Reversal Breakout Oversold RSI Strategy

Author: ChaoZhang, Date: 2023-12-22 15:00:48Tags:

Overview

The Reversal Breakout Oversold RSI strategy is an algorithmic trading strategy that uses the Relative Strength Index (RSI) indicator to determine oversold situations and goes long when prices reverse. The strategy sets the RSI threshold at 30 - when the RSI is below 30, it is considered oversold, and at that time a long position is opened. The strategy locks in profits through strict stop loss and take profit rules.

Strategy Logic

The Reversal Breakout Oversold RSI strategy uses a 14-period RSI indicator. When the RSI falls below 30, it is judged to be oversold. This indicates that prices have been falling continuously over the previous period and are currently in an oversold state, so the market is about to reverse and prices are likely to start rising. The strategy opens a long position at this time to seek reversal opportunities.

Specifically, when RSI <30 and within the backtest time window, a long signal is triggered to open a position. Then set the stop loss at 1% below the entry price and take profit at 7% above. When the price rises above the take profit or falls below the stop loss, close the position.

The whole strategy grows capital by identifying oversold reversal entry points and setting stop losses and take profits to lock in profits.

Advantage Analysis

The Reversal Breakout Oversold RSI Strategy has the following advantages:

-

Captures long opportunities brought about by oversold reversals, which is a relatively reliable trading strategy.

-

Uses the RSI indicator to identify entry points, which is more professional than direct price action.

-

Strict stop loss and take profit settings effectively control the risk and profit of each trade.

-

Backtest data shows that the strategy has high returns and win rate.

-

Easy to understand, beginners can use it easily.

Risk Analysis

The Reversal Breakout Oversold RSI strategy also has some risks:

-

There is still a probability that the price reversal will fail. Although RSI below 30 increases the probability of reversal, market conditions are complex and changeable, and failures can still occur, triggering the stop loss at this time.

-

The stop loss point is too close with a high probability of stop loss clustering occurring. The stop loss amplitude can be appropriately relaxed.

-

Improper backtest time window settings can bias test results. The backtest period should be adjusted to fully evaluate strategy performance.

-

Improper selection of trading tokens can also affect profits. This strategy works best on more volatile coins.

Optimization

There is still room for optimization of the Reversal Breakout Oversold RSI Strategy:

-

Adjust RSI parameters and test the impact of different parameters on strategy returns.

-

Test different trading pairs and select more volatile coins.

-

Adjust stop loss and take profit parameters to find the optimal parameter combination. Appropriately widening the stop loss amplitude is also a direction.

-

Add other indicators filters, such as only entering after the price breaks a certain moving average.

-

Test different time period parameters to find the best entry timing.

Summary

The Reversal Breakout Oversold RSI strategy is easy to understand and operate overall, capturing reversal opportunities from oversold situations to make profits. The biggest advantage of the strategy is that it is easy to grasp even for beginners. At the same time, the strict stop loss and take profit mechanism also makes the risk controllable. The next step is to optimize from directions like adjusting parameters and adding filter indicators to make the strategy performance even better.

