Overview

The trend tracking reversal strategy is a trend trading strategy based on moving averages and price extremes. The strategy uses two moving averages to track price trends and opens reverse positions when the trends reverse. At the same time, it also calculates a price channel based on the highest and lowest prices of recent K-lines to stop loss when prices approach the channel boundaries, further controlling risks.

Strategy Logic

The strategy uses 3-period high and low point moving averages hma and lma to track price trends. When prices cross above hma, it is interpreted as bullish; when prices fall below lma, it is interpreted as bearish.

The strategy also calculates the upper and lower rails (uplevel and dnlevel) of the price channel based on the highest and lowest prices within the recent bars K-lines. uplevel is the highest price in recent bars K-lines plus a retracement coefficient corr upwards; dnlevel is the lowest price in recent bars K-lines minus a retracement coefficient corr downwards. This constitutes the price channel range.

When opening long positions, the stop loss price is set at the upper rail of the channel; when opening short positions, the stop loss price is set at the lower rail of the channel. This effectively controls the risk of losses from price reversals.

When a reverse signal appears, the strategy will immediately reverse open positions to track the new price trend. This is the principle behind tracking reversals.

Advantages

- The strategy takes full advantage of moving averages to track trends and capture price moves quickly.

- It applies price channels and reverse opening positions to control risks and lock in profits effectively.

- The strategy logic is simple and clear, easy to understand and implement.

- Customizable parameters such as trend judgment length, retracement coefficients, etc. adapt to different products.

- Support same-direction pyramiding, fully capture trend opportunities.

Risks

- Prone to false signals during price consolidations.

- Trend reversals may not always trigger stop loss, maximum loss cannot be controlled.

- Improper parameter settings may cause too sensitive or slow reactions.

- Proper products and time frames need to be selected for best results.

Improvements:

1. Filter out invalid signals with other indicators;

2. Add moving stop loss to lock profits and limit maximum drawdown;

3. Test and optimize parameters for different products and cycles.

Optimization Directions

There is room for further optimization:

Other indicators can be introduced to filtrate some invalid signals, such as MACD, KD, etc.

Adaptive stop loss logic can be added, such as moving stop loss, balance stop loss, etc. to further control risks.

Test the impact of different parameters on strategy performance and optimize parameter combinations, such as MA cycle lengths, retracement coefficient sizes, etc.

The strategy currently trades in timed sessions. It can also be adjusted to all-day trading. This may require additional filtering rules.

Conclusion

In summary, this is a trend reversal trading strategy combining price channels and moving averages. By tracking trends and timely reverse opening positions, it can effectively follow price movements. At the same time, the risk control measures of price channels and reverse opening also enable it to effectively control single losses. The strategy idea is simple and clear, and is worth further testing and optimization in live trading.

