Dynamic Momentum Weighted Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-01-12 12:04:55Tags:

Overview

This strategy generates buy and sell signals when two Moving Average of Exponential Moving Averages (MAEMA) with different periods cross over. The short period line is used to determine market trend and short term reversal signals, while the long period line is used to determine the major trend direction.

Principles

- Calculate the fast MAEMA (80 periods) and slow MAEMA (144 periods).

- The fast line reflects short term trend and reversal points. The slow line reflects major trend direction.

- When the fast line crosses above the slow line, a buy signal is generated. When the fast line crosses below the slow line, a sell signal is generated.

- The strategy also plots 3 predicted points, representing possible values for next period, to determine future crossover trend.

- The strategy makes full use of the momentum and predictive functionality of the MAEMA itself.

Advantages

- MAEMA itself incorporates momentum factor to capture trend changes faster.

- Dual moving average strategy judges trends over different timeframes.

- Combining fast and slow line crossovers and the predictive points of MAEMA itself makes trading signals more reliable.

- Complete auto-charting provides intuitive reflection of market fluctuations.

Risks

- When abnormal volatility occurs, sensitivity of MAEMA may be too high, generating false signals. Stop loss points can be loosened appropriately.

- Moving average systems tend to give false signals during range-bound markets. Additional filters can be added.

- The periods for fast and slow lines should be determined by finding optimal parameters for each product.

Enhancement

- Optimize periods of fast and slow MAEMA to find best parameter combinations.

- Add filter conditions to avoid opening positions during zigzag markets. For example introducing DMI, MACD to determine trendiness.

- Keep adjusting ATR multiples, trailing stops based on backtest results to reduce false positives and control risks.

Summary

The strategy judges changes in market trend using MAEMA dual moving average crossovers. The basic principles are simple and clear. Combined with the momentum and predictive capabilities of MAEMA itself, it is effective in identifying reversal signals. Attention should be paid to parameter optimization and enhancing filters to improve robustness.

