Overview

This strategy mainly combines signals from two different types of strategies to superimpose strategy signals and improve signal quality. The first type of strategy is the cross trend reversal strategy and the second type of signal is the three ten oscillator strategy.

Strategy 1: Cross Trend Reversal Strategy

This strategy originates from page 183 of the book “How I Tripled My Money in the Futures Market”. It belongs to the reversal type of strategy. The specific logic is: when the closing price is higher than the previous closing price for two consecutive days, and the 9-day slow K-line is lower than 50, go long; when the closing price is lower than the previous closing price for two consecutive days, and the 9-day fast K-line is higher than 50, go short.

Strategy 2: Three Ten Oscillator Strategy

This strategy uses the difference between the 3-day moving average and the 10-day moving average to construct an indicator. Specifically, it is the 3-day exponential moving average minus the 10-day exponential moving average. The difference is the fast line. Taking a 16-day simple moving average of this fast line gives the slow line. When the fast line breaks through the slow line from bottom to top, go long; when the fast line breaks through the slow line from top to bottom, go short.

Strategy Principle

- First calculate the trading signal posReversal123 of the cross trend reversal strategy;

- Then calculate the trading signal posD_Three of the three ten oscillator strategy;

- When the two signals are in the same direction (dual multi or dual short), output a combined signal;

- Determine the specific trading direction and price based on the combined signal pos;

- Draw K-lines in different colors.

Advantage Analysis

This composite signal of multi-strategy stacking has the following advantages:

- Filter fake signals and improve signal quality

As two strategies are required to give signals in the same direction at the same time, the impact of fake signals in a single strategy can be avoided, thereby improving signal reliability.

- Integrate multiple trading ideas

Combining reversal strategies and trend strategies integrates two ideas to some extent Reduce the blind spots of the strategy and get a more comprehensive market perspective.

- High flexibility

According to actual needs, the combination of participating strategies can be adjusted to create more diversified combination strategies by combining different types of strategies.

Risk Analysis

- Contradictory assumptions

The basic assumption of this strategy is that multiple strategies can verify signals with each other. But in theory, it is also possible for all strategies to give wrong signals at the same time.

- Inconsistent signals

When the two strategy signals are inconsistent, it is impossible to determine which strategy is more reliable, and there is a certain decision risk.

- Parameter mismatch

Improper parameter settings may cause some strategies to fail to function properly, resulting in failure to achieve the expected effects of strategy combinations.

Countermeasures:

Increase the number of strategies for majority vote

Set stop loss points to control losses from individual signals

Optimize parameters to ensure normal strategy operation

Optimization Directions

The strategy can also be optimized in the following directions:

- Increase combination of more strategies

Continue to add more different types of strategies to form combination strategies, so as to further improve signal quality.

- Prior filtering conditions

According to market conditions, some prior conditions can be set, such as market filtering, to avoid opening positions in unsuitable market conditions.

- Dynamically adjust strategy weights

The weights of different strategies in the combination can be dynamically adjusted according to their historical performance, so that strategies with better performance can play a greater role.

- Optimize parameter details

A more systematic approach can be used to carefully test and optimize the internal parameters of each strategy in order to obtain the optimal parameters.

Summary

This strategy belongs to a multi-strategy overlay composite strategy. It integrates two sub-strategies, the cross-trend reversal strategy and the three-ten oscillation strategy. It generates trading orders only when their trading signals are in the same direction, which can effectively filter out fake signals in a single strategy and improve signal quality. Compared with a single strategy, this type of strategy combination has advantages such as higher signal reliability and stronger fault tolerance. But the risks brought by consistency assumptions also need to be noted, and appropriate measures should be taken to control them. In general, this multi-strategy combination framework has great potential for expansion, and can be deepened through adding more sub-strategies, optimizing parameters and setting filtering conditions.

