Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-02-02 11:16:32Tags:

Overview

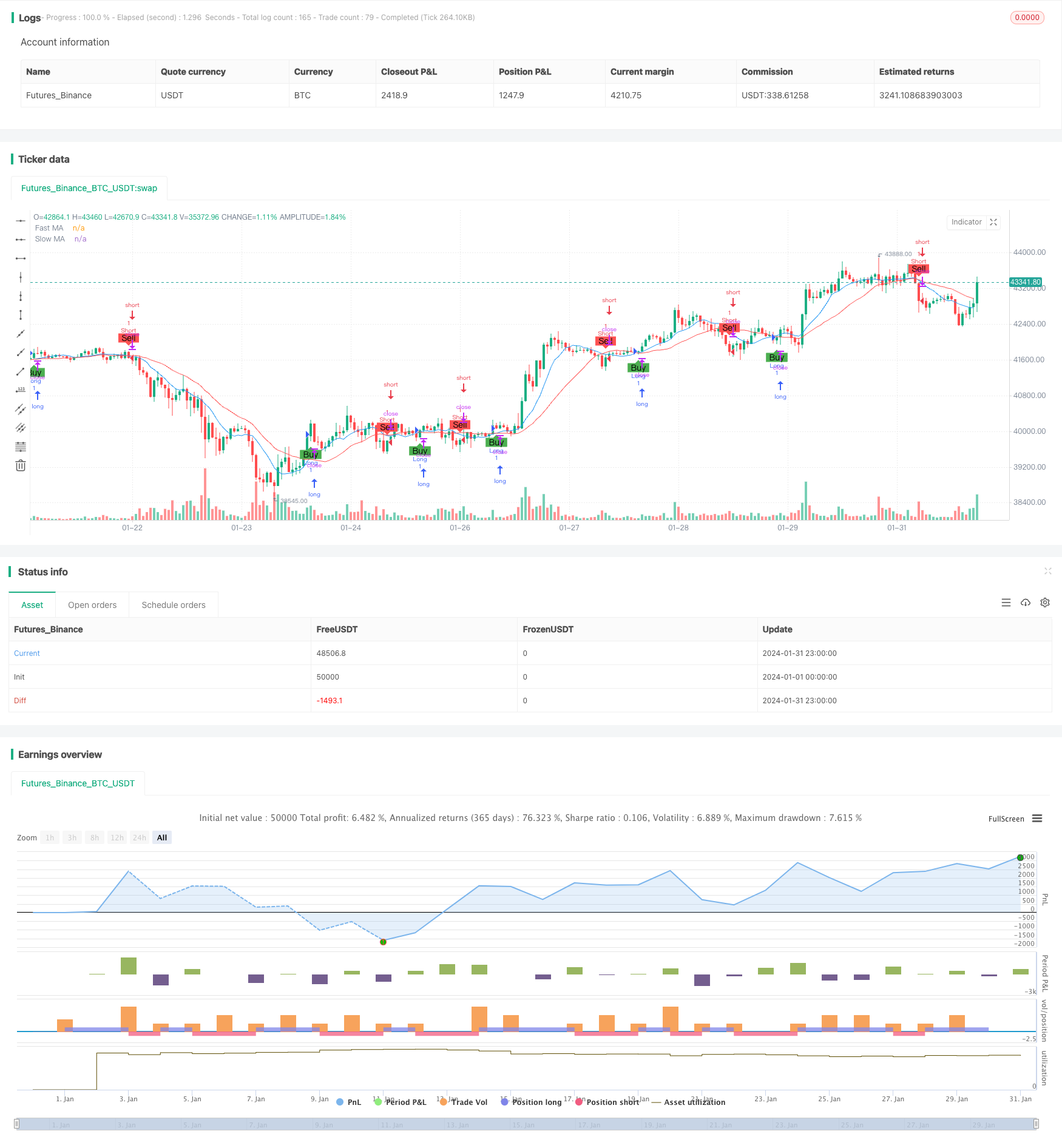

This strategy generates buy and sell signals based on the crossover of two moving average lines to catch trend changes. By customizing the lengths of the fast and slow moving averages, it produces buy signals when the fast line crosses above the slow line and sell signals when the fast line crosses below the slow line.