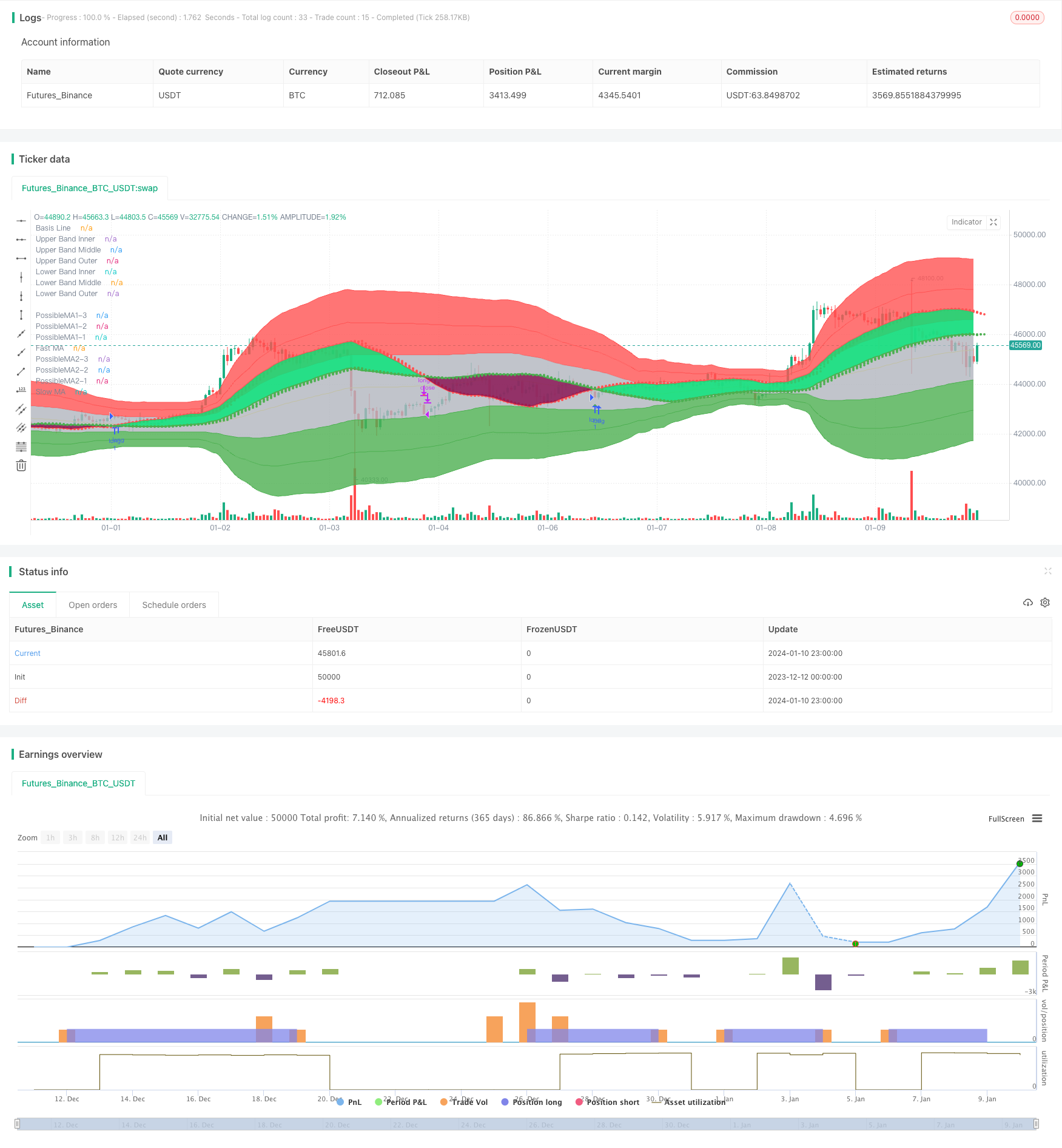

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © informanerd

//@version=4

strategy("MultiType Shifting Predictive MAs Crossover", shorttitle = "MTSPMAC + MBHB Strategy", overlay = true)

//inputs

predict = input(true, "Show MA Prediction Tails")

trendFill = input(true, "Fill Between MAs Based on Trend")

signal = input(true, "Show Cross Direction Signals")

showMA1 = input(true, "[ Show Fast Moving Average ]══════════")

type1 = input("MAEMA (Momentum Adjusted Exponential)", "Fast MA Type", options = ["MAEMA (Momentum Adjusted Exponential)", "DEMA (Double Exponential)", "EMA (Exponential)", "HMA (Hull)", "LSMA (Least Squares)", "RMA (Adjusted Exponential)", "SMA (Simple)", "SWMA (Symmetrically Weighted)", "TEMA (Triple Exponential)", "TMA (Triangular)", "VMA / VIDYA (Variable Index Dynamic Average)", "VWMA (Volume Weighted)", "WMA (Weighted)"])

src1 = input(high, "Fast MA Source")

len1 = input(80, "Fast MA Length", minval = 2)

shift1 = input(0, "Fast MA Shift")

maThickness1 = input(2, "Fast MA Thickness", minval = 1)

trendColor1 = input(false, "Color Fast MA Based on Detected Trend")

showBand1 = input(false, "Show Fast MA Range Band")

atrPer1 = input(20, "Fast Band ATR Lookback Period")

atrMult1 = input(3, "Fast Band ATR Multiplier")

showMA2 = input(true, "[ Show Slow Moving Average ]══════════")

type2 = input("MAEMA (Momentum Adjusted Exponential)", "Slow MA Type", options = ["MAEMA (Momentum Adjusted Exponential)", "DEMA (Double Exponential)", "EMA (Exponential)", "HMA (Hull)", "LSMA (Least Squares)", "RMA (Adjusted Exponential)", "SMA (Simple)", "SWMA (Symmetrically Weighted)", "TEMA (Triple Exponential)", "TMA (Triangular)", "VMA / VIDYA (Variable Index Dynamic Average)", "VWMA (Volume Weighted)", "WMA (Weighted)"])

src2 = input(close, "Slow MA Source")

len2 = input(144, "Slow MA Length", minval = 2)

shift2 = input(0, "Slow MA Shift")

maThickness2 = input(2, "Slow MA Thickness", minval = 1)

trendColor2 = input(false, "Color Slow MA Based on Detected Trend")

showBand2 = input(false, "Show Slow MA Range Band")

atrPer2 = input(20, "Slow Band ATR Lookback Period")

atrMult2 = input(3, "Slow Band ATR Multiplier")

