Multiple Indicator Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-01-26 16:19:47Tags:

Overview

This strategy utilizes multiple technical indicators for quantitative trading. It mainly uses indicators including EMA crossovers, SuperTrend, RSI, MACD etc. to generate trading signals.

Strategy Logic

The core logic is based on the following aspects:

EMA Crossover: Compute fast EMA1 and slow EMA2. When EMA1 crossover above EMA2, generate buy signal. When EMA1 crossover below EMA2, generate sell signal.

VWMA: Compute VWMA. When close price crossover above VWMA, it is a buy signal. When close price crossover below VWMA, it is a sell signal.

SuperTrend: Compute the upper band and lower band based on ATR and multiplier parameter. Determine trend direction. Generate buy signals in uptrend and sell signals in downtrend.

RSI: Compute RSI indicator. When RSI is above overbought level, it is sell signal. When RSI is below oversold level, it is buy signal.

MACD: Compute MACD, signal line and histogram. When MACD line crossover above signal line, generate buy. When MACD line crossover below signal line, generate sell.

The strategy adopts “AND” logic to combine signals above. Only when multiple indicators emit buy/sell signal simultaneously, a final trading signal will be generated.

Advantages

This strategy combines multiple indicators to filter the market and avoid false signals. Main advantages:

Multiple indicators combination avoids errors of single indicator.

Combination of trend indicator and oscillator capture extra profit during trends.

Use of stop loss logic limits maximum loss per trade.

Martingale logic provides chance to break even after losses.

Risks

Main risks:

Too conservative indicator combination may miss some trading chance. Simplify the indicators combination when necessary.

Martingale logic may lead to significant losses. Set reasonable limitation to the number of additional entries.

Improper use of stop loss may lead to unnecessary stop out. Adopt adaptive stop loss mechanism.

Improper parameter tuning may lead too more false signals. Optimize parameters to find the best combination.

Optimization

The strategy can be further optimized in the following aspects:

Evaluate different combination of indicators, determine the weights.

Test different parameters for each indicator.

Add adaptive stop loss logic.

Add dynamic position sizing mechanism.

Leverage machine learning to optimize parameters and models.

Summary

In summary, this is a very practical quantitative trading strategy. It combines the strength of multiple classical technical indicators for market analysis. Further parameter tuning and model optimization can lead to better results.

