Dynamic Trailing Stop Loss Strategy

Author: ChaoZhang, Date: 2023-12-29 10:42:27Tags:

Overview

The dynamic trailing stop loss strategy is a quantitative trading strategy that utilizes a trailing stop loss mechanism. It sets a trailing stop loss line based on trend tracking theory to confirm stop loss and adjust trailing stop loss. It is mainly used to control the stop loss of a single trade, maximize profit locking, and reduce trading risks.

Strategy Logic

The core of the dynamic trailing stop loss strategy lies in setting three key parameters: initial stop loss distance, trailing stop loss distance and trailing stop loss trigger distance. After a buy signal is triggered, the initial stop loss price is calculated based on the entry price and the set initial stop loss distance. Then, every bar will judge whether the trailing stop loss trigger condition is met. If yes, a new trailing stop loss price will be set. The new trailing stop loss price is calculated based on the current closing price and trailing stop loss distance. Thus, as long as the price runs in a favorable direction, the trailing stop loss line will continue to move up to lock in profits. When the price reversal triggers the trailing stop loss line, a sell signal will be generated.

This strategy also has a lower stop loss. No matter whether the trailing stop loss is activated or not, if the price breaks below the lower stop loss, stop loss will be directly triggered. The lower stop loss serves to guard against price gaps caused by sudden events. Therefore, through the dynamic stop loss mechanism in the form of double-line stop loss, the stop loss line can automatically track favorable trends, while preventing excessive losses.

Advantages

-

Continuously lock in profits through trailing stop loss, avoiding giving too much retracement room.

-

Adopt a double-line stop loss structure to ensure the stop loss line can promptly follow up, while preventing excessive losses.

-

Use a continuous judgment mechanism for stop loss adjustment with simple operation and easy implementation.

-

Parameters can be optimized according to market and stock characteristics to improve stop loss efficacy.

-

No need to predict market trends, just follow the trend.

Risks

-

Improper parameter settings may result in either too loose or too tight stop loss. Too loose would make stop loss ineffective, while too tight tends to get stopped out by normal price fluctuations.

-

In case of price gaps caused by sudden events, it may fail to stop loss. Other protective measures should be taken accordingly.

-

Trading costs and slippage may affect the actual selling price after the stop loss line is triggered.

-

Adaptability is not strong. It does not work well in certain stages, such as range-bound movements.

Countermeasures:

- It is recommended to continuously optimize parameters based on backtest and live results.

- Set a wider lower stop loss to guard against price gaps.

- Take trading costs and slippage into account when calculating stop loss price.

- Use in combination with trend and volatility indicators.

Directions for Optimization

-

Adjust the trailing stop loss line in percentage change, which can better track price movements across different price levels.

-

Add volatility metrics to suspend trailing stop loss when facing high volatility, avoiding normal fluctuations from triggering stop loss.

-

Automatically optimize parameters via machine learning. Choose return of different parameter combinations in recent period as training samples.

-

Add open position criteria with consideration of indicators like trend, support & resistance to avoid opening positions in ranging markets.

Conclusion

The dynamic trailing stop loss strategy sets trailing stop loss lines through a double-line stop loss mechanism to confirm stop loss and adjust trailing stop loss based on price changes. It can automatically adjust stop loss distance to lock in profits, reduce pullbacks and control losses. With simple operation and easy implementation, this strategy can be further optimized based on market conditions and used together with other strategies for better performance. But it also has some limitations. It is advisable to improve and test it sufficiently before applying it in live trading.

