Overview

The main idea of this strategy is to combine the Zero Lag Overlapping Moving Average (ZLSMA) indicator to judge the trend direction, and the Chandelier Exit (CE) indicator to find more precise entry and exit points. ZLSMA is a trend indicator that can identify trend changes earlier. CE dynamically adjusts exit points by calculating ATR to effectively control stop loss. This strategy is mainly suitable for medium-short term operations.

Strategy Principle

ZLSMA part:

- Use linear regression method to calculate 130-period LMA lines respectively.

- Then overlay the two LMA lines to get the difference value assigned to eq.

- Finally, construct the Zero Lag Overlapping Moving Average ZLSMA through the original LMA line plus the eq difference.

- Use linear regression method to calculate 130-period LMA lines respectively.

CE part:

- Calculate the ATR indicator and multiply it by a factor (default 2) to determine the dynamic distance from the most recent high or low point.

- When the closing price exceeds the most recent long or short stop loss line, adjust the stop loss line accordingly.

- Determine long or short direction based on the change in closing price relative to the stop loss line.

- Calculate the ATR indicator and multiply it by a factor (default 2) to determine the dynamic distance from the most recent high or low point.

Entry signal:

- ZLSMA judges trend direction, enter when CE issues signal.

- ZLSMA judges trend direction, enter when CE issues signal.

Exit stop loss:

- Fixed stop loss and take profit for long position.

- For short position, use CE’s dynamic exit to replace fixed stop loss.

Advantage Analysis

- ZLSMA can identify trend earlier to avoid false breakout.

- CE can flexibly adjust exit points according to market volatility.

- Customizable risk-reward ratio of the strategy.

- Different methods of stop loss and take profit used for long and short positions to control risk.

Risk Analysis

- Improper parameter settings may increase loss rate or expand stop loss range.

- There is still risk of stop loss being broken in case of swift market reversal.

Optimization Directions

- Parameters can be optimized for different markets and timeframes.

- Consider adjusting profit/stop parameters based on volatility or specific cycles.

- Try combining with other indicators or models to improve profit rate.

Summary

The strategy mainly uses Zero Lag Overlapping Moving Average to determine the trend direction, combined with Chandelier Exit indicator to find more precise entry and exit points. The advantages lie in the customizable stop/profit ratio and the dynamic adjustment of Chandelier Exit can control risks according to market conditions. Next steps could be parameter optimization and strategy combination to further improve stability and profitability.

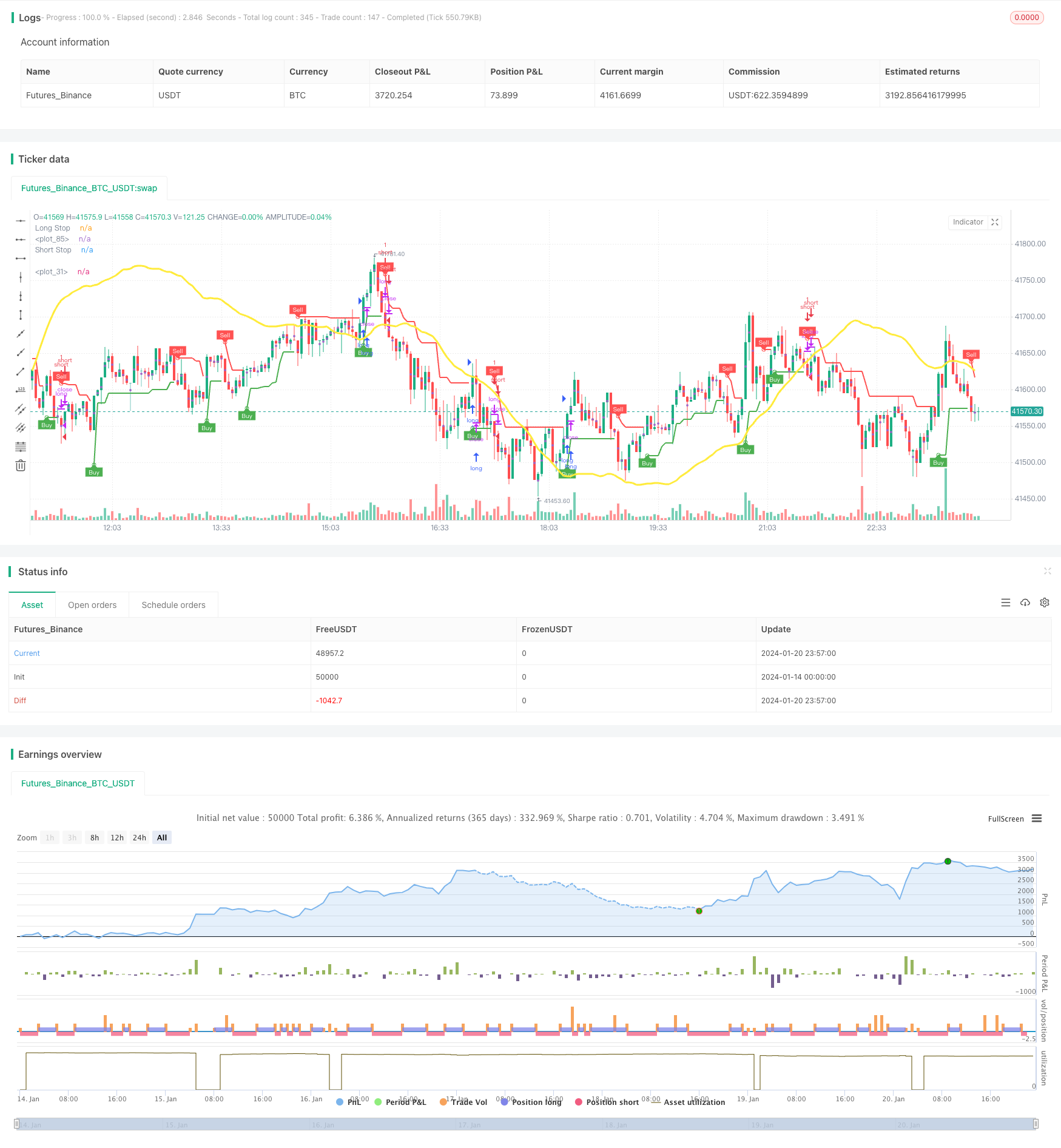

/*backtest

start: 2024-01-14 00:00:00

end: 2024-01-21 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GGkurg

//@version=5

strategy(title = "ZLSMA + Chandelier Exit", shorttitle="ZLSMA + CE", overlay=true)

