Gold Fast Breakthrough EMA Trading Strategy

Author: ChaoZhang, Date: 2024-01-18 11:37:10Tags:

Overview

The Gold Fast Breakthrough EMA Trading Strategy is a gold scalping strategy based on the EMA indicator. This strategy uses the crossover of the fast EMA and slow EMA to generate trading signals, combined with ATR indicators to set stop loss and take profit points to implement gold scalping trading.

Strategy Principle

This strategy mainly relies on the crossover of the 9-day fast EMA and 21-day slow EMA, as well as the relationship between price and EMA to determine entry. Specifically, when the fast EMA crosses above the slow EMA and the close price is higher than the slow EMA, go long; when the fast EMA crosses below the slow EMA and the close price is lower than the slow EMA, go short.

In addition, this strategy also uses the ATR indicator to calculate the average range of fluctuations in the most recent 2 days. After entry, the stop loss point is set at the lowest (atrLength) minus atr multiplied by atrMultiplier; the take profit point is set at the highest (atrLength) plus atr multiplied by atrMultiplier. This is a volatility trailing stop mechanism based on the ATR indicator.

Advantage Analysis

This is a relatively simple gold scalping strategy with the following advantages:

- Using EMA crossover to judge, it can capture clearer trends;

- Combined with the relationship between price and EMA to filter false breakout signals and improve accuracy;

- The trailing stop based on the ATR indicator can dynamically adjust the stop loss and take profit according to market volatility, which is conducive to locking in profits.

Risk Analysis

This strategy also has some risks:

- As a scalping strategy, it has higher requirements for trading capital size and leverage, otherwise the single profit is limited;

- EMA crossover strategies are prone to wrong signals in choppy markets;

- The distance of stop loss and take profit set by the ATR indicator may be too large or too small and needs to be optimized.

In response to the above risks, we can consider appropriately reducing the position size, combining with other indicators to filter signals, or testing different parameters to optimize the setting of stop loss and take profit.

Optimization Directions

This strategy can also be optimized in the following directions:

- Add other indicators to judge, such as MACD, Bollinger Bands, etc. to form multiple filters and improve signal quality;

- Add a position sizing adjustment mechanism based on volatility. For example, appropriately reduce the position size when volatility increases;

- Optimize the parameters of the ATR volatility range to find the optimal parameter combination.

Summary

The Gold Fast Breakthrough EMA Trading Strategy is a simple and practical gold scalping strategy. It uses EMA crossover to determine the trend and sets stop loss and take profit based on the ATR indicator, which can effectively lock in small profits. This strategy can be improved through multiple indicator filtering, position sizing adjustment, parameter optimization, etc., making it more adaptable to market conditions.

