Overview

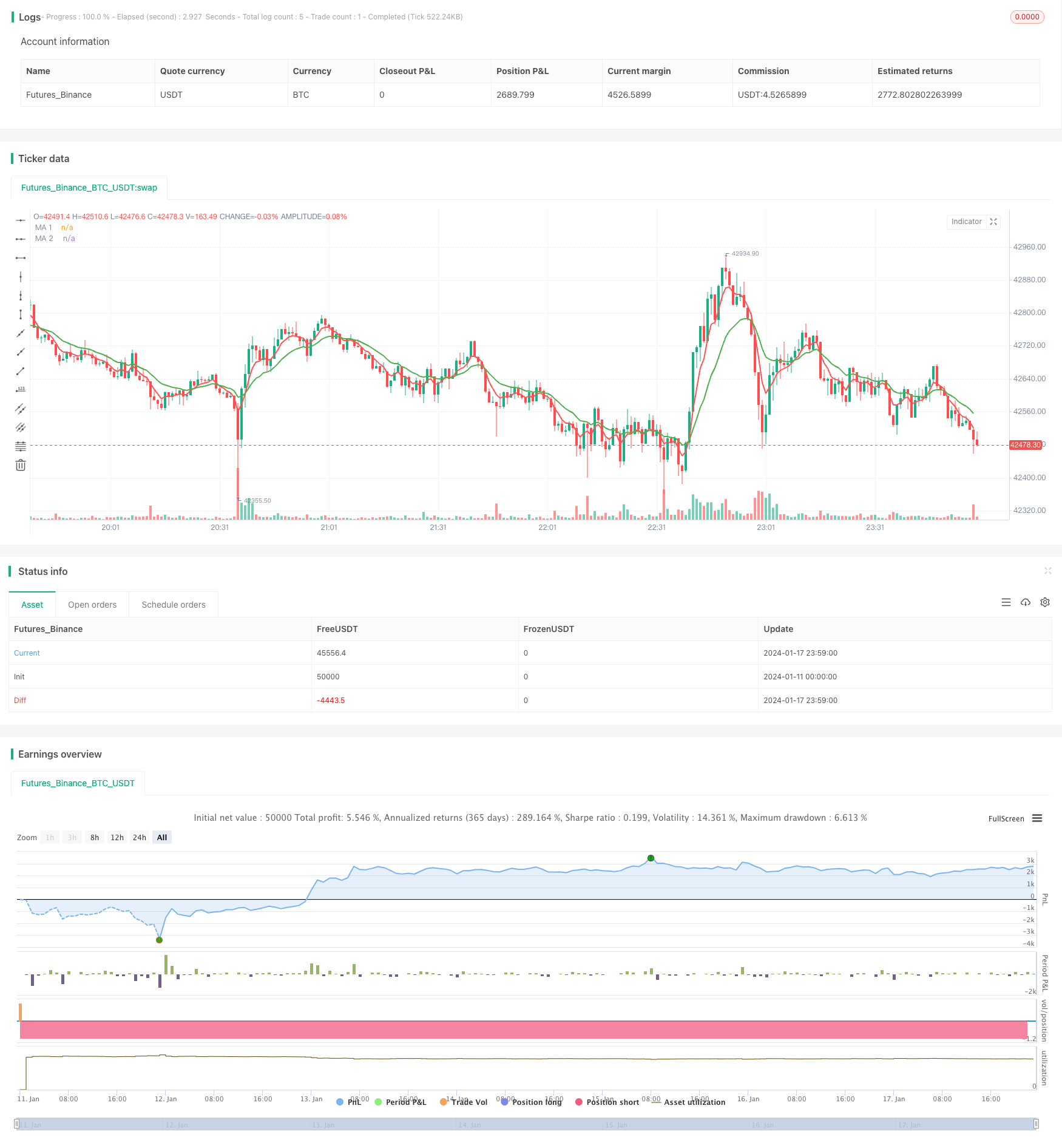

The Dual Moving Average Trading Strategy is a common quantitative trading strategy. This strategy uses two moving averages with different time periods to generate trading signals based on their crossover. Specifically, when the short-term moving average crosses above the long-term moving average, it is considered a buy signal; when the short-term moving average crosses below the long-term moving average, it is considered a sell signal.