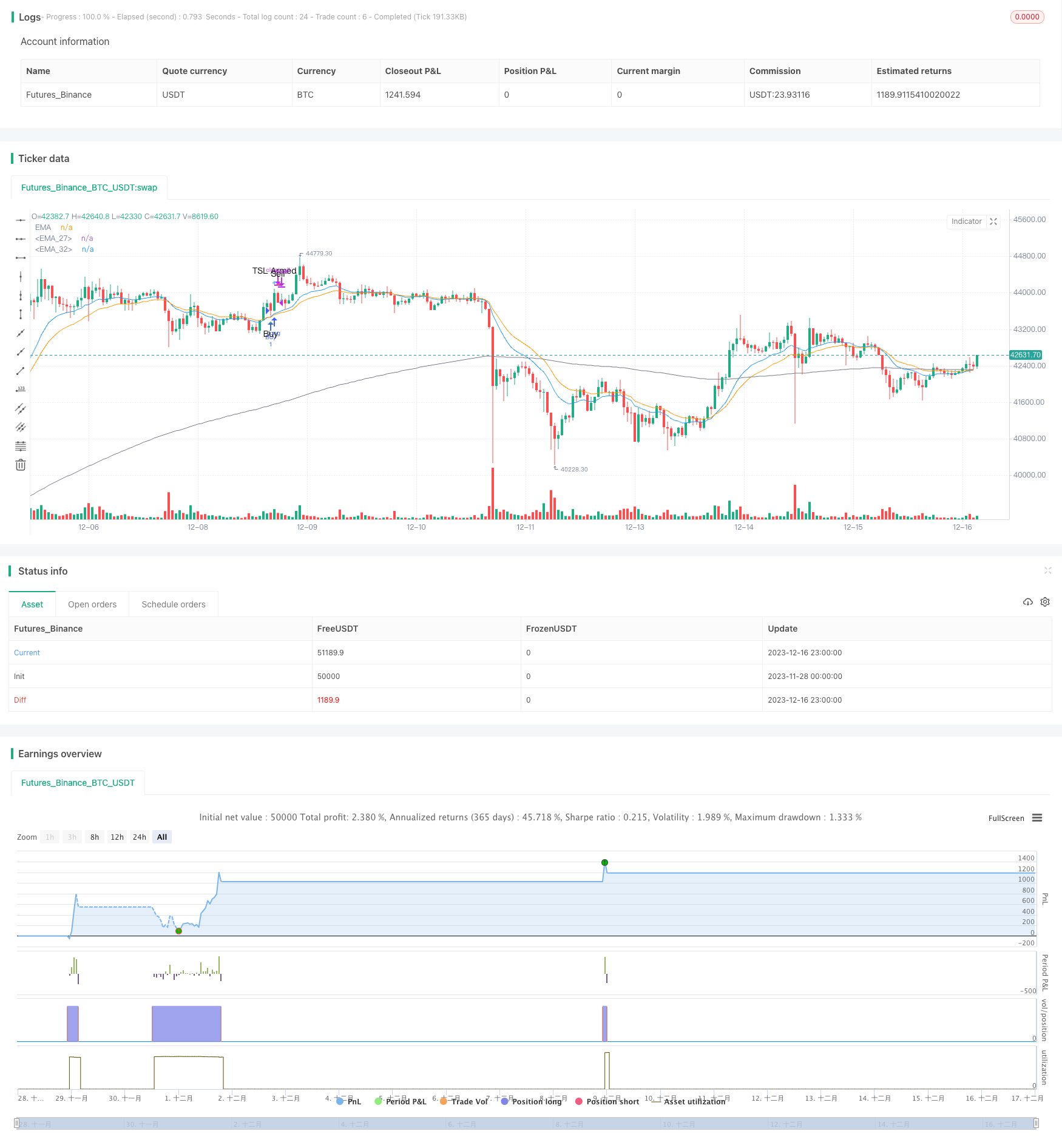

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Thumpyr

//@version=5

/////////////////////////////////////////////////////////////////////////////////////////////

// Comment out Strategy Line and remove // from Indicator line to turn into Indicator //////

// Do same for alertConidction at bottom //////

/////////////////////////////////////////////////////////////////////////////////////////////

strategy("PCT Trailing Stoploss-Strategy", shorttitle="PCT Trailing Stoploss- Strategy", overlay=true)