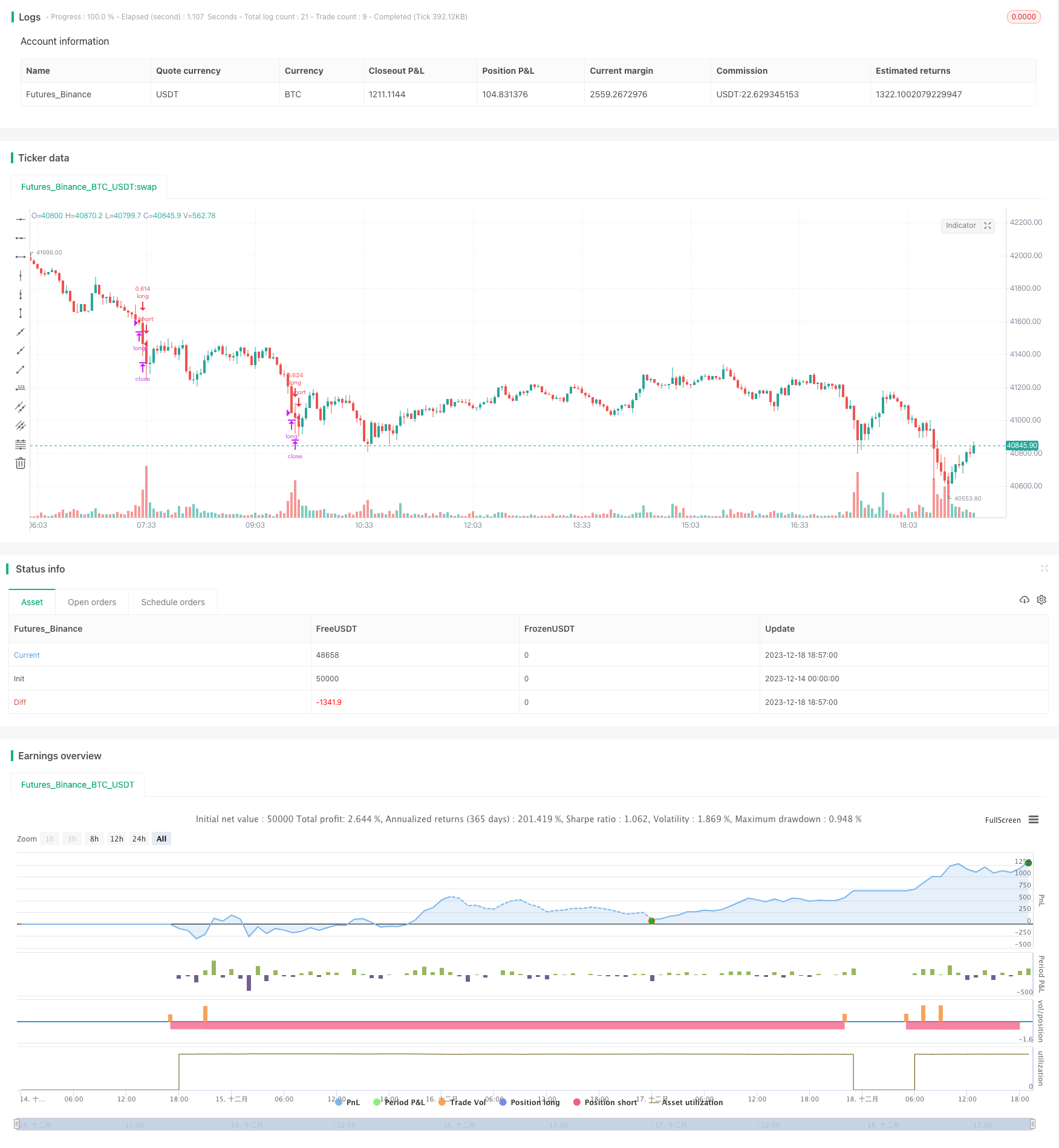

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-18 19:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © brodieCoinrule

//@version=4

strategy(shorttitle='Oversold RSI with tight SL',title='Oversold RSI with tight SL Strategy (by Coinrule)', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 50, commission_type=strategy.commission.percent, commission_value=0.1)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

perc_change(lkb) =>

overall_change = ((close[0] - close[lkb]) / close[lkb]) * 100

// RSI inputs and calculations

lengthRSI = 14

RSI = rsi(close, lengthRSI)

oversold= input(30)

//Entry

strategy.entry(id="long", long = true, when = RSI< oversold and window())

//Exit

Stop_loss= ((input (1))/100)

Take_profit= ((input (7)/100))

longStopPrice = strategy.position_avg_price * (1 - Stop_loss)

longTakeProfit = strategy.position_avg_price * (1 + Take_profit)

strategy.close("long", when = close < longStopPrice or close > longTakeProfit and window())

- Dynamic Filter Quant Trading Strategy

- Dual MA Crossover Strategy

- Heikin Ashi Percentile Interpolation Trading Strategy

- Turtle Trading Strategy Based on Donchian Channels

- EMA Crossover Intraday Trading Strategy Based on AO Oscillator

- The Ichimoku Oscillator [ChartPrime] indicator is the most commonly used indicator.

- FRAMA and Moving Average Crossover Trading Strategy Based on Dual Moving Average

- Moving Average Crossover Long-Short Trading Strategy

- Fast Scalping RSI Switching Strategy v1.7

- Moving Average Crossover Quantitative Strategy

- Dual Moving Average Bollinger Band Trend Tracking Strategy

- Sentiment Based XBT Futures Trading Strategy

- Parabolic SAR Momentum Reversal Strategy

- Empirical Mode Decomposition Based Quantitative Trading Strategy

- Dynamic Pyramiding Strategy

- YinYang RSI Volume Trend Trading Strategy

- Quad MA Trend Scalper Strategy

- Oscillator Index Transformation Strategy

- Golden Cross Dead Cross Dual Moving Average MACD Trend Tracking Strategy

- This is an experimental quantitative trading strategy