Overview

This strategy calculates the upper band, middle band and lower band of Bollinger Bands and combines the closing price of K-line to implement Bollinger Bands breakout trading strategy. It goes long when price breaks through the upper band and goes short when price breaks through the lower band. Stop loss and take profit prices are also set.

Strategy Principle

Calculate the middle band SMA of Bollinger Bands with period 60, representing the middle band of price trend.

Calculate the upper band and lower band of Bollinger Bands. The upper band is middle band + 2 times standard deviation and the lower band is middle band - 2 times standard deviation. The band width is controlled by multiplier.

When closing price is greater than the upper band, go long. When closing price is less than the lower band, go short.

Set stop loss and take profit mechanism. The stop loss percentage is 1.5% and take profit percentage is 6%.

When price re-enters the Bollinger Bands or reaches stop loss/take profit price, close position.

Advantage Analysis

Bollinger Bands indicator has strong ability of trend judgment by breakout.

Simple strategy logic and easy to understand and implement.

Stop loss and take profit control risks.

Risk Analysis

Bollinger Bands breakout cannot accurately determine price trend reversal points, with the risk of false breakout.

Unreasonable stop loss and take profit settings may bring greater risks.

High trading frequency may be affected by transaction costs.

Optimization Directions

Combine with other indicators to filter out false signals, e.g. KDJ for trend and MACD for divergence.

Dynamically adjust Bollinger Bands parameters based on market volatility to calculate reasonable band width.

Optimize stop loss and take profit strategy, e.g. trailing stop or partial closing.

Consider transaction costs’ impact and adjust holding period.

Conclusion

This strategy follows trend by Bollinger Bands breakout and has some positive effects. But false breakout may bring greater risks. Combining with other indicators and keep optimizing parameters can control risks and improve profitability.

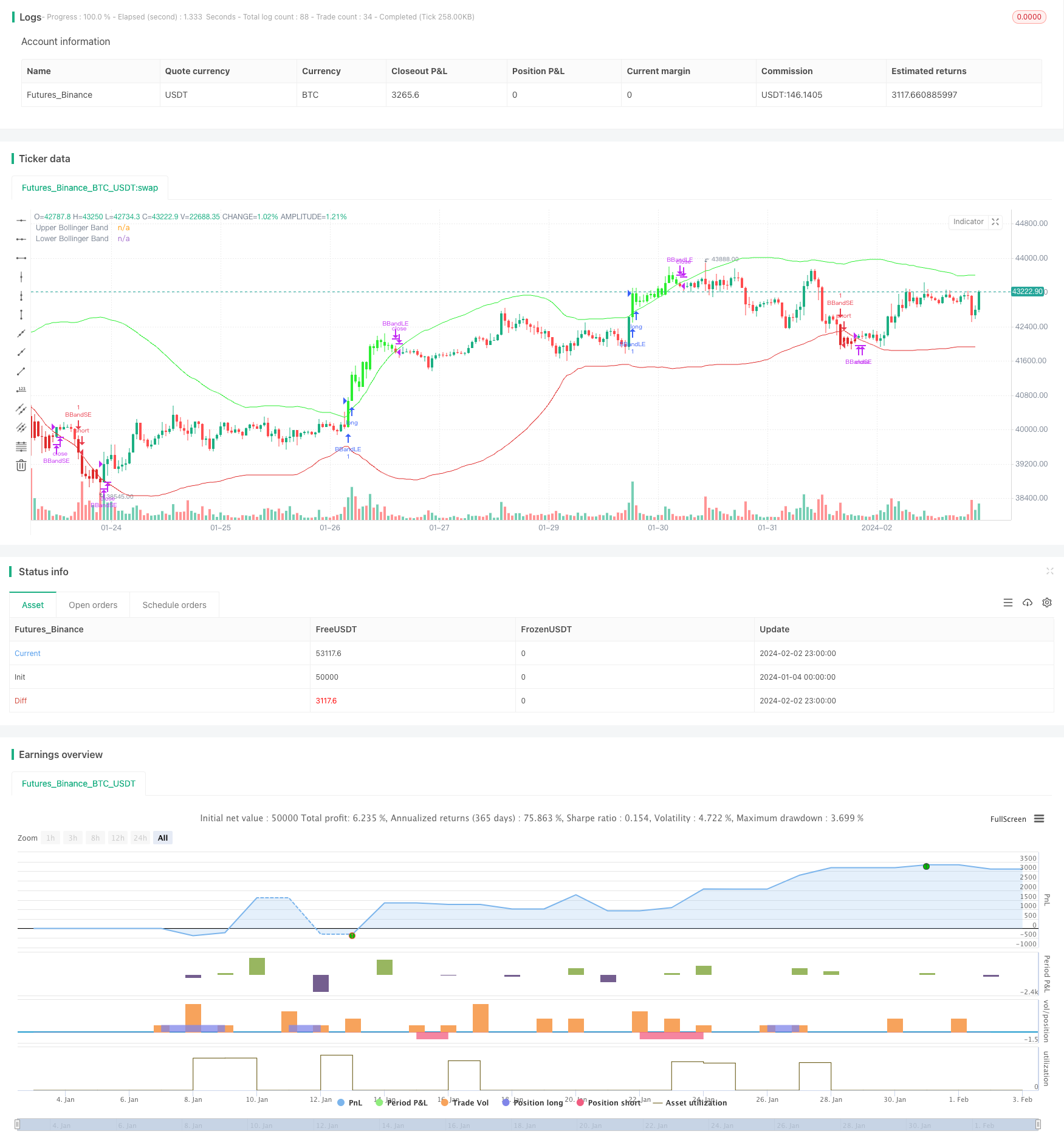

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fuera Bolinga", overlay=true)

length = input.int(60, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

take_profit_percentage = 6.0

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

stop_loss_percentage = 1.5

// Determinar si la vela cierra por fuera de las bandas

above_upper_band = close > upper

under_lower_band = close < lower

// Pintar las velas que cierran por fuera de las bandas

barcolor(above_upper_band ? color.new(#2cee32, 0) : na)

barcolor(under_lower_band ? color.new(#e02c2c, 0) : na)

// Entrada larga con stop loss y take profit

if (ta.crossover(close, upper))

strategy.entry("BBandLE", strategy.long, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

// Entrada corta con stop loss y take profit

if (ta.crossunder(close, lower))

strategy.entry("BBandSE", strategy.short, oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//// Salida de operación larga

if ((ta.crossunder(close, upper) or ta.crossunder(close, lower)) and (strategy.opentrades != 0))

strategy.close("BBandLE")

// Salida de operación corta

if ((ta.crossover(close, lower) or ta.crossover(close, upper)) and (strategy.opentrades != 0))

strategy.close("BBandSE")

// Plot de las bandas de Bollinger

plot(upper, color=color.new(#2cee32, 0), title="Upper Bollinger Band")

plot(lower, color=color.new(#e02c2c, 0), title="Lower Bollinger Band")