Principle

The core principle of this strategy is: the short-term moving average reflects the short-term trend of the asset price, and the long-term moving average reflects the long-term trend of the asset price. When the short-term line crosses above the long-term line, it indicates that the short-term trend has turned to rise, at this time you can buy. When the short-term line crosses below the long-term line, it indicates that the short-term trend has turned to fall, at this time you can sell. Follow the trend, capture the turning point of price trend.

Specifically, the strategy defines two moving averages: a 5-day short-term moving average to capture short-term price trends; and a 15-day long-term moving average to judge long-term price trends. When the 5-day line moves above the 15-day line, it indicates that the short-term price has started to rise, which is a buy signal; when the 5-day line crosses below the 15-day line, it indicates that the short-term price starting to fall, this is a sell signal.

Advantages Analysis

Compared with other strategies, the dual moving average strategy has the following advantages:

1. Simple to operate, easy to understand and implement, suitable for quantitative trading novice.

2. Follow the trend, avoid pursue the fundamental reason of complex market trend.

3. Flexible parameter adjustment, the moving average period can be adjusted to adapt to different market environment.

4. Effective filter market noise, capture turning points of long and short term trend.

5. Customizable trading frequency to reduce transaction costs and slippage losses.

Risk Analysis

Dual moving average strategy also has some risks, mainly including:

1. It may generate false signals because the moving average is essentially a lagging signal.

2. Need to monitor two moving averages simultaneously, parameter adjustment and effect test are complex.

3. Cannot handle scenarios with dramatic price fluctuations well, easily stopped loss.

4. Trading frequency may be too high or too low, parameters need to be optimized.

5. The effect is highly correlated with market conditions, poor performance during overall bear market.

Solutions:

1. Combine with other indicators to filter signals.

2. Optimize moving average parameters and test performances.

3. Set appropriate stop loss range.

4. Adjust moving average parameters to optimize trading frequency.

5. Adjust parameters under different market conditions.

Optimization Directions

The strategy can be optimized in the following directions:

Combine with other indicators like MACD, KDJ to filter false signals.

Introduce adaptive moving average, dynamically adjust parameters based on market volatility to improve robustness.

Optimize moving average parameters to find the best combination and improve strategy performance.

Add stop loss mechanism to limit losses and enhance risk control.

Combination of multiple time frames, utilizing signals from daily and weekly lines to improve stability.

Markov state switch, use different parameters under different market states to improve adaptability.

Summary

In general, the dual moving average trading strategy is quite effective and stable. The trading principle is simple to understand and implement, parameters are flexible to adapt to market trends. Meanwhile there are some limitations like generating false signals and difficulty in handling drastic market fluctuations. These can be addressed through introducing other tools and parameter optimization. Overall speaking, this is a practical strategy suitable for quantitative trading beginners to learn and practice.

//@version=3

strategy("CS: 2 Moving Averages Script - Strategy (Testing)", overlay=true)

// === GENERAL INPUTS ===

// short ma

ma1Source = input(defval = close, title = "MA 1 Source")

ma1Length = input(defval = 5, title = "MA 1 Period", minval = 1)

// long ma

ma2Source = input(defval = close, title = "MA 2 Source")

ma2Length = input(defval = 15, title = "MA 2 Period", minval = 1)

// === SERIES SETUP ===

/// a couple of ma's..

ma1 = ema(ma1Source, ma1Length)

ma2 = ema(ma2Source, ma2Length)

// === PLOTTING ===

fast = plot(ma1, title = "MA 1", color = red, linewidth = 2, style = line, transp = 30)

slow = plot(ma2, title = "MA 2", color = green, linewidth = 2, style = line, transp = 30)

// === LOGIC ===

enterLong = crossover(ma1, ma2)

exitLong = crossover(ma2, ma1)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2012)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2012)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

// Entry //

strategy.entry(id="Long Entry", long=true, when=enterLong and window())

strategy.entry(id="Short Entry", long=false, when=exitLong and window())