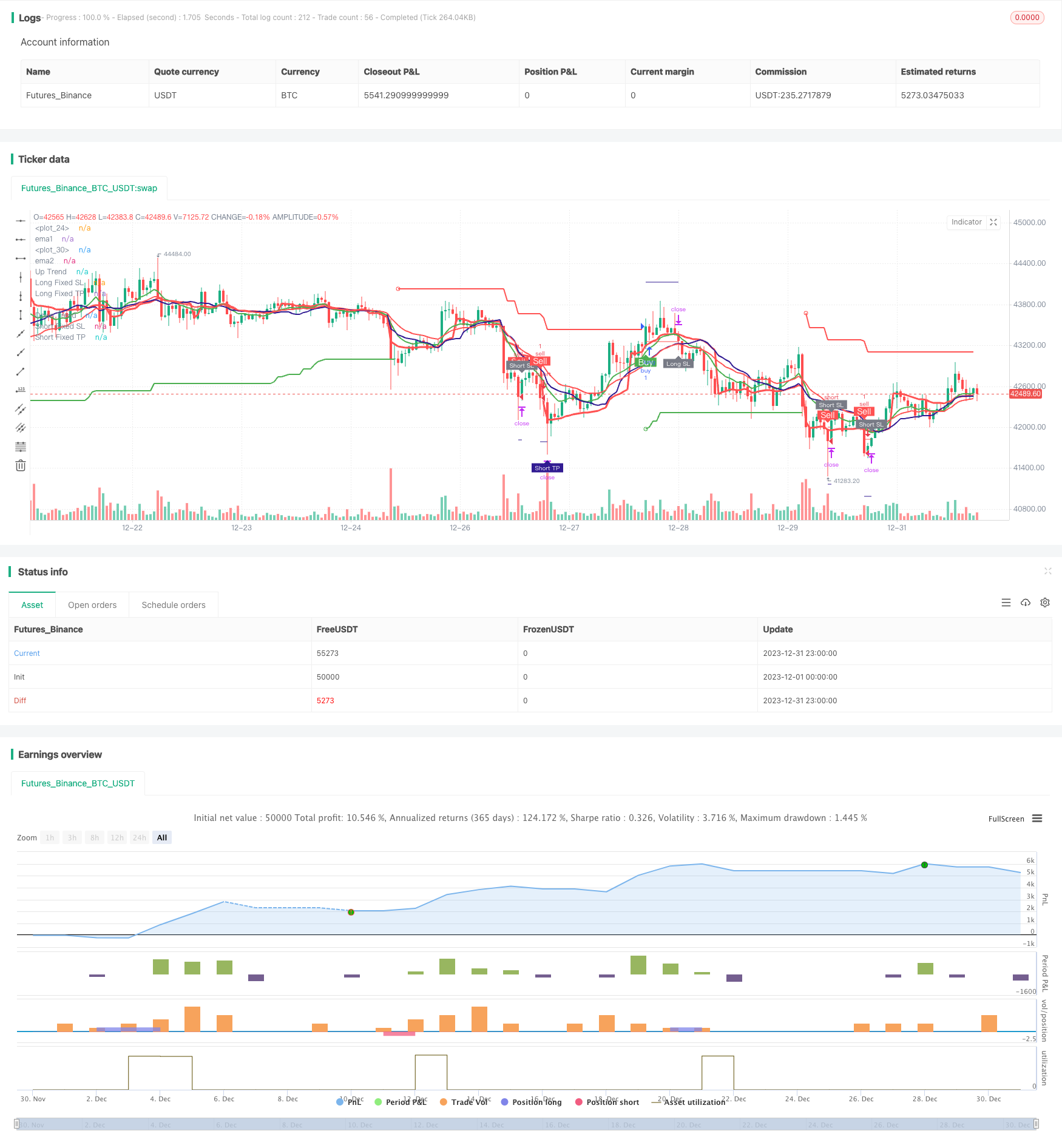

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Pinku Buy', overlay=true)

fromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12)

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31)

fromYear = input.int(defval=2021, title='From Year', minval=1970)

thruMonth = input.int(defval=1, title='Thru Month', minval=1, maxval=12)

thruDay = input.int(defval=1, title='Thru Day', minval=1, maxval=31)

thruYear = input.int(defval=2112, title='Thru Year', minval=1970)

showDate = input(defval=true, title='Show Date Range')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59)

window() => true

// ema crossover

length1 = input.int(10)

length2 = input.int(20)

ema1 = ta.ema(close , length1)

ema2 = ta.ema(close , length2)

//vwap

VWAP = ta.vwap(hlc3)

plot(VWAP, color=color.new(color.red, 0), linewidth=3)

buy_1 = close > VWAP

sell_1 = close < VWAP

//vwma

len = input.int(20, 'VWMA_len', minval=1)

ma = ta.vwma(close, len)

plot(ma, color=color.new(color.navy, 0), linewidth=2)

buy_2 = close > ma

sell_2 = close < ma

//super trend

//inputs

Periods = input(title='STR Period', defval=22)

Source = input(hl2, title='Source')

Multiplier = input.float(title='STR Multiplier', step=0.1, defval=5.0)

//Compute ATR Levels

atr = ta.atr(Periods)

//Creating Upper Channel

up = Source - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

//Creating Down Channel

dn = Source + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

//Compute the Trend Stream +1/-1

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

//Create Stoploss for Longs

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

//buy_a = close > upPlot

//Buy Signal

buy_3 = trend == 1 and trend[1] == -1

plotshape(buy_3 ? up : na, title='Go Long', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

//sell_a = close < dnPlot

//Sell Signal

sell_3 = trend == -1 and trend[1] == 1

plotshape(sell_3 ? dn : na, title='Go Short', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// //paraboloic sar

// start = input(0.02)

// increment = input(0.02)

// maximum = input(0.2, 'Max Value')

// out = ta.sar(start, increment, maximum)

buy_4 = ema1 > ema2

//buy_4 = buy1 and not buy1[1]

//plotshape(buy_4 , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

sell_4 = close < ema2

//sell_4 = sell1 and not sell1[1]

