Mean Reversion Line Strategy

Author: ChaoZhang, Date: 2023-12-29 11:33:04Tags:

Overview

The mean reversion line strategy is a short-term trading strategy based on moving average reversals. It combines Bollinger Bands, RSI, CCI and other indicators to capture short-term market fluctuations and achieve the goal of buying low and selling high.

The strategy is mainly used for highly liquid products such as stock indexes, forex, and precious metals. It pursues maximization of profit per trade while controlling the overall risk-return ratio of trading.

Strategy Principle

-

Use Bollinger Bands to judge the price deviation zones. Consider going short when the price approaches the upper Bollinger Band and consider going long when the price approaches the lower Bollinger Band.

-

Combine the RSI indicator to determine overbought and oversold conditions. The RSI indicator can effectively identify overbought and oversold situations.

-

Use the CCI indicator to determine price reversal signals. The CCI indicator is relatively sensitive to anomalies and can effectively capture price reversal opportunities.

-

Go long when the price breaks above the 5-day moving average, and go short when it breaks below. The position of the moving average represents the current main price range, and the relationship between price and moving average reflects potential trend changes.

-

After the entry signal is confirmed, close the position quickly to take profits. Set stop loss based on retracement to realize high win rate.

Advantages of the Strategy

- Combination of multiple indicators improves signal accuracy

The mean reversion line strategy combines Bollinger Bands, RSI, CCI and other indicators. These indicators are quite sensitive to price changes, and their combination can improve signal accuracy and reduce false signals.

- Strict entry rules avoid chasing trends

The strategy requires synchronous indicator signals and prices to avoid misleading by a single indicator. It also requires obvious price reversal to reduce related risks.

- Efficient stop loss mechanism controls single trade loss

Whether going long or going short, the strategy will set a relatively strict stop loss line. Once the price breaks through the stop loss line in an unfavorable direction, the strategy will quickly stop loss to avoid large losses per trade.

- Reasonable profit taking pursues maximization of profit per trade

The strategy will set two take profit targets to realize profits in steps. At the same time, after taking profit, it will use small step adjustment tracking stop loss to expand the profit space per trade.

Risk Analysis

- Price volatility triggers stop loss

In the event of extreme price fluctuations, the stop loss line may be broken, causing unnecessary losses. Such situations usually occur during abnormal price movements caused by major events.

This risk can be mitigated by expanding the stop loss range and avoiding operations during major events.

- Unable to reverse after overheating rises

When the uptrend is too fierce, prices often rise too quickly to reverse in time. Persistently going short in this case may face the risk of chasing uptrends.

It is better to wait and see temporarily in this case, and consider going short only after the upward momentum has significantly weakened.

Optimization Directions

- Optimize indicator parameters to improve signal accuracy

Backtest results can be tested under different parameter combinations to select the optimal parameters. For example, RSI parameters, CCI parameters can be optimized.

- Incorporate volume indicators to determine true reversal timing

Volume indicators such as trading volume or Bollinger bandwidth can be added. This can avoid generating false signals when prices are only adjusting slightly.

- Optimize profit taking and stop loss strategies to maximize single profit

Different profit taking and stop loss points can be tested to maximize profit per trade. At the same time, risks should also be balanced to prevent the stop loss from being easily triggered.

Conclusion

The mean reversion line strategy comprehensively utilizes multiple indicator judgments and has the characteristics of accurate signals, sound operations, and controllable risks. It is suitable for products that are highly sensitive to market changes and have relatively strong liquidity. It can capture price reversal opportunities between Bollinger Bands and key moving averages to achieve the goal of buying low and selling high.

In practical applications, attention should still be paid to the optimization of indicator parameters, while combining volume indicators to determine the timing of real reversals. In addition, proper risk management should be taken against extreme price fluctuations. If used properly, this strategy can obtain relatively stable alpha returns.

