This strategy is a bidirectional adaptive range filtering momentum tracking strategy

Author: ChaoZhang, Date: 2024-01-24 11:31:51Tags:

Overview

This strategy is a bidirectional adaptive range filtering momentum tracking strategy. It uses an adaptive range filter to track price fluctuations and combines volume indicators to determine the direction of value, in order to implement low buying and high selling.

Strategy Principles

-

Use an adaptive range filter to track price fluctuations. The size of the filter is adjusted adaptively according to the user-defined range period, quantity and scale.

-

There are two types of filters: Type 1 and Type 2. Type 1 is a standard range tracking type, and Type 2 is a stepped rounding type.

-

Determine the direction of price fluctuation based on the relationship between the filter and the closing price. Above the upper rail is bullish, and below the lower rail is bearish.

-

Combined with the rise and fall of the closing price compared to the previous day, determine the direction of value. Value rising is bullish and value falling is bearish.

-

Issue a buy signal when the price breaks through the upper track and the value rises; Issue a sell signal when the price breaks through the lower track and the value falls.

Advantage Analysis

-

The adaptive range filter can accurately capture market fluctuations.

-

Two types of filters can meet different trading preferences.

-

Combining volume indicators can effectively identify value direction.

-

The strategy is flexible and parameters can be adjusted according to market conditions.

-

Customizable trading condition logic.

Risk Analysis

-

Improper parameter settings may lead to overtrading or missing trades.

-

Breakout signals have a certain lag.

-

Volume indicators have a certain risk of stalling.

-

Range breaks are prone to being trapped.

Risk Prevention:

-

Choose appropriate parameter combinations and adjust them in a timely manner.

-

Combine other indicators to identify trends.

-

Trade cautiously around key levels and trend reversals.

Optimization Directions

-

Test different combinations of range sizes and smoothing cycles to find the optimal combination.

-

Try different types of filters and choose your preferred type.

-

Experiment with other volume indicators or auxiliary technical indicators.

-

Optimize and adjust trading condition logic to reduce irrational trading.

-

Incorporate market theorems to set adaptive position sizing.