//plotshape(sell_4, color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

plot(ema1, 'ema1', color=color.new(color.green, 0), linewidth=2)

plot(ema2, 'ema2', color=color.new(color.red, 0), linewidth=2)

// rsi

lenr = input(14, title='Rsi Period')

rs = ta.rsi(close, lenr)

over_sold = input(44)

over_bought = input(56)

buy_5 = rs > over_bought

sell_5 = rs < over_sold

// macd

slow_len_macd = input.int(12)

fast_len_macd = input.int(26)

signal_len_macd = input.int(9)

ema3 = ta.ema(close , slow_len_macd)

ema4 = ta.ema(close , fast_len_macd)

ema5 = ta.ema(close , signal_len_macd)

buy_6 = ema5 > ema4

sell_6 = ema5 < ema4

// adx

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

//plot(sig, color=color.red, title="ADX")

adx_Greater_than = input.int(25)

signal = sig > adx_Greater_than

// volume ema

volume_ema = input.int(10)

vema = ta.ema(volume,volume_ema)

signal_2 = volume > vema

//define buy sell

g = buy_1 and buy_2 and buy_4 and trend == 1 and buy_5 and buy_6 and signal and signal_2 and window()

r = sell_1 and sell_2 and sell_4 and trend == -1 and sell_5 and sell_6 and signal and signal_2 and window()

rg = 0

rg := r ? 1 : g ? 2 : nz(rg[1])

buy11 = 0

buy11 := r ? 0 : g ? 1 : nz(buy11[1])

sell11 = 0

sell11 := r ? 1 : g ? 0 : nz(sell11[1])

buy = buy11 and not buy11[1]

sell = sell11 and not sell11[1]

multiple_signals = input(true)

if multiple_signals

buy := g and not g[1] and window()

sell := r and not r[1] and window()

sell

else

buy := buy and window()

sell := sell and window()

sell

//plotshape(long , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

//plotshape(short , color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

Stop = input(0.5, title='StopLoss') / 100

ProfitPerc = input(defval=1.5, title='Profit') / 100

rev = input(1024,title = "Reverse Limit")

Averaging_position_ = input(true , title = "Averaging position ? ")

qn = 1

qn := nz(qn[1])

long_short = 0

long_last = buy and (nz(long_short[1]) == 0 or nz(long_short[1]) == -1)

short_last = sell and (nz(long_short[1]) == 0 or nz(long_short[1]) == 1)

long_short := long_last ? 1 : short_last ? -1 : long_short[1]

long_entered = false

long_entered := long_entered[1]

short_entered = false

short_entered := short_entered[1]

longPrice = ta.valuewhen(long_last, close, 0)

shortPrice = ta.valuewhen(short_last, close, 0)

longStop = longPrice * (1 - Stop)

shortStop = shortPrice * (1 + Stop)

longTake = longPrice * (1 + ProfitPerc)

shortTake = shortPrice * (1 - ProfitPerc)

plot(long_short == 1 ? longStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Long Fixed SL')

plot(long_short == -1 ? shortStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Short Fixed SL')

plot(long_short == 1 ? longTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Long Fixed TP')

plot(long_short == -1 ? shortTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Short Fixed TP')

longBar1 = ta.barssince(long_last)

longBar2 = longBar1 >= 1 ? true : false

shortBar1 = ta.barssince(short_last)

shortBar2 = shortBar1 >= 1 ? true : false

longSLhit = long_short == 1 and longBar2 and low < longStop

if long_entered and sell

longSLhit := true

longSLhit

plotshape(longSLhit and not(sell and not short_entered and long_entered), style=shape.labelup, location=location.belowbar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Long SL', textcolor=color.new(color.white, 0))

shortSLhit = long_short == -1 and shortBar2 and high > shortStop

if short_entered and buy

shortSLhit := true

shortSLhit

plotshape(shortSLhit and not(buy and not long_entered and short_entered), style=shape.labeldown, location=location.abovebar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Short SL', textcolor=color.new(color.white, 0))

longTPhit = long_short == 1 and longBar2 and high > longTake

plotshape(longTPhit, style=shape.labeldown, location=location.abovebar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Long TP', textcolor=color.new(color.white, 0))

