Donchian Channel Breakout Strategy

Author: ChaoZhang, Date: 2024-01-29 11:51:08Tags:

Overview

The Donchian channel breakout strategy is a trend following strategy. It forms a price channel by calculating the highest and lowest prices over a certain period of time and uses the channel boundaries as buy and sell signals. It goes short when the price breaks through the upper rail and goes long when the price breaks through the lower rail. This strategy is suitable for highly volatile cryptocurrency trading.

Strategy Logic

This strategy uses the Donchian Channel indicator to determine price trends and calculate entry and exit points. The Donchian Channel consists of an upper rail, lower rail and middle rail. The upper rail is the highest price over a certain period, the lower rail is the lowest price, and the middle rail is the average price.

The entry and exit period lengths can be configured independently. When the price breaks through the lower rail upward, it goes long. When the price breaks through the upper rail downward, it goes short. The exit point is when the price touches the corresponding rail again. The middle rail can also be used as a stop loss line.

In addition, the strategy also sets a take profit point. The take profit price for long positions is the entry price multiplied by (1 + take profit percentage), and vice versa for short positions. Enabling this feature locks in profits and prevents losses from expanding.

In summary, while judging the trend, this strategy ensures sufficient room to set stops and take profits. This makes it particularly suitable for highly volatile assets like cryptocurrencies.

Advantage Analysis

The advantages of this strategy include:

- Clear signal logic and simple/reliable signal generation.

- The Donchian Channel indicator is insensitive to price fluctuations, which helps capture the trend.

- Customizable channel parameters to suit different assets and timeframes.

- Built-in stop loss/take profit functions effectively control risk.

- High profit potential for volatile assets like cryptocurrencies.

Risk Analysis

The risks of this strategy include:

- Unable to fully avoid risks from huge price swings despite stop loss.

- Improper parameter settings may lead to over-trading, increasing costs.

- Insensitive to price fluctuations, may miss some trading opportunities.

To mitigate the above risks:

- Appropriately size positions and diversify across assets to control overall risk.

- Optimize parameters to find the best combination, possibly using machine learning.

- Incorporate additional indicators to determine signal reliability.

Optimization Directions

This strategy can be further optimized in the following dimensions:

- Test and optimize more parameter combinations to find the optimum values. Key parameters include channel periods, take profit percentage, allowing long/short etc.

- Incorporate machine learning models to automatically identify optimal parameters, e.g. using reinforcement learning.

- Combine other indicators like moving averages and volume to determine trend and signal reliability.

- Develop more advanced stop loss strategies e.g. trailing stop loss, Chandelier Exit etc. to better control risks.

- Expand strategy across more asset classes to find the best fit.

Conclusion

In conclusion, the Donchian channel breakout strategy provides clear signals and controllable risks for trend trading. It is especially suitable for volatile assets like cryptocurrencies with great profit potential. There are also possibilities to further optimize parameters and incorporate other indicators, which are avenues for future enhancements. With continuous innovations, this strategy has the potential to become an important algorithmic trading strategy for cryptocurrencies.

