Overview

The Stochastic Momentum Strategy is a quantitative trading strategy that combines the Stochastic Momentum Index (SMI) and the Relative Strength Index (RSI). It uses the SMI to identify overbought and oversold areas in the market, with the fast RSI acting as a signal filter. It also implements a body filter for more reliable signal selection.

Strategy Principles

Stochastic Momentum Index

The Stochastic Momentum Index (SMI) is a common technical indicator used in quantitative trading that combines the strengths of momentum and oscillation indicators.

Specifically, the SMI is calculated as:

SMI = (Close - (HH + LL)/2)/(0.5*(HH - LL)) * 100

where HH is the highest price over the past N days, and LL is the lowest price.

So the SMI incorporates both the trend-following judgment of momentum and the reversal judgment of oscillation. Values above 80 are considered overbought, while values below 20 are oversold. The strategy generates trading signals when SMI reaches these overbought or oversold levels.

Fast RSI

The Relative Strength Index (RSI) is a standard overbought/oversold indicator. This strategy uses a fast RSI with a period of 7 to judge short-term overbought/oversold conditions.

Readings below 20 are considered oversold, while those above 80 are deemed overbought per the fast RSI. Signals are generated when these thresholds are breached.

Body Filter

The strategy also implements a body filter by checking the candlestick body size to filter certain signals. Only bodies exceeding a set threshold will trigger trades.

This filters out some false signals and increases reliability.

Advantages

Multi-Indicator Combo

This approach combines the SMI, fast RSI, and body filter into a robust 3-part system. Using multiple integrated signals improves accuracy and enhances stability.

Overbought/Oversold Detection

Both SMI and fast RSI are excellent for detecting exhausted trends. By trading mean-reversions from these overextended areas, the strategy adheres to buying low and selling high.

Two-Way Trading

The ability to both buy dips and short rallies maximizes opportunities across market conditions.

Risk Control

The body filter avoids whipsaws by rejecting low-conviction signals in choppy conditions.

Risks

Whipsaws

Frequent long/short switching brings whipsaw risk. Optimizing logic could minimize this.

Crowded Trades

Signals may cluster market participants and spur quick reversals upon entry. Fine-tuning parameters could reduce herding risk.

Black Swans

Extreme events can upend all models. Intelligent stop losses are necessary to control systematic risks.

Enhancements

Parameter Optimization

Testing different SMI/RSI periods and body filter thresholds could uncover optimal values for higher returns.

Dynamic Stops

Incorporating volatility-based or ATR stops would better contain position and portfolio risk.

Machine Learning

Models predicting future indicator levels could identify turning points earlier. This would enhance predictive power.

Conclusion

In summary, by integrating the SMI, fast RSI, and body filter, this strategy has created a fairly comprehensive overbought/oversold system. The multi-signal approach improves accuracy, while two-way trade capability and risk controls contribute to balance. With continual parameter and model optimization, it shows promise for capturing gains over the long run.

