Stochastic RSI Momentum Oscillation Trading Strategy

Author: ChaoZhang, Date: 2023-12-26 12:11:21Tags:

Overview

This article mainly explains a momentum oscillation trading strategy based on the Stochastic RSI indicator. The strategy adopts shorter cycle technical indicators (such as 30 minutes) to make trading decisions based on whether the Stochastic RSI enters the overbought/oversold region. Compared with other momentum strategies, this strategy combines the advantages of both RSI and Stochastic indicators to more accurately capture short-term market oscillations.

Strategy Principle

The core indicator of the strategy is Stochastic RSI. The calculation formula of Stochastic RSI is:

Stochastic RSI = (RSI - RSI Low) / (RSI High - RSI Low) * 100

Where RSI is calculated using the lengthRSI parameter (default 12), and Stochastic RSI is calculated using the lengthStoch parameter (default 12).

When Stochastic RSI is higher than the purple filled area, it is the overbought area, then go short; when Stochastic RSI is lower than the purple filled area, it is the oversold area, then go long.

In addition, the strategy also sets the moving average filter condition. Only when the fast EMA is higher than the slow EMA can you open a long position; only when the fast EMA is lower than the slow EMA can you open a short position. This avoids counter-trend trading.

Advantages of the Strategy

Compared with a single RSI strategy, this strategy combines the Stochastic indicator to more clearly identify overbought/oversold areas, thereby improving the reliability of signals.

Compared with a single Stochastic strategy, this strategy uses RSI as the input data source of Stochastic, which can filter out some noise and make the signal more reliable.

The moving average filter condition is set to effectively avoid counter-trend positions building, thereby reducing unnecessary losses.

The position holding time delay is set to avoid being stopped out by false breakouts.

Risks of the Strategy

The strategy mainly uses short-cycle indicators, so it is only suitable for short-term operations and may not perform well in the long run.

The Stochastic RSI indicator itself has a certain lag and may miss signals after drastic price changes in the short term.

In oscillating markets, Stochastic RSI may produce multiple penetrations of overbought/oversold areas, which may lead to overtrading and increased transaction costs.

Optimization Directions

Different parameter combinations can be tested to further optimize the length, K and D values of Stochastic RSI.

Different RSI length parameters can be tested to find a more appropriate RSI cycle.

Try combining with other indicators to further improve signal accuracy, such as MACD, Bollinger Bands, etc.

Test different position holding delay parameters to find a more appropriate exit timing.

Conclusion

This article details the construction principles, advantages, risks and optimization ideas of a momentum strategy based on the Stochastic RSI indicator. Compared with single indicator strategies, this strategy utilizes the strengths of both RSI and Stochastic to more clearly and reliably identify short-term overbought/oversold phenomena in the market for reversal trading. Further performance improvements can be expected through parameter optimization and indicator combinations.