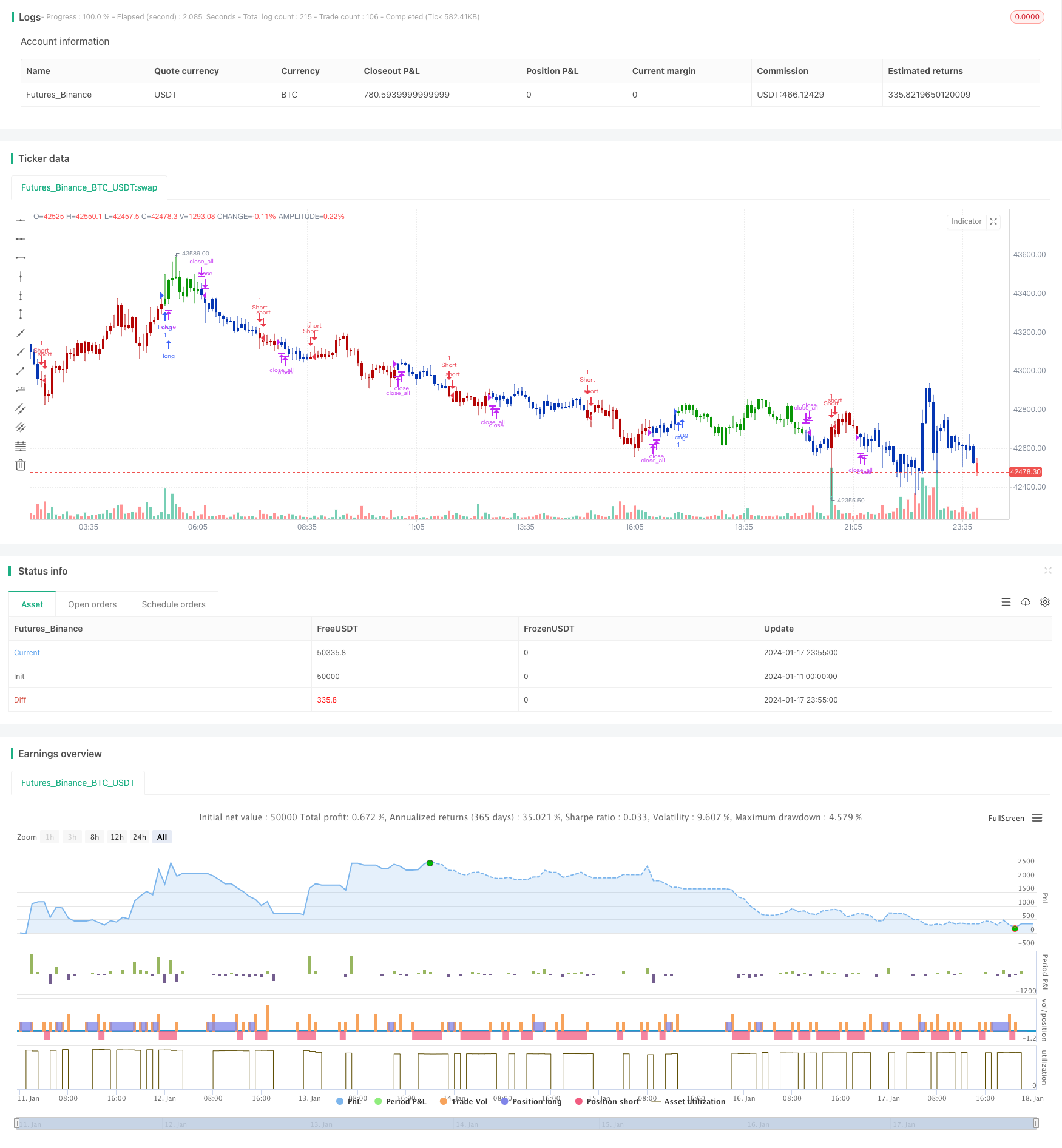

/*backtest

start: 2024-01-11 00:00:00

end: 2024-01-18 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 04/12/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// TradeStation does not allow the user to make a Multi Data Chart with

// a Tick Bar Chart and any other type a chart. This indicator allows the

// user to plot a daily 3-10 Oscillator on a Tick Bar Chart or any intraday interval.

// Walter Bressert's 3-10 Oscillator is a detrending oscillator derived

// from subtracting a 10 day moving average from a 3 day moving average.

// The second plot is an 16 day simple moving average of the 3-10 Oscillator.

// The 16 period moving average is the slow line and the 3/10 oscillator is

// the fast line.

// For more information on the 3-10 Oscillator see Walter Bressert's book

// "The Power of Oscillator/Cycle Combinations"

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

D_Three(Length1, Length2, Length3) =>

pos = 0.0

xPrice = security(syminfo.tickerid,"D", hl2)

xfastMA = ema(xPrice, Length1)

xslowMA = ema(xPrice, Length2)

xMACD = xfastMA - xslowMA

xSignal = sma(xMACD, Length3)

pos := iff(xSignal > xMACD, -1,

iff(xSignal < xMACD, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & D_Three Ten Osc", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Length1 = input(3, minval=1)

Length2 = input(10, minval=1)

Length3 = input(16, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posD_Three = D_Three(Length1, Length2, Length3)

pos = iff(posReversal123 == 1 and posD_Three == 1 , 1,

iff(posReversal123 == -1 and posD_Three == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )