Baseline Cross Qualifier ATR Volatility & HMA Trend Bias Mean Reversion Strategy

Author: ChaoZhang, Date: 2024-01-17 16:37:23Tags:

Overview

This strategy integrates the baseline mean reversion signal, ATR volatility filter, and HMA trend filter to generate robust trading signals for quantitative trading strategies. It uses two moving averages with different periods to construct trading signals, combines the ATR volatility indicator to filter out some invalid signals, and utilizes HMA to determine the major trend direction to avoid adverse selection.

Strategy Logic

The strategy uses a 37-period moving average as the baseline. When the price breaks out upward from this baseline, it generates a buy signal, and when it breaks down from above, it generates a sell signal. To avoid false signals, the strategy requires the price to move beyond 2xATR volatility after penetrating the baseline to confirm the validity of signals. Also, the strategy uses an 11-period HMA to judge the major trend. It only confirms valid signals when price penetrating baseline is aligned with HMA direction to prevent adverse selection.

For profit taking, the strategy supports using one or multiple (two or three) take profit levels. For stop loss, it simply takes the upper and lower band lines as SL for long and short positions.

Advantage Analysis

Compared with simple moving average breakout strategies, this strategy adds the ATR volatility filter that removes a lot of invalid signals. This aligns very well with visual pattern breakout techniques, thus leading to higher win rates. Also, the HMA trend bias prevents adverse selection and significantly reduces unnecessary losses. The multiple take-profit scheme also allows more profits to be locked in.

Risks & Solutions

The major risk is the ATR volatility filter may remove some valid signals, causing failure to open positions timely. Also, the HMA trend judgment is not very significant sometimes when price is just having a short-term retracement, not reversal. This may lead to unnecessary stop loss. To reduce the risks, we can lower the ATR volatility filter parameter to allow more signals. We can also adjust the HMA period parameter to use longer-term HMA for judging major trends, preventing interference from short-term fluctuations.

Optimization Directions

The strategy can be optimized in the following aspects:

-

Test more parameter combinations to find the optimum set of values, e.g., baseline period, ATR period, volatility coefficient etc.

-

Add more filters or oscillators to judge market conditions to enhance model robustness.

-

Optimize parameters for profit taking mechanisms, test more price levels and allocation schemes.

-

Incorporate machine learning models to generate more effective trading signals.

Conclusion

This strategy integrates dual moving average baseline signal, ATR volatility filter and HMA trend bias filter into a very practical quantitative trading system. Although it still has space to enhance performance through parameter tuning, it already serves well for disciplined rule-based trading.