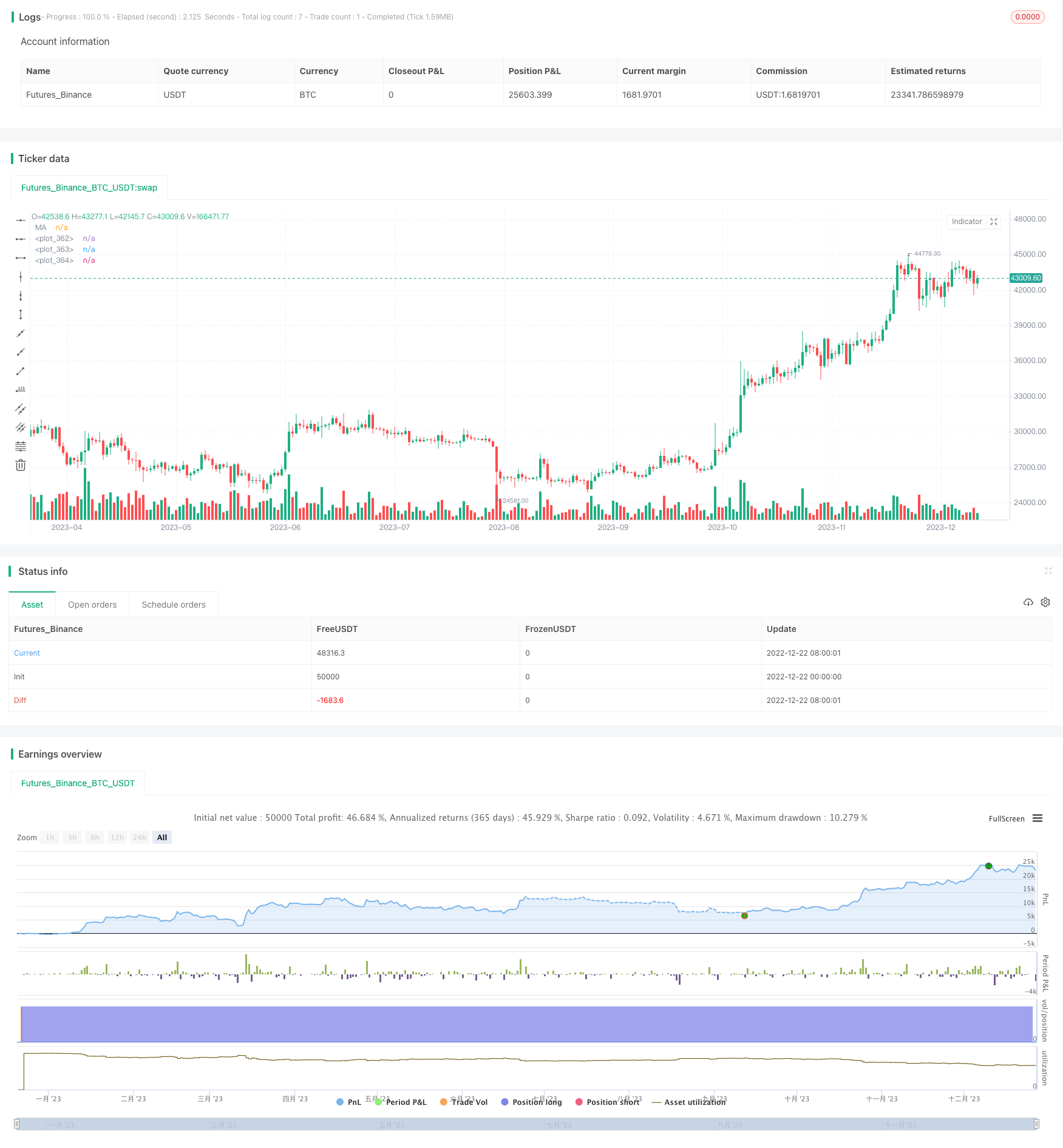

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sg1999

//@version=4

// >>>>>strategy name

strategy(title = "CCI-RSI MR", shorttitle = "CCI-RSI MR", overlay = true)

// >>>>input variables

// 1. risk per trade as % of initial capital

risk_limit = input(title="Risk Limit (%)", type=input.float, minval=0.1, defval=2.0, step=0.1)

// 2. drawdown

Draw_down = input(title="Max Drawdown (x ATR)", type=input.float, minval=0.5, maxval=10, defval=2.0, step=0.1)

// 3. type of stop loss to be used

original_sl_type = input(title="SL Based on", defval="Close Price", options=["Close Price","Last Traded Price"])

// 4. entry signal validity for bollinger strategies

dist_from_signal= input(title="Entry distance from signal", type=input.integer, minval=1, maxval=20, defval=3, step=1)