//indicator(title="PCT Trailing Stoploss- Indicator", shorttitle="PCT Trailing Stoploss - Indicator", timeframe="", timeframe_gaps=true, overlay=true)//

sellLow=input.float(.035, minval=0, title="Stop Loss Loss: 1% = .01", group="Sell Settings")

trailStopArm=input.float(.0065, minval=0, title="Trailing Stop Arm: 1%=.01", group="Sell Settings")

trailStopPct=input.float(.003, minval=0, title="Trailing Stop Trigger: 1%=.01 ", group="Sell Settings")

/////////////////////////////////////////////////

// Indicators //

/////////////////////////////////////////////////

ema1Len = input.int(14, minval=1, title=" ema 1 Length", group="Trend Line Settings")

ema1Src = input(close, title="ema 1 Source", group="Trend Line Settings")

ema1 = ta.ema(ema1Src, ema1Len)

plot(ema1, title="EMA", color=color.blue)

ema2Len = input.int(22, minval=1, title=" ema 2 Length", group="Trend Line Settings")

ema2Src = input(close, title="ema 2 Source", group="Trend Line Settings")

ema2 = ta.ema(ema2Src, ema2Len)

plot(ema2, title="EMA", color=color.orange)

ema3Len = input.int(200, minval=1, title=" ema 3 Length", group="Trend Line Settings")

ema3Src = input(close, title="ema 2 Source", group="Trend Line Settings")

ema3 = ta.ema(ema3Src, ema3Len)

plot(ema3, title="EMA", color=color.gray)

/////////////////////////////

//// Buy Conditions ////

/////////////////////////////

alertBuy = ta.crossover(ema1,ema2) and close>ema3

////////////////////////////////////////////////////////////////////

//// Filter redundant Buy Signals if Sell has not happened ////

////////////////////////////////////////////////////////////////////

var lastsignal = 0

showAlertBuy = 0

if(alertBuy and lastsignal !=1)

showAlertBuy := 1

lastsignal := 1

buyAlert= showAlertBuy > 0

//////////////////////////////////////////////////////////////////

//// Track Conditions at buy Signal ////

//////////////////////////////////////////////////////////////////

alertBuyValue = ta.valuewhen(buyAlert, close,0)

alertSellValueLow = alertBuyValue - (alertBuyValue*sellLow)

////////////////////////////////////////////////////////////

///// Trailing Stop /////

////////////////////////////////////////////////////////////

var TSLActive=0 //Check to see if TSL has been activated

var TSLTriggerValue=0.0 //Initial and climbing value of TSL

var TSLStop = 0.0 //Sell Trigger

var TSLRunning =0 //Continuously check each bar to raise TSL or not

// Check if a Buy has been triggered and set initial value for TSL //

if buyAlert

TSLTriggerValue := alertBuyValue+(alertBuyValue*trailStopArm)

TSLActive := 0

TSLRunning :=1

TSLStop := TSLTriggerValue - (TSLTriggerValue*trailStopPct)

// Check that Buy has triggered and if Close has reached initial TSL//

// Keeps from setting Sell Signal before TSL has been armed w/TSLActive//

beginTrail=TSLRunning==1 and TSLActive==0 and close>alertBuyValue+(alertBuyValue*trailStopArm) and ta.crossover(close,TSLTriggerValue)

if beginTrail

TSLTriggerValue :=close

TSLActive :=1

TSLStop :=TSLTriggerValue - (TSLTriggerValue*trailStopPct)

// Continuously check if TSL needs to increase and set new value //

runTrail= TSLActive==1 and (ta.crossover(close,TSLTriggerValue) or close>=TSLTriggerValue)

if runTrail

TSLTriggerValue :=close

TSLStop :=TSLTriggerValue - (TSLTriggerValue*trailStopPct)

// Verify that TSL is active and trigger when close cross below TSL Stop//

TSL=TSLActive==1 and (ta.crossunder(close,TSLStop) or (close[1]>TSLStop and close<TSLStop))