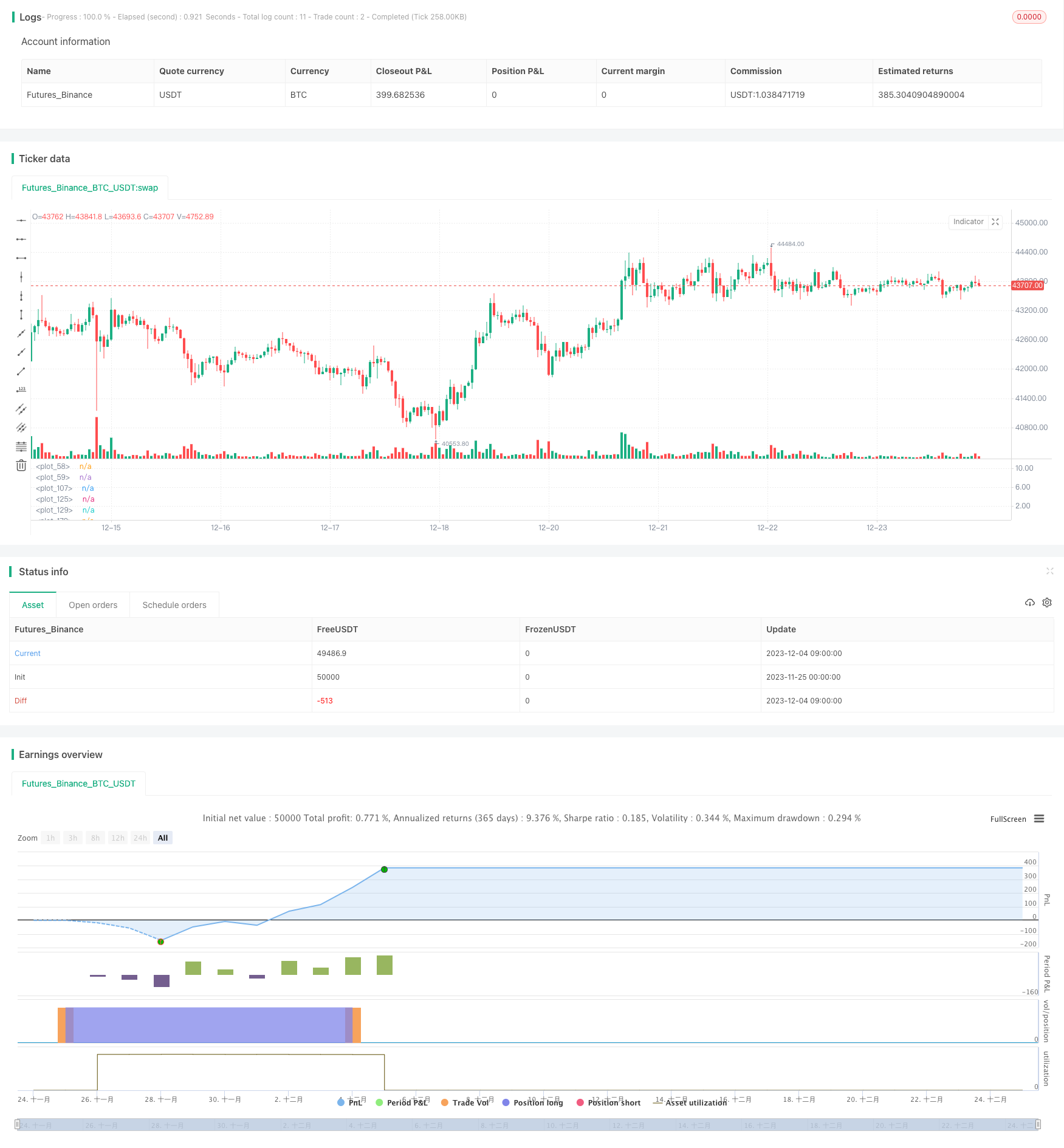

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Drun30 (Federico Magnani)

//@version=4

//STRATEGIA PRINCIPALE

capitaleIniziale=10000

var sizeordineInit= 50 // → % di capitale investita per ogni trade

var deltaSize = 25 // → delta% di capitale investito se trade precedente è stato in perdita

var sizeLimite = 100 //il trade non userà mai questa percentuale di capitale investito

var sizeordine = sizeordineInit

//Parametri ottimali 30 min

usiShort=false

usiLong=true

ipercomprato=85.29

ipervenduto=30.6

//

strategy("Momentum Strategy (V7.B.4)", initial_capital=capitaleIniziale, currency="USD", default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.1, slippage = 5, default_qty_value=sizeordineInit, overlay=false, pyramiding=0)

backtest = input(title="------------------------Backtest Period------------------------", defval = false)

start = timestamp(input(2020, "start year"), input(1, "start month"), input(1, "start day"), 00, 00)

end = timestamp(input(0, "end year"), input(0, "end month"), input(0, "end day"), 00, 00)

siamoindata=time > start?true:false

if end > 0

siamoindata:=time > start and time <= end?true:false

basicParameters = input(title="------------------------Basic Parameters------------------------", defval = false)

smoothK = input(3, minval=1)

smoothD = input(6, minval=1)

lengthRSI = input(12, minval=1)

src = input(close, title="RSI Source")

rsi1 = rsi(src, lengthRSI)

lengthStoch = input(12, minval=1)

k = ema(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ema(k, smoothD)

altezzaipercomprato= input(ipercomprato, title="Overbought Height", minval=1, type=input.float)

altezzaipervenduto= input(ipervenduto, title="Oversold Height", minval=1,type=input.float)

BarsDelay = input(6,title="Bars delay",minval=0)

GambleSizing = input(true, title = "Gamble Sizing?",type=input.bool)

gambleAdd = input(deltaSize,title="Gamble Add (%)",minval=0,type=input.integer)

gambleLimit = input(sizeLimite,title="Gamble MAX (%)",minval=0,type=input.integer)

if GambleSizing and strategy.closedtrades[0]>strategy.closedtrades[1]

if strategy.losstrades[0]>strategy.losstrades[1] and sizeordine<gambleLimit

sizeordine:=sizeordine+gambleAdd

if strategy.wintrades[0]>strategy.wintrades[1]

sizeordine:=sizeordineInit

periodomediamobile_fast = input(1, title="Fast EMA length",minval=1)

periodomediamobile_slow = input(60, title="Slow EMA length",minval=1)

plot(k, color=color.blue)

plot(d, color=color.orange)

h0 = hline(altezzaipercomprato)

h1 = hline(altezzaipervenduto)

fill(h0, h1, color=color.purple, transp=80)

