Single Point Moving Average Breakout Strategy

Author: ChaoZhang, Date: 2024-02-02 11:19:19Tags:

Overview

The single point moving average breakout strategy is a quantitative trading strategy based on the Chande Momentum Oscillator. It detects when the market is in a consolidation phase by calculating the momentum changes of price. When the Chande Momentum line crosses above the buy line or falls below the sell line, long or short trades will be executed accordingly.

Strategy Logic

The strategy first calculates the price momentum change momm, then separates it into positive momentum m1 and negative momentum m2. Next, it sums the positive and negative momentum over a lookback period into sm1 and sm2. Finally, the Chande Momentum Oscillator chandeMO is derived. The indicator oscillates around the zero line. Readings above zero indicate stronger upward momentum, while readings below zero indicate stronger downward momentum.

When the Chande Momentum line crosses above the buy line from lower levels, it signals that price is breaking out of a downtrend and ready to start an uptrend. The strategy will go long. When the line falls below the sell line from higher levels, short positions will be initiated.

Advantage Analysis

- The strategy is able to identify turning points from downtrend to consolidation to uptrend, allowing entries at low prices and exits at high prices.

- The Chande Momentum Oscillator considers both magnitude and rate of price changes, making it very effective for trend detection.

- The strategy logic is simple and easy to implement.

Risk Analysis

- The Chande Momentum Oscillator is sensitive to input parameters. Different parameter tuning can lead to vastly different trading signals and results.

- Static buy and sell line settings may also introduce excessive false signals.

- The lack of stop loss means that losing trades can accumulate large losses.

Some ways to improve include using dynamic buy/sell lines, filtering signals with other indicators, and implementing stop loss to control risks.

Optimization Directions

- Test different parameter settings to find optimal values

- Adopt dynamic buy and sell lines

- Add additional filters with other indicators

- Incorporate stop loss logic to cut losses

Conclusion

The single point moving average breakout strategy identifies trend turning points from downtrend to consolidation to uptrend using the Chande Momentum Oscillator, allowing low buy high sell trading. Despite being simple and intuitive, enhancements in parameter tuning, signal filtering and risk control can further improve performance. Overall, it serves as an effective tool for quantitative traders to determine trend reversals.

