Bollinger Bands + RSI + EMA Double Trading Strategy

Author: ChaoZhang, Date: 2023-12-29 14:46:57Tags:

Overview

This strategy integrates Bollinger Bands, Relative Strength Index (RSI) and Exponential Moving Average (EMA) three indicators to implement an automatic trading strategy with long holding periods for stocks. It generates buy signals when RSI is below oversold line and price is close to or touches the Bollinger Bands lower rail, and generates sell signals when price rises to touch the Bollinger Bands upper rail, utilizing Bollinger Bands to determine market trends and overbought/oversold status for double confirmation.

Strategy Principle

This strategy mainly judges based on Bollinger Bands, RSI and EMA three indicators. The middle rail in Bollinger Bands is the simple moving average of price, and the upper and lower rails are two standard deviation ranges of price. Bollinger Bands can judge the overbought/oversold status of the market. When price is close to the lower rail, it indicates oversold status, and when price is close to the upper rail, it indicates overbought status. RSI is one of the important indicators to judge whether a stock is overbought or oversold. RSI below 30 indicates oversold status and RSI above 70 indicates overbought status. EMA is the exponential weighted moving average of price and can determine price trend.

The buy signal for this strategy is generated when RSI is below the 30 oversold line, and at the same time price has approached or touched the Bollinger Bands lower rail in oversold status. This avoids false signals.

The sell signal is generated when price touches the Bollinger Bands upper rail during an uptrend. This utilizes Bollinger Bands to determine overbought status and sells for profit taking.

Advantages of the Strategy

- Integrates Bollinger Bands and RSI to double confirm overbought/oversold status, avoiding false signals.

- Utilizes EMA to determine price trend direction, avoiding trading against the trend.

- Parameters for both RSI and Bollinger Bands can be customized for different stocks.

- Simple and clear strategy logic, easy to understand and implement.

Risks of the Strategy

- Both Bollinger Bands and RSI may generate false signals, causing wrong entries.

- Stop loss position needs further optimization, with higher retracement risks.

- EMA may fail to perfectly determine trend with missed trend reversal points.

- Inappropriate parameter settings may lead to over-trading or missing trading opportunities.

Solutions:

- Shorten Bollinger Bands period, optimize RSI parameters.

- Dynamic trailing stop loss.

- Integrate other indicators for trend determination.

- Test different parameter settings to find optimum combination.

Directions for Strategy Optimization

The strategy can be further optimized in the following aspects:

- Add more indicators for judgement, e.g. KD for overbought/oversold status.

- Add stop loss mechanisms like moving stop loss, zone stop loss to manage risks.

- Add exit rules based on EMA trend determination in selling conditions.

- Optimize parameter settings to expand profit range, e.g. adjust Bollinger Bands width.

- Add entry rules to avoid false breakouts, e.g. volume filters.

Conclusion

The strategy integrates Bollinger Bands, RSI and EMA for a long holding automatic trading strategy with double confirmation filters. The double confirmation for overbought/oversold status avoids false signals effectively, and using EMA for trend determination prevents trading against the trend. Meanwhile, flexible parameter settings make it adaptable to different stocks. Further improvement in aspects of stop loss and exit mechanisms can enhance the strategy’s efficiency and risk management. The strategy provides a valuable reference framework for beginners and has practical significance.