// n=input(Vicinanzadalcentro,title="Vicinanza dal centro",minval=0)

//sarebbe il livello di D in cui si acquista o si vende, maggiore è la vicinanza maggiore sarà la frequenza dei trades, SE 0 è DISABILITATO

// siamoinipervenduto= d<=altezzaipervenduto and d<=d[n] and d>d[1]?true:false //and d<d[3] and d>d[1]

// siamoinipercomprato= d>=altezzaipercomprato and d>=d[n] and d<d[1]?true:false //and d>d[3] and d<d[1]

goldencross = crossover(k,d)

deathcross = crossunder(k,d)

// METTI VARIABILE IN CUI AVVIENE CROSSOVER O CROSSUNDER

valoreoro = valuewhen(goldencross,d,0)

valoremorte = valuewhen(deathcross,d,0)

siamoinipervenduto = goldencross and valoreoro<=altezzaipervenduto?true:false//d<=altezzaipervenduto?true:false

siamoinipercomprato = deathcross and valoremorte>=altezzaipercomprato?true:false//d>=altezzaipercomprato?true:false

long_separator = input(title="------------------------LONG------------------------", defval = usiLong)

sl_long_inp = input(10, title="Stop Loss LONG %", type=input.float)

tp_long_inp = input(8, title="Take Profit LONG %",type=input.float)

stop_level_long = strategy.position_avg_price * (1 - (sl_long_inp/100)) //strategy.position_avg_price corrisponde al prezzo con cui si è aperta la posizione

take_level_long = strategy.position_avg_price * (1 + (tp_long_inp/100))

//BINANCE

JSON_long = 'OPEN LONG: PUT THE JSON HERE FOR THE API CALL'

JSON_chiusura = 'CLOSE POSITION: PUT THE JSON HERE FOR THE API CALL'

webhookLong = JSON_long

webhookClose= JSON_chiusura

trendFilterL = input(title="TREND FILTER LONG?", defval = true)

EMAfast=ema(close,periodomediamobile_fast)

EMAslow=ema(close,periodomediamobile_slow)

siamoinuptrend_ema=EMAfast>EMAslow?true:false //close>=EMAfast and EMAfast>EMAslow

siamoinuptrend = siamoinuptrend_ema

// CondizioneAperturaLong = siamoinipervenduto and siamoindata // and siamoinuptrend

CondizioneAperturaLong = siamoinipervenduto and siamoindata and long_separator

if trendFilterL

CondizioneAperturaLong := siamoinipervenduto and siamoindata and long_separator and siamoinuptrend

CondizioneChiusuraLong = siamoinipercomprato and siamoindata

possiamoAprireLong=0

if trendFilterL and siamoinuptrend

possiamoAprireLong:=5

plot(possiamoAprireLong,color=color.green)

sonPassateLeBarreG = barssince(CondizioneAperturaLong) == BarsDelay?true:false

sonPassateLeBarreD = barssince(CondizioneChiusuraLong) == BarsDelay?true:false

haiUnLongAncoraAperto = false

haiUnLongAncoraAperto := strategy.position_size>0?true:false

// Se l'ultimo valore della serie "CondizioneAperturaLong" è TRUE, allora hai un long ancora aperto

// Se l'ultimo valore della serie "CondizioneAperturaLong" è FALSE, allora:

// Se l'ultimo valore della serie "CondizioneChiusuraLong" è TRUE, allora NON hai un long ancora aperto

// Se l'ultimo valore della serie "CondizioneChiusuraLong" è FALSE, allora restituisce l'ultimo valore della serie "haiUnLongAncoraAperto"

haiUnLongAncoraAperto_float = if(haiUnLongAncoraAperto==true)

