概述

本策略是一个适用于加密货币市场的高低位策略。它综合运用了MACD、PSAR、ATR、 Elliott波等多个指标,在1小时、4小时或1天等较高时间周期进行交易。策略的优势在于风险回报率高,平均盈利因子可达1.5-2.5。

策略原理

该策略的交易信号来自价格的高低位点和多个指标的综合判断。具体逻辑是:

判断K线是否出现价格高低位区间,即高点连续创新高、低点连续创新低。

检查MACD的直方图水平。

检查PSAR指标判断趋势方向。

检查ATR和MA制成的趋势指标判断趋势方向。

检查Elliott波指标确认趋势方向。

如果上述5个条件都指向同一方向,产生做多或做空信号。

策略优势

风险回报率高,可达1:30。

平均盈利因子高,一般在1.5-2.5之间。

多重指标组合,可以有效过滤假突破。

策略风险

获胜率较低,只有10%-20%。

存在一定的回撤和拉锯盘的风险。

指标效果会受市场环境影响。

需要较强的心理承受能力。

对应措施:

加大交易资金规模以平衡获胜率。

严格控制单笔止损。

根据不同市场调整指标参数。

做好心理建设,控制好位置规模。

优化方向

根据不同加密货币和市场环境测试指标参数。

增加止损、止盈策略优化资金管理。

结合机器学习方法提高获胜率。

增加社交情绪指标过滤交易信号。

考虑多时间周期指标确认。

总结

本策略整体来说是一个适合加密货币的高风险高收益交易策略。它的优势在于风险回报率高,可以获得较高的平均盈利因子。风险主要在于获胜率较低,需要有较强的心理承受能力。下一步的优化方向可以从调整参数、优化资金管理、提高获胜率等多个维度进行。总体而言,本策略对于寻求高收益的加密货币交易者具有一定的实用价值。