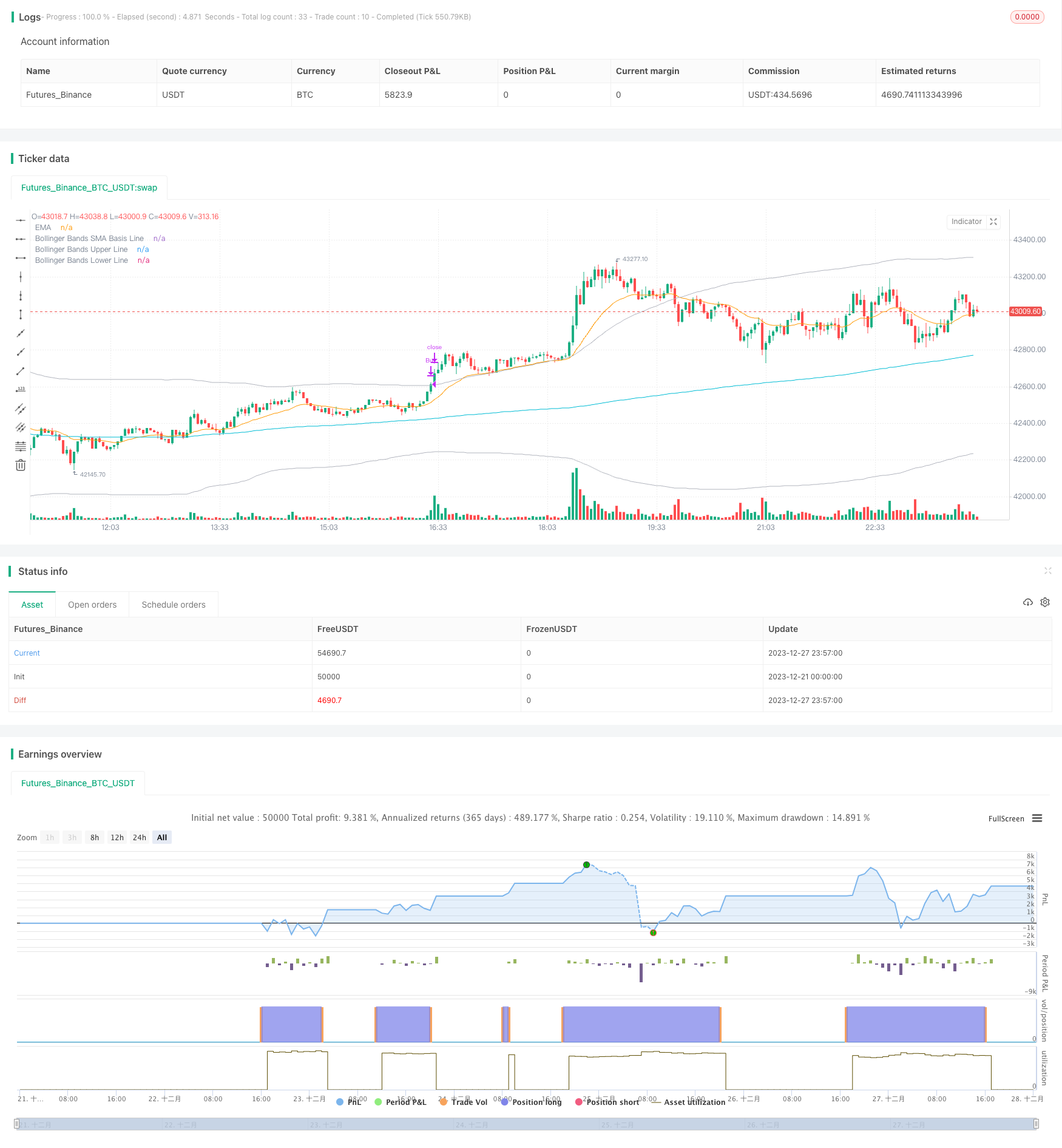

/*backtest

start: 2023-12-21 00:00:00

end: 2023-12-28 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger + RSI + EMA, Double Strategy Long-Only (by ChartArt) v1.3", shorttitle="rsi 30 min ADJ Buy", overlay=true)

///////////// RSI

RSIlength = input(2, title="RSI Period Length") // Adjusted RSI period length

RSIoverSold = input(30, title="RSI Oversold Level") // Adjustable RSI oversold level

RSIoverBought = input(80, title="RSI Overbought Level") // Adjustable RSI overbought level

price = close

vrsi = rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(231, minval=1, title="Bollinger Period Length") // Adjusted Bollinger period length

BBmult = 2

BBbasis = sma(price, BBlength)

BBdev = BBmult * stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

///////////// EMA

useEMA = input(true, title="Use EMA?")

emaLength = input(20, title="EMA Period Length")

ema = useEMA ? ema(close, emaLength) : na

source = close

buyEntry = crossover(source, BBlower) or (close < BBlower and close > BBbasis) or (low < BBlower and close > BBbasis) // Add condition for low touching Bollinger Band

sellEntry = crossunder(source, BBupper)

///////////// Plotting

plot(BBbasis, color=color.aqua, title="Bollinger Bands SMA Basis Line")

plot(BBupper, color=color.silver, title="Bollinger Bands Upper Line")

plot(BBlower, color=color.silver, title="Bollinger Bands Lower Line")

plot(ema, color=color.orange, title="EMA") // Plot EMA

///////////// RSI + Bollinger Bands Strategy

long = crossover(vrsi, RSIoverSold) and buyEntry

close_long = close >= BBupper

if (not na(vrsi))

if long

strategy.entry("Buy", strategy.long, qty=10, stop=BBlower, comment="Buy")

else

strategy.cancel(id="Buy")

if close_long

strategy.close("Buy")

- RSI Indicator Improvement Trading Strategy

- Trend Reversal Momentum Indicators Crossover Tracking Strategy

- Multi Timeframe Breakout Strategy

- Momentum and Money Flow Crossroad Cashing Strategy

- Dynamic Take Profit Following Trend Strategy

- 10EMA Double Cross Trend Tracking Strategy

- Dynamic Pivot Point Backtest Strategy

- Dual EMA Crossover Trend Strategy

- Anchored Rolling CVDVWAP Signal Strategy

- RSI Fibonacci Retracement Strategy

- Dynamic Trailing Stop Optimization Strategy Based on Ichimoku Cloud

- High/Low Cryptocurrency Strategy Based on Multiple Indicators

- VWAP-RSI Oversold Crossunder BTC Short Strategy

- Quant Strategy Based on Linear Regression Intercept

- Mean Reversion Line Strategy

- Fibonacci HMA AI Buy Sell Signal Strategy

- Three Inside Down Reversal Strategy

- Quantitative Trading Dual Moving Average Strategy

- Leveraged RSI Strategy in Pine Script

- Quantitative Trading Reversal Trend Combo T3-CCI Strategy