Crossing Moving Average Breakout Strategy

Author: ChaoZhang, Date: 2024-02-06 15:02:33Tags:

Overview

This strategy uses three moving averages of different periods to identify the market trend direction. It enters a position when the three moving averages are moving in the same direction. At the same time, combined with the highest or lowest price of the most recent N candles, it sets stop loss and take profit.

Strategy Logic

Calculate the long term, medium term and short term three moving averages. Users can set the periods by themselves. The default values are 20, 10 and 5.

Compare the directions of the three moving averages. When the short term moving average crosses above the medium term one, and the medium term crosses above the long term one, it is judged as a bull market. When the short term crosses below the medium term, and the medium term crosses below the long term, it is judged as a bear market.

In a bull market, if the price breaks through the highest price of the most recent N candles, go long; in a bear market, if the price breaks through the lowest price of the most recent N candles, go short. N is also a customizable parameter by users.

After entering a position, set stop loss and take profit. The stop loss in a bull market is set to be the lowest price of the most recent N candles, and that in a bear market is set to be the highest price.

Advantage Analysis

This strategy combines the moving average indicator and candlestick charts, which can better determine the market trend. At the same time, the setting of stop loss and take profit is reasonable, which is conducive to avoiding greater losses.

Compared with a single moving average and other indicators, this strategy uses three moving averages to judge the market trend more reliably. Meanwhile, entering a position when breaking through the highest or lowest price of the most recent N candles is a common breakout strategy. Overall, the strategy idea is clear and easy to implement.

Risk Analysis

The main potential risks of this strategy are:

The probability of erroneous judgment on the direction of the three moving averages. If the medium-short term moving averages cause wrong signals, unnecessary losses may be caused.

Improper selection of the timing to enter the position, which is easy to be trapped in. The timing of entries should be appropriately optimized.

The stop loss distance is set too small. Expanding the stop loss distance helps to allow more running room for the price.

Optimization Directions

The directions to optimize this strategy include:

Add other indicators for filtration to ensure the reliability of moving average signals. For example, add the long/short judgment of trading volume.

Optimize the moving average periods to better adapt them to different products.

Add machine learning algorithms to achieve automatic parameter optimization.

Test the effectiveness of this strategy on high frequency data.

Summary

This strategy is relatively simple and universal. The idea is clear with strong feasibility. As an example of a moving average crossover system, it is a common choice for beginners. Through proper optimization, the system can be applied to more products and time frames to obtain steady returns.