// 5. multiple exit points

exit_1_pft_pct = input(title="1st exit when reward is", type=input.float, minval=0.5, maxval=100, defval=1.0, step=0.1)

exit_1_qty_pct = input(title="1st exit quantity %", type=input.float, minval=1, maxval=100, defval=100, step=5)

exit_2_pft_pct = input(title="2nd exit when reward is", type=input.float, minval=0.5, maxval=100, defval=1.5, step=0.1)

sl_trail_pct = input(title="Trailing SL compared to original SL", type=input.float, minval=0.5, maxval=100, defval=0.5, step=0.5)

//show signal bool

plotBB = input(title="Show BB", type=input.bool, defval=true)

plotSignals = input(title="Show Signals", type=input.bool, defval=true)

// 6. date range to be used for backtesting

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 1990, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2022, title = "Thru Year", type = input.integer, minval = 1970)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// >>>>>strategy variables

//input variables

current_high = highest(high, 5) // swing high (5 period)

current_low = lowest(low, 5) // swing low (5 period)

current_ma = sma(close, 5) // Simple Moving average (5 period)

atr_length = atr(20) // ATR (20 period)

CCI = cci(close,20) // CCI (20 period)

RSI = rsi(close,14) // RSI (14 period)

RSI_5 = sma (RSI, 5) // Simple moving average of RSI (5 period)

// 1. for current candle

long_entry = false

short_entry = false

risk_reward_ok = false

sl_hit_flag = false

tsl_hit_flag = false

sl_cross = false

// 2. across candles

var RSI_short = false //short signal boolean

var RSI_long = false //long signal boolean

var cci_sell = false //sellsignal crossunder boolean

var cci_buy = false //buy signal crossover boolean

var bar_count_long = 0 // Number of bars after a long signal

var bar_count_short = 0 // Number of bars after a short signal

var candles_on_trade = 0

var entry_price = 0.00

var sl_price = 0.00

var qty = 0

var exit_1_qty = 0

var exit_2_qty = 0

var exit_1_price = 0.0

var exit_2_price = 0.0

var hold_high = 0.0 // variable used to calculate Trailing sl

var hold_low = 0.0 // variable used to calculate Trailing sl

var tsl_size = 0.0 // Trailing Stop loss size(xR)

var sl_size = 0.0 // Stop loss size (R)

var tsl_price = 0.0 //Trailing stoploss price

// >>>>>strategy conditions.

// Bollinger bands (2 std)

[mBB0,uBB0,lBB0] = bb(close,20,2)

uBB0_low= lowest(uBB0,3) // lowest among upper BB of past 3 periods

lBB0_high= highest(lBB0,3) //highest among upper BB of past 3 periods

//RSI and CCI may not necessarily crossunder on the same candle

t_sell_RSI = sum( crossunder(RSI,RSI_5)? 1 : 0, 2) == 1 // checks if crossunder has happened in the last 3 candles (including the current candle)

t_sell_CCI = sum( crossunder(CCI,100)? 1 : 0, 2) == 1 //and (CCI >50)

t_buy_RSI = sum( crossover(RSI,RSI_5)? 1 : 0, 2) == 1 //checks if crossover has happened in the last 3 candles (including the current candle)

t_buy_CCI = sum( crossover(CCI,-100) ? 1 : 0, 2) == 1 //and (CCI<-50)

// CONDITIONS FOR A SELL signal

if t_sell_RSI and t_sell_CCI and (current_high >= uBB0_low)

cci_sell := true

bar_count_short := 0

if cci_sell and strategy.position_size ==0

bar_count_short := bar_count_short + 1

if cci_sell and bar_count_short<= dist_from_signal and close <= current_ma and strategy.position_size ==0

RSI_short := true

//conditions for a BUY signal

if t_buy_RSI and t_buy_CCI and (current_low <= lBB0_high) // or current_low_close <= lBB01_high)

cci_buy := true

bar_count_long := 0

if cci_buy and strategy.position_size ==0

bar_count_long := bar_count_long + 1

if cci_buy and bar_count_long<= dist_from_signal and close >= current_ma and strategy.position_size ==0