//ma calculations

ma(type, src, len) =>

if type == "MAEMA (Momentum Adjusted Exponential)"

goldenRatio = (1 + sqrt(5)) / 2

momentumLen = round(len / goldenRatio), momentum = change(src, momentumLen), probabilityLen = len / goldenRatio / goldenRatio

ema(src + (momentum + change(momentum, momentumLen) * 0.5) * sum(change(src) > 0 ? 1 : 0, round(probabilityLen)) / probabilityLen, len)

else if type == "DEMA (Double Exponential)"

2 * ema(src, len) - ema(ema(src, len), len)

else if type == "EMA (Exponential)"

ema(src, len)

else if type == "HMA (Hull)"

wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

else if type == "LSMA (Least Squares)"

3 * wma(src, len) - 2 * sma(src, len)

else if type == "RMA (Adjusted Exponential)"

rma(src, len)

else if type == "SMA (Simple)"

sma(src, len)

else if type == "SWMA (Symmetrically Weighted)"

swma(src)

else if type == "TEMA (Triple Exponential)"

3 * ema(src, len) - 3 * ema(ema(src, len), len) + ema(ema(ema(src, len), len), len)

else if type == "TMA (Triangular)"

swma(wma(src, len))

else if type == "VMA / VIDYA (Variable Index Dynamic Average)"

smoothing = 2 / len, volIndex = abs(cmo(src, len) / 100)

vma = 0., vma := (smoothing * volIndex * src) + (1 - smoothing * volIndex) * nz(vma[1])

else if type == "VWMA (Volume Weighted)"

vwma(src, len)

else if type == "WMA (Weighted)"

wma(src, len)

ma1 = ma(type1, src1, len1)

ma2 = ma(type2, src2, len2)

//ma predictions

pma11 = len1 > 2 ? (ma(type1, src1, len1 - 1) * (len1 - 1) + src1 * 1) / len1 : na

pma12 = len1 > 3 ? (ma(type1, src1, len1 - 2) * (len1 - 2) + src1 * 2) / len1 : na

pma13 = len1 > 4 ? (ma(type1, src1, len1 - 3) * (len1 - 3) + src1 * 3) / len1 : na

pma21 = len2 > 2 ? (ma(type2, src2, len2 - 1) * (len2 - 1) + src2 * 1) / len2 : na

pma22 = len2 > 3 ? (ma(type2, src2, len2 - 2) * (len2 - 2) + src2 * 2) / len2 : na

pma23 = len2 > 4 ? (ma(type2, src2, len2 - 3) * (len2 - 3) + src2 * 3) / len2 : na

//ma range bands

r1 = atr(atrPer1) * atrMult1

hBand1 = ma1 + r1

lBand1 = ma1 - r1

r2 = atr(atrPer2) * atrMult2

hBand2 = ma2 + r2

lBand2 = ma2 - r2

//drawings

ma1Plot = plot(showMA1 ? ma1 : na, "Fast MA", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, maThickness1, offset = shift1)

ma2Plot = plot(showMA2 ? ma2 : na, "Slow MA", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, maThickness2, offset = shift2)

fill(ma1Plot, ma2Plot, trendFill and ma1 > ma2 ? color.lime : trendFill and ma1 < ma2 ? color.maroon : na, 90)

plot(showMA1 and predict ? pma11 : na, "PossibleMA1-1", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 1, show_last = 1)