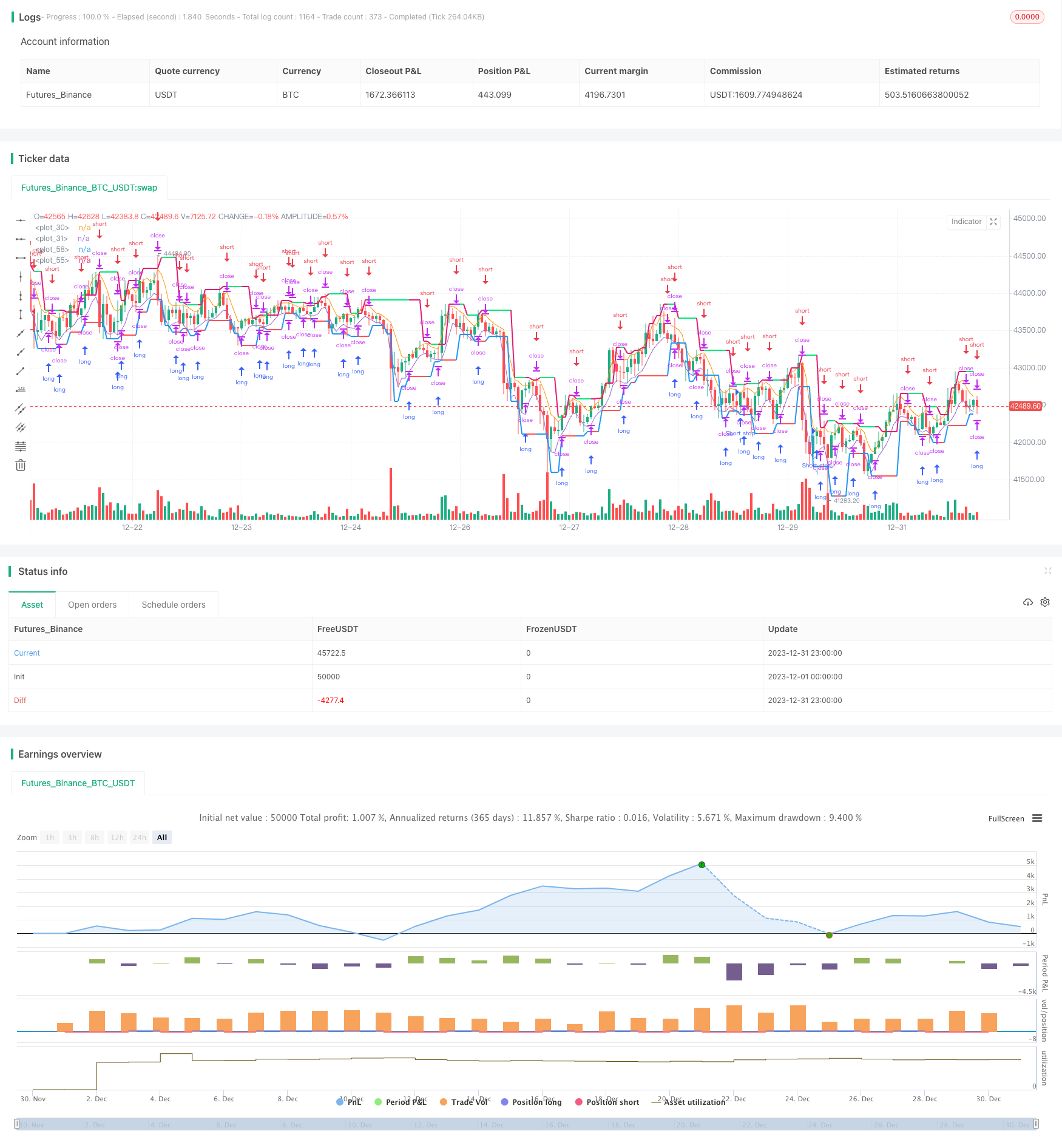

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2019

//@version=3

strategy(title = "Noro's 3Bars Strategy by Larry Williams", shorttitle = "3Bars", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

corr = input(0.0, title = "Correction, %")

bars = input(1, minval = 1)

revers = input(false, defval = false, title = "revers")

showll = input(true, defval = true, title = "Show Levels")

showos = input(true, defval = true, title = "Show Levels one side")

showcl = input(false, defval = false, title = "Show Levels continuous line")

showbg = input(false, defval = false, title = "Show Background")

showar = input(false, defval = false, title = "Show Arrows")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

len = input(3)

hma = sma(high, len)

lma = sma(low, len)

plot(hma)

plot(lma)

//Levels

hbar = 0

hbar := high > high[1] ? 1 : high < high[1] ? -1 : 0

lbar = 0

lbar := low > low[1] ? 1 : low < low[1] ? -1 : 0

uplevel = 0.0

dnlevel = 0.0

hh = highest(high, bars + 1)

ll = lowest(low, bars + 1)

uplevel := hbar == -1 and sma(hbar, bars)[1] == 1 ? hh + ((hh / 100) * corr) : uplevel[1]

dnlevel := lbar == 1 and sma(lbar, bars)[1] == -1 ? ll - ((ll / 100) * corr) : dnlevel[1]

//Background

size = strategy.position_size

trend = 0

trend := size > 0 ? 1 : size < 0 ? -1 : high >= uplevel ? 1 : low <= dnlevel ? -1 : trend[1]

col = showbg == false ? na : trend == 1 ? lime : trend == -1 ? red : na

bgcolor(col)

//Lines

upcol = na

upcol := showll == false ? na : uplevel != uplevel[1] and showcl == false ? na : showos and trend[1] == 1 ? na : lime

plot(uplevel, color = upcol, linewidth = 2)

dncol = na

dncol := showll == false ? na : dnlevel != dnlevel[1] and showcl == false ? na : showos and trend[1] == -1 ? na : red

plot(dnlevel, color = dncol, linewidth = 2)

//Arrows

longsignal = false

shortsignal = false

longsignal := size > size[1]

shortsignal := size < size[1]

plotarrow(longsignal and showar and needlong ? 1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(shortsignal and showar and needshort ? -1 : na, colorup = blue, colordown = blue, transp = 0)

//Trading

lot = 0.0

lot := size != size[1] ? strategy.equity / close * capital / 100 : lot[1]

if uplevel > 0 and dnlevel > 0 and revers == false

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot, stop = uplevel)

strategy.entry("Long stop", strategy.short, 0, stop = lma)

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot, stop = dnlevel)

strategy.entry("Short stop", strategy.long, 0, stop = hma)

// if time > timestamp(toyear, tomonth, today, 23, 59)

// strategy.close_all()