RSI_long := true

if RSI_long and RSI_short

RSI_long := false

RSI_short := false

// >>>>>entry and target specifications

if strategy.position_size == 0 and RSI_short

short_entry := true

entry_price := close

sl_price := current_high + syminfo.mintick // (swing high + one tick) is the stop loss

sl_size := abs(entry_price - sl_price)

candles_on_trade := 0

tsl_size := abs(entry_price - sl_price)*sl_trail_pct // Here sl_trail_pct is the multiple of R which is used to calculate TSL size

if strategy.position_size == 0 and RSI_long

long_entry := true

entry_price := close

sl_price := current_low - syminfo.mintick //(swing low - one tick) is the stop loss

candles_on_trade := 0

sl_size := abs(entry_price - sl_price)

tsl_size := abs(entry_price - sl_price)*sl_trail_pct // Here sl_trail_pct is the multiple of R which is used to calculate TSL size

if long_entry and short_entry

long_entry := false

short_entry := false

// >>>>risk evaluation criteria

//>>>>> quantity determination and exit point specifications.

if (long_entry or short_entry) and strategy.position_size == 0 // Based on our risk (R), no.of lots is calculated by considering a risk per trade limit formula

qty := round((strategy.equity) * (risk_limit/100)/(abs(entry_price - sl_price)*syminfo.pointvalue))

exit_1_qty := round(qty * (exit_1_qty_pct/100))

exit_2_qty := qty - (exit_1_qty)

if long_entry

exit_1_price := entry_price + (sl_size * exit_1_pft_pct)

exit_2_price := entry_price + (sl_size * exit_2_pft_pct)

if short_entry

exit_1_price := entry_price - (sl_size * exit_1_pft_pct)

exit_2_price := entry_price - (sl_size * exit_2_pft_pct)

// trail SL after 1st target is hit

if abs(strategy.position_size) == 0

hold_high := 0

hold_low := 0

if strategy.position_size > 0 and high > exit_1_price

if high > hold_high or hold_high == 0

hold_high := high

tsl_price := hold_high - tsl_size

if strategy.position_size < 0 and low < exit_1_price

if low < hold_low or hold_low == 0

hold_low := low

tsl_price := hold_low + tsl_size

//>>>> entry conditons

if long_entry and strategy.position_size == 0

strategy.cancel("BUY", window()) // add another window condition which considers day time (working hours)

strategy.order("BUY", strategy.long, qty, comment="BUY @ "+ tostring(entry_price),when=window())

if short_entry and strategy.position_size == 0

strategy.cancel("SELL", window()) // add another window condition which considers day time (working hours)

strategy.order("SELL", strategy.short, qty, comment="SELL @ "+ tostring(entry_price),when=window())

//>>>> exit conditons

tsl_hit_flag := false

//exit at tsl

if strategy.position_size > 0 and close < tsl_price and abs(strategy.position_size)!=qty

strategy.order("EXIT at TSL", strategy.short, abs(strategy.position_size), comment="EXIT TSL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

tsl_hit_flag := true

cci_sell := false

cci_buy := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL",true)

if strategy.position_size < 0 and close > tsl_price and abs(strategy.position_size)!=qty

strategy.order("EXIT at TSL", strategy.long, abs(strategy.position_size), comment="EXIT TSL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

tsl_hit_flag := true

cci_sell := false

cci_buy := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL",true)

//>>>>exit at sl

if strategy.position_size > 0 and original_sl_type == "Close Price" and close < sl_price and abs(strategy.position_size)==qty

strategy.cancel("EXIT at SL", true)

strategy.order("EXIT at SL", strategy.short, abs(strategy.position_size),stop= sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

sl_hit_flag := true

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

if strategy.position_size < 0 and original_sl_type == "Close Price" and close > sl_price and abs(strategy.position_size)==qty

strategy.cancel("EXIT at SL", true)

strategy.order("EXIT at SL", strategy.long, abs(strategy.position_size), stop = sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

sl_hit_flag := true

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

//>>>>>for ltp sl setting

if strategy.position_size > 0 and original_sl_type == "Last Traded Price" and abs(strategy.position_size) ==qty

strategy.order("EXIT at SL", strategy.short, abs(strategy.position_size),stop= sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

if strategy.position_size < 0 and original_sl_type == "Last Traded Price" and abs(strategy.position_size) ==qty

strategy.order("EXIT at SL", strategy.long, abs(strategy.position_size), stop = sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

