CRYPTO TREND REVERSAL STRATEGY BASED ON PIVOT SWING HIGH AND LOW POINTS

Author: ChaoZhang, Date: 2024-01-12 14:13:36Tags:

Overview

This strategy identifies trend reversals in crypto assets based on PIVOT swing high/low points and breakout signals. It belongs to the breakout reversal strategy category. The strategy first calculates the recent highest and lowest price points as PIVOT levels, then detects if price breaks out these key levels, signaling major trend changes.

How The Strategy Works

-

Calculate PIVOT High/Low Points

Uses ta.pivothigh() and ta.pivotlow() to find highest high and lowest low prices over a custom bar lookback period to plot PIVOT points.

-

Identify Breakout Signals

If price breaks above PIVOT low point, or breaks below PIVOT high point, the strategy considers it as trend reversal signal.

-

Set Filter Conditions

Requires price to breakout PIVOT levels by meaningful distance, and closing price crosses 150 bar closing prices to avoid whipsaws.

-

Entries and Exits

Trigger buy signal on long condition, close long position on exit condition. Similarly for short setup rules.

Advantages

- PIVOT points are sensitive to major trend shifts

- Avoids whipsaws in consolidation trends with filters

- Captures reversals early with swing high/low breakouts

Risks

- Larger cycles can cause strategy to get whipsawed

- PIVOT points and filters need tuning for each asset

- Exchange fees impact results, need near-zero fee structure

Enhancement Opportunities

- Test different PIVOT lookback periods

- Add moving stop loss to control loss per trade

- Combine with other indicators for filter

Conclusion

The strategy is robust overall to capture large reversals, but needs customized parameters per asset and risk controls. With further optimization and guardrails, it can perform well across crypto markets.