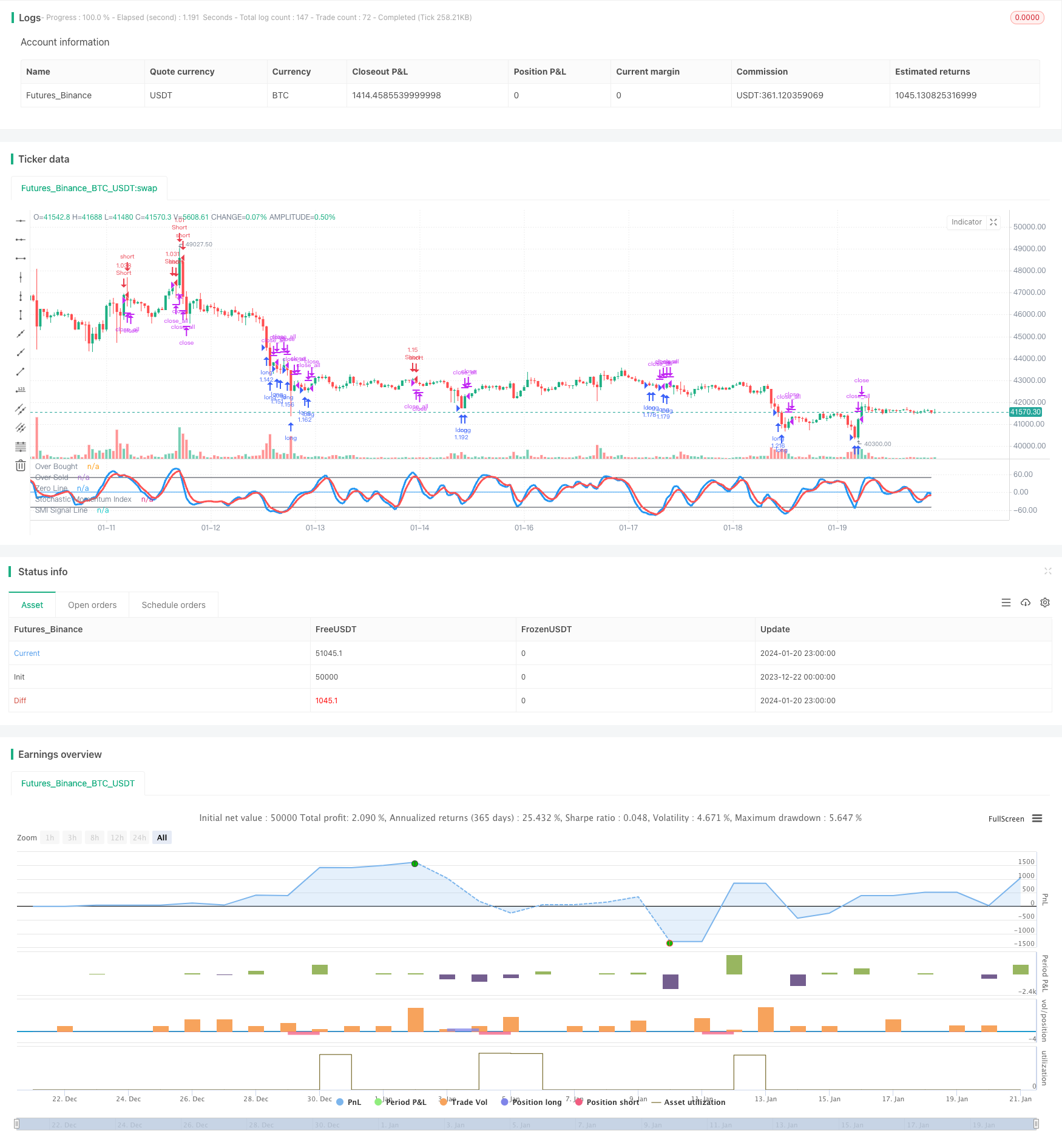

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Stochastic Strategy v1.1", shorttitle = "Stochastic str 1.1", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

usesmi = input(true, defval = true, title = "Use SMI Strategy")

usersi = input(true, defval = true, title = "Use RSI Strategy")

usebod = input(true, defval = true, title = "Use Body-Filter")

a = input(5, "SMI Percent K Length")

b = input(3, "SMI Percent D Length")

limit = input(50, defval = 50, minval = 1, maxval = 100, title = "SMI Limit")

fromyear = input(2017, defval = 2017, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(close), 0), 7)

fastdown = rma(-min(change(close), 0), 7)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Stochastic Momentum Index

ll = lowest (low, a)

hh = highest (high, a)

diff = hh - ll

rdiff = close - (hh+ll)/2

avgrel = ema(ema(rdiff,b),b)

avgdiff = ema(ema(diff,b),b)

SMI = avgdiff != 0 ? (avgrel/(avgdiff/2)*100) : 0

SMIsignal = ema(SMI,b)

//Lines

plot(SMI, color = blue, linewidth = 3, title = "Stochastic Momentum Index")

plot(SMIsignal, color = red, linewidth = 3, title = "SMI Signal Line")

plot(limit, color = black, title = "Over Bought")

plot(-1 * limit, color = black, title = "Over Sold")

plot(0, color = blue, title = "Zero Line")

//Body Filter

nbody = abs(close - open)

abody = sma(nbody, 10)

body = nbody > abody / 3 or usebod == false

//Signals

up1 = SMIsignal < -1 * limit and close < open and body and usesmi

dn1 = SMIsignal > limit and close > open and body and usesmi

up2 = fastrsi < 20 and close < open and body and usersi

dn2 = fastrsi > 80 and close > open and body and usersi

exit = ((strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open)) and body

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

if up1 or up2

if strategy.position_size < 0

strategy.close_all()

strategy.entry("long", strategy.long, needlong == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if dn1 or dn2

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59) or exit

strategy.close_all()