概述

本策略为基于RSI指标的跨时间框架BTC做空策略。该策略通过计算每笔K线的成交量加权平均价(VWAP)得到一个VWAP曲线,再对该曲线应用RSI指标。当RSI指标出现从超买区向下穿越的死叉信号时,做空BTC。

策略原理

- 计算每根K线的成交量加权平均价(VWAP),得到一条VWAP曲线

- 对VWAP曲线应用RSI指标,参数为20日,超买线为85,超卖线为30

- 当RSI指标从超买区(85)向下穿越超卖区(30)时,开仓做空

- 持仓28根K线后,如果RSI指标再次上穿超卖线(30),平仓

优势分析

- 使用VWAP而不是简单的收盘价,更能反映真实交易价格

- 应用RSI指标识别超买超卖状态,避免追高杀跌

- 跨时间框架操作,避免被套

- 风险可控,28根K线止损

风险及解决方案

- 突发事件导致价格急速上涨,无法止损

- 采用跨时间框架,降低被套风险

- 参数设置不当,容易错过机会

- 对RSI参数和超买超卖线进行测试和优化

- K线无法穿越进入超卖区

- 结合其他指标判断趋势,灵活调整参数

优化方向

- 测试更多参数组合,找到最佳参数

- 结合MACD,KD等其他指标判断是否进入超买超卖区

- 根据不同品种分别测试参数设置

- 优化止损机制,根据波动率设置止损幅度

总结

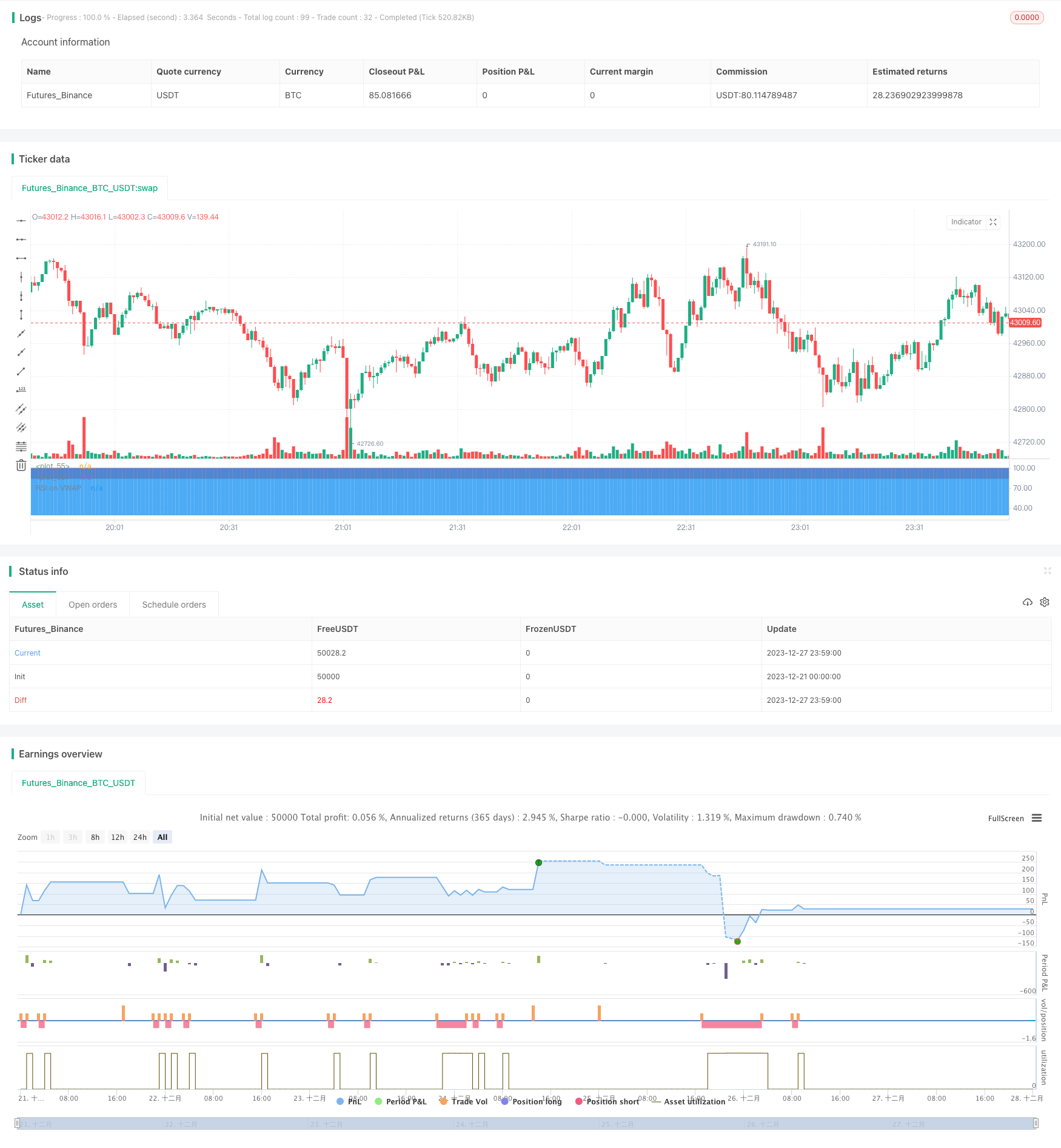

本策略通过VWAP和RSI的结合识别BTC的超买超卖状态,以跨时间框架的方式进行操作,能够有效控制风险。策略思路清晰易懂,值得进一步测试优化,应用于实盘交易。

策略源码

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Soran Strategy 2 - SHORT SIGNALS", pyramiding=1, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=50, overlay=false)

// ----------------- Inputs ----------------- //

reso = input(title="Resolution", type=input.resolution, defval="")

length = input(20, title="RSI Length", type=input.integer)

ovrsld = input(30, "RSI Oversold level", type=input.float)

ovrbgt = input(85, "RSI Overbought level", type=input.float)

lateleave = input(28, "Number of candles", type=input.integer)

// lateleave : numbers of bars in overbought/oversold zones where the position is closed. The position is closed when this number is reached or when the zone is left (the first condition).

// best parameters BTCUSDTPERP M15 : 20 / 30 / 85 / 28

stratbull = input(title="Enter longs ?", type = input.bool, defval=true)

stratbear = input(title="Enter shorts ?", type = input.bool, defval=true)

stratyear = input(2020, title = "Strategy Start Year")

stratmonth = input(1, title = "Strategy Start Month")

stratday = input(1, title = "Strategy Start Day")

stratstart = timestamp(stratyear,stratmonth,stratday,0,0)

// --------------- Laguerre ----------------- //

laguerre = input(title="Use Laguerre on RSI ?", type=input.bool, defval=false)

gamma = input(0.06, title="Laguerre Gamma")

laguerre_cal(s,g) =>

l0 = 0.0

l1 = 0.0

l2 = 0.0

l3 = 0.0

l0 := (1 - g)*s+g*nz(l0[1])

l1 := -g*l0+nz(l0[1])+g*nz(l1[1])

l2 := -g*l1+nz(l1[1])+g*nz(l2[1])

l3 := -g*l2+nz(l2[1])+g*nz(l3[1])

(l0 + 2*l1 + 2*l2 + l3)/6

// ---------------- Rsi VWAP ---------------- //

rsiV = security(syminfo.tickerid, reso, rsi(vwap(close), length))

rsiVWAP = laguerre ? laguerre_cal(rsiV,gamma) : rsiV

// ------------------ Plots ----------------- //

prsi = plot(rsiVWAP, color = rsiVWAP>ovrbgt ? color.red : rsiVWAP<ovrsld ? color.green : color.white, title="RSI on VWAP", linewidth=1, style=plot.style_line)

hline = plot(ovrbgt, color = color.gray, style=plot.style_line)

lline = plot(ovrsld, color = color.gray, style=plot.style_line)

fill(prsi,hline, color = rsiVWAP > ovrbgt ? color.red : na, transp = 30)

fill(prsi,lline, color = rsiVWAP < ovrsld ? color.green : na, transp = 30)

// ---------------- Positions: only shows the Short and close shoret positions --------------- //

timebull = stratbull and time > stratstart

timebear = stratbear and time > stratstart

strategy.entry("Short", false, when = timebear and crossunder(rsiVWAP, ovrbgt), comment="")

strategy.close("Short", when = timebear and crossunder(rsiVWAP, ovrsld)[lateleave] or crossover(rsiVWAP, ovrsld), comment="")