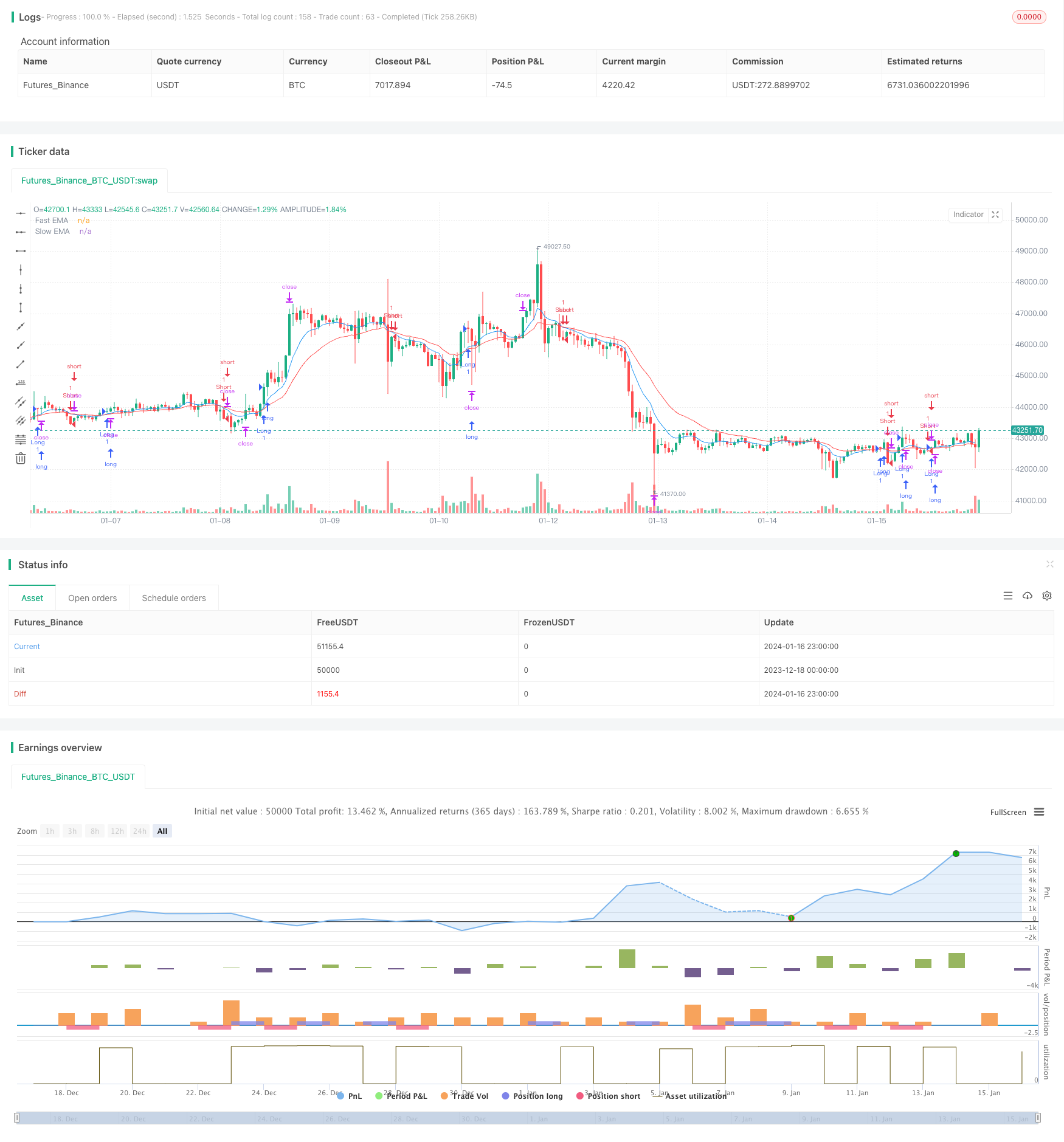

/*backtest

start: 2023-12-18 00:00:00

end: 2024-01-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("XAUUSD Trading Strategy", shorttitle="XAUUSD Strategy", overlay=true)

// Inputs

fastLength = input(9, title="Fast EMA Length")

slowLength = input(21, title="Slow EMA Length")

atrLength = input(2, title="ATR Length")

atrMultiplier = input(2, title="ATR Multiplier")

profitTarget = input(0.7, title="Profit Target") * 100 // in percentage

commission = input(0.001, title="Commission") // 0.1% per trade

// Calculations

fastEMA = ema(close, fastLength)

slowEMA = ema(close, slowLength)

atr = atr(atrLength)

// Entry rules

longCondition = crossover(fastEMA, slowEMA) and close > slowEMA

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = crossunder(fastEMA, slowEMA) and close < slowEMA

if (shortCondition)

strategy.entry("Short", strategy.short)

// Stop loss and take profit

longStop = lowest(atrLength) - atr * atrMultiplier

longTakeProfit = highest(atrLength) + atr * atrMultiplier

shortStop = highest(atrLength) + atr * atrMultiplier

shortTakeProfit = lowest(atrLength) - atr * atrMultiplier

strategy.exit("Exit Long", "Long", stop=longStop, limit=longTakeProfit)

strategy.exit("Exit Short", "Short", stop=shortStop, limit=shortTakeProfit)

// Plot EMAs

plot(fastEMA, title="Fast EMA", color=color.blue)

plot(slowEMA, title="Slow EMA", color=color.red)

- Dynamic Support and Resistance Channel Breakout

- ATR-based SuperTrend Strategy

- Trend Following Strategy Based on Moving Averages

- Parabolic SAR Trend Tracking Strategy

- Bollinger Bands Breakout Strategy

- Multi-factor Moving Average Trend Following Strategy

- Multi Timeframe Trend Tracking Strategy

- Weekly Breakthrough Moving Average Trading Strategy

- RSI+Bollinger Bands Breakout Strategy at Lower Area

- Parabolic SAR, Stoch and Security Indicator Based Multi-Timeframe Quantitative Trading Strategy

- Dual-Factor Momentum Tracking Reversal Strategy

- Momentum Reversal Trading Strategy

- Bollinger Band and RSI Mixing with DCA Strategy

- Emma Pullback Short Strategy

- NoroBands Momentum Position Strategy

- Dual Confirmation Reversal Trend Tracking Strategy

- MACD Indicator Driven OBV Quant Trading Strategy

- Dollar Cost Averaging After Downtrend Strategy

- Triple Indicators Sentiment Driven Breakout Strategy

- A Trend Reversal Strategy Based on Moving Averages, Price Patterns and Volume