Overview

The Exponential Moving Average (EMA) and Moving Average (MA) Crossover with Close Strategy generates trading signals based on the price movement of an asset relative to its 9-period EMA and 20-period MA. It uses EMA and MA crossover signals to determine trend direction for entries and closes positions when the price recrosses the moving averages.

Strategy Logic

EMA and MA Calculation

- ema9 calculates the 9-period Exponential Moving Average of closing prices. EMA gives more weight to recent prices, making it more responsive.

- ma20 calculates the 20-period Simple Moving Average of closing prices. MA is an average of closing prices over 20 periods.

Buy and Sell Conditions

- buyCondition is true when close > both ema9 and ma20. This is interpreted as a bullish signal.

- sellCondition is true when close < both ema9 and ma20. This is interpreted as a bearish signal.

Trade Execution

- When buyCondition is true, execute a long entry order.

- When sellCondition is true, execute a short entry order.

- When price recrosses ema9 or ma20, close any open position.

Candle Coloring

- Green candles indicate buy condition

- Red candles indicate sell condition

- Other candles are default white

EMA and MA Plotting

The 9 EMA and 20 MA are plotted on the chart for visual reference.

Advantage Analysis

The strategy combines two widely used indicators, taking advantage of EMA and MA’s trend following and smoothing capabilities to generate more reliable signals.

Crossovers provide clear trend change signals, avoiding bad trades.

Candle color coding visually indicates conditions without complex calculations.

Automated entry and exit execution strictly follows predetermined rules, aiding risk management.

Risk Analysis

As trend following indicators, moving averages can produce many false signals during range-bound periods. Avoid using this strategy during choppy, non-trending markets.

Fast price moves can create lag in MA and EMA values, causing missed opportunities.

EMA and MA parameters significantly impact strategy performance and should be adjusted for different products and timeframes.

Automated strategies cannot adapt to complex situations like a human trader. Preset stop losses and take profits.

Optimization Directions

Test different EMA and MA length combinations to find optimal parameters that maximize true signals and minimize false signals.

Incorporate volatility metrics like ATR to filter higher risk setups and control potential losses.

Combine with other indicators or signals like volume and Bollinger Bands to confirm signal reliability.

Add stop loss and take profit logic to actively manage trade risk. Stops can be price-based or ATR-based.

Summary

The EMA and MA Crossover with Close Strategy uses EMA and MA crossovers to determine trends and signal entries. While simple and automatable, performance is heavily dependent on parameter tuning and market conditions. Regular optimization is needed to adapt to evolving markets.

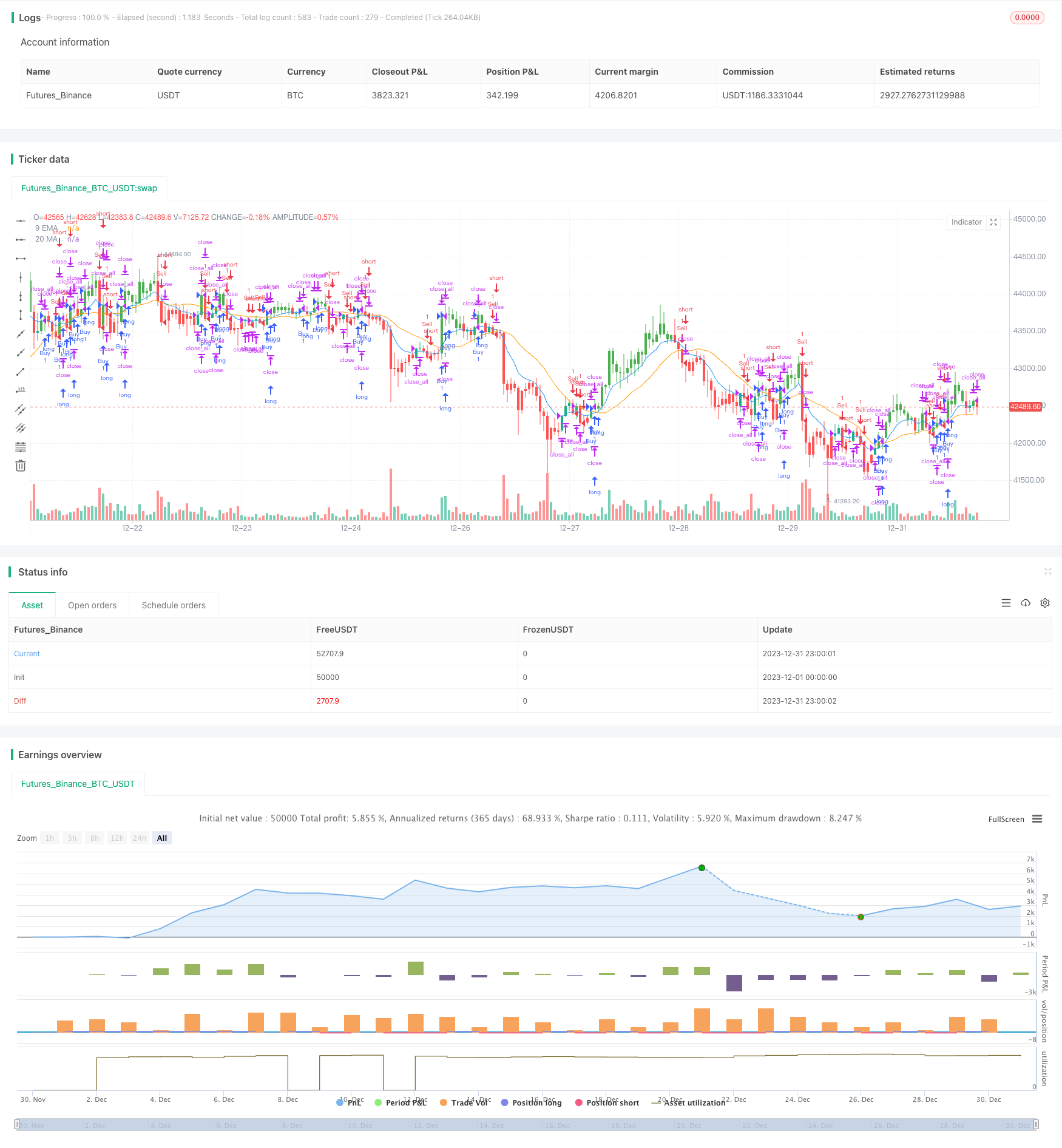

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA and MA Crossover with Close Strategy", shorttitle="EMA_MA_Close", overlay=true)

// Define the length of the Exponential Moving Average and Moving Average

lengthEMA = 9

lengthMA = 20

// Calculate the 9 EMA and 20 MA

ema9 = ema(close, lengthEMA)

ma20 = sma(close, lengthMA)

// Define the buy and sell conditions

buyCondition = close > ema9 and close > ma20

sellCondition = close < ema9 and close < ma20

// Define the close position condition

closeCondition = crossover(close, ema9) or crossover(close, ma20)

// Execute buy or sell orders

if (buyCondition)

strategy.entry("Buy", strategy.long)

else if (sellCondition)

strategy.entry("Sell", strategy.short)

// Close any position if the close condition is met

if (closeCondition)

strategy.close_all()

// Coloring the candles based on conditions

barcolor(buyCondition ? color.green : na)

barcolor(sellCondition ? color.red : na)

// Plotting the EMA and MA for reference

plot(ema9, color=color.blue, title="9 EMA")

plot(ma20, color=color.orange, title="20 MA")