Quantitative Trading Dual Moving Average Strategy

Author: ChaoZhang, Date: 2023-12-29 11:03:14Tags:

Overview

This strategy is designed based on the technical indicators of moving average and trading volume for a long-term trend-following quantitative strategy. When the closing price stands above the 20-day moving average line and the buying volume of the day is greater than the selling volume and the average trading volume over the past n days, the market is considered to be in a bullish state and it is time to buy. When the closing price breaks below the lower rail and the selling volume of the day is greater than the buying volume and the average trading volume over the past n days, the market is considered to be in a bearish state and it is time to sell.

Strategy Principle

The strategy is mainly based on two indicators for judgment:

-

Dual moving average lines: Calculate the 20-day line and 60-day line. When the 20-day line crosses above the 60-day line, the market is considered to be in an uptrend. When the 20-day line crosses below the 60-day line, the market is considered to be in a downtrend.

-

Trading volume: Calculate the daily buying volume and selling volume. If the buying volume is greater than the selling volume and greater than the average trading volume over the past n days, it is determined that the market is bullish. If the selling volume is greater than the buying volume and greater than the average trading volume over the past n days, it is determined that the market is bearish.

The specific trading strategy and logic are as follows:

Go long: When the closing price stands above the 20-day moving average line and the buying volume of the day is greater than the selling volume and the average trading volume over the past n days, the market is considered bullish. Calculate the Bollinger Bands based on volatility, if the closing price is between the midline and lower rail of the Bollinger Bands, go long.

Go short: When the closing price breaks below the lower rail and the selling volume of the day is greater than the buying volume and the average trading volume over the past n days, the market is considered bearish. Calculate the Bollinger Bands based on volatility, if the closing price is below the lower rail of the Bollinger Bands, go short.

Profit taking and stop loss: Set reasonable profit taking and stop loss levels to lock in profits or reduce losses. For example, when the price rises 5% above the entry price, take profit; when the loss reaches 10%, stop loss; or when the price hits a recent new high and then pulls back to some extent, take profit.

Advantage Analysis

The strategy has the following advantages:

-

Combining dual moving average lines and trading volume indicators avoids the blind spots of single technical indicator judgment.

-

Using Bollinger Bands with different parameters determines more precise entry prices.

-

The profit taking and stop loss strategy is reasonable, which helps lock in profits and control risks.

-

Good backtesting results with stable returns, which can be actually applied to quantitative trading.

Risk Analysis

The strategy also has some risks:

-

Dual moving average strategies tend to produce false signals and need to be filtered by volume indicators.

-

Improper Bollinger Bands parameter settings may lead to overly frequent or sparse entries.

-

Improper fixed profit taking and stop loss points may affect strategy returns.

-

A large amount of historical data is required for backtesting, and unexpected losses may still occur in live trading.

Optimization Direction

The strategy can be optimized in the following aspects:

-

Optimize the parameters of the moving average system to find the optimal moving average combination.

-

Optimize the Bollinger Bands parameters for more precise entry.

-

Dynamically adjust profit taking and stop loss points according to market conditions to set reasonable risk-reward ratios.

-

Increase judgment of other technical indicators such as MACD, KD, etc. to improve strategy accuracy.

-

Use machine learning methods to automatically find optimal parameters to make strategies more robust.

Summary

Overall, this is a very practical quantitative trading strategy with good backtesting performance. It is easy to implement, with controllable risks, and is a stable strategy suitable for live trading, which is worth learning for quantitative traders. Of course, there is still a lot of room for strategy optimization, and I look forward to more Quantitative trading experts improving it.