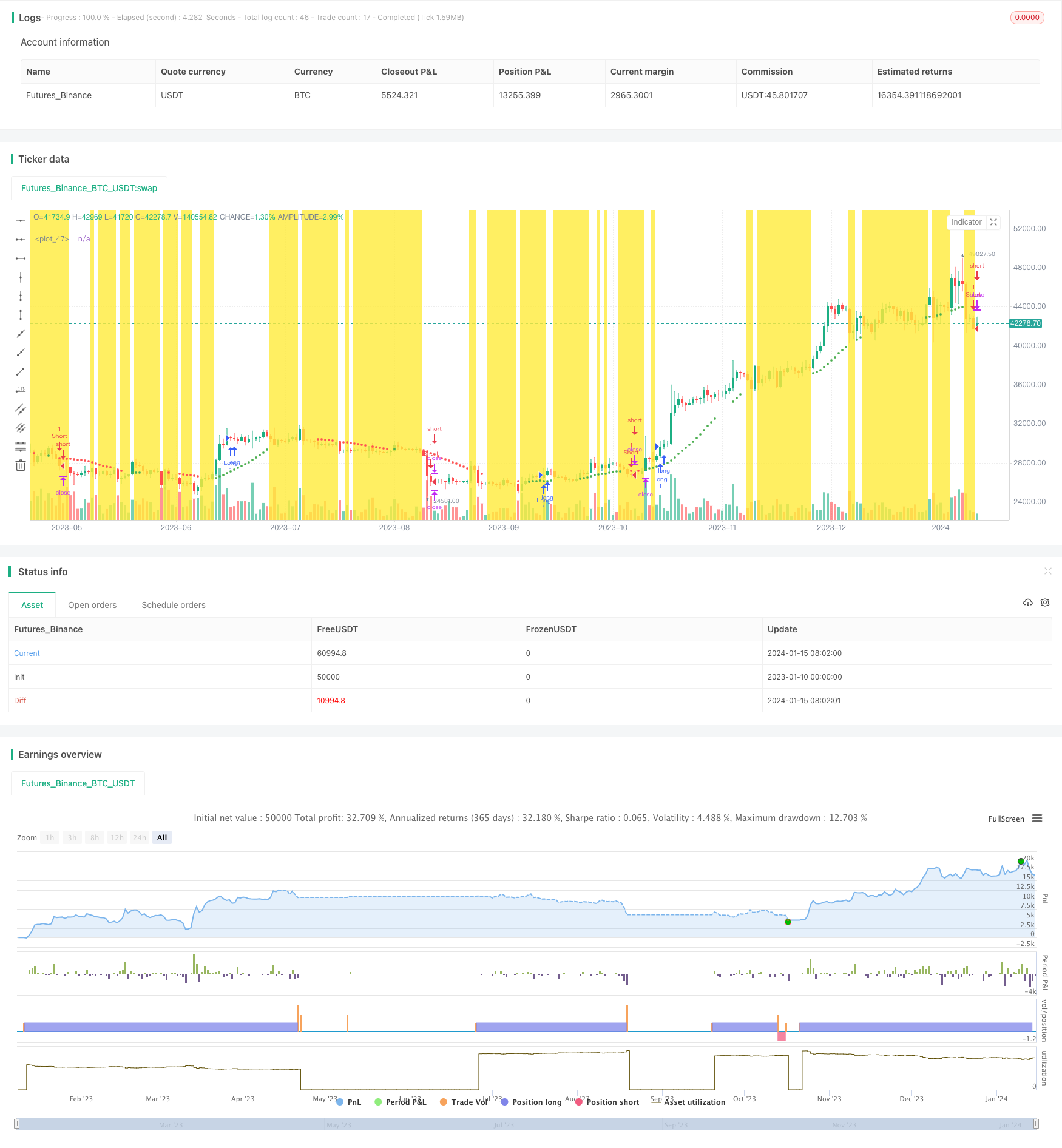

/*backtest

start: 2023-01-10 00:00:00

end: 2024-01-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sevencampbell

//@version=5

strategy(title="Baseline Cross Qualifier Volatility Strategy with HMA Trend Bias", overlay=true)

// --- User Inputs ---

// Baseline Inputs

baselineLength = input.int(title="Baseline Length", defval=20)

baseline = ta.sma(close, baselineLength)

// PBCQ Inputs

pbcqEnabled = input.bool(title="Post Baseline Cross Qualifier Enabled", defval=true)

pbcqBarsAgo = input.int(title="Post Baseline Cross Qualifier Bars Ago", defval=3)

// Volatility Inputs

atrLength = input.int(title="ATR Length", defval=14)

multiplier = input.float(title="Volatility Multiplier", defval=2.0)

rangeMultiplier = input.float(title="Volatility Range Multiplier", defval=1.0)

qualifierMultiplier = input.float(title="Volatility Qualifier Multiplier", defval=0.5)

// Take Profit Inputs

takeProfitType = input.string(title="Take Profit Type", options=["1 Take Profit", "2 Take Profits", "3 Take Profits"], defval="1 Take Profit")

// HMA Inputs

hmaLength = input.int(title="HMA Length", defval=50)

// --- Calculations ---

// ATR

atr = ta.atr(atrLength)

// Range Calculation

rangeHigh = baseline + rangeMultiplier * atr

rangeLow = baseline - rangeMultiplier * atr

rangeColor = rangeLow <= close and close <= rangeHigh ? color.yellow : na

bgcolor(rangeColor, transp=90)

// Qualifier Calculation

qualifier = qualifierMultiplier * atr

// Dot Calculation

isLong = close > baseline and (close - baseline) >= qualifier and close > ta.hma(close, hmaLength)

isShort = close < baseline and (baseline - close) >= qualifier and close < ta.hma(close, hmaLength)

colorDot = isLong ? color.green : isShort ? color.red : na

plot(isLong or isShort ? baseline : na, color=colorDot, style=plot.style_circles, linewidth=3)

// --- Strategy Logic ---

// PBCQ

pbcqValid = not pbcqEnabled or low[pbcqBarsAgo] > baseline

// Entry Logic

longCondition = isLong and pbcqValid

shortCondition = isShort and pbcqValid

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Exit Logic

if (takeProfitType == "1 Take Profit")

strategy.exit("TP/SL", "Long", limit=rangeHigh, stop=rangeLow)

strategy.exit("TP/SL", "Short", limit=rangeLow, stop=rangeHigh)

else if (takeProfitType == "2 Take Profits")

strategy.exit("TP1", "Long", qty=strategy.position_size * 0.5, limit=rangeHigh / 2)

strategy.exit("TP2", "Long", qty=strategy.position_size * 0.5, limit=rangeHigh)

strategy.exit("TP1", "Short", qty=strategy.position_size * 0.5, limit=rangeLow / 2)

strategy.exit("TP2", "Short", qty=strategy.position_size * 0.5, limit=rangeLow)

else if (takeProfitType == "3 Take Profits")

strategy.exit("TP1", "Long", qty=strategy.position_size * 0.5, limit=rangeHigh / 2)

strategy.exit("TP2", "Long", qty=strategy.position_size * 0.25, limit=rangeHigh * 0.75)

strategy.exit("TP3", "Long", qty=strategy.position_size * 0.25, limit=rangeHigh * 1.5)

- A Trend Reversal Strategy Based on Moving Averages, Price Patterns and Volume

- Dual Moving Average Strategy

- Momentum Moving Average Crossover Trading Strategy

- Dual Moving Average Golden Cross Strategy

- Momentum Wave Bollinger Bands Trend Strategy

- Reverse Momentum Trading Strategy

- Bandpass Mean PB Indicator Strategy

- RSI & Fibonacci 5-Minute Trading Strategy

- Triple Moving Average Combined with MACD Quantitative Strategy

- Momentum Breakout Optimization

- Volatility Bands and VWAP Multi-Timeframe Stock Trend Trading Strategy

- Price Reversal with Crossover Capturing Strategy

- Ehlers Stochastic Cyber Cycle Strategy

- Breakthrough of Daily High-low Price Based on Fibonacci Levels

- Improved SuperTrend Strategy

- Quantitative Trading Strategy Integrating MACD, RSI and RVOL

- Momentum Inversion Tracking Strategy

- Trend Following Strategy Based on EMA and SMA Crossover

- Simple Pivot Reversal Algorithmic Trading Strategy

- Adaptive Trading Strategy Based on ADX Indicator