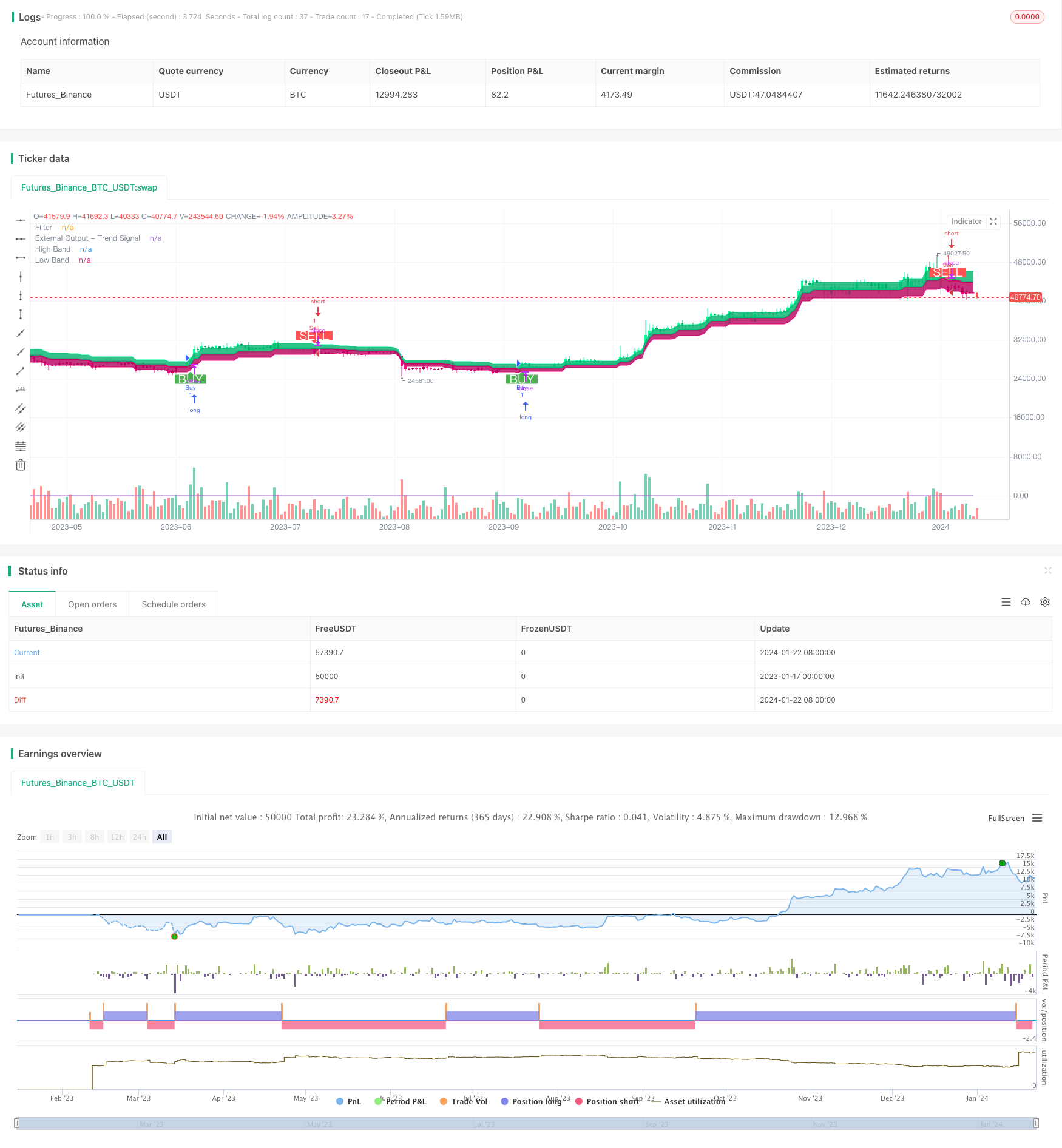

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Range Filter [DW] & Labels", shorttitle="RF [DW] & Labels", overlay=true)

//Conditional Sampling EMA Function

Cond_EMA(x, cond, n)=>

var val = array.new_float(0)

var ema_val = array.new_float(1)

if cond

array.push(val, x)

if array.size(val) > 1

array.remove(val, 0)

if na(array.get(ema_val, 0))

array.fill(ema_val, array.get(val, 0))

array.set(ema_val, 0, (array.get(val, 0) - array.get(ema_val, 0))*(2/(n + 1)) + array.get(ema_val, 0))

EMA = array.get(ema_val, 0)

EMA

//Conditional Sampling SMA Function

Cond_SMA(x, cond, n)=>

var vals = array.new_float(0)

if cond

array.push(vals, x)

if array.size(vals) > n

array.remove(vals, 0)

SMA = array.avg(vals)

SMA

//Standard Deviation Function

Stdev(x, n)=>

sqrt(Cond_SMA(pow(x, 2), 1, n) - pow(Cond_SMA(x, 1, n), 2))

//Range Size Function

rng_size(x, scale, qty, n)=>

ATR = Cond_EMA(tr(true), 1, n)

AC = Cond_EMA(abs(x - x[1]), 1, n)

SD = Stdev(x, n)

rng_size = scale=="Pips" ? qty*0.0001 : scale=="Points" ? qty*syminfo.pointvalue : scale=="% of Price" ? close*qty/100 : scale=="ATR" ? qty*ATR :

scale=="Average Change" ? qty*AC : scale=="Standard Deviation" ? qty*SD : scale=="Ticks" ? qty*syminfo.mintick : qty

//Two Type Range Filter Function

rng_filt(h, l, rng_, n, type, smooth, sn, av_rf, av_n)=>

rng_smooth = Cond_EMA(rng_, 1, sn)

r = smooth ? rng_smooth : rng_

var rfilt = array.new_float(2, (h + l)/2)

array.set(rfilt, 1, array.get(rfilt, 0))

if type=="Type 1"

if h - r > array.get(rfilt, 1)

array.set(rfilt, 0, h - r)

if l + r < array.get(rfilt, 1)

array.set(rfilt, 0, l + r)

if type=="Type 2"

if h >= array.get(rfilt, 1) + r

array.set(rfilt, 0, array.get(rfilt, 1) + floor(abs(h - array.get(rfilt, 1))/r)*r)

if l <= array.get(rfilt, 1) - r

array.set(rfilt, 0, array.get(rfilt, 1) - floor(abs(l - array.get(rfilt, 1))/r)*r)

rng_filt1 = array.get(rfilt, 0)

hi_band1 = rng_filt1 + r

lo_band1 = rng_filt1 - r

rng_filt2 = Cond_EMA(rng_filt1, rng_filt1 != rng_filt1[1], av_n)

hi_band2 = Cond_EMA(hi_band1, rng_filt1 != rng_filt1[1], av_n)

lo_band2 = Cond_EMA(lo_band1, rng_filt1 != rng_filt1[1], av_n)

rng_filt = av_rf ? rng_filt2 : rng_filt1

hi_band = av_rf ? hi_band2 : hi_band1

lo_band = av_rf ? lo_band2 : lo_band1

[hi_band, lo_band, rng_filt]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Type

f_type = input(defval="Type 1", options=["Type 1", "Type 2"], title="Filter Type")