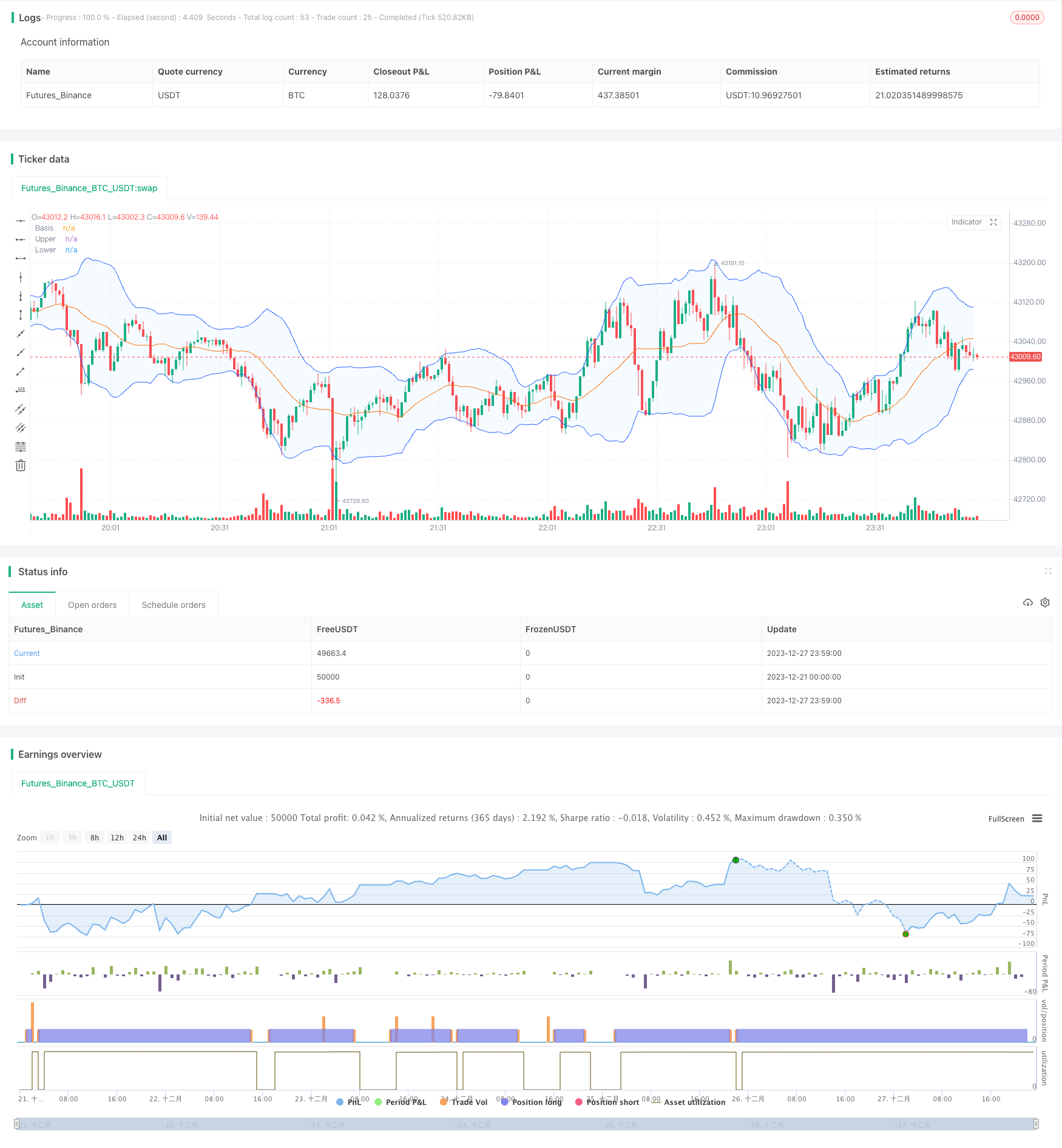

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KAIST291

//@version=4

strategy("prototype",initial_capital=0.01,commission_type=strategy.commission.percent,commission_value=0.1, format=format.volume, precision=0,overlay=true)