plot(showMA1 and predict ? pma12 : na, "PossibleMA1-2", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 2, show_last = 1)

plot(showMA1 and predict ? pma13 : na, "PossibleMA1-3", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, style = plot.style_circles, offset = shift1 + 3, show_last = 1)

plot(showMA2 and predict ? pma21 : na, "PossibleMA2-1", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 1, show_last = 1)

plot(showMA2 and predict ? pma22 : na, "PossibleMA2-2", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 2, show_last = 1)

plot(showMA2 and predict ? pma23 : na, "PossibleMA2-3", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, style = plot.style_circles, offset = shift2 + 3, show_last = 1)

plot(showBand1 ? hBand1 : na, "Fast Higher Band", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, offset = shift1)

plot(showBand1 ? lBand1 : na, "Fast Lower Band", trendColor1 and ma1 > src1 ? color.maroon : trendColor1 and ma1 < src1 ? color.lime : trendColor1 ? color.gray : color.red, offset = shift1)

plot(showBand2 ? hBand2 : na, "Slow Higher Band", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, offset = shift2)

plot(showBand2 ? lBand2 : na, "Slow Lower Band", trendColor2 and ma2 > src2 ? color.maroon : trendColor2 and ma2 < src2 ? color.lime : trendColor2 ? color.gray : color.green, offset = shift2)

//crosses & alerts

up = crossover(ma1, ma2)

down = crossover(ma2, ma1)

plotshape(signal ? up : na, "Buy", shape.triangleup, location.belowbar, color.green, offset = shift1, size = size.small)

plotshape(signal ? down : na, "Sell", shape.triangledown, location.abovebar, color.red, offset = shift1, size = size.small)

alertcondition(up, "Buy", "Buy")

alertcondition(down, "Sell", "Sell")

// @version=1

// Title: "Multi Bollinger Heat Bands - EMA/Breakout options".

// Author: JayRogers

//

// * Description *

// Short: It's your Basic Bollinger Bands, but 3 of them, and some pointy things.

//

// Long: Three stacked sma based Bollinger Bands designed just to give you a quick visual on the "heat" of movement.

// Set inner band as you would expect, then set your preferred additional multiplier increments for the outer 2 bands.

// Option to use EMA as alternative basis, rather than SMA.

// Breakout indication shapes, which have their own multiplier seperate from the BB's; but still tied to same length/period.

// strategy(shorttitle="[JR]MBHB_EBO", title="[JR] Multi Bollinger Heat Bands - EMA/Breakout options", overlay=true)

// Bollinger Bands Inputs

bb_use_ema = input(false, title="Use EMA Basis?")

bb_length = input(80, minval=1, title="Bollinger Length")

bb_source = input(close, title="Bollinger Source")

bb_mult = input(1.0, title="Base Multiplier", minval=0.001, maxval=50)

bb_mult_inc = input(1, title="Multiplier Increment", minval=0.001, maxval=2)

// Breakout Indicator Inputs

break_mult = input(3, title="Breakout Multiplier", minval=0.001, maxval=50)

breakhigh_source = input(high, title="High Break Source")

breaklow_source = input(low, title="Low Break Source")

bb_basis = bb_use_ema ? ema(bb_source, bb_length) : sma(bb_source, bb_length)

// Deviation

// * I'm sure there's a way I could write some of this cleaner, but meh.

dev = stdev(bb_source, bb_length)

bb_dev_inner = bb_mult * dev

bb_dev_mid = (bb_mult + bb_mult_inc) * dev

bb_dev_outer = (bb_mult + (bb_mult_inc * 2)) * dev

break_dev = break_mult * dev

// Upper bands

inner_high = bb_basis + bb_dev_inner

mid_high = bb_basis + bb_dev_mid

outer_high = bb_basis + bb_dev_outer

// Lower Bands

inner_low = bb_basis - bb_dev_inner

mid_low = bb_basis - bb_dev_mid

outer_low = bb_basis - bb_dev_outer

// Breakout Deviation

break_high = bb_basis + break_dev

break_low = bb_basis - break_dev

// plot basis

plot(bb_basis, title="Basis Line", color=color.yellow, transp=50)