Strategy Logic

The strategy uses two moving averages, including a fast moving average (blue line) and a slow moving average (red line). The lengths of these moving averages can be customized through Pine Script input parameters.

When the fast moving average crosses above the slow moving average, a buy signal is generated (represented by a green arrow and the “Buy” label). This is considered a bullish signal, indicating a potential upward trend.

When the fast moving average crosses below the slow moving average, a sell signal is generated (represented by a red arrow and the “Sell” label). This is considered a bearish signal, indicating a potential downward trend.

The strategy uses the strategy.entry function to execute trades based on the buy and sell signals. Long positions are entered when buy signals occur (longCondition is true). Short positions are entered when sell signals occur (shortCondition is true).

Plotshape functions plot arrows on the chart to visually represent the buy and sell signals. Green arrows with “Buy” labels indicate buy signals. Red arrows with “Sell” labels indicate sell signals.

Advantage Analysis

The dual moving average crossover strategy has the following advantages:

- Simple and clear rules, easy to understand and implement

- Can effectively track trend changes and capture trading signals

- Moving average lengths can be adjusted to adapt to different market conditions

- Easy to combine with other technical indicators to build complex strategies

Risk Analysis

The strategy also has the following risks:

- Prone to generating false signals during range-bound markets

- Does not consider stop losses, which can lead to large losses

- Trading signals can be front run by others using the same strategy

Risks can be reduced through:

- Filtering out false signals using other indicators

- Adding a moving stop loss to control risks

- Optimizing moving average parameters

Optimization Directions

The strategy can be optimized through:

- Adding indicators like volume moving average as filter signals

- Incorporating stop loss strategies to manage risks e.g. moving/array stop loss

- Grading buy/sell signals and using different parameter sets

- Optimizing moving average lengths

- Adding machine learning models to improve strategy performance

With multi-dimensional optimization, the strategy’s stability and profitability can be further enhanced.

Conclusion

As a simple trend following strategy based on moving average crossover, this strategy has clear and simple rules that are easy to implement and backtest for determining market trends quickly. At the same time, potential risks should be monitored and managed through additional technical indicators and risk management techniques when traded live to improve overall strategy stability and profitability. With continuous optimization and enhancement, this strategy demonstrates strong practical utility.

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Moving Average Crossover", overlay=true)

// Input parameters

fastLength = input(9, title="Fast MA Length")

slowLength = input(21, title="Slow MA Length")

src = close

// Calculate moving averages

fastMA = sma(src, fastLength)

slowMA = sma(src, slowLength)

// Plot moving averages on the chart

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Strategy logic

longCondition = crossover(fastMA, slowMA)

shortCondition = crossunder(fastMA, slowMA)

// Execute strategy

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Plot buy and sell signals on the chart

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.labelup, text="Buy", location=location.belowbar)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.labeldown, text="Sell", location=location.abovebar)

- Gold Cross Dead Cross Quantitative Trading Strategy

- Dual Moving Average Strategy 360°

- Open High Close Low Breakout Trading Strategy

- Double Exponential Moving Average Quant Trading Strategy

- Dynamic SMMA and SMA Crossover Strategy

- Trend Following Strategy Based on Bollinger Bands, RSI and Moving Average

- Trend Trading Strategy Based on MACD Indicator

- Stochastic & Moving Average Strategy with Double Filters

- Stoch RSI Based Trend Following Strategy

- Single Point Moving Average Breakout Strategy

- SuperTrend Strategy

- Parabolic Period and Bollinger Band Combined Moving Stop Loss Strategy

- Moving Average Price Based Trading Strategy

- Ergotic Momentum Direction Convergence Trading Strategy

- Moving Average and Stochastic Trading Strategy

- An Optimization of Dual Moving Average Trend Following Strategy Based on Indicators Combination

- The Efficient Quant Trading Strategy Combining

- Dual Moving Average Crossover and Williams Indicator Combo Strategy

- Momentum Breakthrough Silver Line Strategy

- RWI Volatility Contrarian Strategy