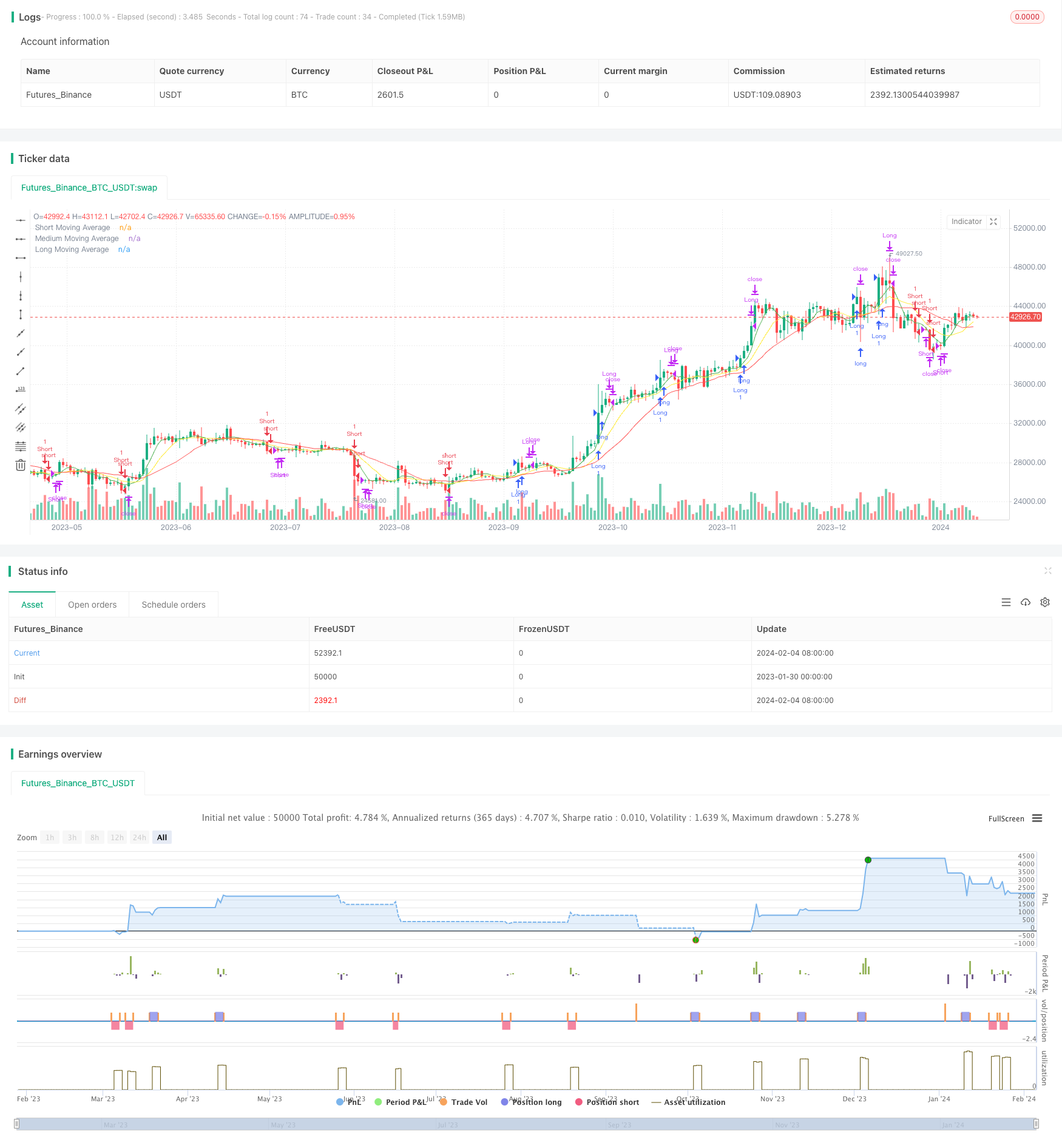

/*backtest

start: 2023-01-30 00:00:00

end: 2024-02-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © hobbiecode

//@version=5

strategy("Cross Breakout - Hobbiecode", shorttitle="Cross - HOBBIE", overlay=true)

// User-defined input for moving averages

long_period = input(20, title="Long Period")

medium_period = input(10, title = "Medium Period")

short_period = input(5, title="Short Period")

type_ma = input.string("SMA", title = "MA type", options = ["SMA", "EMA"])

candles_back = input(10, title = "Candles Back")

bars_valid = input(3, title = "Bars to Exit")

// Calculating moving averages

long_ma = 0.0

medium_ma = 0.0

short_ma = 0.0

if type_ma == "SMA"

long_ma := ta.sma(close, long_period)

medium_ma := ta.sma(close, medium_period)

short_ma := ta.sma(close, short_period)

else

long_ma := ta.ema(close, long_period)

medium_ma := ta.ema(close, medium_period)

short_ma := ta.ema(close, short_period)

// Plot moving averages

plot(long_ma, title="Long Moving Average", color=color.red)

plot(medium_ma, title = "Medium Moving Average", color = color.yellow)

plot(short_ma, title="Short Moving Average", color=color.green)

// Check last min/max

last_min = ta.lowest(candles_back)

last_max = ta.highest(candles_back)

// Strategy logic for crossing of moving averages

longCondition = short_ma > medium_ma and medium_ma > long_ma and high == last_max

shortCondition = short_ma < medium_ma and medium_ma < long_ma and low == last_min

longCondition_entry = longCondition and strategy.position_size == 0

shortCondition_entry = shortCondition and strategy.position_size == 0

// Check last min/max for operation

last_min_op = ta.lowest(candles_back)[1]

last_max_op = ta.highest(candles_back)[1]

// Plot lines

var line r1Line = na

// Entry orders

// if (longCondition)

// from_line = chart.point.now(high)

// to_line = chart.point.from_index(bar_index + candles_back, high)

// r1Line := line.new(from_line, to_line, color = color.green, width = 2)

if longCondition_entry and ta.crossover(close,last_max_op)

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", stop=low)

// if (shortCondition)

// from_line = chart.point.now(low)

// to_line = chart.point.from_index(bar_index + candles_back, low)

// r1Line := line.new(from_line, to_line, color = color.red, width = 2)

if shortCondition_entry and ta.crossunder(close,last_min_op)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short", stop=high)

if ta.barssince(longCondition_entry) >= bars_valid

strategy.close("Long")

if ta.barssince(shortCondition_entry) >= bars_valid

strategy.close("Short")

- Volatility Trend Tracking Strategy

- Dual-driver Quantized Reversal Tracking Strategy

- Overlay Trend Signals Strategy

- Swing Points Breakouts Long-term strategy

- The Quantitative Trading Strategy Based on Dynamic Moving Average Breakthrough Entry

- Three Candle Reversal Trend Strategy

- Adaptive Dual Breakthrough Trading Strategy

- Quantitative Trading Strategy for Bottom Reversal

- Momentum Trend Optimization Combination Strategy

- Multiple Moving Average Bollinger Bands Strategy

- SuperTrend Trailing Stop Strategy Based on Heikin Ashi

- Dual Moving Average With Momentum Breakout Strategy

- Bollinger Band Breakout Strategy Based on VWAP

- Fibonacci Retracement Dynamic Stop Loss Strategy

- Dynamic EMA and MACD Crossover Strategy

- Double Momentum Index and Reversal Hybrid Strategy

- TD Sequential Dual-Direction S/R Trading Strategy

- SuperTrend Quantitative Trading Strategy for Bitcoin

- A Short-term Strategy Combining RSI Indicator and Price Breakthrough

- Richard's Turtle Trading Strategy