概述

该策略通过计算最近一定时间段内的最高价和最低价,结合当前价格,形成一个动态的中轴线。然后根据最近的波动率生成红色下行通道和绿色上行通道。这三条通道线构成一个可交易范围。当价格接近通道边界时,做反向操作,目标是回到中轴线上获利。同时,策略内部包含一个趋势计算,用于过滤不顺趋势的交易,防止被大趋势捣毁。

策略原理

- 计算最近N周期内的最高价和最低价,结合当前收盘价形成动态中轴线

- 根据ATR和乘数生成动态通道带,带宽随市场波动率变化

- 当价格从下方通道线反弹时做多,从上方通道线反弹时做空

- 有止盈和止损逻辑,目标回到中轴线停利

- 同时计算趋势指数,用于过滤不顺势的交易

优势分析

- 通道线位置动态变化,能实时捕捉市场波动率

- 顺势交易概率较大,有利于把握趋势

- 有止损逻辑控制单笔损失

风险分析

- 参数优化不当可能导致过度交易

- 大趋势下无法完全滤除逆势交易

- 单边突破通道线可能继续运行

优化方向

- 调整通道线的参数,使其更符合不同品种的特点

- 调整趋势指数参数,提高顺势概率

- 增加机器学习元素,使参数动态优化

总结

该策略主要依赖市场的震荡特征获利。通过动态通道捕捉价格反转点,并结合趋势过滤,可以有效利用反转交易获利,同时控制风险。关键在与参数的调节,需要使通道线既能实时跟踪价格,又不会过于敏感。同时趋势指数也需要选取合适周期才能发挥过滤作用。该策略理论顺势且有止损,实际运用中通过参数优化可以获得不错回报。

策略源码

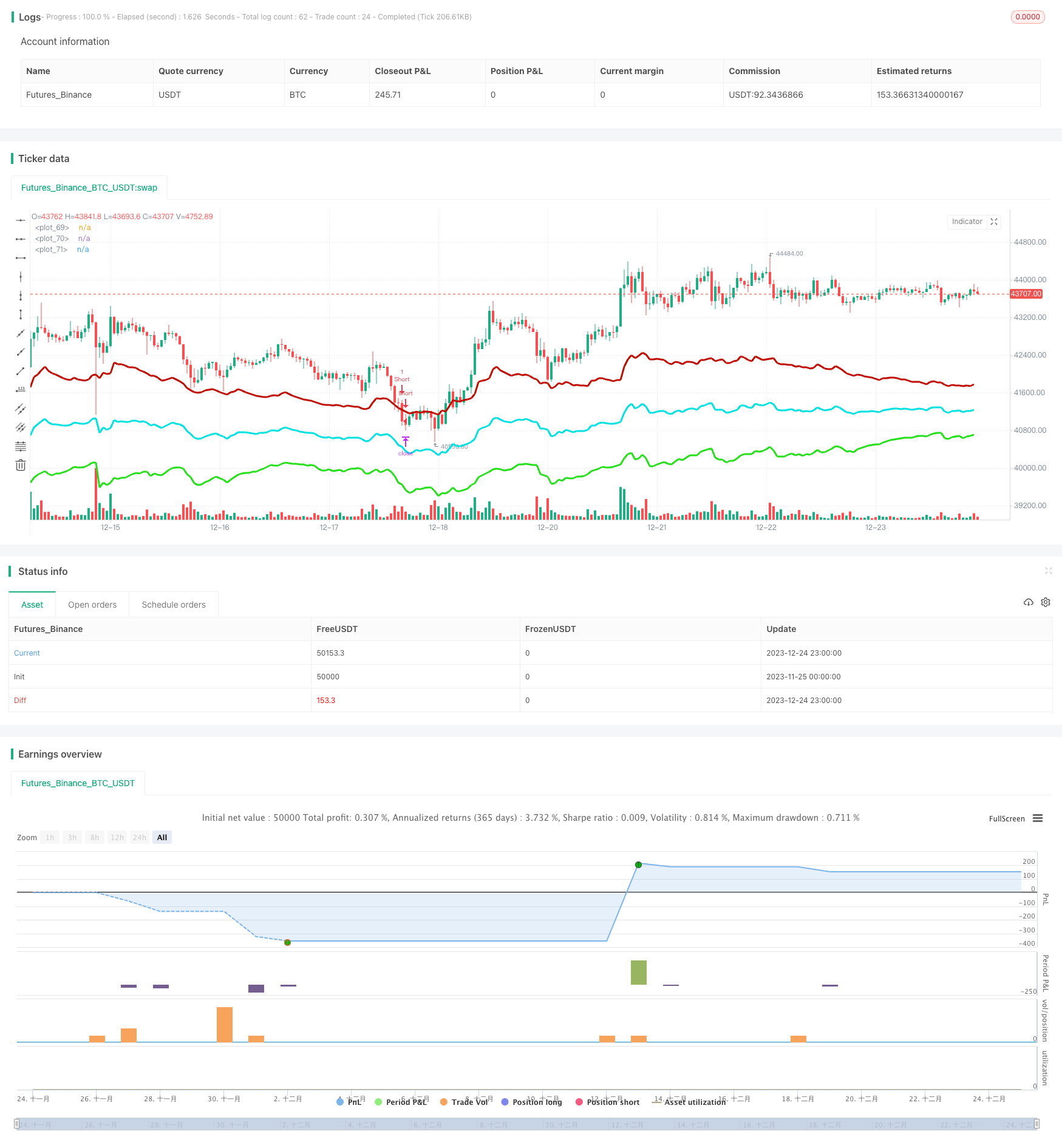

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Strategy - Bobo PAPATR", overlay=true, default_qty_type = strategy.fixed, default_qty_value = 1, initial_capital = 10000)

// === STRATEGY RELATED INPUTS AND LOGIC ===

len = input(24, minval=1, title="Pivot Length, defines lookback for highs and lows to make pivots")

length = input(title="ATR lookback (Lower = bands more responsive to recent price action)", type=input.integer, defval=22)

myatr = atr(length)

dailyatr = myatr[1]

atrmult = input(title="ATR multiplier (Lower = wider bands)", type=input.float, defval=3)

pivot0 = (high[1] + low[1] + close[1]) / 3

// PIVOT CALC

h = highest(len)

h1 = dev(h, len) ? na : h

hpivot = fixnan(h1)

l = lowest(len)

l1 = dev(l, len) ? na : l

lpivot = fixnan(l1)

pivot = (lpivot + hpivot + pivot0) / 3

upperband1 = (dailyatr * atrmult) + pivot

lowerband1 = pivot - (dailyatr * atrmult)

middleband = pivot

// == TREND CALC ===

i1=input(2, "Momentum Period", minval=1) //Keep at 2 usually

i2=input(20, "Slow Period", minval=1)

i3=input(5, "Fast Period", minval=1)

i4=input(3, "Smoothing Period", minval=1)

i5=input(4, "Signal Period", minval=1)

i6=input(50, "Extreme Value", minval=1)

hiDif = high - high[1]

loDif = low[1] - low

uDM = hiDif > loDif and hiDif > 0 ? hiDif : 0

dDM = loDif > hiDif and loDif > 0 ? loDif : 0

ATR = rma(tr(true), i1)

DIu = 100 * rma(uDM, i1) / ATR

DId = 100 * rma(dDM, i1) / ATR

HLM2 = DIu - DId

DTI = (100 * ema(ema(ema(HLM2, i2), i3), i4)) / ema(ema(ema(abs(HLM2), i2), i3), i4)

signal = ema(DTI, i5)

// === RISK MANAGEMENT INPUTS ===

inpTakeProfit = input(defval = 0, title = "Take Profit (In Market MinTick Value)", minval = 0)

inpStopLoss = input(defval = 100, title = "Stop Loss (In Market MinTick Value)", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong = (((low<=lowerband1) and (close >lowerband1)) or ((open <= lowerband1) and (close > lowerband1))) and (strategy.opentrades <1) and (atr(3) > atr(50)) and (signal>signal[3])

exitLong = (high > middleband)

strategy.entry(id = "Long", long = true, when = enterLong)

strategy.close(id = "Long", when = exitLong)

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort = (((high>=upperband1) and (close < upperband1)) or ((open >= upperband1) and (close < upperband1))) and (strategy.opentrades <1) and (atr(3) > atr(50)) and (signal<signal[3])

exitShort = (low < middleband)

strategy.entry(id = "Short", long = false, when = enterShort)

strategy.close(id = "Short", when = exitShort)

// === STRATEGY RISK MANAGEMENT EXECUTION ===

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss)

// === CHART OVERLAY ===

plot(upperband1, color=#C10C00, linewidth=3)

plot(lowerband1, color=#23E019, linewidth=3)

plot(middleband, color=#00E2E2, linewidth=3)

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)