//>>>>>exit at target

if strategy.position_size > 0 and abs(strategy.position_size) == qty and not tsl_hit_flag

strategy.order("EXIT 1", strategy.short, exit_1_qty, limit=exit_1_price, comment="EXIT TG1 @ "+ tostring(exit_1_price))

strategy.cancel("Exit Drawd",true)

cci_sell := false

cci_buy := false

if strategy.position_size > 0 and abs(strategy.position_size) < qty and abs(strategy.position_size) != qty and not tsl_hit_flag

strategy.order("EXIT 2", strategy.short, exit_2_qty, limit=exit_2_price, comment="EXIT TG2 @ "+ tostring(exit_2_price))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL", true)

if strategy.position_size < 0 and abs(strategy.position_size) == qty and not tsl_hit_flag

strategy.order("EXIT 1", strategy.long, exit_1_qty, limit=exit_1_price, comment="EXIT TG1 @ "+ tostring(exit_1_price))

strategy.cancel("Exit Drawd",true)

cci_buy := false

cci_sell := false

if strategy.position_size < 0 and abs(strategy.position_size) < qty and abs(strategy.position_size) != qty

strategy.order("EXIT 2", strategy.long, exit_2_qty, limit=exit_2_price, comment="EXIT TG2 @ "+ tostring(exit_2_price))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL", true)

//>>>>>>drawdown execution

if strategy.position_size < 0 and original_sl_type == "Close Price" and not tsl_hit_flag

strategy.cancel("Exit Drawd",true)

strategy.order("Exit Drawd", strategy.long, abs(strategy.position_size), stop= (entry_price + Draw_down*atr_length) ,comment="Drawdown exit S")

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

if strategy.position_size > 0 and original_sl_type == "Close Price" and not tsl_hit_flag and not sl_hit_flag

strategy.cancel("Exit Drawd",true)

strategy.order("Exit Drawd", strategy.short, abs(strategy.position_size), stop= (entry_price - Draw_down*atr_length) ,comment="Drawdown exit B")

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

//>>>>to add sl hit sign

if strategy.position_size != 0 and sl_hit_flag //For symbols on chart

sl_cross := true

//>>>>>cancel all pending orders if the trade is booked

strategy.cancel_all(strategy.position_size == 0 and not (long_entry or short_entry))

//>>>>plot indicators

p_mBB = plot(plotBB ? mBB0 : na, color=color.teal)

p_uBB = plot(plotBB ? uBB0 : na, color=color.teal, style=plot.style_stepline)

p_lBB = plot(plotBB ? lBB0 : na, color=color.teal, style=plot.style_stepline)

plot(sma(close,5), color=color.blue, title="MA")

//>>>>plot signals

plotshape(plotSignals and RSI_short, style=shape.triangledown, location=location.abovebar, color=color.red)

plotshape(plotSignals and RSI_long, style=shape.triangleup, location=location.belowbar, color=color.green)

plotshape(sl_cross, text= "Stoploss Hit",size= size.normal,style=shape.xcross , location=location.belowbar, color=color.red)

//>>>>plot signal high low

if strategy.position_size != 0

candles_on_trade := candles_on_trade + 1

if strategy.position_size != 0 and candles_on_trade == 1

line.new(x1=bar_index[1], y1=high[1], x2=bar_index[0], y2=high[1], color=color.black, width=2)

line.new(x1=bar_index[1], y1=low[1], x2=bar_index[0], y2=low[1], color=color.black, width=2)

//>>>>end of program

- 10EMA Double Cross Trend Tracking Strategy

- Dynamic Pivot Point Backtest Strategy

- Dual EMA Crossover Trend Strategy

- Anchored Rolling CVDVWAP Signal Strategy

- RSI Fibonacci Retracement Strategy

- Bollinger Bands + RSI + EMA Double Trading Strategy

- Dynamic Trailing Stop Optimization Strategy Based on Ichimoku Cloud

- High/Low Cryptocurrency Strategy Based on Multiple Indicators

- VWAP-RSI Oversold Crossunder BTC Short Strategy

- Quant Strategy Based on Linear Regression Intercept

- Fibonacci HMA AI Buy Sell Signal Strategy

- Three Inside Down Reversal Strategy

- Quantitative Trading Dual Moving Average Strategy

- Leveraged RSI Strategy in Pine Script

- Quantitative Trading Reversal Trend Combo T3-CCI Strategy

- Dynamic Trailing Stop Loss Strategy

- Slow RSI OB/OS Strategy

- Multi-indicator Adaptive Trend Trading Strategy

- Relative Volume Price Strategy

- Slow Stochastic Trend Following Strategy