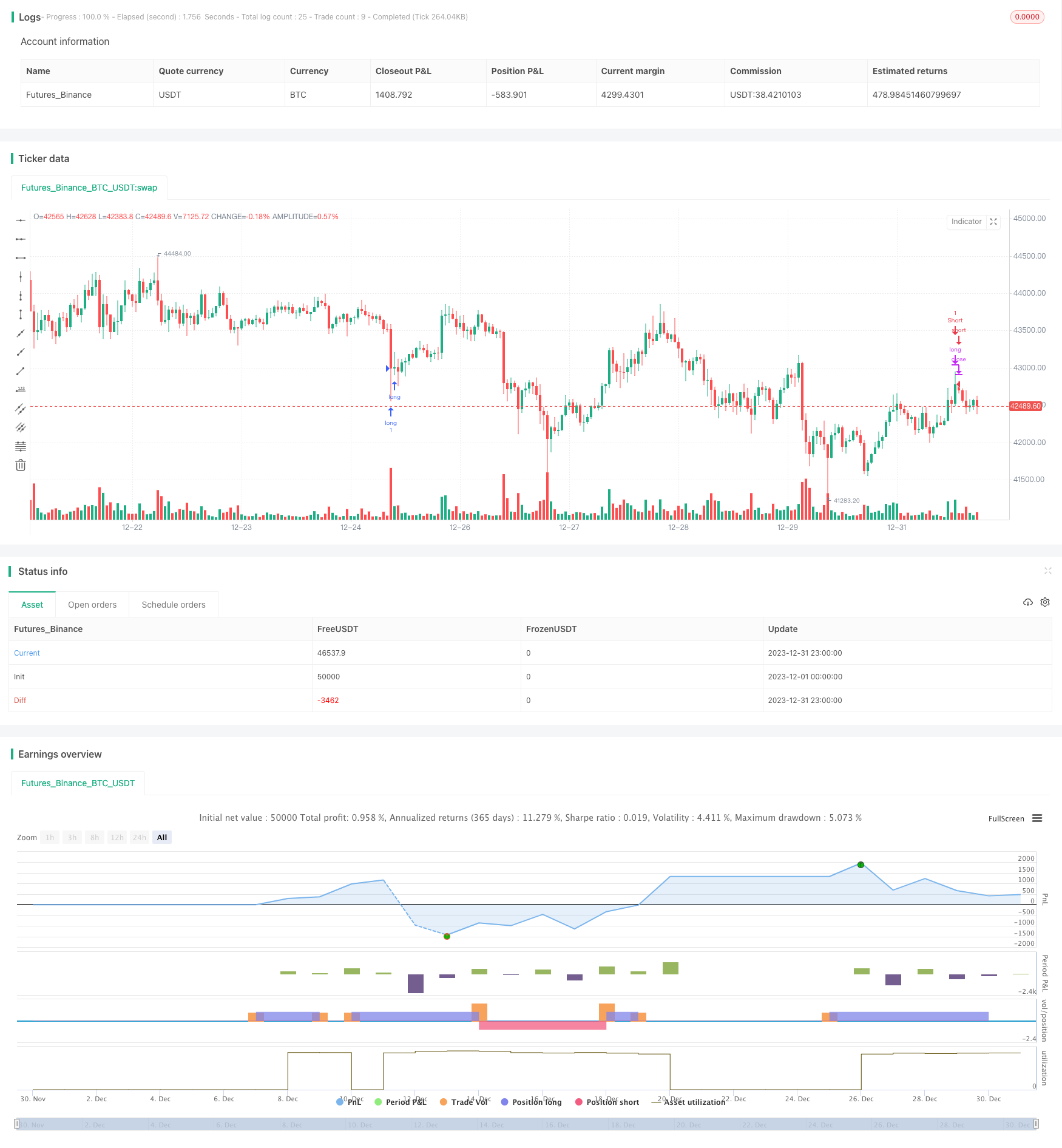

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nkrastins95

//@version=5

strategy("Swing Hi Lo", overlay=true, margin_long=100, margin_short=100)

//-----------------------------------------------------------------------------------------------------------------------//

tf = input.timeframe(title="Timeframe", defval="")

gr="LENGTH LEFT / RIGHT"

leftLenH = input.int(title="Pivot High", defval=10, minval=1, inline="Pivot High",group=gr)

rightLenH = input.int(title="/", defval=10, minval=1, inline="Pivot High",group=gr)

colorH = input(title="", defval=color.red, inline="Pivot High",group=gr)

leftLenL = input.int(title="Pivot Low", defval=10, minval=1, inline="Pivot Low", group=gr)

rightLenL = input.int(title="/", defval=10, minval=1, inline="Pivot Low",group=gr)

colorL = input(title="", defval=color.blue, inline="Pivot Low",group=gr)

//-----------------------------------------------------------------------------------------------------------------------//

pivotHigh(ll, rl) =>

maxLen = 1000

float ph = ta.pivothigh(ll, rl)

int offset = 0

while offset < maxLen

if not na(ph[offset])

break

offset := offset + 1

ph[offset]

pivotLow(ll, rl) =>

maxLen = 1000

float pl = ta.pivotlow(ll, rl)

int offset = 0

while offset < maxLen

if not na(pl[offset])

break

offset := offset + 1

pl[offset]

//-----------------------------------------------------------------------------------------------------------------------//

ph = request.security(syminfo.tickerid, tf, pivotHigh(leftLenH, rightLenH), barmerge.gaps_off, barmerge.lookahead_on)

pl = request.security(syminfo.tickerid, tf, pivotLow(leftLenL, rightLenL), barmerge.gaps_off, barmerge.lookahead_on)

drawLabel(_offset, _pivot, _style, _color) =>

if not na(_pivot)

label.new(bar_index[_offset], _pivot, str.tostring(_pivot, format.mintick), style=_style, color=_color, textcolor=#131722)

//-----------------------------------------------------------------------------------------------------------------------//

VWAP = ta.vwap(ohlc4)

longcondition = ta.crossunder(close,pl) and close > close[150]

exitcondition = close > ph

shortcondition = ta.crossover(close,ph) and close < close[150]

covercondition = close < pl

strategy.entry("long", strategy.long, when = longcondition)

strategy.close("long", when = exitcondition)

strategy.entry("Short", strategy.short, when = shortcondition)

strategy.close("Short", when = covercondition)

- Multi-timeframe Super Trend Tracking Strategy

- Dual Moving Average Crossover Strategy

- Trend Following Strategy with Stop Loss

- ATR-based Trailing Stop Strategy for ES

- Dual MACD Reversal Trading Strategy

- Quantitative Trading Strategy - Quantity Trend Tracking Opening

- Trend Following Strategy Based on Moving Average Difference

- Quantitative Dual Factor Reversal Inertia Trading Strategy

- Trend Tracking EMA Breakout Strategy

- Quant Trading Strategy Based on Ichimoku Cloud

- Ultimate Balance Oscillator Trading Strategy

- Exponential Moving Average Crossover Strategy

- Dual EMA Golden Cross Profit-Taking Strategy

- Dynamic Santa Claus Regression Strategy

- Stochastic Overlap with RSI Index Quant Trading Strategy

- RSI V-shaped Pattern Swing Trading Strategy

- Momentum Breakthrough ATR Volatility Strategy

- Polynomial Interpolation Based RSI Momentum Strategy

- Momentum Reversal Combo Strategy

- BTC Hash Ribbons Strategy