// Plot point of inital arming of TSL//

TSLTrigger=TSLActive==1 and TSLActive[1]==0

plotshape(TSLTrigger, title='TSL Armed', location=location.abovebar, color=color.new(color.blue, 0), size=size.small, style=shape.cross, text='TSL Armed')

////////////////////////////////////////////////////////////

// Plots used for troubleshooting and verification of TSL //

////////////////////////////////////////////////////////////

//plot(TSLActive,"Trailing Stop", color=#f48fb1)

//plot(TSLRunning,"Trailing Stop", color=#f48fb1)

//plot(TSLTriggerValue,"Trailing Stop Trigger", color.new(color=#ec407a, transp = TSLRunning==1 ? 0 : 100))

//plot(TSLStop,"Trailing Stop", color.new(color=#f48fb1, transp = TSLRunning==1 ? 0 : 100))//

////////////////////////////////////////////////////////////

///// Sell Conditions ///////

////////////////////////////////////////////////////////////

Sell1 = TSL

Sell2 = ta.crossunder(close,alertSellValueLow)

alertSell= Sell1 or Sell2

////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////

//// Remove Redundant Signals ////

////////////////////////////////////////////////////////////

showAlertSell = 0

if(alertSell and lastsignal != -1)

showAlertSell := 1

lastsignal := -1

sellAlert= showAlertSell > 0

if sellAlert

TSLActive :=0

TSLRunning :=0

/////////////////////////////////////////

// Plot Buy and Sell Shapes on Chart //

/////////////////////////////////////////

plotshape(buyAlert, title='Buy', location=location.belowbar, color=color.new(color.green, 0), size=size.small, style=shape.triangleup, text='Buy')

plotshape(sellAlert, title='Sell', location=location.abovebar, color=color.new(color.red, 0), size=size.small, style=shape.triangledown, text='Sell')

/////////////////////////////////////////////////////////////////////////////////////////////

// Remove // to setup for Indicator //

/////////////////////////////////////////////////////////////////////////////////////////////

//Alerts

//alertcondition(title='Buy Alert', condition=buyAlert, message='Buy Conditions are Met')

//alertcondition(title='Sell Alert', condition=sellAlert, message='Sell Conditions are Met')

/////////////////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////

//// Comment out this section if setup as Indicator ////

////////////////////////////////////////////////////////////

longCondition = buyAlert

if (longCondition)

strategy.entry("Buy", strategy.long)

alert(message='Buy', freq=alert.freq_once_per_bar_close)

shortCondition = sellAlert

if (shortCondition)

strategy.close_all(sellAlert,"Sell")

alert(message='Sell', freq=alert.freq_once_per_bar_close)

/////////////////////////////////////////////////////////////

- Dynamic Trailing Stop Optimization Strategy Based on Ichimoku Cloud

- High/Low Cryptocurrency Strategy Based on Multiple Indicators

- VWAP-RSI Oversold Crossunder BTC Short Strategy

- Quant Strategy Based on Linear Regression Intercept

- Mean Reversion Line Strategy

- Fibonacci HMA AI Buy Sell Signal Strategy

- Three Inside Down Reversal Strategy

- Quantitative Trading Dual Moving Average Strategy

- Leveraged RSI Strategy in Pine Script

- Quantitative Trading Reversal Trend Combo T3-CCI Strategy

- Slow RSI OB/OS Strategy

- Multi-indicator Adaptive Trend Trading Strategy

- Relative Volume Price Strategy

- Slow Stochastic Trend Following Strategy

- Comprehensive Quantitative Trading Strategy Based on Multiple Indicators

- Parabolic Stop and Reserve Multi-Indicator Trading Strategy

- Premium Double Trend Filter MA Ratio Strategy

- Dual Moving Average Convergence Trend Tracking Strategy

- Triple EMA Crossover Breakout Strategy

- Bollinger Bands Based Quantitative Trading Strategy