策略源码

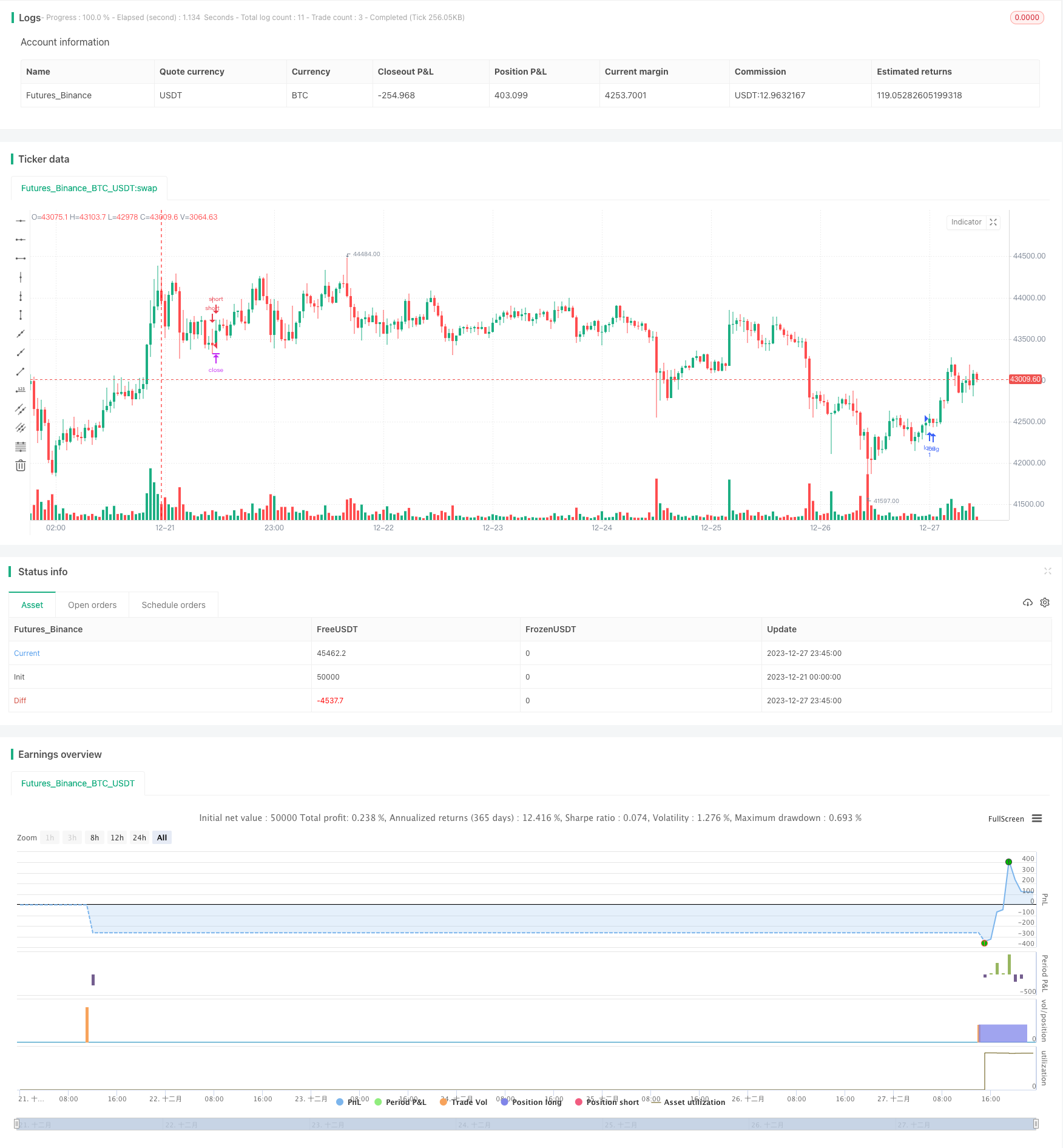

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("Crypto strategy high/low", overlay=true)

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=true)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

//sar

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

CCI = input(20)

ATR = input(5)

Multiplier=input(1,title='ATR Multiplier')

original=input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=0.0

x:=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=0.0

swap:=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?color.lime:color.red

swap3=thisCCI >=0 ?color.lime:color.red

swap4=original?swap3:swap2

//elliot wave

srce = input(close, title="source")

sma1length = input(5)

sma2length = input(35)

UsePercent = input(title="Show Dif as percent of current Candle", type=input.bool, defval=true)

smadif=iff(UsePercent,(sma(srce, sma1length) - sma(srce, sma2length)) / srce * 100, sma(srce, sma1length) - sma(srce, sma2length))

col=smadif <= 0 ? color.red : color.green

longC = high > high[1] and high[1] > high[2] and close[2] > high[3] and hist > 0 and uptrend and smadif < 0 and swap4==color.lime

//longC = high > high[1] and high[1] > high[2] and high[2] > high[3] and high[3] > high[4] and close[4] > high[5]

shortC = low < low[1] and low[1] < low[2] and close[2] < low[3] and hist < 0 and not uptrend and smadif > 0 and swap4==color.red

//shortC = low < low[1] and low[1] < low[2] and low[2] < low[3] and low[3] < low[4] and close[4] < low[5]

tp=input(0.15, title="tp")

sl=input(0.005, title="sl")

strategy.entry("long",1,when=longC)

strategy.entry("short",0,when=shortC)

strategy.exit("x_long", "long" ,loss = close * sl / syminfo.mintick, profit = close * tp / syminfo.mintick , alert_message = "closelong")

//strategy.entry("short",0, when= loss = close * sl / syminfo.mintick)

strategy.exit("x_short", "short" , loss = close * sl / syminfo.mintick, profit = close * tp / syminfo.mintick,alert_message = "closeshort")

//strategy.entry("long",1, when = loss = close * sl / syminfo.mintick)

//strategy.close("long",when= hist < 0)

//strategy.close("short", when= hist > 0)