shortTPhit = long_short == -1 and shortBar2 and low < shortTake

plotshape(shortTPhit, style=shape.labelup, location=location.belowbar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Short TP', textcolor=color.new(color.white, 0))

long_short := (long_short == 1 or long_short == 0) and longBar2 and (longSLhit or longTPhit) ? 0 : (long_short == -1 or long_short == 0) and shortBar2 and (shortSLhit or shortTPhit) ? 0 : long_short

if(shortSLhit or longSLhit or (long_entered[1] and sell) or (short_entered[1] and buy ))

qn := qn*2

if(longTPhit or shortTPhit or qn > rev)

qn := 1

if Averaging_position_

qn := 1

plotshape(buy and not long_entered, color=color.new(color.green, 0), style=shape.labelup, text='Buy', textcolor=color.new(color.white, 0), location=location.belowbar)

plotshape(sell and not short_entered, color=color.new(color.red, 0), style=shape.labeldown, text='Sell', textcolor=color.new(color.white, 0), location=location.abovebar)

// plotshape(buy and not(long_entered) and (short_entered), color = color.green , style = shape.labelup , text = "FA Buy" , textcolor = color.white , location = location.belowbar)

// plotshape(sell and not(short_entered) and (long_entered), color = color.red , style = shape.labeldown , text = "FA Sell" , textcolor = color.white , location = location.abovebar)

// alertcondition(condition=buy and not(long_entered) and (short_entered), title="Fully Algo Buy")

// alertcondition(condition=sell and not(short_entered) and (long_entered), title="Fully Algo sell")

alertcondition(condition=buy and not long_entered, title='Buy')

alertcondition(condition=sell and not short_entered, title='Sell')

if long_last

long_entered := true

short_entered := false

short_entered

if short_last

short_entered := true

long_entered := false

long_entered

alertcondition(condition=longSLhit and not(sell and not short_entered and long_entered), title='Long SL')

alertcondition(condition=shortSLhit and not(buy and not long_entered and short_entered), title='Short SL')

alertcondition(condition=longTPhit, title='Long TP')

alertcondition(condition=shortTPhit, title='Short TP')

if longSLhit or longTPhit

long_entered := false

long_entered

if shortSLhit or shortTPhit

short_entered := false

short_entered

// if buy

// strategy.entry('buy', strategy.long)

// strategy.exit('exit', 'buy', limit=longTake, stop=longStop)

// if sell

// strategy.entry('sell', strategy.short)

// strategy.exit('exit', 'sell', limit=shortTake, stop=shortStop)

if(buy)

strategy.entry("buy",strategy.long,qty = qn)

strategy.exit("Stop","buy",limit = longTake,stop = longStop)

if(sell)

strategy.entry("sell",strategy.short,qty = qn)

strategy.exit("Stop","sell",limit = shortTake,stop = shortStop)

strategy.close("buy",when = longTPhit or sell or longSLhit, comment = "Target")

strategy.close("sell",when = shortSLhit or shortTPhit or buy , comment = "Stop Loss")

strategy.cancel("buy",when = longTPhit or sell or longSLhit)

strategy.cancel("sell",when = shortSLhit or shortTPhit or buy )

- Quantitative Trading Strategy Based on Stoch RSI and MFI

- Multi-indicator Composite Trading Strategy

- Crossover EMA Short-term Trading Strategy

- Trend Following Strategy Based on Dynamic Stop Loss of Dual EMA Crossover

- Bull Market Breakout Darvas Box Buy Strategy

- The relative momentum strategy

- Wave Trend and VWMA Based Trend Following Quant Strategy

- Dual Moving Average and Williams Average Combination Strategy

- Adaptive Triple Supertrend Strategy

- Moving Average Crossover Strategy

- Market Cypher Wave B Automated Trading Strategy

- Key Reversal Backtest Strategy

- Three EMA Stochastic RSI Crossover Golden Cross Strategy

- Reversal Candlestick Backtesting Strategy

- Ehlers-Smoothed Stochastic RSI Strategy

- Swing High Low Price Channel Strategy V.1

- Momentum Reversal Trading Strategy

- Adaptive Linear Regression Channel Strategy

- Moving Average Difference Zero Cross Strategy

- Multiple Indicators Follow Strategy