Dual RSI Breakthrough Strategy

Author: ChaoZhang, Date: 2023-12-27 14:33:15Tags:

Overview

The dual RSI breakout strategy is an algorithmic trading strategy that identifies price reversal points using the RSI indicator. It generates trading signals by comparing the RSI indicator with preset upper and lower threshold values to determine whether the market is overbought or oversold.

Strategy Logic

This strategy mainly relies on the RSI indicator to judge the market condition. The RSI indicator is calculated based on the changes in closing prices over a certain period, reflecting the buying and selling momentum of the stock. When the RSI crosses above the preset upper threshold (default 75), it indicates the stock has entered the overbought zone. When the RSI falls below the preset lower threshold (default 25), it indicates the stock has entered the oversold zone.

The judgment rules are:

- When RSI crosses above the upper threshold, go short;

- When RSI crosses below the lower threshold, go long;

- Close position when reaching stop loss or take profit.

Its trading logic is simple and clear, with reasonable reference parameter settings, large configuration space, and is suitable for capturing larger trends in the market.

Advantage Analysis

The advantages of this strategy include:

- Simple logic that is easy to understand and implement;

- Reasonable reference parameter settings that can be personalized;

- Configurable reverse trading logic that can flexibly respond to market conditions;

- Can effectively identify price reversal points and capture major trends.

In general, with reasonable reference parameter settings, simple implementation, and the ability to effectively determine price reversals through RSI, this strategy is suitable for medium- to long-term trend capturing and is easy to grasp and use as a quantitative strategy.

Risk Analysis

Although this strategy is relatively simple and reliable, we cannot ignore the potential risks it faces:

- Relatively high probability of RSI indicators triggering false signals. RSI cannot perfectly predict price reversals, which may lead to misjudgements.

- Possibility of continuous stop loss in a trending market. RSI finds it difficult to distinguish normal range-bound adjustments from trend reversals.

- More losses likely in a ranging market. RSI is unable to effectively determine ranging trends, leading to greater losses in this environment.

To control risks, we need to pay attention to the following:

- Adjust parameters appropriately to prevent excessive misjudgement rates.

- Confirm trading signals with other indicators to improve accuracy.

- Increase the profit taking ratio and reduce single stop loss size.

- Avoid trading in ranging markets.

Optimization Directions

Considering the main risks faced by this strategy are reversal misjudgements and losses in ranging markets, we can optimize from the following aspects:

- Filter signals with other indicators. Indicators like KDJ and MACD can play a filtering role to avoid misjudgements.

- Increase the threshold for single stop loss amounts. Appropriately expanding the single stop loss space can help the strategy follow big trends.

- Set open position frequency limits. Add logic restricting entries to once or N times per certain period to control overly frequent position opening.

- Set market condition judgements. Ensure strategy only runs in trending markets, avoiding ranging markets, which can significantly optimize the strategy’s risk-reward ratio.

Conclusion

In summary, the dual RSI breakout strategy is a simple and practical quantitative strategy. It identifies price reversals via RSI to achieve simple trend following. Although certain misjudgement risks exist, optimizations like parameter tuning, signal filtering can help mitigate this and allow it to play an important role in catching medium- to long-term trends. Its logic is straightforward, making it suitable for beginner quants to reference and learn from. With further optimizations, this strategy shows promise in obtaining relatively stable quantitative returns.

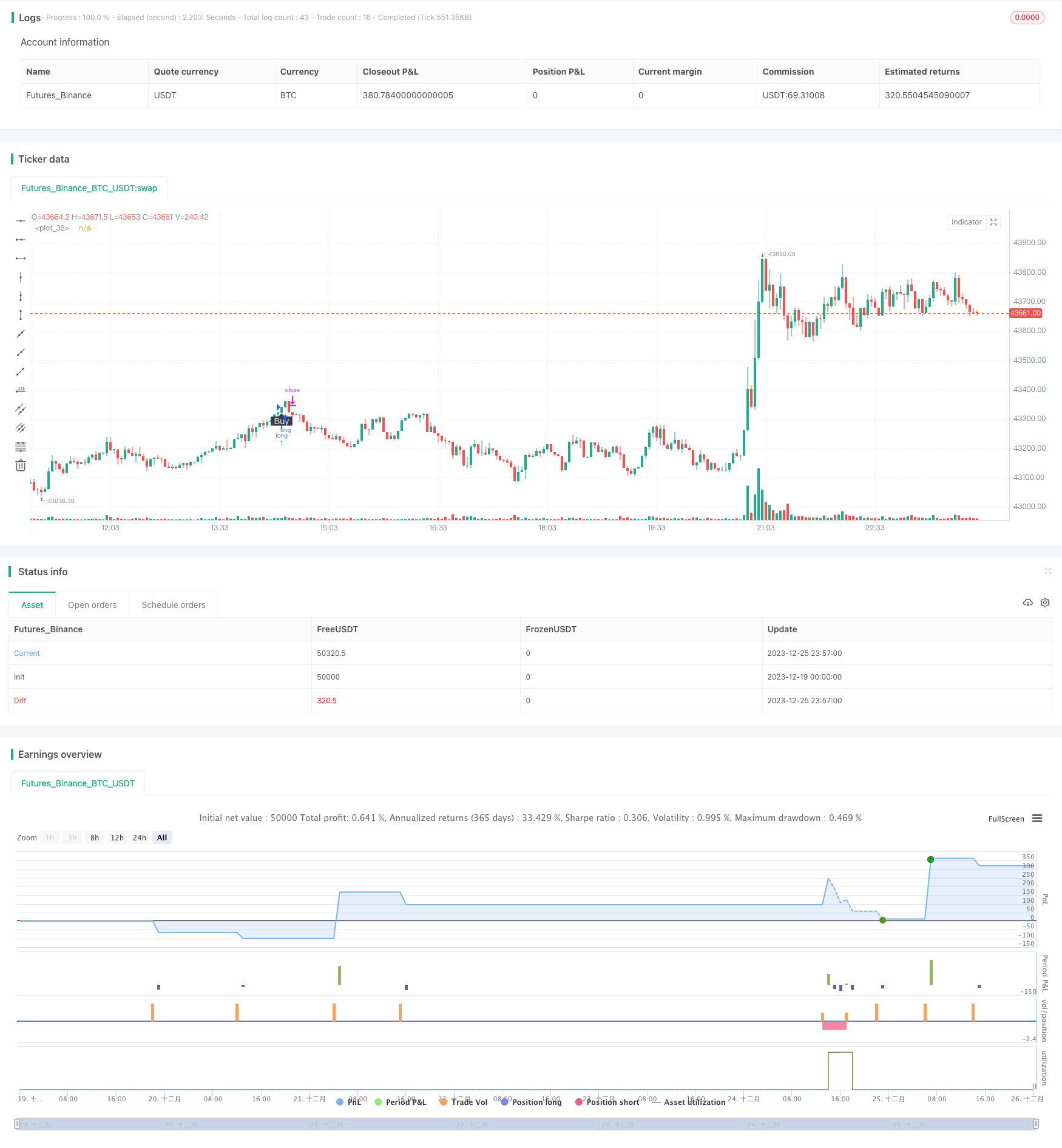

/*backtest

start: 2023-12-19 00:00:00

end: 2023-12-26 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RSI Algo", overlay=true)

// Calculate start/end date and time condition

DST = 1 //day light saving for usa

//--- Europe

London = iff(DST==0,"0000-0900","0100-1000")

//--- America

NewYork = iff(DST==0,"0400-1500","0500-1600")

//--- Pacific

Sydney = iff(DST==0,"1300-2200","1400-2300")

//--- Asia

Tokyo = iff(DST==0,"1500-2400","1600-0100")