// plot and fill upper bands

ubi = plot(inner_high, title="Upper Band Inner", color=color.red, transp=90)

ubm = plot(mid_high, title="Upper Band Middle", color=color.red, transp=85)

ubo = plot(outer_high, title="Upper Band Outer", color=color.red, transp=80)

fill(ubi, ubm, title="Upper Bands Inner Fill", color=color.red, transp=90)

fill(ubm, ubo, title="Upper Bands Outer Fill",color=color.red, transp=80)

// plot and fill lower bands

lbi = plot(inner_low, title="Lower Band Inner", color=color.green, transp=90)

lbm = plot(mid_low, title="Lower Band Middle", color=color.green, transp=85)

lbo = plot(outer_low, title="Lower Band Outer", color=color.green, transp=80)

fill(lbi, lbm, title="Lower Bands Inner Fill", color=color.green, transp=90)

fill(lbm, lbo, title="Lower Bands Outer Fill", color=color.green, transp=80)

// center channel fill

fill(ubi, lbi, title="Center Channel Fill", color=color.silver, transp=100)

// plot breakouts

plotshape(breakhigh_source >= break_high, title="High Breakout", style=shape.triangledown, location=location.abovebar, size=size.tiny, color=color.white, transp=0)

plotshape(breaklow_source <= break_low, title="Low Breakout", style=shape.triangleup, location=location.belowbar, size=size.tiny, color=color.white, transp=0)

High_Break = breakhigh_source >= break_high

Low_Break = breaklow_source <= break_low

// Conditions

Stop_Momentum = low < ma1

//Strategy Tester

strategy.entry("long", strategy.long, when=(up and (hlc3 < inner_high)))

strategy.close("long", when=down)

strategy.entry("longwickdown", strategy.long, when=Low_Break)

strategy.close("longwickdown", when=(high > ma1))

//true signals test

//var winCount = 0, var loseCount = 0, testBarIndex = 1

//if (up[testBarIndex] and close > close[testBarIndex]) or (down[testBarIndex] and close < close[testBarIndex])

// label.new(bar_index, 0, "W", yloc = yloc.abovebar, color = color.green)

// winCount := winCount + 1

//else if (up[testBarIndex] and close < close[testBarIndex]) or (down[testBarIndex] and close > close[testBarIndex])

// label.new(bar_index, 0, "L", yloc = yloc.abovebar, color = color.red)

// loseCount := loseCount + 1

//winRate = label.new(time + (time - time[1]) * 2, ohlc4, tostring(round(winCount / (winCount + loseCount) * 100)) + "%", xloc = xloc.bar_time, color = color.orange, style = label.style_label_left)

//if not na(winRate[1])

// label.delete(winRate[1])

More

- Dual EMA Golden Cross Profit-Taking Strategy

- Dynamic Santa Claus Regression Strategy

- Stochastic Overlap with RSI Index Quant Trading Strategy

- RSI V-shaped Pattern Swing Trading Strategy

- Momentum Breakthrough ATR Volatility Strategy

- Polynomial Interpolation Based RSI Momentum Strategy

- Momentum Reversal Combo Strategy

- BTC Hash Ribbons Strategy

- Multi-level Moving Average Crossing Strategy for Quant Masters

- Volume Ratio Reversal Trading Strategy

- Bull Power Trading Strategy

- Daily Moving Average Tracking Strategy for Gold Value

- Multi-Timeframe Moving Average Combined with Trading Hours Quantitative Trading Strategy

- Multi-Timeframe Trading Strategy Based on MACD

- Bear Power Tracking Strategy

- Trend Following Trading Strategy Based on Multiple Indicators

- Swing Trading Strategy with 20/50 EMA Cross

- Dynamic Trend Tracking Optimized Strategy

- Dual Moving Average Strategy Combined with Stochastic Indicator

- Trend Tracking Strategy Based on Moving Average and Average True Range