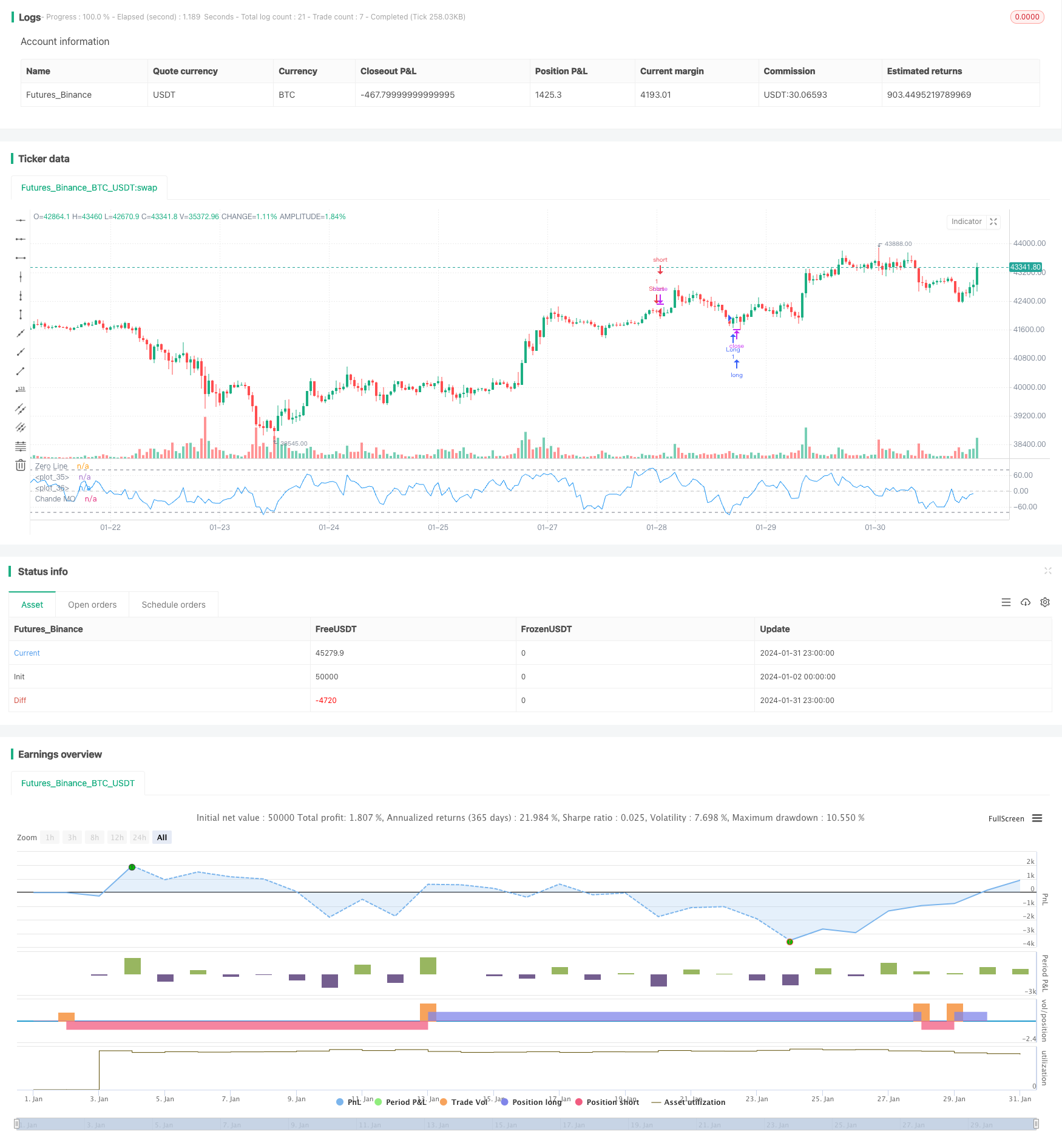

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//* Backtesting Period Selector | Component *//

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made *//

testStartYear = input(2021, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(10, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(999999, "Backtest Stop Year")

testStopMonth = input(9, "Backtest Stop Month")

testStopDay = input(26, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

/////////////// END - Backtesting Period Selector | Component ///////////////

strategy(title="Chande Momentum Strat", shorttitle="ChandeMO Strat", format=format.price, precision=2)

length = input(9, minval=1)

src = input(close, "Price", type = input.source)

momm = change(src)

f1(m) => m >= 0.0 ? m : 0.0

f2(m) => m >= 0.0 ? 0.0 : -m

m1 = f1(momm)

m2 = f2(momm)

sm1 = sum(m1, length)

sm2 = sum(m2, length)

percent(nom, div) => 100 * nom / div

chandeMO = percent(sm1-sm2, sm1+sm2)

plot(chandeMO, "Chande MO", color=color.blue)

hline(0, color=#C0C0C0, linestyle=hline.style_dashed, title="Zero Line")

buyline= input(-80)

sellline= input(80)

hline(buyline, color=color.gray)

hline(sellline, color=color.gray)

if testPeriod()

if crossover(chandeMO, buyline)

strategy.entry("Long", strategy.long, alert_message="a=ABCD b=buy e=binanceus q=1.2 s=uniusd")

// strategy.exit(id="Long Stop Loss", stop=strategy.position_avg_price*0.8) //20% stop loss

if crossunder(chandeMO, sellline)

strategy.entry("Short", strategy.short, alert_message="a=ABCD b=sell e=binanceus q=1.2 s=uniusd")

// strategy.exit(id="Short Stop Loss", stop=strategy.position_avg_price*1.2) //20% stop loss

// remember to alert as {{strategy.order.alert_message}}

- Spiral Cross Strategy with Moving Average Confirmation

- Gold Cross Dead Cross Quantitative Trading Strategy

- Dual Moving Average Strategy 360°

- Open High Close Low Breakout Trading Strategy

- Double Exponential Moving Average Quant Trading Strategy

- Dynamic SMMA and SMA Crossover Strategy

- Trend Following Strategy Based on Bollinger Bands, RSI and Moving Average

- Trend Trading Strategy Based on MACD Indicator

- Stochastic & Moving Average Strategy with Double Filters

- Stoch RSI Based Trend Following Strategy

- Moving Average Crossover Strategy

- SuperTrend Strategy

- Parabolic Period and Bollinger Band Combined Moving Stop Loss Strategy

- Moving Average Price Based Trading Strategy

- Ergotic Momentum Direction Convergence Trading Strategy

- Moving Average and Stochastic Trading Strategy

- An Optimization of Dual Moving Average Trend Following Strategy Based on Indicators Combination

- The Efficient Quant Trading Strategy Combining

- Dual Moving Average Crossover and Williams Indicator Combo Strategy

- Momentum Breakthrough Silver Line Strategy