var GRP1 = "take profit / stop loss"

TP = input(title='long TP%', defval=2.0, inline = "1", group = GRP1)

SL = input(title='long SL%', defval=2.0, inline = "1", group = GRP1)

TP2 = input(title='short TP', defval=2.0, inline = "2", group = GRP1)

SL2 = input(title='short SL', defval=2.0, inline = "2", group = GRP1)

//-------------------------------------------------calculations

takeProfitPrice = strategy.position_avg_price * (1+(TP/100))

stopLossPrice = strategy.position_avg_price * (1-(SL/100))

takeProfitPrice2 = strategy.position_avg_price * (1-(TP2/100))

stopLossPrice2 = strategy.position_avg_price * (1+(SL2/100))

//---------------------------------------ZLSMA - Zero Lag LSMA

var GRP2 = "ZLSMA settings"

length1 = input(title='Length', defval=130, inline = "1", group = GRP2)

offset1 = input(title='Offset', defval=0, inline = "2", group = GRP2)

src = input(close, title='Source', inline = "3", group = GRP2)

lsma = ta.linreg(src, length1, offset1)

lsma2 = ta.linreg(lsma, length1, offset1)

eq = lsma - lsma2

zlsma = lsma + eq

plot(zlsma, color=color.new(color.yellow, 0), linewidth=3)

//---------------------------------------ZLSMA conditisions

//---------long

longc1 = close > zlsma

longclose1 = close < zlsma

//---------short

shortc1 = close < zlsma

shortclose1 = close > zlsma

//---------------------------------------Chandelier Exit

var string calcGroup = 'Chandelier exit settings'

length = input.int(title='ATR Period', defval=1, group=calcGroup)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2.0, group=calcGroup)

useClose = input.bool(title='Use Close Price for Extremums', defval=true, group=calcGroup)

var string visualGroup = 'Visuals'

showLabels = input.bool(title='Show Buy/Sell Labels', defval=true, group=visualGroup)

highlightState = input.bool(title='Highlight State', defval=true, group=visualGroup)

var string alertGroup = 'Alerts'

awaitBarConfirmation = input.bool(title="Await Bar Confirmation", defval=true, group=alertGroup)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var color longColor = color.green

var color shortColor = color.red

var color longFillColor = color.new(color.green, 90)

var color shortFillColor = color.new(color.red, 90)

var color textColor = color.new(color.white, 0)

longStopPlot = plot(dir == 1 ? longStop : na, title='Long Stop', style=plot.style_linebr, linewidth=2, color=color.new(longColor, 0))

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal ? longStop : na, title='Long Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(longColor, 0))

plotshape(buySignal and showLabels ? longStop : na, title='Buy Label', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(longColor, 0), textcolor=textColor)

shortStopPlot = plot(dir == 1 ? na : shortStop, title='Short Stop', style=plot.style_linebr, linewidth=2, color=color.new(shortColor, 0))

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal ? shortStop : na, title='Short Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(shortColor, 0))

plotshape(sellSignal and showLabels ? shortStop : na, title='Sell Label', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(shortColor, 0), textcolor=textColor)

midPricePlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none, editable=false)

longStateFillColor = highlightState ? dir == 1 ? longFillColor : na : na

shortStateFillColor = highlightState ? dir == -1 ? shortFillColor : na : na

fill(midPricePlot, longStopPlot, title='Long State Filling', color=longStateFillColor)

fill(midPricePlot, shortStopPlot, title='Short State Filling', color=shortStateFillColor)

await = awaitBarConfirmation ? barstate.isconfirmed : true

alertcondition(dir != dir[1] and await, title='Alert: CE Direction Change', message='Chandelier Exit has changed direction!')

alertcondition(buySignal and await, title='Alert: CE Buy', message='Chandelier Exit Buy!')

alertcondition(sellSignal and await, title='Alert: CE Sell', message='Chandelier Exit Sell!')

//---------------------------------------Chandelier Exit conditisions

//---------long

longc2 = buySignal

longclose2 = sellSignal

//---------short

shortc2 = sellSignal

shortclose2 = buySignal

//---------------------------------------Long entry and exit

if longc1 and longc2

strategy.entry("long", strategy.long)

if strategy.position_avg_price > 0

strategy.exit("close long", "long", limit = takeProfitPrice, stop = stopLossPrice, alert_message = "close all orders")

if longclose1 and longclose2 and strategy.opentrades == 1

strategy.close("long","ema long cross", alert_message = "close all orders")

//---------------------------------------Short entry and exit

if shortc1 and shortc2

strategy.entry("short", strategy.short)

if strategy.position_avg_price > 0

strategy.exit("close short", "short", limit = takeProfitPrice2, stop = stopLossPrice2, alert_message = "close all orders")

if shortclose1 and shortclose2 and strategy.opentrades == 1

strategy.close("close short","short", alert_message = "close all orders")