//-- Time In Range

timeinrange(res, sess) => time(res, sess) != 0

london = timeinrange(timeframe.period, London)

newyork = timeinrange(timeframe.period, NewYork)

time_cond = true

myPeriod = input(defval=14, type=input.integer, title="Period")

myThresholdUp = input(defval=75, type=input.float, title="Upper Threshold")

myThresholdDn = input(defval=25, type=input.float, title="Lower Threshold")

myAlgoFlipToggle = input(defval=false, type=input.bool, title="Imverse Algorthim")

myLineToggle = input(defval=true, type=input.bool, title="Show Lines")

myLabelToggle = input(defval=true, type=input.bool, title="Show Labels")

myRSI=rsi(close, myPeriod)

buy = myAlgoFlipToggle ? falling(myRSI,1) and cross(myRSI, myThresholdDn) : rising(myRSI, 1) and cross(myRSI,myThresholdUp) //and time_cond

sell = myAlgoFlipToggle ? rising(myRSI, 1) and cross(myRSI,myThresholdUp) : falling(myRSI,1) and cross(myRSI, myThresholdDn) //and time_cond

myPosition = 0

myPosition := buy==1 ? 0 : sell==1 or myPosition[1]==1 ? 1 : 0

trendColor = buy ? color.red : sell ? color.green : na

plot(myLineToggle ? buy and myPosition[1]==1 ? low - 0.004: sell and myPosition[1]==0 ? high + 0.004 : na : na, color=trendColor, style=plot.style_line, linewidth=4, editable=false)

plotshape(myLabelToggle ? buy and myPosition[1]==1 ? low - 0.005 : na : na, style=shape.labelup, location=location.absolute, text="Buy", transp=0, textcolor = color.white, color=color.black, editable=false)

plotshape(myLabelToggle ? sell and myPosition[1]==0 ? high + 0.005 : na : na, style=shape.labeldown, location=location.absolute, text="Sell", transp=0, textcolor = color.white, color=color.black, editable=false)

strategy.initial_capital = 50000

//Calculate the size of the next trade

balance = strategy.netprofit + strategy.initial_capital //current balance

floating = strategy.openprofit //floating profit/loss

risk = input(2,type=input.float,title="Risk %")/100 //risk % per trade

isTwoDigit = input(false,"Is this a 2 digit pair? (JPY, XAU, XPD...")

stop = input(250, title="stop loss pips")

tp = input(2500, title="take profit pips")

if(isTwoDigit)

stop := stop/100

temp01 = balance * risk //Risk in USD

temp02 = temp01/stop //Risk in lots

temp03 = temp02*100000 //Convert to contracts

size = 1

strategy.entry("long",1,size,when=buy and myPosition[1]==1 )

strategy.entry("short",0,size,when=sell and myPosition[1]==0)

strategy.exit("exit_long","long",loss=stop, profit=tp) //Long exit (stop loss)

strategy.exit("exit_short","short",loss=stop, profit=tp) //Short exit (stop loss)

//strategy.close_all(when= not time_cond)

- Momentum Direction Divergence Strategy

- Intraday Trend Following Strategy with Multiple Stop Loss

- Kana Candle Breakout Strategy Based on Moving Average and Support Resistance

- Triple Supertrend Ichimoku Cloud Quantitative Trading Strategy

- Double Strategy Combination – Stochastic Slow and Relative Strength Index

- JBravo Quantitative Trend Strategy

- Keltner Channel Pullback Strategy

- Trending Darvas Box Quantitative Trading Strategy

- MFI and MA Based Quantitative Reversal Strategy

- Up versus Down Close Candles Strategy with EMA filter and Session Timeframes

- Cross-Pair Bollinger Band Crossover Quantitative Strategy

- Bullish Engulfing Buy and Sell Strategy

- Quant Bitcoin Trading Strategy Combining MACD, RSI and FIB

- Dual Moving Average Golden Cross Quantitative Strategy

- Leveraged Position Sizing with Margin Call Risk Management Strategy

- Ichimoku Balance Line Strategy

- Ichimoku Cloud with Dual Moving Average Crossover Strategy

- An ATR and Breakout based ETF Trading Strategy

- Tracking Supertrend Strategy

- Moving Average Envelopes Trading Strategy