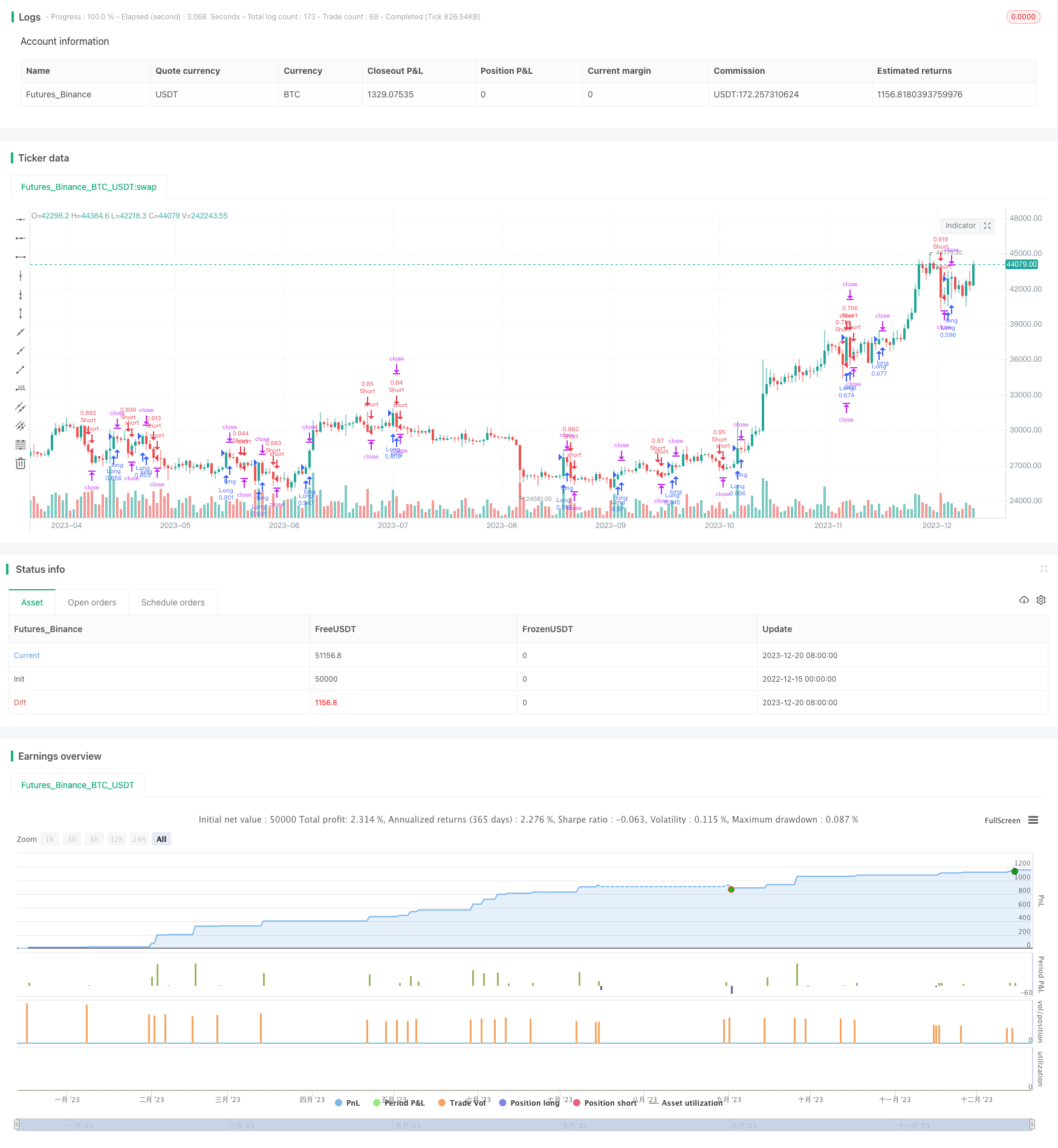

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="strategy modelius volume model ", shorttitle="mvm",overlay=true, calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=50, overlay=false)

method = input(defval="ATR", options=["ATR", "Traditional", "Part of Price"], title="Renko Assignment Method")

methodvalue = input(defval=14.0, type=float, minval=0, title="Value")

pricesource = input(defval="Close", options=["Close", "Open / Close", "High / Low"], title="Price Source")

useClose = pricesource == "Close"

useOpenClose = pricesource == "Open / Close" or useClose

useTrueRange = input(defval="Auto", options=["Always", "Auto", "Never"], title="Use True Range instead of Volume")

isOscillating=input(defval=true, type=bool, title="Oscillating")

normalize=input(defval=false, type=bool, title="Normalize")

vol = useTrueRange == "Always" or (useTrueRange == "Auto" and na(volume))? tr : volume

op = useClose ? close : open

hi = useOpenClose ? close >= op ? close : op : high

lo = useOpenClose ? close <= op ? close : op : low

if method == "ATR"

methodvalue := atr(round(methodvalue))

if method == "Part of Price"

methodvalue := close/methodvalue

currclose = na

prevclose = nz(currclose[1])

prevhigh = prevclose + methodvalue

prevlow = prevclose - methodvalue

currclose := hi > prevhigh ? hi : lo < prevlow ? lo : prevclose

direction = na

direction := currclose > prevclose ? 1 : currclose < prevclose ? -1 : nz(direction[1])

directionHasChanged = change(direction) != 0

directionIsUp = direction > 0

directionIsDown = direction < 0

barcount = 1

barcount := not directionHasChanged and normalize ? barcount[1] + barcount : barcount

vol := not directionHasChanged ? vol[1] + vol : vol

res = barcount > 1 ? vol/barcount : vol

x=isOscillating and directionIsDown ? -res : res

TP = input(0) * 10

SL = input(0) * 10

TS = input(1) * 10

TO = input(3) * 10

CQ = 100

TPP = (TP > 0) ? TP : na

SLP = (SL > 0) ? SL : na

TSP = (TS > 0) ? TS : na

TOP = (TO > 0) ? TO : na

longCondition = crossover(x,0)

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = crossunder(x,0)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Close Short", "Short", qty_percent=CQ, profit=TPP, loss=SLP, trail_points=TSP, trail_offset=TOP)

strategy.exit("Close Long", "Long", qty_percent=CQ, profit=TPP, loss=SLP, trail_points=TSP, trail_offset=TOP)