10

else

0

plot(haiUnLongAncoraAperto_float,color=color.red) //FInché la linea rossa si trova a livello "1" allora c'è un ordine long in corso

quantita = (sizeordine/100*(capitaleIniziale+strategy.netprofit))/valuewhen(haiUnLongAncoraAperto==false and CondizioneAperturaLong,close,0)

plot(sizeordine,color=color.purple, linewidth=3)

if strategy.position_size<=0 and CondizioneAperturaLong //and sonPassateLeBarreG and haiUnLongAncoraAperto==false strategy.opentrades==0

strategy.entry("Vamonos",strategy.long, alert_message=webhookLong, comment="OPEN LONG", qty=quantita)

if strategy.position_size>0 //and sonPassateLeBarreD // and CondizioneChiusuraLong

if siamoinuptrend == true and sonPassateLeBarreD

strategy.close("Vamonos", alert_message=webhookClose, comment="CLOSE LONG")

else if siamoinuptrend == false and CondizioneChiusuraLong

strategy.close("Vamonos", alert_message=webhookClose, comment="CLOSE LONG")

if strategy.position_size>0 and siamoindata

strategy.exit("Vamonos", stop=stop_level_long, limit=take_level_long, comment="CLOSE LONG (LIMIT/STOP)")

short_separator = input(title="------------------------SHORT------------------------", defval = usiShort)

sl_short_inp = input(20, title="Stop Loss SHORT %")

tp_short_inp = input(35, title="Take Profit SHORT %")

stop_level_short = strategy.position_avg_price * (1 + (sl_short_inp/100))

take_level_short= strategy.position_avg_price * (1 - (tp_short_inp/100))

// BINANCE

JSON_short = 'OPEN SHORT: PUT THE JSON HERE FOR THE API CALL'

webhookShort = JSON_short

trendFilterS = input(title="TREND FILTER SHORT?", defval = true)

siamoindowntrend_ema=EMAfast<EMAslow?true:false //close<=EMAfast and EMAfast<EMAslow

siamoindowntrend=siamoindowntrend_ema

CondizioneAperturaShort = short_separator and siamoinipercomprato and siamoindata

if trendFilterS

CondizioneAperturaShort:=short_separator and siamoinipercomprato and siamoindata and siamoindowntrend

CondizioneChiusuraShort = siamoinipervenduto and siamoindata

sonPassateLeBarreGs = barssince(CondizioneAperturaShort) == BarsDelay?true:false

sonPassateLeBarreDs = barssince(CondizioneChiusuraShort) == BarsDelay?true:false

haiUnoShortAncoraAperto = false

haiUnoShortAncoraAperto := strategy.position_size<0?true:false

haiUnoShortAncoraAperto_float = if(haiUnoShortAncoraAperto==true)

15

else

0

plot(haiUnoShortAncoraAperto_float,color=color.purple) //FInché la linea viola si trova a livello "2" allora c'è un ordine short in corso

if CondizioneAperturaShort and strategy.position_size>=0 //and haiUnoShortAncoraAperto==false

strategy.entry("Andale",strategy.short,alert_message=webhookShort, comment="OPEN SHORT")

if strategy.position_size<0 //and sonPassateLeBarreD // and CondizioneChiusuraLong

if siamoindowntrend == true and sonPassateLeBarreDs

strategy.close("Andale",alert_message=webhookClose, comment="CLOSE SHORT")

else if siamoindowntrend == false and CondizioneChiusuraShort

strategy.close("Andale",alert_message=webhookClose, comment="CLOSE SHORT")

if strategy.position_size<0 and siamoindata

strategy.exit("Andale", stop=stop_level_short, limit=take_level_short, comment="CLOSE SHORT (LIMIT/STOP)")

- Quantitative Reversal Index Strategy Integrating Dual Trend Signals

- Inertia Indicator Trading Strategy

- Bollinger Band RSI Dual Line Strategy

- Dynamic Support Resistance Breakout Trend Strategy

- Rainbow Oscillator Backtesting Strategy

- Larry Williams' Moving Average Crossover Strategy

- Oscillator Differential Moving Average Timing Strategy

- A DMI & Stochastic Trading Strategy with Dynamic Stop-loss

- Dual-Factor Combo Reversal and Mass Index Strategy

- Quantitative Trading Strategy Based on Double Trend Filter

- Trading Strategy of Short Selling When Bollinger Band Crosses Below Price with RSI Callback

- Moving Average Crossover Strategy

- Trend Tracking Strategy Based on Dynamic Pivot Bands

- Bollinger Bands Momentum Trend Following Strategy

- Dynamic Buying Selling Volume Breakout Strategy

- Supertrend MACD Quantitative Strategy

- 4 EMA Trend Strategy

- Bitcoin Trading Strategy Based on Quantitative Indicators

- Last N Candle Reverse Logic Strategy

- Trend Tracking Breakout Strategy