// SETTING //

length1=input(1)

length3=input(3)

length7=input(7)

length14=input(14)

length20=input(20)

length60=input(60)

length120=input(120)

ma1= sma(close,length1)

ma3= sma(close,length3)

ma7= sma(close,length7)

ma14=sma(close,length14)

ma20=sma(close,length20)

ma60=sma(close,length60)

ma120=sma(close,length120)

rsi=rsi(close,14)

// BUYING VOLUME AND SELLING VOLUME //

BV = iff( (high==low), 0, volume*(close-low)/(high-low))

SV = iff( (high==low), 0, volume*(high-close)/(high-low))

vol = iff(volume > 0, volume, 1)

dailyLength = input(title = "Daily MA length", type = input.integer, defval = 50, minval = 1, maxval = 100)

weeklyLength = input(title = "Weekly MA length", type = input.integer, defval = 10, minval = 1, maxval = 100)

//-----------------------------------------------------------

Davgvol = sma(volume, dailyLength)

Wavgvol = sma(volume, weeklyLength)

//-----------------------------------------------------------

length = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

mult2= input(1.5, minval=0.001, maxval=50, title="exp")

mult3= input(1.0, minval=0.001, maxval=50, title="exp1")

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

dev2= mult2 * stdev(src, length)

Supper= basis + dev2

Slower= basis - dev2

dev3= mult3 * stdev(src, length)

upper1= basis + dev3

lower1= basis - dev3

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

//----------------------------------------------------

exit=(close-strategy.position_avg_price / strategy.position_avg_price*100)

bull=(close>Supper and BV>SV and BV>Davgvol)

bull2=(close>ma20 and BV>SV and BV>Davgvol)

bux =(close<Supper and close>Slower and volume<Wavgvol)

bear=(close<Slower and close<lower and SV>BV and SV>Wavgvol)

hi=highest(exit,10)

imInATrade = strategy.position_size != 0

highestPriceAfterEntry = valuewhen(imInATrade, high, 0)

// STRATEGY LONG //

if (bull and close>ma3 and ma20>ma60 and rsi<70)

strategy.entry("Long",strategy.long,0.1)

if (strategy.position_avg_price*1.05<close)

strategy.close("Long",0.1)

else if (highestPriceAfterEntry*0.999<close and close>strategy.position_avg_price*1.002)

strategy.close("Long",0.1)

else if (highestPriceAfterEntry*0.997<close and close>strategy.position_avg_price*1.002)

strategy.close("Long",0.1)

else if (highestPriceAfterEntry*0.995<close and close>strategy.position_avg_price*1.002)

strategy.close("Long",0.1)

else if (strategy.openprofit < strategy.position_avg_price*0.9-close)

strategy.close("Long",0.1)

//////////////////////////////////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////////////

- Anchored Rolling CVDVWAP Signal Strategy

- RSI Fibonacci Retracement Strategy

- Bollinger Bands + RSI + EMA Double Trading Strategy

- Dynamic Trailing Stop Optimization Strategy Based on Ichimoku Cloud

- High/Low Cryptocurrency Strategy Based on Multiple Indicators

- VWAP-RSI Oversold Crossunder BTC Short Strategy

- Quant Strategy Based on Linear Regression Intercept

- Mean Reversion Line Strategy

- Fibonacci HMA AI Buy Sell Signal Strategy

- Three Inside Down Reversal Strategy

- Leveraged RSI Strategy in Pine Script

- Quantitative Trading Reversal Trend Combo T3-CCI Strategy

- Dynamic Trailing Stop Loss Strategy

- Slow RSI OB/OS Strategy

- Multi-indicator Adaptive Trend Trading Strategy

- Relative Volume Price Strategy

- Slow Stochastic Trend Following Strategy

- Comprehensive Quantitative Trading Strategy Based on Multiple Indicators

- Parabolic Stop and Reserve Multi-Indicator Trading Strategy

- Premium Double Trend Filter MA Ratio Strategy