//Movement Source

mov_src = input(defval="Close", options=["Wicks", "Close"], title="Movement Source")

//Range Size Inputs

rng_qty = input(defval=2.618, minval=0.0000001, title="Range Size")

rng_scale = input(defval="Average Change", options=["Points", "Pips", "Ticks", "% of Price", "ATR", "Average Change", "Standard Deviation", "Absolute"], title="Range Scale")

//Range Period

rng_per = input(defval=14, minval=1, title="Range Period (for ATR, Average Change, and Standard Deviation)")

//Range Smoothing Inputs

smooth_range = input(defval=true, title="Smooth Range")

smooth_per = input(defval=27, minval=1, title="Smoothing Period")

//Filter Value Averaging Inputs

av_vals = input(defval=true, title="Average Filter Changes")

av_samples = input(defval=2, minval=1, title="Number Of Changes To Average")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Definitions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//High And Low Values

h_val = mov_src=="Wicks" ? high : close

l_val = mov_src=="Wicks" ? low : close

//Range Filter Values

[h_band, l_band, filt] = rng_filt(h_val, l_val, rng_size((h_val + l_val)/2, rng_scale, rng_qty, rng_per), rng_per, f_type, smooth_range, smooth_per, av_vals, av_samples)

//Direction Conditions

var fdir = 0.0

fdir := filt > filt[1] ? 1 : filt < filt[1] ? -1 : fdir

upward = fdir==1 ? 1 : 0

downward = fdir==-1 ? 1 : 0

//Colors

filt_color = upward ? #05ff9b : downward ? #ff0583 : #cccccc

bar_color = upward and (close > filt) ? (close > close[1] ? #05ff9b : #00b36b) :

downward and (close < filt) ? (close < close[1] ? #ff0583 : #b8005d) : #cccccc

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Outputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Plot

filt_plot = plot(filt, color=filt_color, transp=0, linewidth=3, title="Filter")

//Band Plots

h_band_plot = plot(h_band, color=#05ff9b, transp=100, title="High Band")

l_band_plot = plot(l_band, color=#ff0583, transp=100, title="Low Band")

//Band Fills

fill(h_band_plot, filt_plot, color=#00b36b, transp=85, title="High Band Fill")

fill(l_band_plot, filt_plot, color=#b8005d, transp=85, title="Low Band Fill")

//Bar Color

barcolor(bar_color)

//External Trend Output

plot(fdir, transp=100, editable=false, display=display.none, title="External Output - Trend Signal")

// Trading Conditions Logic

longCond = close > filt and close > close[1] and upward > 0 or close > filt and close < close[1] and upward > 0

shortCond = close < filt and close < close[1] and downward > 0 or close < filt and close > close[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

// Strategy Entry and Exit

strategy.entry("Buy", strategy.long, when = longCondition)

strategy.entry("Sell", strategy.short, when = shortCondition)

strategy.close("Buy", when = shortCondition)

strategy.close("Sell", when = longCondition)

// Plot Buy and Sell Labels

plotshape(longCondition, title = "Buy Signal", text ="BUY", textcolor = color.white, style=shape.labelup, size = size.normal, location=location.belowbar, color = color.green, transp = 0)

plotshape(shortCondition, title = "Sell Signal", text ="SELL", textcolor = color.white, style=shape.labeldown, size = size.normal, location=location.abovebar, color = color.red, transp = 0)

// Alerts

alertcondition(longCondition, title="Buy Alert", message = "BUY")

alertcondition(shortCondition, title="Sell Alert", message = "SELL")

- RSI and Moving Average Breakout Strategy

- EMA Tracking Strategy

- Trend Following Strategy Based on Moving Average

- SMA Crossover Ichimoku Market Depth Volume Based Quantitative Trading Strategy

- Trend Tracking Stop Loss Take Profit Strategy

- Bi-directional Crossing Zero Axis Qstick Indicator Backtest Strategy

- Moving Average Crossover Trading Strategy

- Moving Average Divergence Strategy

- Reversal High Frequency Trading Strategy Based on Shadow Line

- Quantitative Trading Strategy Based on Linear Regression RSI

- Dual Moving Average Trend Tracking Strategy

- Force Breakthrough Strategy

- RSI CCI Williams%R Quantitative Trading Strategy

- Dynmaic Risk Adjusted Momentum Trading Strategy

- Momentum Moving Average Crossover Trading Strategy

- Bollinger Band Limit Market Maker Strategy

- Long-term Moving Average Crossover Renko Strategy

- Binance New Transaction Monitored on the Internet

- Dual-direction Trend Tracking Renko Trading Strategy

- Combined Moving Average and Infinite Impulse Response Line Strategy