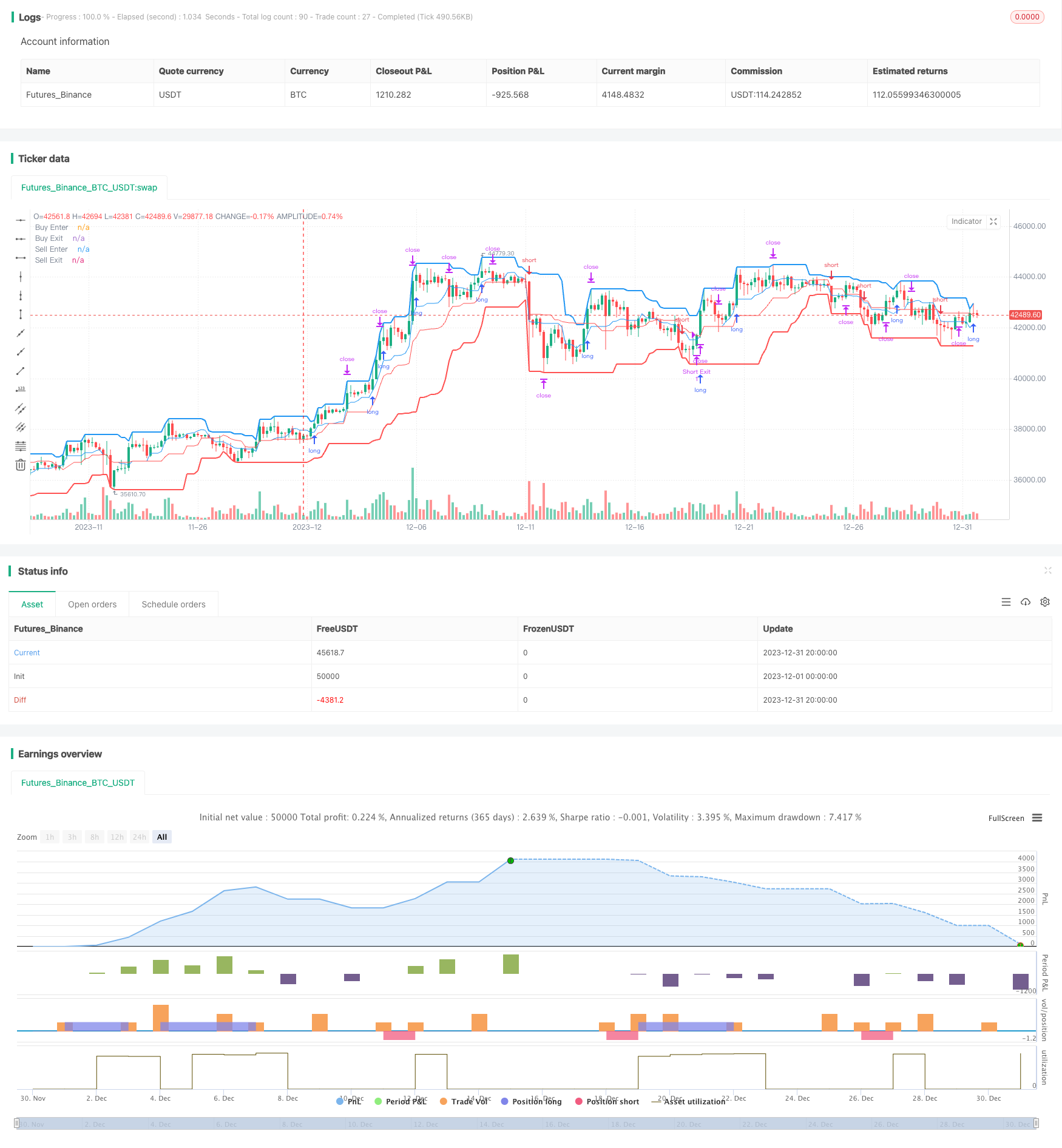

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © algotradingcc

// Strategy testing and optimisation for free trading bot

//@version=4

strategy("Donchian Channel Strategy [for free bot]", overlay=true )

//Long optopns

buyPeriodEnter = input(10, "Channel Period for Long enter position")

buyPeriodExit = input(10, "Channel Period for Long exit position")

isMiddleBuy = input(true, "Is exit on Base Line? If 'no' - exit on bottom line")

takeProfitBuy = input(2.5, "Take Profit (%) for Long position")

isBuy = input(true, "Allow Long?")

//Short Options

sellPeriodEnter = input(20, "Channel Period for Short enter position")

sellPeriodExit = input(20, "Channel Period for Short exit position")

isMiddleSell = input(true, "Is exit on Base Line? If 'no' - exit on upper line")

takeProfitSell = input(2.5, "Take Profit (%) for Short position")

isSell = input(true, "Allow Short?")

// Test Start

startYear = input(2005, "Test Start Year")

startMonth = input(1, "Test Start Month")

startDay = input(1, "Test Start Day")

startTest = timestamp(startYear,startMonth,startDay,0,0)

//Test End

endYear = input(2050, "Test End Year")

endMonth = input(12, "Test End Month")

endDay = input(30, "Test End Day")

endTest = timestamp(endYear,endMonth,endDay,23,59)

timeRange = time > startTest and time < endTest ? true : false

// Long&Short Levels

BuyEnter = highest(buyPeriodEnter)

BuyExit = isMiddleBuy ? ((highest(buyPeriodExit) + lowest(buyPeriodExit)) / 2): lowest(buyPeriodExit)

SellEnter = lowest(sellPeriodEnter)

SellExit = isMiddleSell ? ((highest(sellPeriodExit) + lowest(sellPeriodExit)) / 2): highest(sellPeriodExit)

// Plot Data

plot(BuyEnter, style=plot.style_line, linewidth=2, color=color.blue, title="Buy Enter")

plot(BuyExit, style=plot.style_line, linewidth=1, color=color.blue, title="Buy Exit", transp=50)

plot(SellEnter, style=plot.style_line, linewidth=2, color=color.red, title="Sell Enter")

plot(SellExit, style=plot.style_line, linewidth=1, color=color.red, title="Sell Exit", transp=50)

// Calc Take Profits

TakeProfitBuy = 0.0

TakeProfitSell = 0.0

if strategy.position_size > 0

TakeProfitBuy := strategy.position_avg_price*(1 + takeProfitBuy/100)

if strategy.position_size < 0

TakeProfitSell := strategy.position_avg_price*(1 - takeProfitSell/100)

// Long Position

if isBuy and timeRange

strategy.entry("Long", strategy.long, stop = BuyEnter, when = strategy.position_size == 0)

strategy.exit("Long Exit", "Long", stop=BuyExit, limit = TakeProfitBuy, when = strategy.position_size > 0)

// Short Position

if isSell and timeRange

strategy.entry("Short", strategy.short, stop = SellEnter, when = strategy.position_size == 0)

strategy.exit("Short Exit", "Short", stop=SellExit, limit = TakeProfitSell, when = strategy.position_size < 0)

// Close & Cancel when over End of the Test

if time > endTest

strategy.close_all()

strategy.cancel_all()

- Dual Moving Average Crossover Trading Strategy

- Volume-based Trend Following Trading Strategy

- Significant Pivot Points Reversal Strategy

- FNGU Quantitative Trading Strategy Based on Bollinger Bands and RSI

- Bollinger Bands RSI OBV Strategy

- P-Signal Reversal Strategy

- RSI Alligator Trend Strategy

- Daily FX Strategy Based on Moving Average and Williams Indicator

- Moving Average Channel Breakout Trading Strategy

- Dual Moving Average Stochastic Strategy

- Moving Average Trend Tracking Strategy

- RSI Indicator Grid Trading Strategy

- PPO Price Sensitivity Momentum Double Bottom Directional Trading Strategy

- Scalping Strategy with Volume and VWAP Confirmation

- ADX, MA and EMA Long Only Trend Tracking Strategy

- Momentum Breakthrough Golden Cross Strategy

- Triple Indicator Collision Strategy

- Out-of-the-box Machine Learning Trading Strategy

- Moving Average Turning Point Crossover Trading Strategy

- Cross-Cycle Arbitrage Strategy Based on Multiple Indicators